Nitin Agrawal Moneycontrol Research

Varroc Engineering (Varroc), one of India’s leading automobile component manufacturers, has launched its Rs 1,955 crore initial public offer (IPO). The company has a strong clientele, consistent financial performance, and lean balance sheet. This coupled with a positive industry outlook provides it strong earnings visibility. However, the ongoing global trade war is a big concern as the company generates almost two-third of its revenue from the global market. The issue is priced at a steep premium which tempers our excitement. We would wait for the stock to correct after its listing to turn buyers.

Leadership in several areas

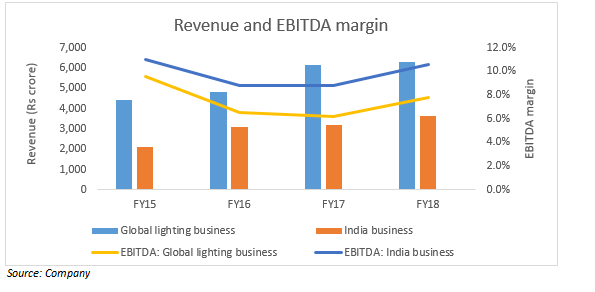

Varroc has two primary business segments: Varroc Lighting Systems (VLS) and Varroc India Business (VIB). VLS is a global supplies of exterior lighting systems to passenger car original equipment manufacturers (OEMs). VIB manufactures and supplies a diverse range of auto components primarily to two-wheelers (2W) and three-wheeler (3W) OEMs.

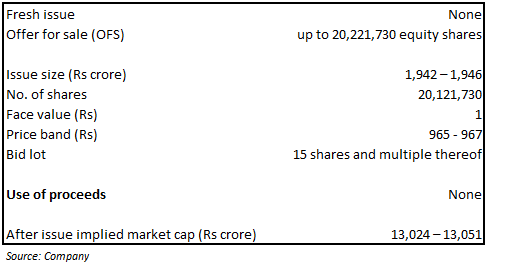

IPO contours

Strong client base, no client concentration

The company caters mostly to marquee OEMs. In the global market, it caters to Ford, Jaguar-Land Rover, Volkswagen, Renault-Nissan, Chrysler, Peugeot and an electric vehicle (EV) major Tesla. In the Indian market, its clientele includes Bajaj Auto, Honda Motorcycle & Scooter India, Hero MotoCorp, Royal Enfield (RE), Yamaha and Mahindra & Mahindra.

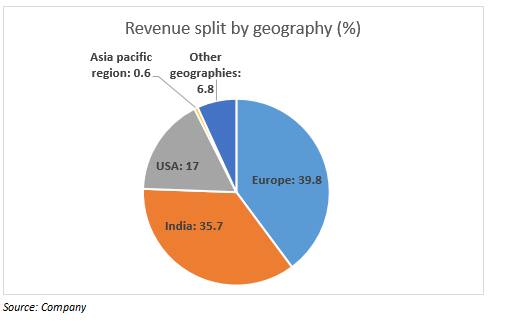

Its revenue is diversified across customers and geographies as is evident from the revenue split. In 9M FY18, its largest customer contributed 19.5 percent of total invoiced amounts while top 5 customers contributed 61.7 percent.

Dedicated R&D facility

Research and development (R&D) is the critical part of the business and the management’s focus area. The company has its own dedicated R&D centres in India, Czech Republic, China, USA, Mexico, Germany, Italy, Romania and Poland, which houses 1,414 engineers focusing on development of new products, designing, prototyping and product upgrades. Its R&D efforts have resulted in the filing of 185 global patents.

Leadership position Varroc is the sixth largest exterior auto lighting supplier globally and has grown faster than its peers. It registered a compounded annual growth rate of 27.5 percent in exterior auto lighting revenue between CY14 and CY18 as compared to second best growth of 10.2 percent registered by its peer.

In India, it is the second largest auto component manufacturer, which is growing faster than its customers. It supplies to 2W OEMs which command almost 85 percent of total domestic 2W market.

Positive industry outlook

Varroc primarily caters to the fast growing Indian 2W and global passenger vehicle (PV) segments.

In the global PV segment, the market is concentrated with 8 players controlling 90 percent share. As per Yole, revenue from the global automotive exterior lighting market is expected to grow (at 4.3 percent CAGR annually over 2016-21) at a higher pace than global PV sales (3.8 percent). This growth will be mainly driven by wider adoption of LEDs (light-emitting diode) which are expensive and popular due to its aesthetics and energy efficiency. In the short term, there could be challenges on the demand front accruing from Europe owing to uncertainty regarding diesel vehicles.

