Jitendra Kumar Gupta Moneycontrol Research

IRCON International, an integrated engineering and construction company generating 87 percent of its revenues from the railways, could be a great proxy to capitalise on the growing investments by the government in Indian Railways. To put things in perspective, IRCON’s order book has grown at an annual 19 percent CAGR (compounded annual growth rate) during FY15 to FY18. It is currently sitting on an order book of close to Rs 22,400 crore, which is 5.6 times its FY18 revenue, providing strong revenue visibility.

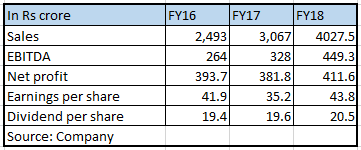

While growth is reasonable, the other aspect is quality of growth. IRCON, which was incorporated in 1976, is a debt free company after adjusting for cash on its books to the tune of Rs 4,690 crore. It is awarded projects on a nomination and tender basis where a certain margin is assured. Over the last three years the company has maintained an earnings before interest, depreciation, tax and amortisation (EBIDTA) margin of about 10 percent. Moreover, after adjusting for cash and capital work in its books, the company earns a core return on equity of close to 21-22 percent, which is quite attractive for a growing public sector undertaking.

Unlike its private engineering peers, which often get caught on the wrong side of the working capital cycle, IRCON is far more efficient and least risky as the government provides advances for each of the projects awarded. Its debtors days of about 63 and inventory days of 13 days is one of the lowest in the industry, helping in faster cash conversion. This is precisely the reason why surplus cash generated from the business is paid back through dividends.

While the company largely caters to domestic markets, accounting for 93 percent of its order book, it intends to increase its international pie as well as gradually shift into other segments to better margin. Other large segments such as highways account for 6 percent of its revenue. It is now focusing on larger projects worth over Rs 500 crore to drive efficiencies and improve asset turn leading to better margin and return ratios in coming years.

Valuations

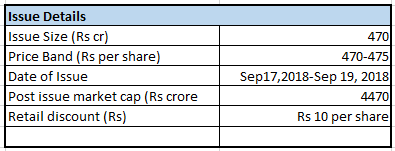

At the upper band of the offer price of Rs 475 per share, the issue is priced at 11 times its FY18 earnings, which is quite attractive particularly for retail investors that would receive an additional Rs 10 as discount on the allotment price. After discount, assuming shares are allotted at the upper band of the issue price, the dividend yield works out close to 4.6 percent. Valuations are at quite discount compared to peers who are commanding a price-to-earnings ratio of about 18-20 times at present, based on FY18 earnings.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!