Sachin Pal Moneycontrol Research

Highlights:- Quarterly volumes came in 13 percent higher - Binani Cement renamed to UltraTech Nathdwara Cement - Decline in input costs should ease cost pressures - Valuations rich at 19 times FY19 estimated EV/EBITDA -------------------------------------------------

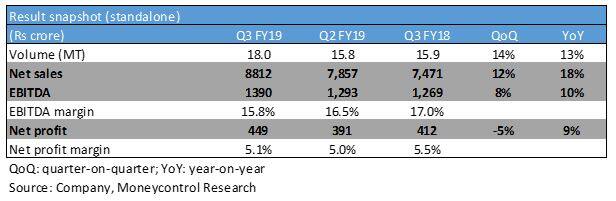

UltraTech Cement, India’s largest cement manufacturer, posted a decent set of Q3 FY19 earnings . The company reported healthy double-digit volume growth on the back of consolidation of Binani Cement volumes. Operating margin declined on a sequential basis, but cost pressures seem to be easing as power & fuel as well as logistics costs have started moving downwards.

Key positives - Revenue growth (up 18 percent year-on-year) was mainly driven by 13 percent volume growth. This was primarily aided by consolidation of Binani Cement (renamed UltraTech Nathdwara Cement) volumes (0.1 million tonne over a 40-day period) and capacity ramp-up of JP Associates' cement assets

- Operating margin contracted on a sequential as well as yearly basis, but the cost structure saw a marginal improvement on a sequential basis. Cost per tonne came in a percent lower quarter-on-quarter due to the reduction in power & fuel and logistics expenses

- Decline in oil (down 20 percent) and petcoke prices (down 10-15 percent) along with strengthening of domestic currency is expected to benefit margin in coming quarters

- UltraTech continues to fortify its market presence through mergers and acquisitions. The company has undertaken three big transactions (acquired the cement assets of JP Associates, Century Textiles and Binani Cement) in the last 18 months. The company expects to benefit from acquisition synergies over the medium to long run as it continues to optimise the cost structure of newly acquired capacities and move them in-line with its own standards

Key negatives - Realisations came in lower QoQ as cement prices weakened in most parts of India. The demand mix remains skewed towards institutional segment, which lacks pricing power

- Margin was impacted by increased costs related to maintenance shutdown. Eleven kilns were shut for maintenance, which pushed costs higher by around Rs 145-150 crore on an aggregate basis (Rs 80 per tonne)

- Competitive intensity remains high as industry players remain focused on pushing volumes higher as the sector is operating at 70 percent capacity utilisation

- The demand environment continues to remain uncertain in the near term as corporates are in wait-and-watch mode in light of the upcoming elections

Outlook and recommendation - Driven by large scale infrastructure construction, cement demand saw a healthy growth in Q3 FY19. The management expects the demand trend to continue for the rest of the year and indicated 7-8 percent volume growth for the industry over the medium term

- Prices in the cement markets remain muted despite health volume growth across markets. Outlook for the industry is positive as capacity utilisation for the industry continues to move up. Demand-supply dynamics is expected in favour of cement manufacturers in the medium term

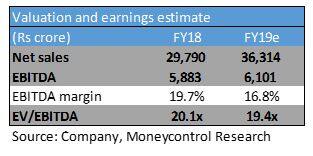

- UltraTech is a proxy for India’s economic growth. Although the company has a strong market position with a strict cost focus, current valuations appear little stretched as the recent acquisitions appear to be earnings dilutive (Binani Cement to turn profitable by FY20-end) from a near term perspective. We, therefore, recommend accumulating the stock on dips

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!