The market erased one-third of gains in later part of the session on profit booking but still closed in the green with a percent gains on April 26, aided by banking & financials and metals stocks.

The BSE Sensex rose 508.06 points or 1.06 percent to close at 48,386.51, while the Nifty50 rallied 143.60 points or 1 percent to 14,485 and formed a bullish candle on the daily charts.

"The daily price action has formed a small bullish candle forming a higher high-low compared to the previous sessions, which remains a positive sign. Since the past 8-9 trading sessions, the index continues to consolidate within 14,700-14,200 levels, representing a rangebound movement. Hence, any either side breakout of mentioned range may signal further direction," Rajesh Palviya, Head - Technical and Derivative Research at Axis Securities told Moneycontrol.

"On the daily chart, the index continues to trend lower forming a lower Top and lower Bottom formation indicating a short term down trend. The next higher levels to be watched are around 14,600 levels. Any sustainable move above 14,600 may cause pullback towards 14,700-14,800 which should be used as an exit opportunity for short-term traders," Palviya said.

On the downside, any violation of an intraday support zone of 14,400 levels may signal weakness towards 14,300-14,200 levels, he added.

The Nifty Midcap 100 and Smallcap 100 indices also closed in the green, rising 0.78 percent and 1.13 percent respectively.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 14,418.37, followed by 14,351.73. If the index moves up, the key resistance levels to watch out for are 14,554.57 and 14,624.13.

Nifty Bank

The Nifty Bank index closed at 32,275.20, rising 552.90 points or 1.74 percent on April 26. The important pivot level, which will act as crucial support for the index, is placed at 32,078.77, followed by 31,882.34. On the upside, key resistance levels are placed at 32,537.67 and 32,800.13 levels.

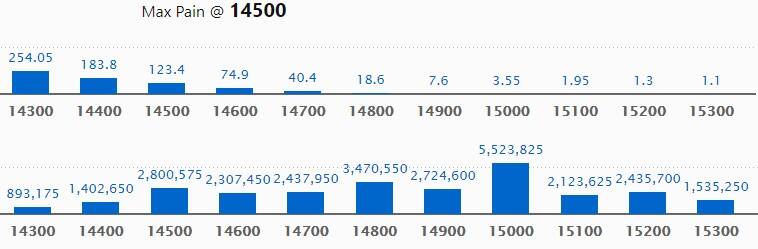

Call option data

Maximum Call open interest of 55.23 lakh contracts was seen at 15,000 strike, which will act as a crucial resistance level in the April series.

This is followed by 14,800 strike, which holds 34.70 lakh contracts, and 14,500 strike, which has accumulated 28 lakh contracts.

Call writing was seen at 14,900 strike, which added 5.26 lakh contracts, followed by 15,300 strike which added 2.42 lakh contracts and 15,000 strike which added 2.25 lakh contracts.

Call unwinding was seen at 14,300 strike, which shed 3.83 lakh contracts, followed by 14,400 strike which shed 3.27 lakh contracts and 14,600 strike which shed 3.02 lakh contracts.

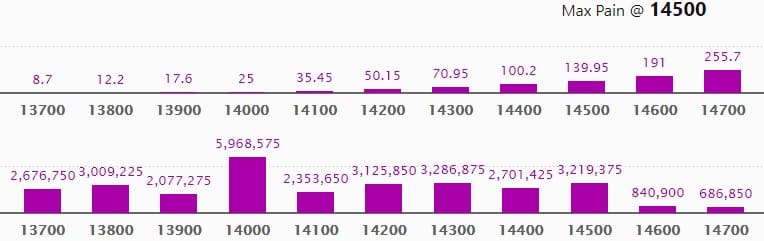

Put option data

Maximum Put open interest of 59.68 lakh contracts was seen at 14,000 strike, which will act as a crucial support level in the April series.

This is followed by 14,300 strike, which holds 32.86 lakh contracts, and 14,500 strike, which has accumulated 32.19 lakh contracts.

Put writing was seen at 14,400 strike, which added 10.46 lakh contracts, followed by 14,500 strike which added 9.76 lakh contracts and 13,800 strike which added 7.9 lakh contracts.

