The market continued to scale a record closing high for the third consecutive session on January 12, driven by Reliance Industries, auto, telecom, banks, select PSU, and IT stocks.

The BSE Sensex climbed 247.79 points to 49,517.11, while the Nifty50 finally crossed the 14,500-mark, up 78.70 points to 14,563.50, and formed bullish candle on the daily charts as closing was higher than opening levels.

"A long bull candle was formed at the new all-time high of 14,590, which signals an uptrend continuation pattern. Though, Nifty placed at the highs, there is no indication of any trend reversal in the market," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

"The short term trend of Nifty continues to be positive. Now, one needs to be cautious about the higher level weakness in the next few sessions (2-3 sessions). The next upside levels to be watched around 14,700-14,800. Immediate support is placed at 14,490," Shetti said.

The overall market breadth was positive on Tuesday and broader market indices like Nifty Midcap and Smallcap indices closed slightly higher by around 0.67 percent and 0.09 percent, respectively. This underperformance in the broader market was mainly due to outperformance by the large-cap participants on Tuesday, which resulted in decent upside gains.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 14,467.3, followed by 14,371.1. If the index moves up, the key resistance levels to watch out for are 14,625.2 and 14,686.9.

Nifty Bank

The Nifty Bank outpaced Nifty50 on January 12, rising 340.10 points to close at 32,339. The important pivot level, which will act as crucial support for the index, is placed at 31,910.57, followed by 31,482.13. On the upside, key resistance levels are placed at 32,582.67 and 32,826.33.

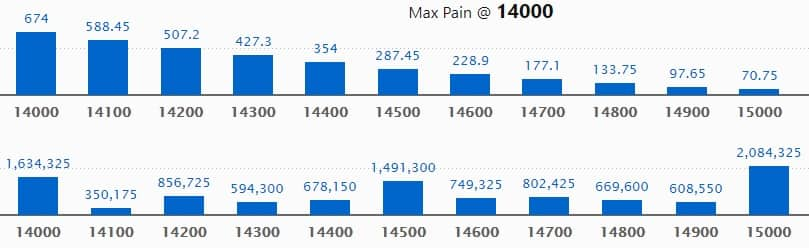

Call option data

Maximum Call open interest of 20.84 lakh contracts was seen at 15,000 strike, which will act as a crucial resistance level in the January series.

This is followed by 14,000 strike, which holds 16.34 lakh contracts, and 14,500 strike, which has accumulated 14.91 lakh contracts.

Call writing was seen at 15,000 strike, which added 1.85 lakh contracts, followed by 15,100 strike which added 1.13 lakh contracts and 15,300 strike which added 78,975 contracts.

Call unwinding was seen at 14,000 strike, which shed 98,400 contracts, followed by 14,400 strike which shed 88,050 contracts and 14,500 strike which shed 84,075 contracts.

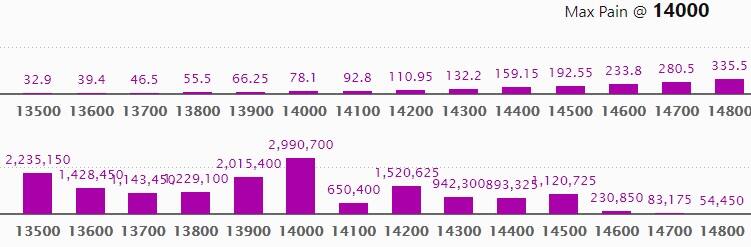

Put option data

Maximum Put open interest of 29.90 lakh contracts was seen at 14,000 strike, which will act as crucial support level in the January series.

This is followed by 13,500 strike, which holds 22.35 lakh contracts, and 13,900 strike, which has accumulated 20.15 lakh contracts.

Put writing was seen at 14,500 strike, which added 4.34 lakh contracts, followed by 13,900 strike, which added 2.49 lakh contracts and 14,600 strike which added 1.66 lakh contracts.

Put unwinding was seen at 13,800 strike, which shed 1.69 lakh contracts, followed by 15,100 strike, which shed 2,235 contracts.

