The market on September 28 fell quite sharply by 1.6 percent intraday but managed to cut down losses in the last hour of trade and finally settled with a 0.6 percent decline due to buying at lower levels. Banking and Financials, Auto and IT stocks pulled the market down.

The BSE Sensex dropped 410.28 points to 59,667.60, while the Nifty50 fell 106.50 points to 17,748.60 and formed a bearish candle on the daily charts as the closing was lower than opening levels.

"A long negative candle was formed as per daily timeframe chart with long lower shadow. Technically, this pattern indicates a broad-based profit booking from recent new highs of 17,947 levels. The sharp upside recovery of the later part of Tuesday's session signals the absence of any significant trend reversal at the highs," said Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

He feels the near term trend setup of Nifty is still positive and one may expect buying to emerge from the lows in the next 1-2 sessions. "Immediate supports to be watched are at 17,650-17,575 levels," he said.

The broader markets also traded in line with frontliners as the Nifty Midcap 100 index was down 0.67 percent and Smallcap 100 index slipped 0.54 percent.

We have collated 14 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,578.87, followed by 17,409.13. If the index moves up, the key resistance levels to watch out for are 17,915.57 and 18,082.54.

Nifty Bank

The Nifty Bank declined 226.30 points to close at 37,945 on September 28. The important pivot level, which will act as crucial support for the index, is placed at 37,381.07, followed by 36,817.13. On the upside, key resistance levels are placed at 38,443.07 and 38,941.13 levels.

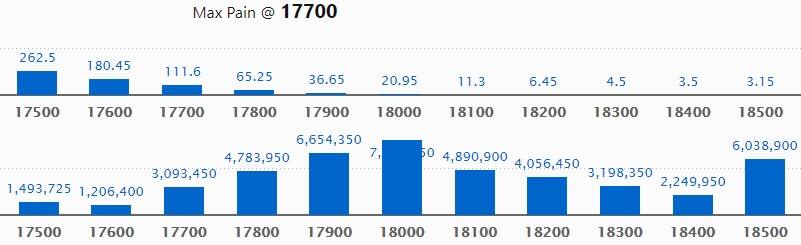

Call option data

Maximum Call open interest of 79.82 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the September series.

This is followed by 17,900 strike, which holds 66.54 lakh contracts, and 18,500 strike, which has accumulated 60.38 lakh contracts.

Call writing was seen at 17,800 strike, which added 22.21 lakh contracts, followed by 17,900 strike, which added 17.08 lakh contracts and 17,700 strike which added 15.56 lakh contracts.

Call unwinding was seen at 18,400 strike, which shed 1.3 lakh contracts, followed by 17,400 strike, which shed 98,050 contracts, and 17,300 strike which shed 44,100 contracts.

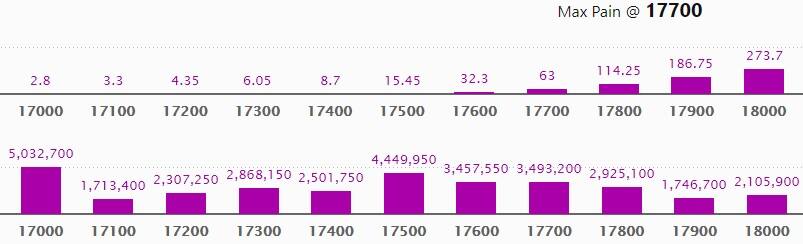

Put option data

Maximum Put open interest of 50.32 lakh contracts was seen at 17,000 strike, which will act as a crucial support level in the September series.

This is followed by 17,500 strike, which holds 44.49 lakh contracts, and 17,700 strike, which has accumulated 34.93 lakh contracts.

Put writing was seen at 17,500 strike, which added 5.94 lakh contracts, followed by 17,600 strike which added 3.08 lakh contracts, and 17,200 strike which added 2.25 lakh contracts.

Put unwinding was seen at 17,800 strike, which shed 14.43 lakh contracts, followed by 17,900 strike which shed 8.4 lakh contracts, and 17,000 strike which shed 7.34 lakh contracts.

