The market started off the week on a positive note and ended at a fresh record closing high on September 6, extending gains for third consecutive session. IT, select metal, auto stocks, and index heavyweight Reliance Industries supported the market.

The BSE Sensex climbed 166.96 points to 58,296.91, while the Nifty50 surpassed 17,400 mark intraday, rising 54.20 points to close at 17,377.80 and formed Spinning Top kind of pattern on the daily charts.

"A small negative candle was formed with minor upper and lower shadow. Technically this formation indicate a Spinning Top type pattern at the highs. Normally, such patterns at the highs/crucial hurdles more often act as a reversal after the confirmations of decline in subsequent sessions. Therefore, any reasonable decline on Tuesday could signal minor downward correction in the market," said Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

He further said, on the other side, the Nifty has been in a sharp uptrended move with minimal decline in between.

"Minor negative patterns or consolidation movements recently have eventually taken out on the upside in the short span of time. Hence, there is a higher possibility of follow-through upmove in the market in the next session."

"Initial upside targets to be watched around 17,500-17,600 levels in the next few sessions. Immediate support is placed at 17,300 levels," he said.

The broader markets also continued positive momentum with the Nifty Midcap 100 and Smallcap 100 indices rising 0.41 percent and 1.09 percent, respectively.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,339.07, followed by 17,300.33. If the index moves up, the key resistance levels to watch out for are 17,423.07 and 17,468.33.

Nifty Bank

The Nifty Bank extended losses to correct 168.90 points to close at 36,592.30 on September 6. The important pivot level, which will act as crucial support for the index, is placed at 36,456.66, followed by 36,320.93. On the upside, key resistance levels are placed at 36,825.87 and 37,059.34 levels.

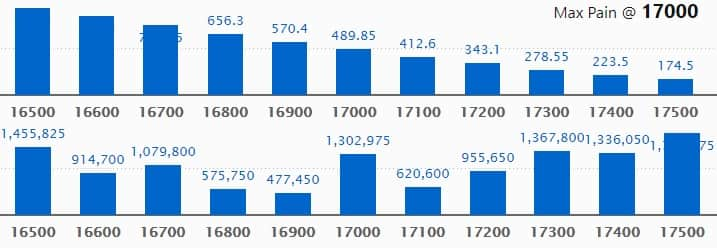

Call option data

Maximum Call open interest of 17.53 lakh contracts was seen at 17500 strike, which will act as a crucial resistance level in the September series.

This is followed by 16500 strike, which holds 14.55 lakh contracts, and 17300 strike, which has accumulated 13.67 lakh contracts.

Call writing was seen at 17400 strike, which added 2.09 lakh contracts, followed by 18000 strike, which added 1.35 lakh contracts and 17700 strike which added 95,250 contracts.

Call unwinding was seen at 17200 strike, which shed 2.39 lakh contracts, followed by 17000 strike, which shed 1.26 lakh contracts, and 16900 strike which shed 73,050 contracts.

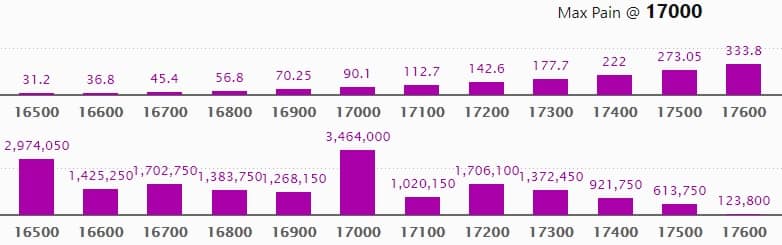

Put option data

Maximum Put open interest of 34.64 lakh contracts was seen at 17000 strike, which will act as a crucial support level in the September series.

This is followed by 16500 strike, which holds 29.74 lakh contracts, and 17200 strike, which has accumulated 17.06 lakh contracts.

Put writing was seen at 17000 strike, which added 4.68 lakh contracts, followed by 17400 strike which added 4.43 lakh contracts, and 17300 strike which added 2.09 lakh contracts.

Put unwinding was seen at 16500 strike, which shed 79,150 contracts, followed by 16600 strike which shed 56,650 contracts and 16700 strike which shed 30,050 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