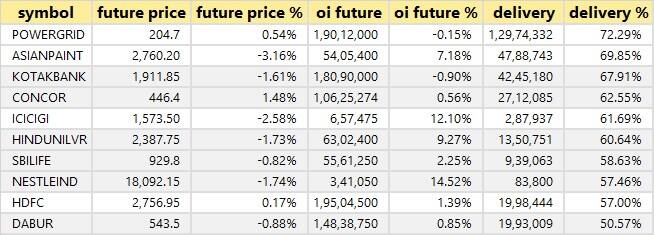

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

64 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

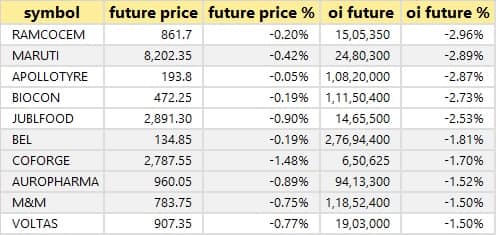

17 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

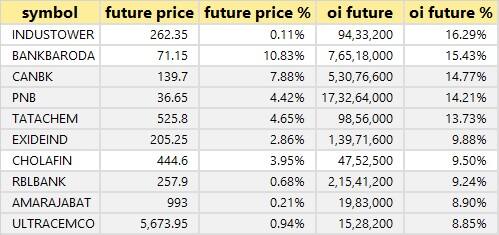

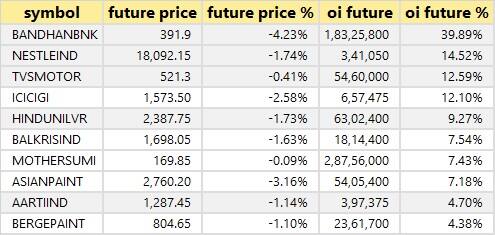

31 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

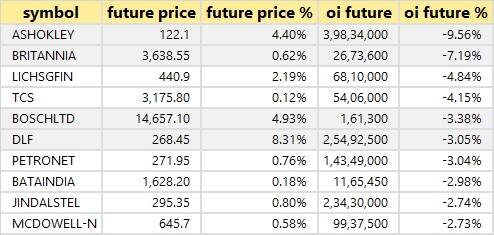

29 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

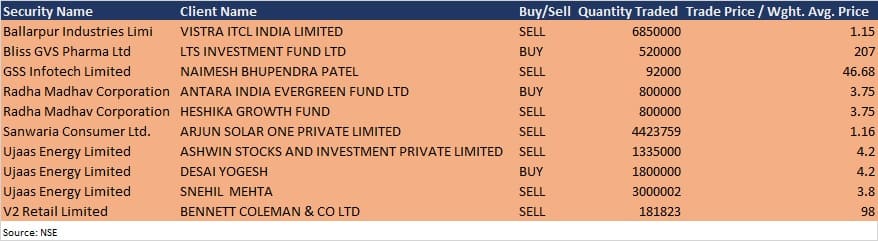

Bulk deals

(For more bulk deals, click here)

Infosys, Wipro, 5paisa Capital, Amtek Auto, Asian Tea & Exports, CESC, Capital Trade Links, GTPL Hathway, Mideast (India) and Rajoo Engineers will announce their quarterly earnings on January 13.

Stocks in the news

Hero MotoCorp: The company appointed new distributor partners in Nicaragua & Honduras, in Central America.

Tata Elxsi: The company reported sharply higher profit at Rs 105 crore in Q3FY21 against Rs 78.8 crore, revenue rose to Rs 477.1 crore from Rs 430.2 crore QoQ.

Bharti Airtel: The company received approvals for its relevant downstream investments and is initiating the process to revise the foreign investment limit to 100% with immediate effect.

Tech Mahindra: The company will buy entire stake in Payments Technology for $9 million.

Tata Motors: Global wholesales increased 37 percent QoQ and 1 percent year-on-year to 2.78 lakh units in Q3FY21.

Bharat Rasayan: The board approved the proposal of buyback of 2.2 percent shares at Rs 11,500 per share.

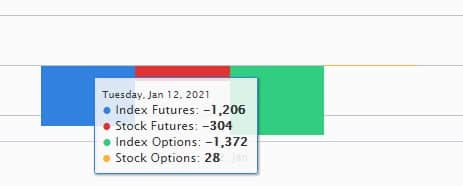

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 571.47 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 1,334.5 crore in the Indian equity market on January 12, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

One stock - SAIL - is under the F&O ban for January 13. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!