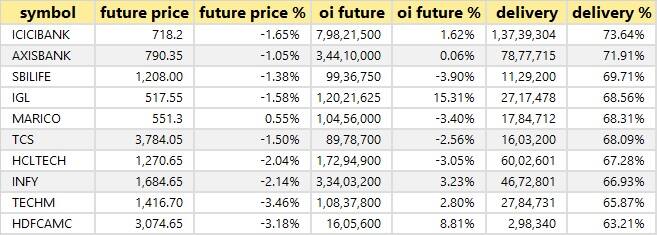

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

22 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

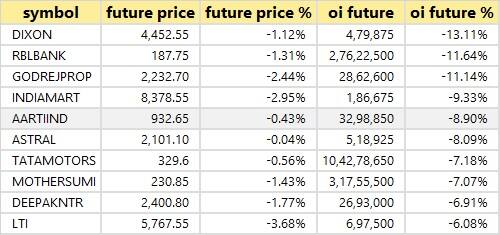

60 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

47 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

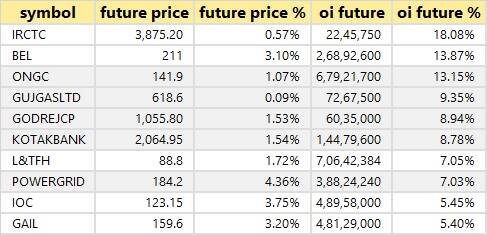

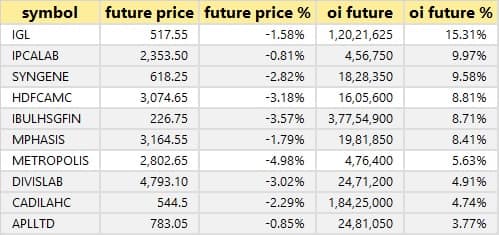

46 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

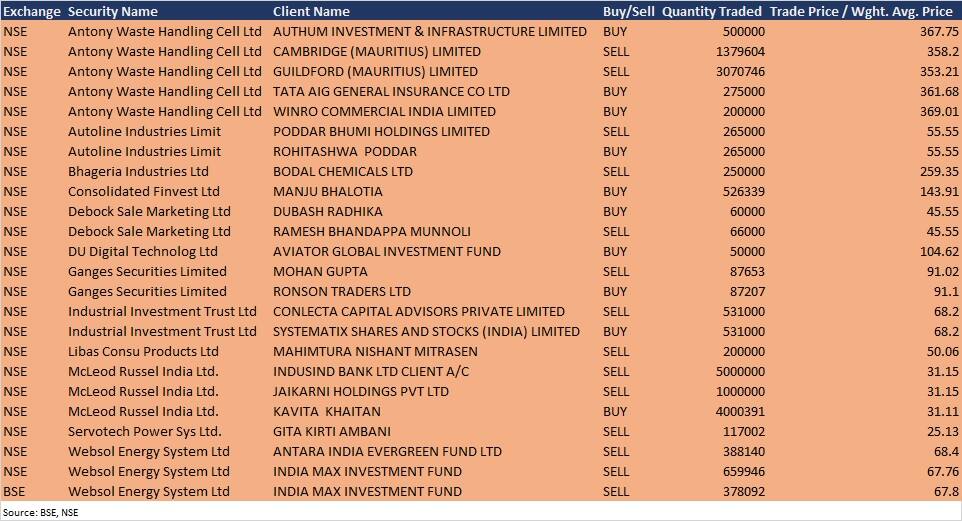

Bulk deals

Websol Energy System: India Max Investment Fund sold 3,78,092 equity shares in the company at Rs 67.80 per share on the BSE, the bulk deals data showed.

(For more bulk deals, click here)

Analysts/Investors Meeting

Nuvoco Vistas Corporation: The company's officials will meet Torq Capital Management on September 29.

Vascon Engineers: The company's officials will meet investors at Arihant Capital Conference on September 29.

Sterlite Technologies: The company's officials will meet investors and analysts on September 29.

Windlas Biotech: The company's officials will meet investors and analysts on September 29.

Heranba Industries: The company's officials will meet investors and analysts on September 29.

Jamna Auto Industries: The company's officials will meet investors and analysts on September 29.

Gokaldas Exports: The company's officials will meet HDFC Mutual Fund on September 29.

Radico Khaitan: The company's officials will meet investors in Equirus Virtual Annual Conference on September 30.

Sun Pharma: The company's officials will meet investors in Citi India Healthcare and Pharma Tour, 2021 on September 30.

Advanced Enzyme Technologies: The company's officials will meet investors and analysts in Motilal Oswal’s Biotech and Medtech Day on October 1.

Stocks in News

HDFC AMC: Foreign promoter Standard Life Investments likely to sell 1.06 crore equity shares (5 percent stake) in HDFC Asset Management Company via an open market transaction on September 29, according to CNBC-TV18. LIC of India acquired 1.24 lakh equity shares in the company via an open market transaction on September 24, increasing shareholding to 5.007 percent from 4.949 percent earlier.

Atul Auto: The commercial production at the Bhayla plant in Ahmedabad of the company for manufacturing three-wheelers was commenced on September 27.

Lupin: The company launched Droxidopa capsules, a generic equivalent of Northera capsules of Lundbeck NA, in the United States. The drug is used for the treatment of orthostatic dizziness and lightheadedness.

KSE: Godrej Agrovet acquired 507 shares in the company via an open market transaction on September 24, increasing shareholding to 5 percent from 4.99 percent.

Compucom Software: The company has won a tender and received a Letter of Acceptance for job works for building and other construction work from Building and Other Construction Worker Welfare Board (BOCW), Labour Department, Rajasthan for a period of 12 months. The project is worth Rs 6.07 crore.

Bharti Airtel: CRISIL has upgraded the long-term rating on bank loan facilities of Rs 20,000 crore, to AA+/Stable from AA/Stable.

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 1,957.70 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 161.45 crore in the Indian equity market on September 28, as per provisional data available on the NSE.

Disclaimer: The views and investment tips expressed by the investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!