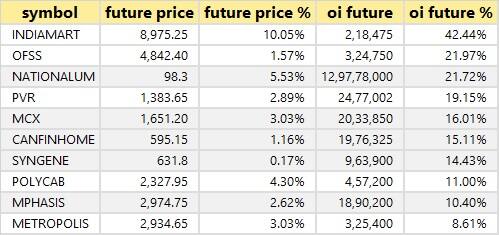

54 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

30 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

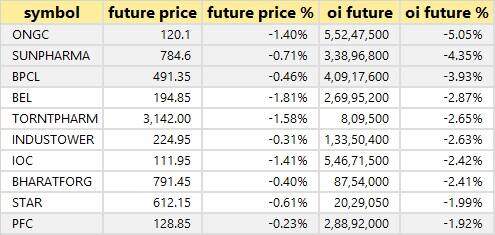

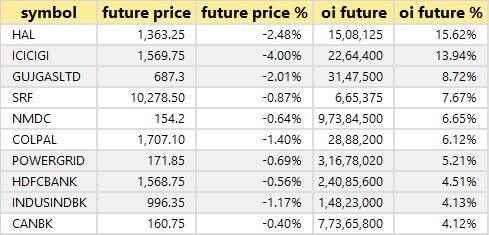

48 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

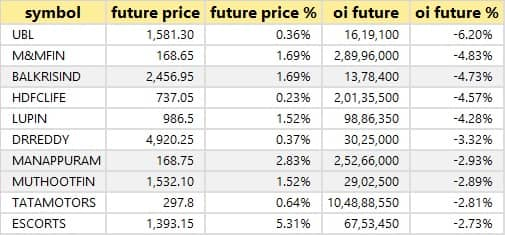

41 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

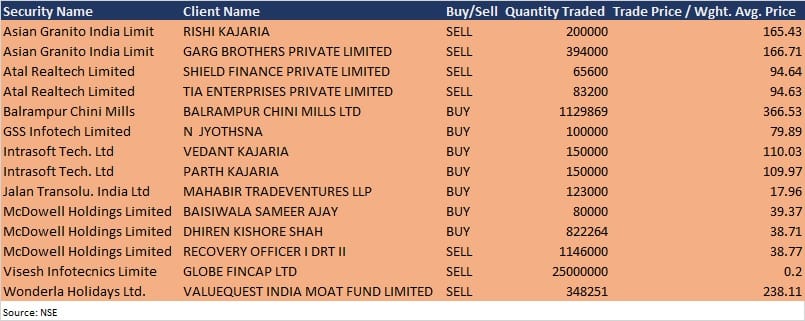

Bulk deals

Balrampur Chini Mills: The company acquired 11,29,869 equity shares of itself at Rs 366.53 per share on the NSE, the bulk deals data showed.

Intrasoft Technologies: Vedant Kajaria bought 1.5 lakh equity shares at Rs 110.03 per share and Parth Kajaria bought 1.5 lakh shares at Rs 109.97 per share on the NSE, the bulk deals data showed.

McDowell Holdings: Recovery Officer I DRT (Debt Recovery Tribunal) II sold 11.46 lakh equity shares in the company at Rs 38.77 per share, whereas Baisiwala Sameer Ajay bought 80,000 equity shares at Rs 39.37 per share and Dhiren Kishore Shah acquired 8,22,264 equity shares at Rs 38.71 per share on the NSE, the bulk deals data showed.

Wonderla Holidays: Valuequest India Moat Fund sold 3,48,251 equity shares in the company at Rs 238.11 per share on the NSE, the bulk deals data showed.

(For more bulk deals, click here)

Analysts/Investors Meeting

UltraTech Cement: The company's officials will meet Amundi Asset Management on September 7.

Asian Granito India: The company's officials will meet analysts on September 7 for upcoming rights issue.

Dhanuka Agritech: The company's officials will meet investors in 'Ashwamedh - Elara India Dialogue 2021' on September 7.

Globus Spirits: The company's officials will meet investors in 'Ashwamedh - Elara India Dialogue 2021' on September 8.

Gland Pharma: The company's officials will meet investors in CEO track forum - Motilal Oswal 17th Annual Global Investor Conference, and Citi's GEMS Virtual Conference on September 8-9.

Rail Vikas Nigam: The company's officials will meet Canara HSBC OBC Life, New Horizon, ITI MF, and TruEquity Adviors on September 8.

Adani Ports: The company's officials will meet investors in Elara Capital Virtual Conference on September 8, and Jefferies Virtual Conference on September 9.

Emami: The company's officials will meet investors in the Motilal Oswal Annual Global Investor Conference on September 15.

Indoco Remedies: The company's officials will meet Sameeksha Capital on September 16.

Bharat Electronics: The company's officials will meet analysts on September 28.

Stocks in News

Nuvoco Vistas Corporation: The company reported higher consolidated profit at Rs 114.28 crore in Q1FY22 against Rs 37.52 crore in Q1FY21, revenue fell to Rs 2,202.97 crore from Rs 2,631.61 crore YoY.

Orient Cement: HDFC Asset Management Company sold 44.70 lakh shares in the company via open market transaction on September 3, reducing shareholding to 2.97% from 5.15% earlier.

VST Tillers Tractors: The company has entered into an agreement with ETG (Export Trading Group), for distribution of its tractors, power tillers, power reapers and diesel engines in the Southern African markets including South Africa, Namibia, Botswana, Zimbabwe, Swaziland, and Zambia.

Starteck Finance: The company approved to sell 100% stake in subsidiary Starteck Housing Finance to Paripurna Trust and/or Matrabhav Trust for Rs 11.45 crore.

International Conveyors: The company sold 7.95% stake in Elpro International for Rs 74.14 crore.

Triveni Turbine: Due to multiple disputes for over two years amongst JV Partners, Triveni Turbine and D I Netherlands B V and Baker Hughes and its affiliates (BH Parties), General Electric Company and its affiliates (GE Parties), these parties agreed to terminate the joint venture agreement and finally resolved the multiple disputes amongst them.

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 589.36 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 547.31 crore in the Indian equity market on September 6, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Two stocks - Indiabulls Housing Finance and NALCO - are under the F&O ban for September 7. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!