Bulls gained major strength, lifting benchmark indices higher by nearly 2 percent on June 21 as the rally was seen across sectors. Positive global cues also aided sentiment.

The BSE Sensex jumped 934 points or 1.8 percent to 52,532, while the Nifty50 rose 289 points or 1.88 percent to 15,639 and formed a bullish candle on the daily charts after Doji candles in the previous two sessions.

"On the daily charts, the Nifty has closed just below the breakdown level of 15,650 which will be the immediate resistance levels followed by the 15,800 mark," Vidnyan Sawant, AVP - Technical Research at GEPL Capital said.

He further said the strong support level for the Nifty would be 15,380 followed by 15,180 and 15,000 levels for the short to medium term.

On the indicator front, the relative strength index (RSI) is showing positive diversion on the daily charts at the oversold levels, he added.

"If the Nifty sustains above 15,650 levels then it will move further up till 15,886 levels, which is a previous week's high," the market expert said.

The broader markets also gained strength and outperformed frontliners with the Nifty Midcap 100 and Smallcap 100 indices rising around 3.5 percent each on strong breadth. About 5.5 shares advanced for every falling share on the NSE.

India VIX, the fear index fell by 5.66 percent to 21.14 levels, which was a supportive factor for bulls. For further stability in the markets, the volatility has to decline below 20 levels, experts said.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 15,470, followed by 15,301. If the index moves up, the key resistance levels to watch out for are 15,757 and 15,876.

Nifty Bank also joined the bulls' party, climbing 507 points or 1.55 percent to 33,192 on Tuesday. The important pivot level, which will act as crucial support for the index, is placed at 32,795, followed by 32,398. On the upside, key resistance levels are placed at 33,591 and 33,991 levels.

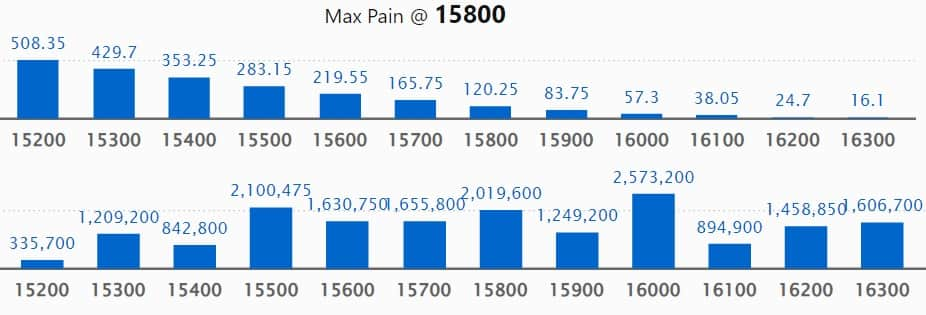

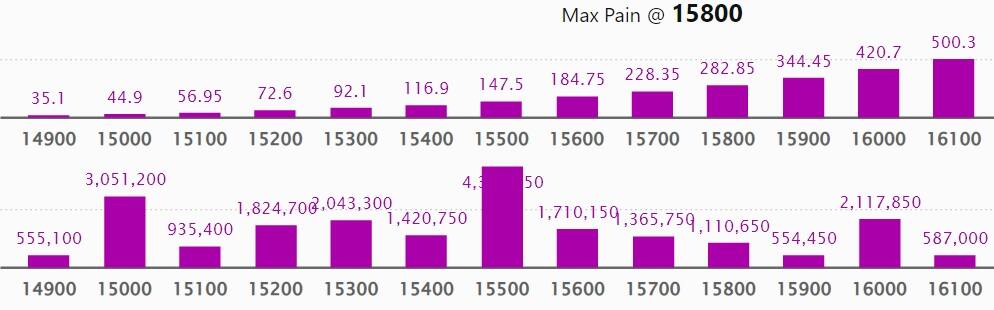

Maximum Call open interest of 25.73 lakh contracts was seen at 16,000 strike, which will act as a crucial resistance level in the June series.

This is followed by 17,000 strike, which holds 25.61 lakh contracts, and 16,500 strike, which has accumulated 24.53 lakh contracts.

Call writing was seen at 16,400 strike, which added 3.79 lakh contracts, followed by 16,200 strike which added 2.67 lakh contracts and 15,600 strike which added 2.61 lakh contracts.

Call unwinding was seen at 15,300 strike, which shed 6.11 lakh contracts, followed by 15,500 strike which shed 3.89 lakh contracts and 16,000 strike which shed 3.78 lakh contracts.

Maximum Put open interest of 43.22 lakh contracts was seen at 15,500 strike, which will act as a crucial support level in the June series.

