Highlights - Healthy performance post consecutive weak quarters - Gross margins contract due to high inventory cost and pricing pressure - EBITDA and net margins shape up - Pricing pressure to continue in domestic markets - Raw material prices cooling off, Chinese import situation improving - New product launches to drive growth

-------------------------------------------------After consecutive quarters of softness, leading crop care company Rallis India saw a turnaround in fortunes in the December 2019 quarter on the back of a healthy top line growth, positive farm sentiment and new product launches.

Both domestic and international markets gained traction. With fresh capacity addition, we expect growth in top line for the Tata group company in coming quarters. However, pricing pressure is expected to stay for its various product categories in the local market.

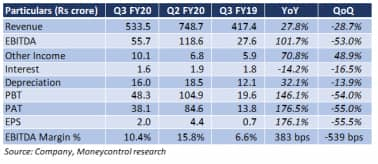

- Positive sentiment for the Rabi season after a favourable monsoon stoked demand, which supported growth. Revenue was up 28 percent year-on-year (YoY).

- Input pricing pressure coupled with high cost inventory led to contraction in gross margin, which came under strain locally as well as globally.

- Lower tax rates meant an uptick in net margin during the quarter.

- While revenue from India grew 35 percent YoY, the figure stood at 24 percent for overseas markets. Agrochemical as well as seed businesses were in a good shape.

- Rallis has rolled out a total of six new products so far during 2019-20, including two in India. Traction in sales from these products is expected to provide some momentum in coming quarters.

- It added close to 60 dealers to its distribution network during Q3 FY20, taking the total to 330 since the beginning of the year, a 10 percent jump. That's a positive from the revenue perspective.

-The management highlighted that the inventory pipeline in stable and the working capital situation is improving.

Other commentsThe performance during the quarter under review inspires confidence. The management, however, has pointed to continuity of the pricing pain during FY21, which could dim the lustre a bit.

With some production units getting back in business, the raw material situation in China is improving . This could spell some relief on the cost front, which has been a major overhang on Rallis' performance over the last consecutive quarters.

The second phase of capacity expansion of 500 million tonnes per annum Metribuzin unit is likely to be completed by February this year. Revenues from these new capacities will start flowing in from FY21.

Outlook

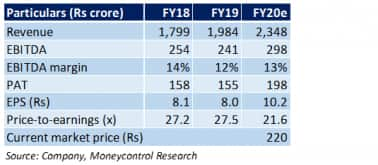

Post an improvement in Q3 numbers, the stock has seen a substantial run-up, trading at a 2020e PE of 21.6x. Rallis’ renewed strategy and planned capex, which had been missing for the past 3-4 years, is expected to pay off in a big way in the long term. However, the company is impacted by the external operating environment, and we believe that's a joker in the pack for the near term.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!