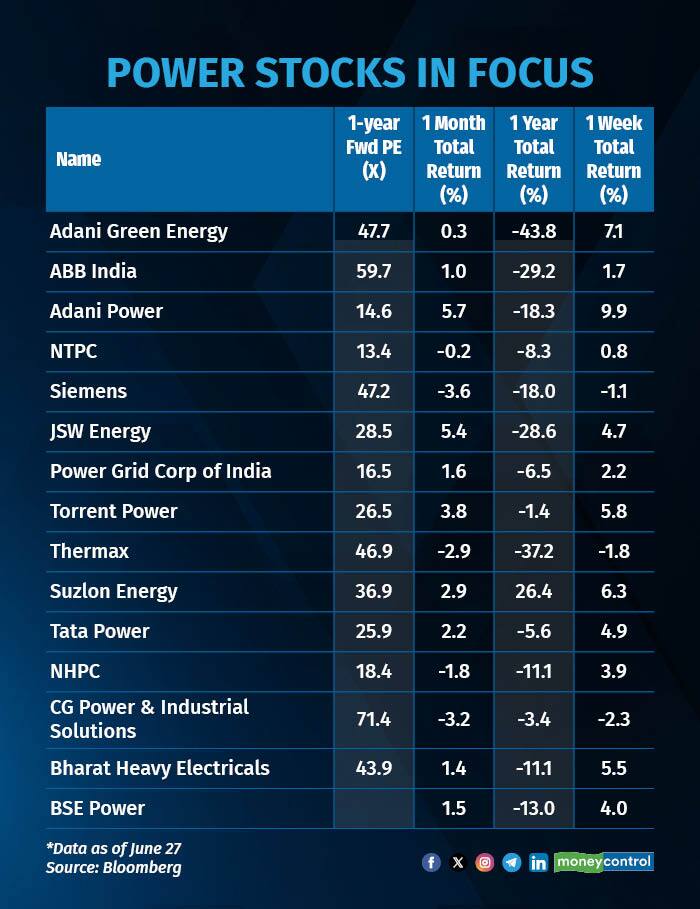

The BSE Power Index rose over 4 percent in the week ending June 27, comfortably outpacing the broader market and lifting stocks like Adani Power, Suzlon Energy, BHEL, and Torrent Power. While most of the momentum can be attributed to short-term demand peaks and technical triggers, analysts suggest the deeper structural story is intact—one that could support valuation across the sector.

Rupesh Sankhe, VP- Research, Elara Securities points to a notable recovery in demand despite a high base last year. “In the last 20 days, we’ve seen a good demand recovery. Demand hasn’t fallen, which is encouraging,” he said, noting that peak power requirements have surged from around 190 GW six months ago to nearly 220 GW now. While last year’s May demand had touched 250 GW, this year too, the bounce back in June, despite the onset of monsoon, reflects underlying industrial resilience in sectors like cement and metals. The demand is lower this year, according to Sankhe due to a higher base the previous year.

Adding to the momentum is a renewed push by discoms, which had been hesitant buyers, due to the weak demand and surplus inventory. Several recent power purchase agreements highlight a shift. JSW Energy signed deals for a combined 550 MW of renewable capacity, and ACME Solar closed a 300 MW solar PPA with SECI over the last week.

Also read: ACME Solar inks power purchase agreement with SECI for 300 MW project in Rajasthan

Structural story intact

The structural setup is strong, considering rising electrification, energy transition, and policy reforms. As per a recent report by OmniScience, emerging sectors such as EVs, data centers, and railways are projected to consume nearly 500 TWh by 2035, roughly 12 to 13 percent of India’s estimated total electricity demand. According to Ashwini Shami, EVP and Portfolio Manager at OmniScience Capital, that scale of demand will be transformative not just for generators but across the entire value chain.

There are other changes that are seen as good for the power ecosystem. The introduction of electricity derivatives on the NSE, for example, is expected to help discoms hedge demand volatility and avoid costly last-minute power purchases. “Earlier, a 20 percent swing in demand meant discoms had to rush and buy power at a premium,” Sankhe explained. “Now, with 15-day hedging products, they can plan better and manage costs.” This is expected to benefit platforms like IEX, though reduced price volatility may dampen upside for some merchant generators. Yet, it is seen as a positive for the sector as a whole.

The valuation debate

Though some market experts say that valuations for the sector may be getting stretched, others feel there is still headroom for growth. Shami says that a large pool of companies from the power ecosystem continues to be mispriced, despite the recent rise, because their growth potential is being underestimated. He points out that power financiers are expected to grow at 10–12 percent annually, backed by strong loan books and low credit risk, yet several are still trading at single-digit forward earnings multiples. In his view, these companies offer strong return profiles with limited downside, especially as India’s power investment requirement surges in the run-up to 2030.

Also read: MC Explains: What are Electricity Futures and how will they impact the power sector?

He also sees valuation gaps in select power generators, particularly public sector players. Traditional P/E ratios understate their true value, he says, because they don’t account for capital work-in-progress and upcoming capacity. “When we apply normalised ROEs to this under-construction capacity, many of these firms look far more reasonably priced,” Shami explained, adding that forward valuations, when adjusted for growth, are often closer to 13–15x—still attractive in today’s market.

Beyond these, parts of the broader ecosystem, including mining-linked companies (like NLC) and capital goods firms, are also benefiting from rising power sector capex.

Sankhe believes the sector offers a rare combination of defensive stability and structural growth. “You’ve got visibility on earnings, higher capex allocation, and healthy dividend yields. It’s a segment that can cushion downside while offering long-term growth,” he said.

Favourable technicals

Amid all the ‘good news’, technical signals have added fuel to the rally. The BSE Power Index has crossed its 20-day moving average and is nearing its 200-DMA around 7015. “If that level is breached, we could see a move toward 7400,” said Vatsal Bhuva, technical analyst at LKP Securities. “But this is not just a technical breakout. With banks and autos largely priced in and IT lagging, power is emerging as a smart rotational play.”

All things considered, it seems the power story may still have steam left.

.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!