Bears were in full control of Dalal Street on February 7 as they pulled down the benchmark indices by 1.75 percent, amid feeble global cues. Traders adopted wait-and-watch mode as they keenly awaited the outcome of RBI's bi-monthly monetary policy meeting scheduled to be held between February 8 and 10.

That apart, consistent selling by FIIs amid rate hike expectations by Federal Reserve and rising oil prices, too, weighed on the sentiment.

The BSE Sensex plunged 1,023.63 points to 57,621.19, while the Nifty50 declined 302.70 points to 17,213.60 and formed a big bearish candle on the daily charts, wiping out all gains registered around Budget.

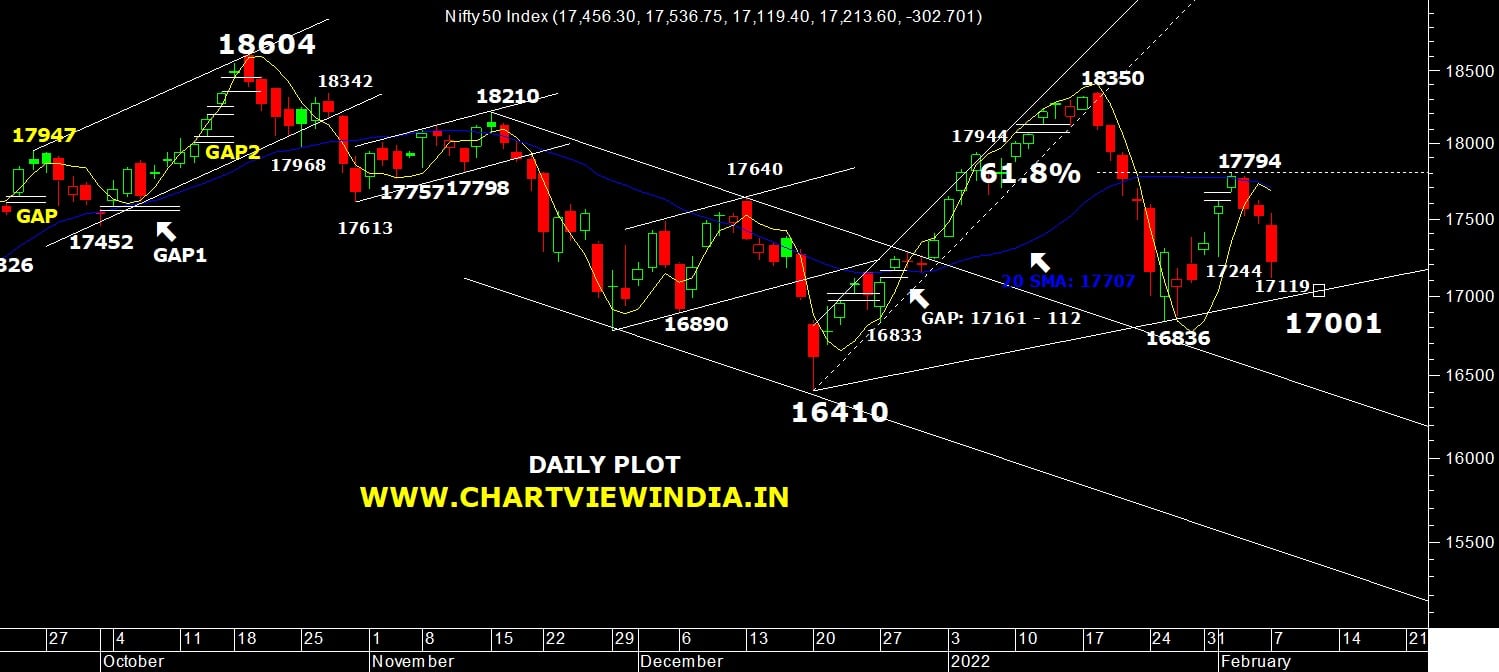

"Nifty50 registered a strong black candle as it has given up all the gains registered from the budget day before signing off the session close to 17,200 levels. However, as long as it stays below 17,244 levels, it should remain under pressure and can breach the psychological support of 17,000 levels," said Mazhar Mohammad, Founder & Chief Market Strategist at Chartviewindia.

Mazhar added, over a period of time, the index can eventually head to test the recent corrective swing low of 16,836 levels. "In between, strength in Nifty shall not be expected unless it closes above 17,536 levels," the expert said.

