Anubhav Sahu Moneycontrol Research

Continuing with our attempt to highlight interesting stock picks after the Q1 results season, in this edition we highlight a couple of stocks from the Chlor-Alkali value chain, which pertains to production of caustic soda.

Favorable supply demand dynamics and better end markets have led to improved operating performance in this segment. A couple of names that grabbed our attention are Gujarat Alkalies and Chemicals (GACL) and Chemfab Alkalis.

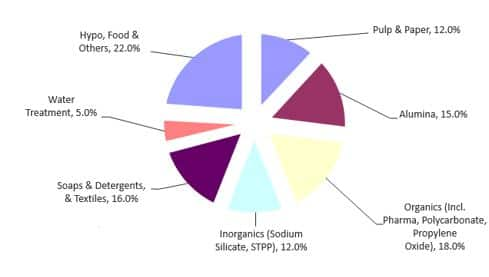

Chart: Global end-market usage

Source: IHS Markit conference, 2016

Global factors supportive

Improving end-market demand (paper, alumina, water treatment, personal care) and supply cuts, due to plant closures in China and Europe, have led to a sharp improvement in caustic soda prices.

While stricter environmental compliance has led to reduced production in China, in Europe, the lower supply is due to closure of mercury process based chlor-alkali units (26 percent of regional capacity amounting to 1.3 million tonne).

It is noteworthy that European Union regulatory norms required discontinuation of such units beyond December 2017.

Product price cycle remains firm

In the last fiscal year, international caustic soda prices firmed up from around $400 per tonne to around $750 per tonne.

Although prices seem to have softened since the beginning of the current fiscal year, recent spot prices, and guidance from international peer Olin Corporation, point toward another surge in prices.

Also, commentary from DCM Shriram suggests that the demand dynamics for chlorine, which is a major by-product, have improved and that the challenge of its disposal has subsided.

Chart: Caustic Soda/ Chlorine prices in North America

Chart: Caustic Soda spot prices in China

Source: www.sunsirs.com

Indian caustic soda industry:

The total installed capacity for production of caustic soda is around 39 lakh tonne per annum. On average, 83 percent of this capacity is put to use.

Expansion plans of domestic manufacturers and reduced global supply mean that India's dependency on imports is reducing. Net import of caustic soda is currently around 3.3 lakh tonne, which constitutes around 10 percent of the total demand.

In FY17, the total quantity imported declined by 18 percent year on year, while in FY18, imports were broadly at a similar level.

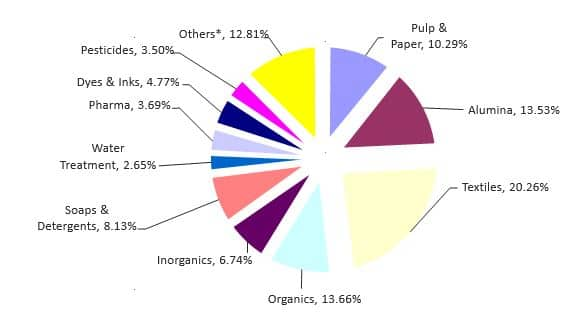

End market break up for India– Caustic Soda

Source: AMAI

Technology change supportive for margins

In recent years, the industry has transitioned to membrane cell process technology, which is energy-efficient when compared to mercury cell technology.

It is reported that earlier, the industry's average power consumption was 3,150-3,300 kWh/tonne. This has now been scaled down to 2,300-2,450 kWh/tonne.

Gujarat Alkalies and Chemicals ltd. (GACL) – One of the largest manufacturer

GACL (Market cap: Rs 4,300 crore) is a major manufacturer of caustic soda (54 percent of sales) and enjoys a market share of about 15 percent. It has an installed capacity of 4.29 lakh tonne.

With 36 products in the portfolio, the company is fairly diversified with products like sodium chlorate (paper and water treatment chemicals) witnessing high demand.

Prospects for the sodium chlorate business are good, particularly in light of the anti-dumping rules curtailing imports from Canada, China and EU.

Strong quarterly result

The company reported a strong set of numbers of Q1 FY19, with a sales growth of 38 percent year on year and 8 percent quarter on quarter. A strong operational performance resulted in a 989 bps year-on-year jump in EBITDA margin to 38 percent.

Factors working in the company's favor

A robust product price cycle has helped in improving the company's free cash flow (~Rs 900 crore in FY18) by more than four times over the last fiscal year.

Further, a strong balance sheet with virtually no debt helps the company embark upon a Rs 1,700 crore (~50 percent debt funded) capex program over the next three years. This includes expanded capacities for a range of downstream products like chloromethanes, hydrogen peroxide, poly aluminium chloride.

The stock has corrected 37 percent from its 52-week high and is now trading at 12-month trailing P/E multiple of 7 times. It is available at an interesting level.

Chemfab Alkalis

Chemfab Alkalis (Market cap: Rs 218 crore) is a relatively small player based out of Tamil Nadu with a caustic soda capacity of 45,600 tonne per annum. Its revenue majorly comes from caustic soda (71 percent of sales) and sodium chlorate (15 percent of sales).

Capacity expansion on cards

The company has got an in-principal approval to increase capacity to 200 tonne per day (from 125 tonne per day). Operationalization of this capacity by Q4 FY19 would take its overall capacity to 72,000 tonne per annum.

Diversification to PVC pipe business

The company is diversifying into the PVC-O (Oriented PVC) pipe business (Rs 50 crore investment). The manufacturing facility is expected to get operational in Q3 FY19.

The stock, after its recent correction, is trading at a high single-digit trading multiple and offers an opportunity to accumulate.

Risk factors to watch out

The above-mentioned companies are involved in an energy-intensive business wherein cost of power constitutes the bulk of all operating cost and hence, any adverse movement in prices of gas and power needs to be watched out for.

Also, the caustic soda business is highly cyclical in nature and the price cycle relies on global supply-demand dynamics.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!