Sachin Pal Moneycontrol Research

Liquor manufacturers’ showed earnings momentum in the second half of last fiscal after revocation of the highway liquor ban by the Supreme Court in August last year. While demand has remained buoyant since, Q1 and Q2 earnings of companies operating in the alcohol beverage space appear mixed as the competitive intensity has picked up in recent months.

The sector’s prospects seem exciting as liquor consumption is on an uptrend. So, which midcap companies are worthy of investment from a long term view.

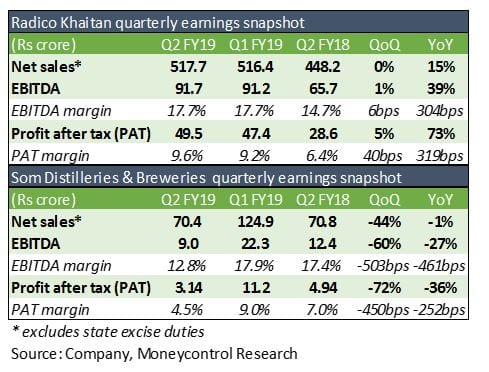

Radico KhaitanThe company delivered a stellar performance in Q2 FY19. Revenue jump of 15 percent year-on-year was aided by 11 percent volume growth. Benign raw material prices (molasses) and richer product mix (higher contribution from the premium segment) aided expansion in operating margin. Operating profit came in 39 percent higher at Rs 92 crore and profit after tax surged 73 percent to Rs 50 crore. Lower interest expenses, resulting from a reduction in debt, boosted bottomline.

The balance sheet continues to strengthen as cash flow from operations and better working capital management resulted in repayment of debt of around Rs 200 crore in H1 FY19. The debt-to-equity ratio reduced to 0.3 times from 0.5 times over the same period. The company aims to repay all its long term borrowings by FY19-end and aims to be a zero debt company by FY21.

Som Distilleries & Breweries SDBL had a disappointing September quarter as sales came in flat at Rs 70 crore. Topline remained stagnant despite the 5 percent price hike taken earlier this year, indicating that quarterly volumes contracted by mid-single digits. Operating profit slumped on account of a sharp contraction in operating margin.

In Q2, the company commenced commercial production at its subsidiary -- Woodpecker Distilleries & Breweries Pvt -- located in Hassan, Karnataka. This plant has a manufacturing capacity of 34 lakh cases of beer and 27 lakh cases of IMFL (Indian-made foreign liquor). The management indicated that revenue from the Hassan unit will start accruing meaningfully from Q1 FY20. SDBL has also acquired a brewery (capacity 42 lakh cases) in Odisha for Rs 46 crore. It plans to incur an expenditure of around Rs 25-30 crore on upgradation of this manufacturing unit.

The company had a strong FY18 on the back of a 39 percent growth in beer volumes. However, the base effect as well as competitive intensity seems to be catching up in FY19 as volumes de-grew in Q2 after a near 10 percent growth in Q1. Accordingly, the management has revised its yearly revenue guidance downwards to Rs 425 crore from Rs 500 crore at the end of FY18 and Rs 450 crore at the end of Q1 FY19. Incremental sales is being targeted through entry into newer markets: Karnataka, Kerala, West Bengal and Puducherry.

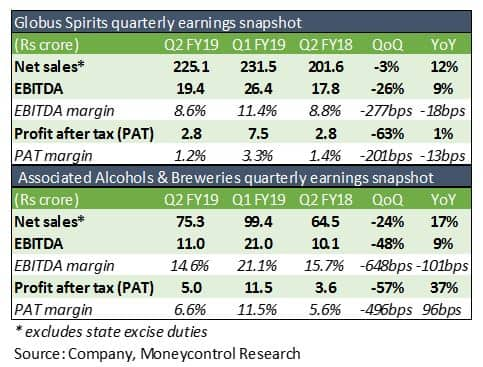

Globus SpiritsFor Globus Spirits, the growth in topline was driven by strong performance from the manufacturing segment. Revenue from the manufacturing space grew to Rs 127 crore in Q2 FY19 from Rs 97 crore in Q2 FY18. Accordingly, capacity utilisation of this segment improved to 91 percent from 88 percent. Around 45 percent of production is held for captive consumption, while the balance is leased out to market players. Globus restarted its Bihar-based manufacturing facility during October. The plant was shut last year due to restriction on manufacturing of extra neutral alcohol in the state.

The consumer segment had a weak quarter. IMIL volumes declined 17 percent, which resulted in a revenue decline to Rs 98 crore in Q2 FY19 from Rs 105 crore YoY. On a regional basis, volumes in Rajasthan, Globus’ core operating market, continued to remain steady. While Haryana and Delhi reported significant volume contraction, West Bengal saw volume growth in excess of 20 percent.

The company is also targeting entry into the premium IMFL segment through its subsidiary: Unibev. Its portfolio currently consists of Oakton (Scotch whisky), Governors Reserve (Scotch whisky) and L’Affaire Napoleon (brandy). It aims to target southern markets through these brands in its first phase of expansion.

Associated Alcohols & Breweries

The Madhya Pradesh-based company posted a decent performance in the September quarter. Topline growth came in strong at 17 percent. Operating profit rose 9 percent as input costs inched up on a yearly basis. Lower interest expenses aided 37 percent growth in profit after tax.

Performance during Q2 was robust considering that production at its Barwaha distillery plant (Khargone, Madhya Pradesh) underwent 30-day shutdown to expand capacity at its distillation plant to 140 kilo litres per day (KLPD) from 105 KLPD. The new unit is expected to start commercial operations from Q3 onwards.

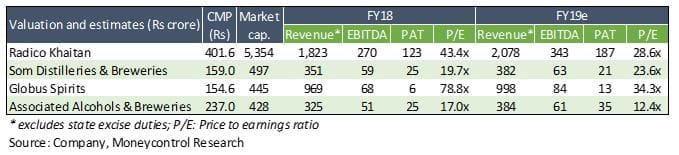

Outlook and recommendation Liquor consumption presents an attractive opportunity as the country has a large young population and remains an underpenetrated market in the alcoholic beverage segment. The per capita consumption is India is far lower compared to western countries and provides huge growth opportunities. In our view, Radico Khaitan and Associated Alcohols remain well positioned to capitalise on market opportunities.

Radico Khaitan commands 6 percent volume share in the IMFL segment. Its Magic Moments vodka brand is highly popular in the mid-market segment and commands a market share of more than 50 percent. The company has increased its advertising spends to enhance brand visibility and is also expanding its distribution channel to gain volumes across regions.

Associated Alcohols enjoys a sticky business relationship with United Spirits and is a key manufacturing partner for its major brands such as Bagpiper, Director’s Special, McDowell’s No. 1 and White Mischief. Earnings appear to be at inflection point as the company is nearing completion of its capacity expansion. Ramp-up of the facility is likely to be the key earnings catalyst and could result in a multiple re-rating.

From a valuation standpoint, Radico Khaitan appears a bit expensive from a near term perspective. The stock should be kept on radar for accumulation in times of a correction. In contrast, around 12 times estimated FY19 earnings, Associated Alcohols appears fairly reasonable at current levels.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!