This is followed by 14,500 strike, which holds 30.82 lakh contracts, and 15,000 strike, which has accumulated 30.51 lakh contracts.

Put writing was seen at 15,600 strike, which added 6.33 lakh contracts, followed by 15,500 strike, which added 6.25 lakh contracts and 15,400 strike which added 2.78 lakh contracts.

Put unwinding was seen at 15,300 strike, which shed 3.84 lakh contracts, followed by 14,500 strike which shed 2.25 lakh contracts, and 14,200 strike which shed 2.02 lakh contracts.

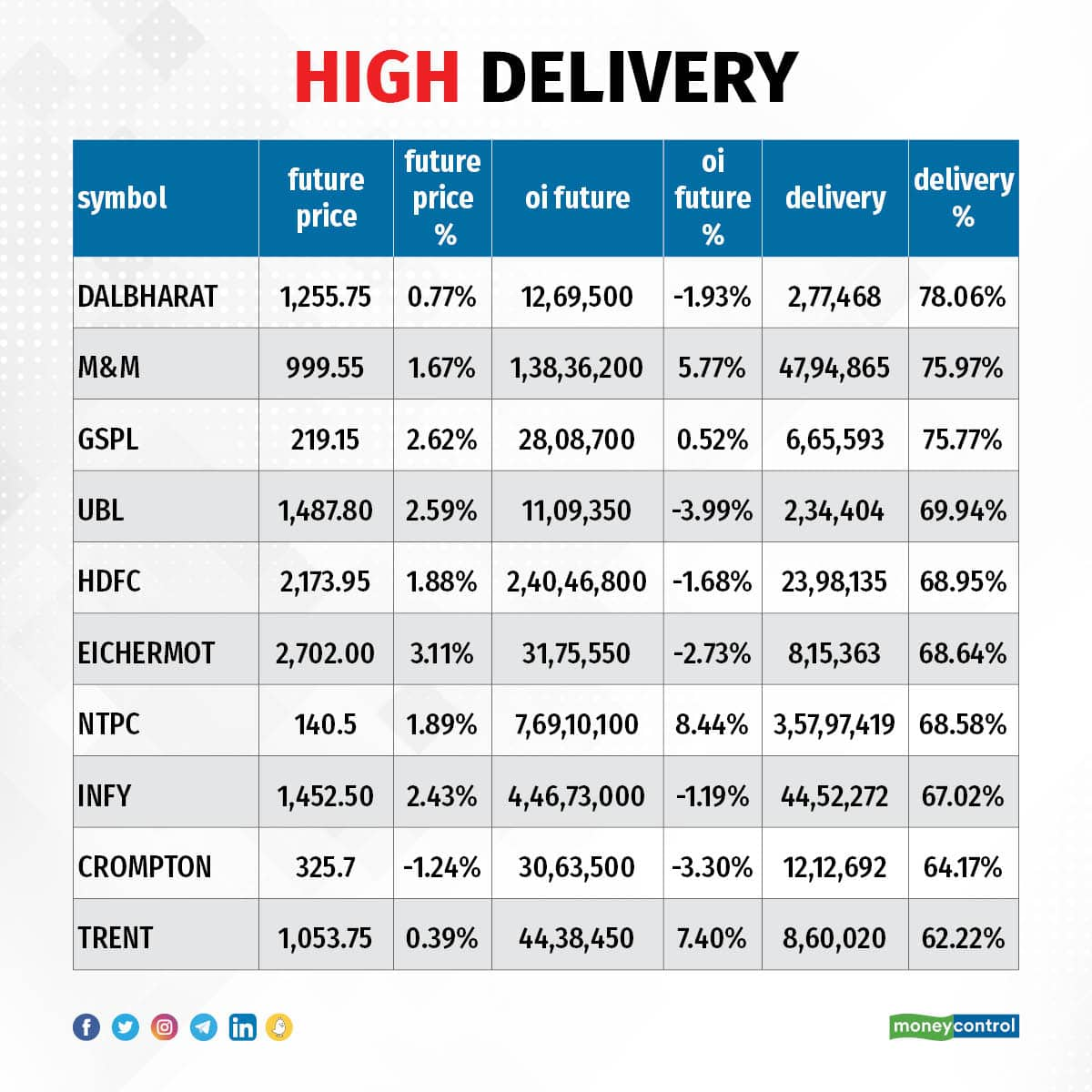

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Dalmia Bharat, M&M, Gujarat State Petronet, United Breweries, and HDFC, among others.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including IDFC First Bank, Navin Fluorine International, Vedanta, NTPC, and Delta Corp, in which a long build-up was seen.

