With a robust project pipeline across key markets, Larsen & Toubro (L&T) is witnessing a surge in transmission and distribution (T&D) opportunities driven by the global push towards energy transition, said T Madhava Das, the company’s Senior Executive Vice President (Utilities) and Wholetime Director.

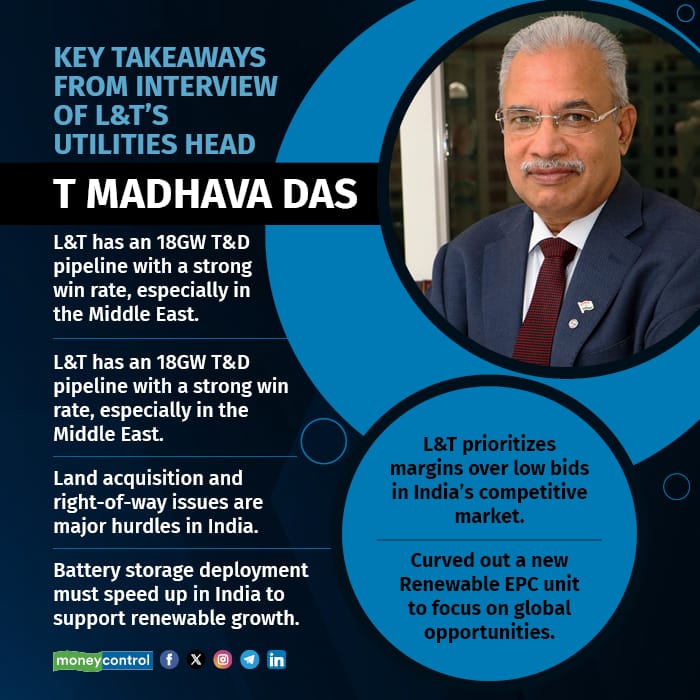

While international prospects remain promising, Das said that there are challenges in project execution in India due to land acquisition, right-of-way (RoW) issues, and resource shortages, which continue to slow down progress. Despite these concerns, L&T is confident that strategic government intervention and growing focus on renewables will keep it on track to capitalise on the clean energy boom, he said.

In an exclusive interview to Moneycontrol, Das said that with 18 Gigawatts (GW) in the pipeline (of which 1.5 GW is in India), the T&D order book is looking robust. He expects a win rate of 15 to 20 percent in India and a significantly high rate in the Middle East.

Das also spoke about navigating T&D bottlenecks, the rationale behind carving out the renewable engineering, procurement, and construction (EPC) division into a separate vertical, and the importance of bridging the battery storage gap in India.

Edited excerpts follow: A section of the T&D industry has concerns about the pace of work in India. What’s your assessment of the situation?Up to 2015-16, the pace of renewables rollouts was not very fast; we used to add 5 to 6 GW a year, scattered across the country. Now, we have mega solar parks coming up, concentrated in Rajasthan and Gujarat. The turnaround time of these depends on getting the land in hand. Most project developers like NTPC, Adani, etc., either have the parks in hand, or are able to procure the land before they launch a project. A two-three GW (solar project) can be executed in two years. So, a transmission line has to be put up much faster to be ready for timely evacuation from a plant.

The execution timelines of T&D projects are catching up with power generation projects, but we need to start doing these well in advance so that projects are not bunched up.

In states where many transmission lines are coming up, the right of way and land acquisition can become critical issues. These bottlenecks need to be cleared. Often, that takes a lot of push from the government and the local authorities.

What’s the main challenge when tenders are bunched up?There is a manpower crunch and there is pressure on the system due to the backlog. With battery prices coming down, the number of battery parks coming up will go up. Hence, a little synchronisation by central authorities in the planning, and the PFC and REC detailing which projects are going to come up at least six to eight months in advance will help smoothen the process.

The government aims to add 50-60 GW of renewable capacity every year. We last did 12-18 GW, and will soon start touching 25-30 GW. So, T&D will have to keep pace with it.

