Indian equity benchmarks, the S&P BSE Sensex and the Nifty50, ended in the red for the third consecutive session on March 16 as concerns over rising bond yields and inflation continued to weigh on market sentiment.

Sensex settled 31 points, or 0.06 percent, lower at 50,363.96 and Nifty ended 19 points, or 0.13 percent, down at 14,910.45.

Siddhartha Khemka, Head - Retail Research, Motilal Oswal Financial Services, is of the view that Nifty has to decisively cross and hold above 15,000 mark to witness an up move towards 15,150 and 15,250.

"India VIX fell down by 4.90 percent from 21.22 to 20.19 levels. Cooling down of VIX below 20 zones is required for bullish grip and smoother move in the market," Khemka said.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 14,850.27, followed by 14,790.03. If the index moves up, the key resistance levels to watch out for are 15,011.17 and 15,111.83.

Nifty Bank

The Nifty Bank index fell 378 points to close at 34,804.60 on March 16. The important pivot level, which will act as crucial support for the index, is placed at 34,564.44, followed by 34,324.27. On the upside, key resistance levels are placed at 35,224.94 and 35,645.27 levels.

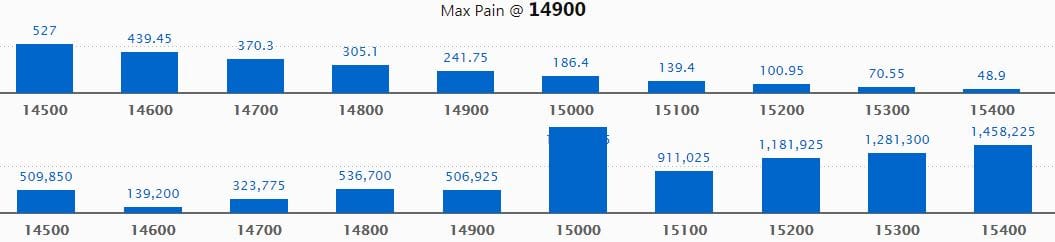

Call option data

Maximum Call open interest of 18.42 lakh contracts was seen at 15,000 strike, which will act as a crucial resistance level in the March series.

This is followed by 15,400 strike, which holds 14.6 lakh contracts, and 15,300 strike, which has accumulated 12.81 lakh contracts.

Call writing was seen at 15,000 strike, which added 1.22 lakh contracts, followed by 15,300 strike which added 50,475 contracts.

Call unwinding was seen at 14,900 strike, which shed 96,375 contracts, followed by 15,400 strike which shed 75,675 contracts and 15,200 strike which shed 72,150 contracts.

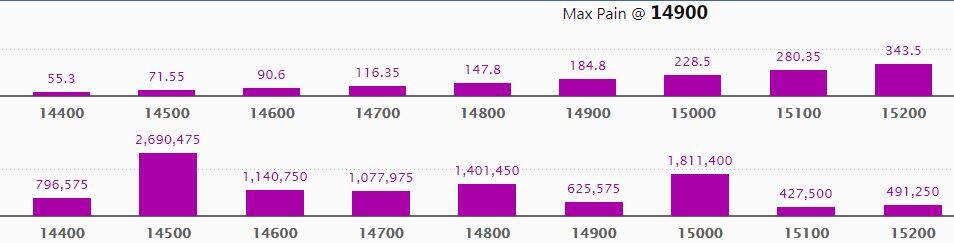

Put option data

Maximum Put open interest of 26.90 lakh contracts was seen at 14,500 strike, which will act as a crucial support level in the March series.

This is followed by 15,000 strike, which holds 18.11 lakh contracts, and 14,800 strike, which has accumulated 14.01 lakh contracts.

Put writing was seen at 14,800 strike, which added 1.59 lakh contracts, followed by 14,600 strike, which added 1.01 lakh contracts and 14,900 strike which added 81,375 contracts.

Put unwinding was seen at 15,200 strike, which shed 51,150 contracts, followed by 15,300 strike which shed 27,600 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

29 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

35 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

45 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

46 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

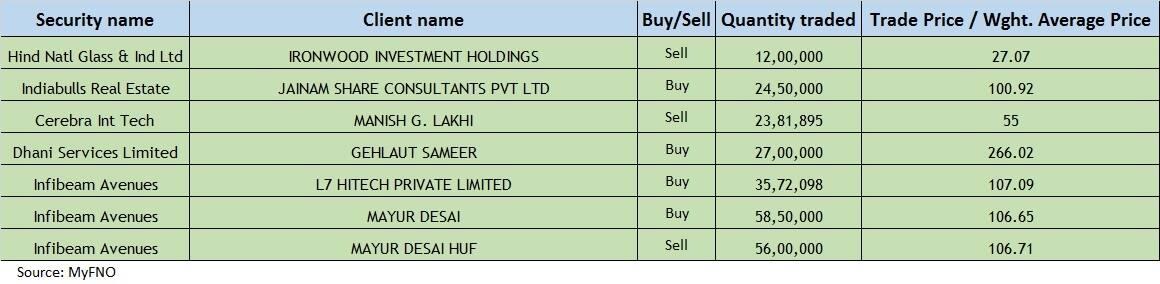

Bulk deals

(For more bulk deals, click here)

Board Meetings

Somany Ceramics: The board will meet on March 17 to consider interim dividend.

Jyoti Structures:The board will meet on March 17 to consider and approve quarterly results.

Bal Pharma:The board will meet on March 17 to consider and approve the preferential issue of shares.

Stocks in the news

Shriram City Union Finance:The Banking and Securities Management Committee of the company on March 16, 2021, approved the issue of secured rated listed redeemable principal-protected market-linked (PP-MLD) non-convertible debentures (NCDs) of the face value of Rs 10,00,000 each, aggregating up to 5,000 NCDs amounting to Rs 500 crore.

Karur Vysya Bank:The company informed that promotor S Nirupama pledged 40,000 shares of the company on March 12, 2021, with Bajaj Finserv.

Asian Hotels (West):The company informed in a regulatory filing that Saurabh Kirpal, an Independent Non-Executive Director of the company, submitted his resignation with effect from March 15, 2021.

PNB Gilts: Rating agencies ICRA and CRISIL on March 16, 2021, reaffirmed the credit ratings of "ICRA A1+" and "CRISIL A1+", respectively, assigned to Rs 1,000 crore commercial paper programme of the company.

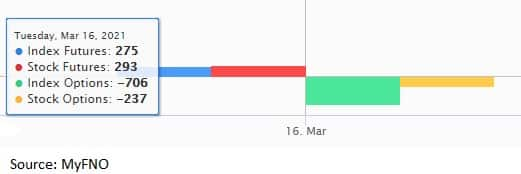

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 1,692.31 crore, while domestic institutional investors (DIIs) net sold shares worth Rs 1,168.59 crore in the Indian equity market on March 16, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Two stocks - BHEL and Sun TV Network - are under the F&O ban for March 17. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!