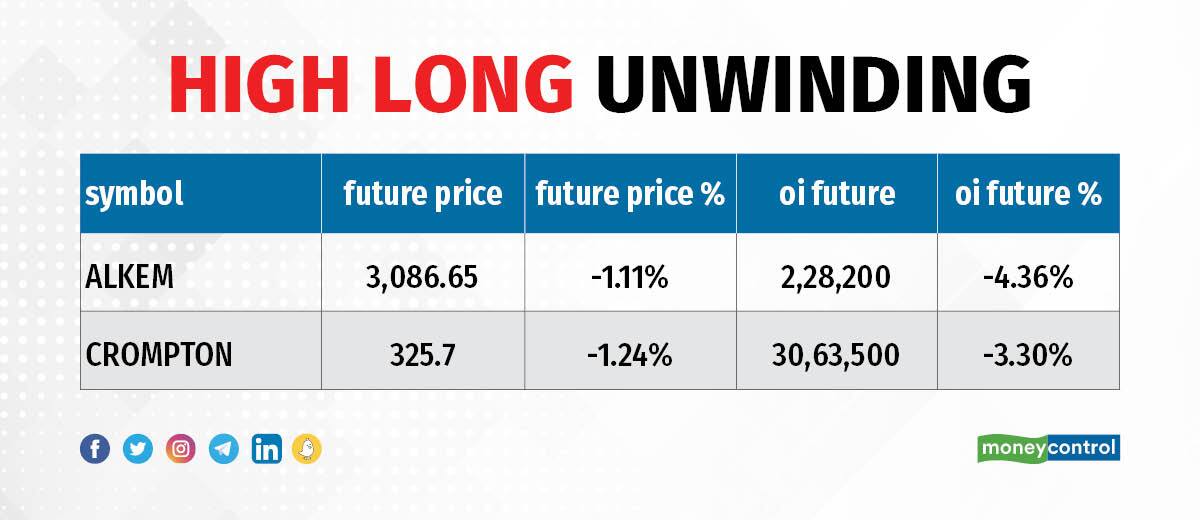

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the 2 stocks - Alkem Laboratories, and Crompton Greaves Consumer Electricals, in which long unwinding was seen.

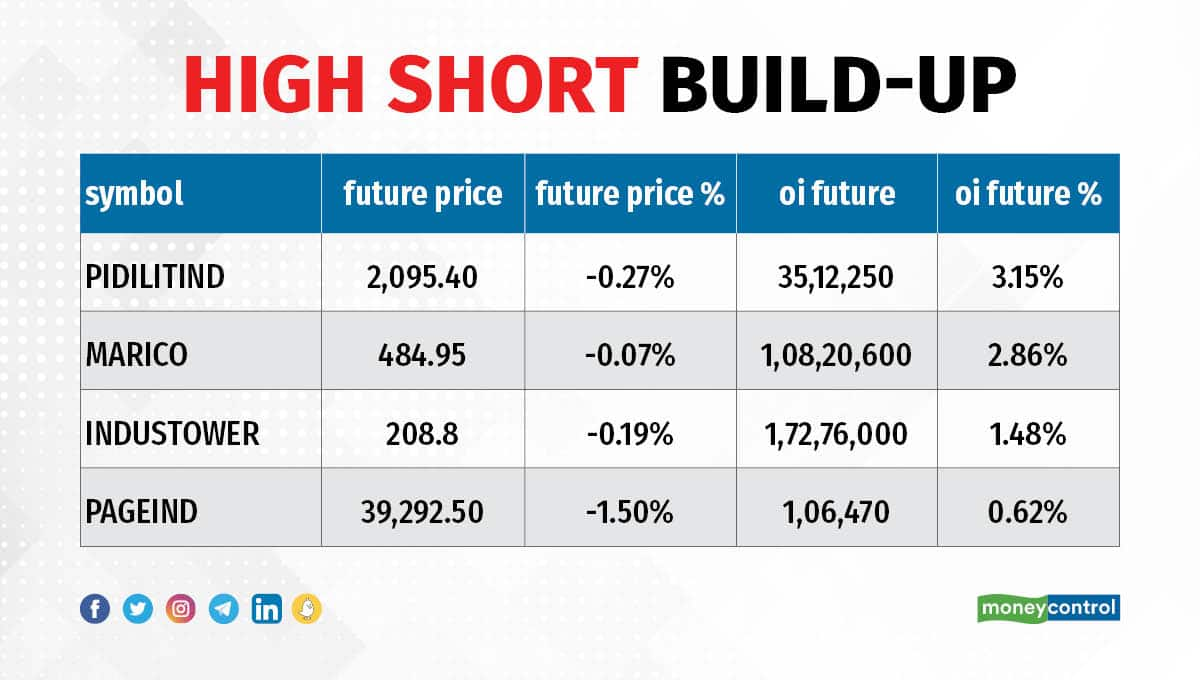

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the 4 stocks - Pidilite Industries, Marico, Indus Towers, and Page Industries, in which a short build-up was seen.