Therefore, he advised traders to avoid long side bets whereas intraday traders, with high risk-taking ability, can short below 17,100 levels and look for a modest target of 17,000.

On the broader markets front, the Nifty Midcap 100 and Smallcap 100 indices declined more than 1 percent each.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,043.07, followed by 16,872.54. If the index moves up, the key resistance levels to watch out for are 17,460.47 and 17,707.34.

The Nifty Bank plunged 793.85 points or 2.05 percent to 37,995.45 on February 7. The important pivot level, which will act as crucial support for the index, is placed at 37,586.2, followed by 37,177. On the upside, key resistance levels are placed at 38,621.1 and 39,246.8 levels.

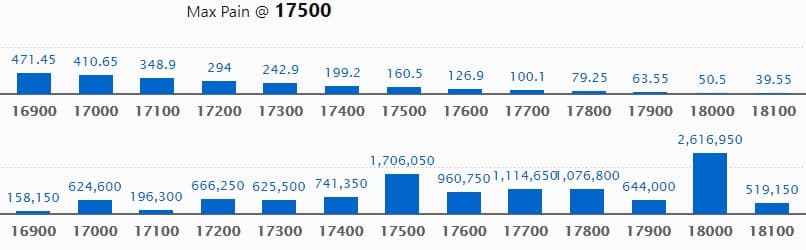

Maximum Call open interest of 26.16 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the February series.

This is followed by 17,500 strike, which holds 17.06 lakh contracts, and 18,500 strike, which has accumulated 14.76 lakh contracts.

Call writing was seen at 18,000 strike, which added 4.55 lakh contracts, followed by 17,500 strike which added 4.43 lakh contracts, and 17,300 strike which added 3.7 lakh contracts.

Call unwinding was seen at 17,700 strike, which shed 7,800 contracts, followed by 16,600 strike which shed 700 contracts.

Maximum Put open interest of 37.22 lakh contracts was seen at 16,500 strike, which will act as a crucial support level in the February series.

This is followed by 17,000 strike, which holds 28.98 lakh contracts, and 18,000 strike, which has accumulated 19.66 lakh contracts.

Put writing was seen at 18,000 strike, which added 4.05 lakh contracts, followed by 16,900 strike, which added 3.27 lakh contracts, and 17,200 strike which added 2.41 lakh contracts.

Put unwinding was seen at 17,500 strike, which shed 1.69 lakh contracts, followed by 17,600 strike which shed 1.08 lakh contracts, and 16,400 strike which shed 99,500 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

19 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

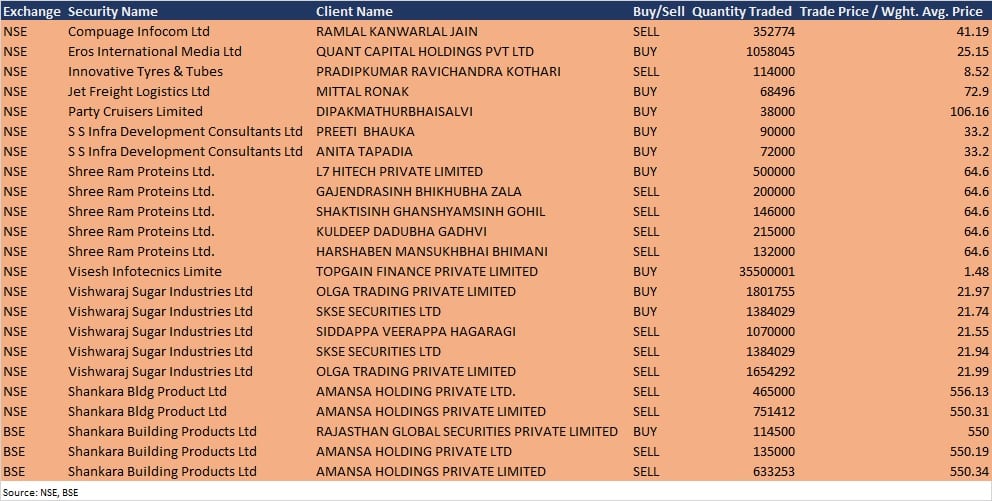

Shankara Building Products: Amansa Holdings Private Limited sold 4.65 lakh equity shares in the company at Rs 556.13 per share on the NSE, and 7,51,412 shares at Rs 550.31 apiece on the NSE, 1.35 lakh shares at Rs 550.19 per share on the BSE, and 6,33,253 shares at Rs 550.34 per share on the BSE, however, Rajasthan Global Securities acquired 1,14,500 equity shares in the company at Rs 550 per share on the BSE, the bulk deal data showed.