Put unwinding was seen at 14,800 strike, which shed 30,525 contracts, followed by 14,700 strike which shed 10,725 contracts, and 15,200 strike which shed 7,725 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

66 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

14 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

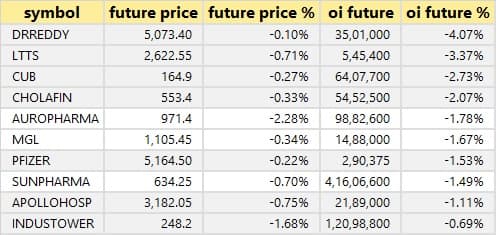

37 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

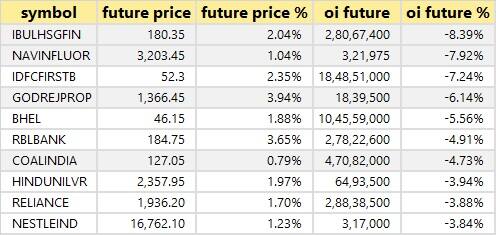

41 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

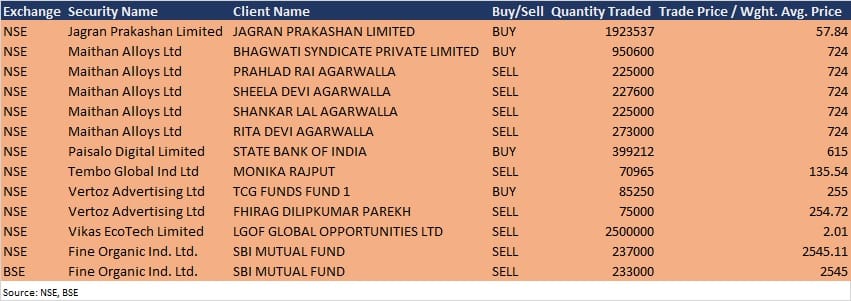

Bulk deals

(For more bulk deals, click here)

Results on April 27

Axis Bank, Maruti Suzuki, ABB India, Bajaj Finance, Britannia Industries, HDFC Asset Management Company, Nippon Life India Asset Management, PNB Housing Finance, CHPL Industries, Cochin Malabar Estates, Gateway Distriparks, Hatsun Agro Product, Hindustan Zinc, Indag Rubber, JTL Infra, LKP Securities, Moschip Technologies, Prism Medico and Pharmacy, Sanofi India, Sanathnagar Enterprises, Sky Industries, Symphony, Syngene International, Tata Investment Corporation, TVS Motor Company, United Breweries, Vesuvius India, and VST Industries will release their quarterly earnings on April 27.

Stocks in News

Tech Mahindra: The company reported a sharp decline in profit at Rs 1,081 crore in Q4FY21 against Rs 1,310 crore in Q3FY21. Revenue rose to Rs 9,730 crore from Rs 9,647.1 crore in the previous quarter. The company's subsidiary will acquire 100% equity shares in Eventus Solutions Group LLC.

HDFC Life Insurance Company: The company reported a higher consolidated profit at Rs 319.06 crore in Q4FY21 against Rs 311.65 crore in Q4FY20; net premium income jumped to Rs 12,869.55 crore from Rs 10,475.95 crore in the year-ago period.

Schaeffler India: The company reported profit of Rs 139.54 crore for Q4FY21 against Rs 78.35 crore in the corresponding quarter of the previous fiscal while revenue rose to Rs 1,316.82 crore from Rs 928.54 crore in Q4FY20.

SBI Cards and Payment Services: The company reported a sharp increase in its profit at Rs 175 crore for Q4FY21 against Rs 84 crore in Q4FY20. However, revenue declined to Rs 2,308.68 crore from Rs 2,433.24 crore in the year-ago quarter.

Great Eastern Shipping Company: HDFC Mutual Fund acquired 30,88,000 equity shares (2.10% of total paid up equity) via open market transactions on April 22, increasing total stake to 7.23% from 5.13% earlier.

Castrol India: The company reported higher profit at Rs 243.6 crore in March quarter 2021 against Rs 125.2 crore in March quarter 2020, revenue jumped to Rs 1,138.7 crore from Rs 688 crore YoY.

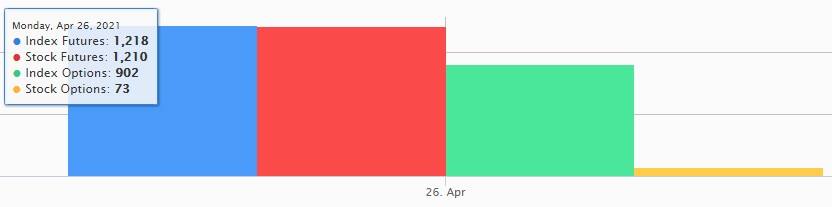

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 1,111.89 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 1,022.57 crore in the Indian equity market on April 26, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Three stocks - Indiabulls Housing Finance, SAIL and Sun TV Network - are under the F&O ban for April 27. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!