109 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks including Bank Nifty, Coforge, GNFC, Bandhan Bank, and Alembic Pharmaceuticals, in which short-covering was seen.

(For more bulk deals, click here)

Investors Meetings on June 22

Prudent Corporate Advisory Services: Officials of the company will meet Quant Money Managers, Aditya Birla Sun Life AMC, and L&T Investment Management.

Tube Investments of India: Officials of the company will meet IIFL-Institutional Equities.

Krsnaa Diagnostics: Officials of the company will meet Locus Investment Group.

India Pesticides: Officials of the company will meet AS Capital.

Indian Energy Exchange: Officials of the company will meet Nikko Asset Management, JP Morgan Asset Management, and Pictet Asset Management.

Mahindra Holidays & Resorts India: Officials of the company will meet RARE Enterprises.

IIFL Finance: Officials of the company will meet Abakkus Asset Manager LLP.

Vedanta: Officials of the company will meet Rare Enterprise.

Gland Pharma: Officials of the company will attend JP Morgan - India Emerging Opportunities Forum 2022.

Sapphire Foods India, V-Mart Retail: Officials of these companies will attend DART India Consumption Panorama Conference.

Brigade Enterprises: Officials of the company will meet Goldman Sachs.

Barbeque-Nation Hospitality: Officials of the company will meet Dolat Capital.

Voltas: Officials of the company will meet Motilal Oswal.

FSN E-Commerce Ventures: Officials of the company will meet Arisaig Partners, and JM Financial.

Maharashtra Seamless: Officials of the company will meet Emerge Capital, and Eureka Stock & Share Broking Services.

Stocks in News

SIEL Financial Services: Deepak Kumar Rustagi is appointed as Chief Financial Officer (CFO) and key managerial personnel (KMP) of the company with effect from March 17. Ram Jeevan Chaudhary will be relieved from his responsibilities as Chief Financial Officer.

Greenlam Industries: The company has executed a share subscription agreement with Smiti Holding and Trading Company for allotment of up to 63.1 lakh equity shares at a price of Rs 309 per share. Smiti Holding is an investor and will get shares on a preferential basis.

Filatex India: CARE revised its credit rating on the company's long-term bank facilities to A+, from 'A', with a stable outlook.

Hero MotoCorp: The company launched Euro-5 compliant variants of its three globally popular products (Xpulse 200 4V motorcycle and Dash 110 & Dash 125 scooters), in Turkiye. Hero has been operating in Turkiye since 2014 and caters to its customers through a network of over 100 touchpoints, which provide sales, service and spares.

Astral: The company has subscribed to Optionally Convertible Debentures of Rs 194 crore allotted by Gem Paints, and has appointed majority directors on the board of Gem Paints, and Esha Paints. Accordingly, Gem Paints and Esha Paints have become a subsidiary and step-down subsidiary of the company respectively.

Generic Engineering Construction and Projects: CRISIL has reaffirmed its long-term credit rating on the company's bank loan facilities as BBB with a stable outlook and short-term rating as A3+.

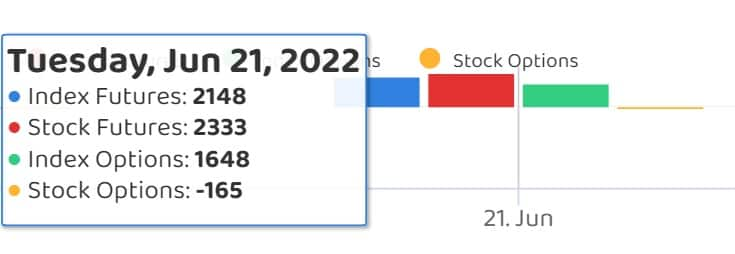

Fund Flow

Foreign institutional investors (FIIs) have net sold Rs 2,701.21 crore worth of shares, whereas domestic institutional investors (DIIs) remained net buyers, to the tune of Rs 3,066.41 crore worth of shares on June 21, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Two stocks - Indiabulls Housing Finance, and RBL Bank - remained under the NSE F&O ban for June 22. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!