Eros International Media: Quant Capital Holdings acquired 10,58,045 equity shares in the company at Rs 25.15 per share on the NSE, the bulk deals data showed.

Vishwaraj Sugar Industries: Investor Siddappa Veerappa Hagaragi sold 10.7 lakh shares in the company at Rs 21.55 per share on the NSE, the bulk deal data showed.

(For more bulk deals, click here)

Analysts/Investors Meeting; and Results on February 8

Results on February 8: Bharti Airtel, IRCTC, Bata India, Jindal Steel & Power, Bajaj Electricals, Ajmera Realty & Infra India, Aster DM Healthcare, Astrazeneca Pharma, Borosil Renewables, Data Patterns (India), Endurance Technologies, Escorts, Glenmark Life Sciences, Godrej Consumer Products, Granules India, Gujarat Gas, HeidelbergCement India, Indraprastha Gas, Jammu & Kashmir Bank, Jagran Prakashan, J Kumar Infraprojects, JK Paper, Kolte-Patil Developers, Latent View Analytics, Mahanagar Gas, NCC, NMDC, Praj Industries, Redington (India), RITES, Stove Kraft, Suven Pharmaceuticals, and Tata Teleservices (Maharashtra) will release their quarterly earnings on February 8.

Tanla Platforms: The company's officials will attend 'Prabhudas Lilladher Tech Tonic 2022 conference' on February 8.

Jubilant Ingrevia: The company's officials will participate in 'Edelweiss India Conference 2022' on February 8.

RITES: The company's officials will meet investors and analysts on February 9 to discuss financial performance.

Tata Consumer Products: The company's officials will attend Edelweiss India e-Conference 2022 – India 2025: The New Edge on February 9.

Advanced Enzyme Technologies: The company's officials will meet Kohlberg Kravis Roberts on February 9 and February 10.

Kolte-Patil Developers: The company's officials will meet investors and analysts on February 9, to discuss financial results.

Borosil Renewables: The company's officials will meet institutional investors and analysts on February 9, to discuss financial results.

Greaves Cotton: The company's officials will interact with several analysts and institutional investors on February 10 and February 11.

VA Tech Wabag: The company's officials will meet investors, analysts and several funds on February 14 to discuss financial results.

Greenply Industries: The company's officials will meet analysts and investors on February 15, to discuss financial results.

Stocks in News

Adani Wilmar: The company will make its debut on the bourses on February 8. The issue price has been fixed at Rs 230 per share.

TVS Motor Company: The company reported higher profit at Rs 288.3 crore in Q3FY22 against Rs 265.6 crore in Q3FY21, revenue increased to Rs 5,706.4 crore from Rs 5,391.4 crore YoY.

NALCO: The company recorded sharply higher profit at Rs 830.6 crore in Q3FY22 against Rs 239.7 crore in Q3FY21, revenue jumped to Rs 3,773.2 crore from Rs 2,378.7 crore YoY.

Castrol India: The company recorded sharply higher profit at Rs 758.1 crore in Q3FY22 against Rs 582.9 crore in Q3FY21, revenue jumped to Rs 4,192.1 crore from Rs 2,996.9 crore YoY.

Paisalo Digital: The company clocked higher profit at Rs 26 crore in Q3FY22 against Rs 22.2 crore in Q3FY21, revenue jumped to Rs 101.4 crore from Rs 86.4 crore YoY.

MM Forgings: The company recorded sharply higher profit at Rs 29.4 crore in Q3FY22 against Rs 15.6 crore in Q3FY21, revenue surged to Rs 293.1 crore from Rs 223 crore YoY.

Jindal Stainless: The company clocked sharply higher profit at Rs 371.8 crore in Q3FY22 against Rs 151.6 crore in Q3FY21, revenue rose to Rs 5,368.4 crore from Rs 3,451.9 crore YoY.

Fund Flow

Foreign institutional investors (FIIs) net sold shares worth Rs 1,157.23 crore, while domestic institutional investors (DIIs) net offloaded shares worth Rs 1,376.49 crore in the Indian equity market on February 7, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Not a single stock is under the F&O ban for February 8. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!