From an India business perspective, the auto sector has been on a strong upmove for more than one year, despite multiple macro disruptions.

Within automobile, 2W has been a stellar performer and registered 7.9 percent CAGR over FY13-18 versus industry growth of 7 percent over the same period. In fact, its 2W business registered double-digit year-on-year (YoY) growth (14.8 percent) in FY18, growth after a very long time. Growth was fuelled primarily by a normal monsoon lifting rural demand and improving consumer sentiment on the back of economic recovery.

With impetus on the rural economy in an election year and expectation of a normal monsoon, the 2W segment should have a strong run going forward as well. Overall, the outlook for global PV and Indian 2W segments looks very promising going forward.

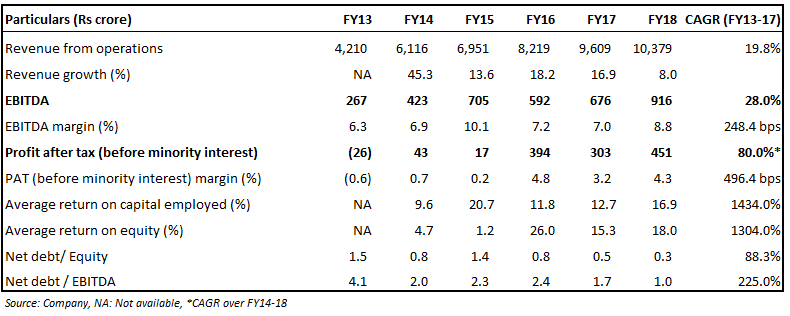

Strong operating performance, lean balance sheet

Historically, the management has delivered consistent performance with net revenue from operations clocking 19.8 percent CAGR over FY13-18. Earnings before interest, tax, depreciation and amortisation grew at a faster pace, registering 28 percent growth. It posted a decent EBITDA margin expansion of 248.8 bps over FY13-18.

It is important for investors to keep in mind that the cost of raw material (RM) and components consumed represents 61 percent of its total cost. Varroc’s financial condition and operations are significantly impacted by availability and cost of raw materials, although this area has been managed well by the company so far.

Currently, it has a total debt of around Rs 980 crore, translating in a debt-to-equity ratio of 0.3 times, is at a comfortable level. This provides enough strength to the management for future expansion.

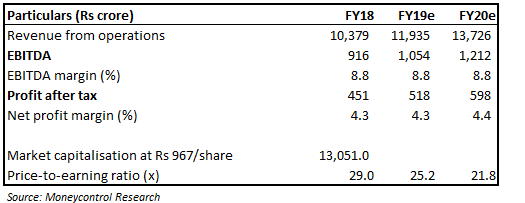

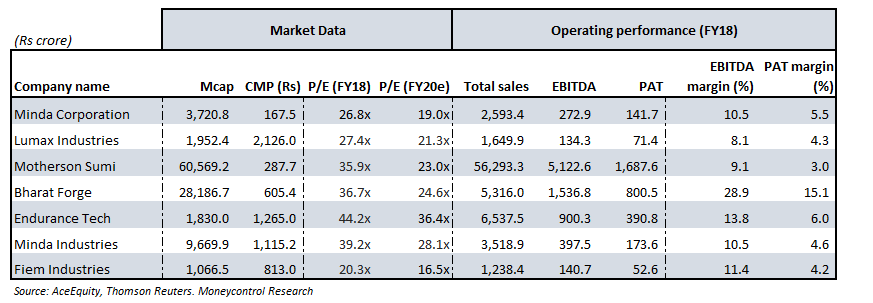

The company’s implied market capitalisation is Rs 13,051 crore at the upper end of the price band. At the upper end of the price band, the valuation works out to 29 times FY18 and 25.2 times FY19e earnings, which is at the higher end of its peer group valuation.

The escalating global trade war could impact its export market which forms close to 65 percent of revenue.

The escalating global trade war could have its impact on its exports market which forms close to 65 percent of its revenue.

The escalating global trade war could have its impact on its exports market which forms close to 65 percent of its revenue.

Peer review

While the business model looks interesting, macro headwinds in the short term and expensive valuation warrant caution. We would wait for a correction after its listing to accumulate this company for the long-term.

For more research articles, visit our Moneycontrol Research page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!