In T&D projects, the right of way on the land is one sensitive issue that can be a deal breaker. Hence, the government’s intervention is critical in this aspect.

Globally, for renewable energy, the model that has worked is strong backup power either fuelled by gas or hydropower, to address the issue of intermittency of renewable energy. Could India's limited backup power create grid distortions due to the mismatch between renewable and backup capacity?I don’t expect distortions in the short term because our power consumption has still not reached that sort of per capita level. But with the electrification of the entire country, including villages, power demand is increasing.

The issue is if there is an increase in the demand and base load at night, how do we meet it? As demand goes up, we are increasing our renewable capacity. Therefore, it is critical that battery and pumped storage capacity also increases. In the next six-eight months, we must push for large scale projects because they take 1-1.5 years to get commissioned.

The pace at which battery and pumped storage capacity is coming up is still slow; batteries, especially, should be really pushed. We need to look at different models like in the Middle East, where the government is taking the lead in putting up huge battery parks of 10-20 Gigawatt hours.

What’s your pipeline for T&D orders?Today, the domestic market has started targeting minimum 500 MW projects in the solar sector. We do a lot of renewable projects abroad, and have a pipeline of close to 18 GW, of which 1.5 GW is in India.

Globally, we are executing parks that are around 2 GW at a single location. Since we have the capability to do large projects, we have now started looking at at least 500 MW projects in India, worth around Rs 2,000 crore, because many of the project developers like NTPC and SJVN have started coming up with 2x250 MW projects.

What is the win rate you are targeting for the 18 GW pipeline?The win rate in the Middle East is very high as they invite only two to three parties and take a quotation from them. They shortlist a few people and negotiate directly.

Whereas in India, things happen on a competitive bid basis and the strike rate can be anywhere between 15 to 20 percent.

How competitive has the Indian market been and what’s your strategy for beating the same?We have become very choosy in the Indian T&D and renewables market because we have the whole global market in front of us. We don't really cut our prices, and we have some minimum guardrails. What we have started seeing is a little more realisation among project developers and clients that price alone is not the only criterion for a job, and we are not in that race at L&T. So, we have started ensuring better margins and realisation. Also, the number of players has reduced; people have realised that low margins are not sustainable.

Many who took up projects at unworkable prices have vanished.

Key Takeaways from interview of L&T's Utilities head T Madhava DasHave things improved on the ground with respect to the challenges relating to land acquisition and right of way?

Key Takeaways from interview of L&T's Utilities head T Madhava DasHave things improved on the ground with respect to the challenges relating to land acquisition and right of way?Both the state and the central governments have realised that if these issues are not addressed seriously, no project will take off. In some places, projects are coming up only if they find that there is a 70-80 percent chance of getting the right of way. Many clients have now started taking responsibility and will help you get the right of way. The client understands that the contractor can’t do this alone.

Secondly, when a client commits on the right of way, it shows that he is confident that the government or somebody else is expediting the resolution of this issue. The process isn’t very efficient yet, but I think there are a lot of green shoots which will be good for us in the long run.

What's the rationale behind L&T carving out renewable EPC into a separate vertical from its T&D business?We had nurtured this business under T&D for quite some time. We built credentials, developed an ecosystem, scaled up, and went overseas. Now we have a proven track record and a huge backlog. With energy transition in focus globally, we see good traction and sustained opportunities in this area. Also, the customer profile of renewables is different from T&D. Hence, we decided to give it a new identity so that it is closer to customers, gets special management attention, and we build a leadership pool in the domain.

Is this in preparation for future value unlocking by listing the renewable EPC arm?In a diverse organisation like L&T, there is creation, grouping, and regrouping of businesses, especially in emerging areas. Any listing related decision is taken at the apex committee and board level and announced at the opportune time with due approvals.

What's the order book for renewable EPC and what growth do you expect going ahead?Currently we are executing 15 GW of solar projects in the Middle East and India. There’s huge potential in this domain, given the focus of the countries in this region and their ambitious targets.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.