The market started off the second week of January on a strong note with the benchmark indices clocking fresh record highs for the second day in a row on January 11, backed by IT, FMCG, auto, and pharma stocks.

The BSE Sensex closed above the psychological level of 49,00o, rising 486.81 points or 1 percent to 49,269.32, while the Nifty50 climbed 137.50 points to 14,484.80 and formed a small bullish candle which resembles Dragon Fly Doji kind of pattern on the daily charts.

"Technically this pattern indicates buy on intraday dips opportunity in the market. The long bull candles of Friday and Monday signal an upside breakout of the small range at 14,250 levels. The new all-time high was formed at 14,498 levels," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

"The short term trend of Nifty continues to be positive. There is a possibility of some more upmove or range movement for the next 3-4 sessions, before showing a sharp one day of decline from the new highs. The next upside levels to be watched at 14,600-14,800. Immediate support is placed at 14,380," he said.

The broader markets underperformed frontline indices with the Nifty Midcap and Smallcap indices closing flat with a negative bias.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 14,412.53, followed by 14,340.27. If the index moves up, the key resistance levels to watch out for are 14,527.63 and 14,570.47.

Nifty Bank

The Nifty Bank underperformed Nifty50, falling 85.30 points to close at 31,998.90 on January 11. The important pivot level, which will act as crucial support for the index, is placed at 31,794.4, followed by 31,589.9. On the upside, key resistance levels are placed at 32,245.9 and 32,492.9.

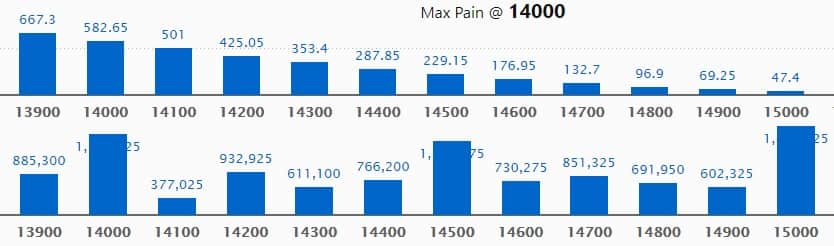

Call option data

Maximum Call open interest of 18.98 lakh contracts was seen at 15,000 strike, which will act as a crucial resistance level in the January series.

This is followed by 14,000 strike, which holds 17.32 lakh contracts, and 14,500 strike, which has accumulated 15.75 lakh contracts.

Call writing was seen at 15,000 strike, which added 4.05 lakh contracts, followed by 14,500 strike which added 88,500 contracts and 14,700 strike which added 71,775 contracts.

Call unwinding was seen at 14,200 strike, which shed 1.99 lakh contracts, followed by 14,300 strike which shed 1.63 lakh contracts and 14,000 strike which shed 1.28 lakh contracts.

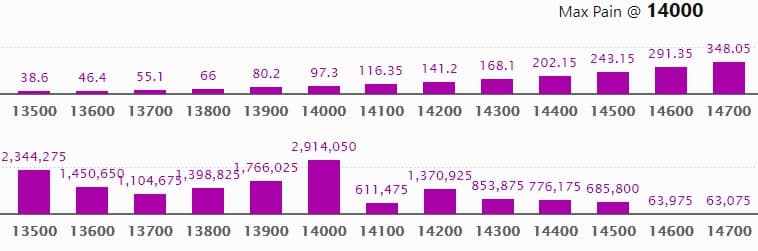

Put option data

Maximum Put open interest of 29.14 lakh contracts was seen at 14,000 strike, which will act as crucial support level in the January series.

This is followed by 13,500 strike, which holds 23.44 lakh contracts, and 13,900 strike, which has accumulated 17.66 lakh contracts.

Put writing was seen at 14,000 strike, which added 4.89 lakh contracts, followed by 14,400 strike, which added 4.43 lakh contracts and 14,500 strike which added 2.09 lakh contracts.

Put unwinding was seen at 13,700 strike, which shed 2.88 lakh contracts, followed by 13,800 strike, which shed 1.31 lakh contracts and 15,000 strike which shed 99,975 contracts.

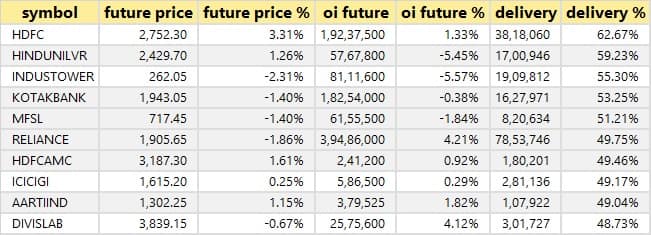

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

44 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

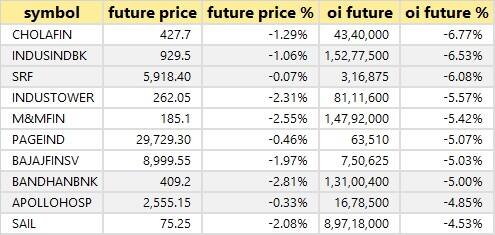

34 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

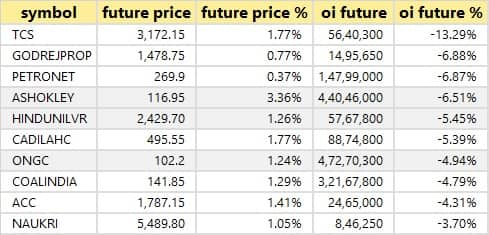

28 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

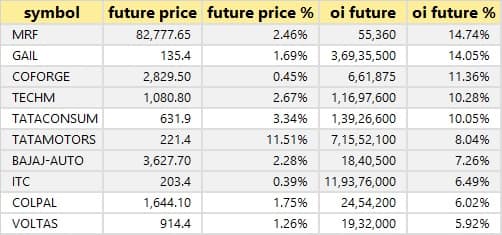

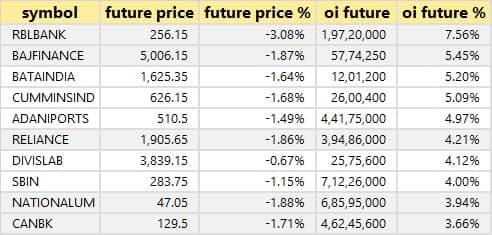

34 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

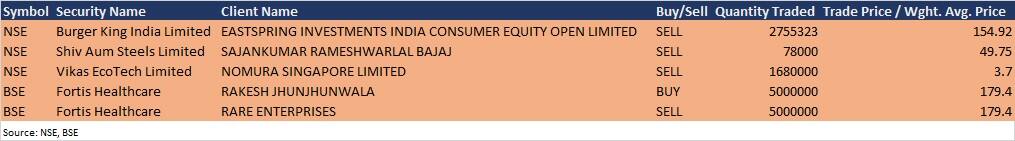

Bulk deals

(For more bulk deals, click here)

Karnataka Bank, Tata Elxsi, Steel Strips Wheels, Filatex India, Hathway Bhawani Cabletel, HPL Electric & Power, Indbank Merchant Banking Services, Ind Bank Housing, ATV Projects India, Continental Securities, Mideast Integrated Steels, Trade Wings, Vikas Multicorp will announce their quarterly earnings on January 12.

Stocks in the news

GAIL: Board meeting is scheduled on January 15 to consider the proposal of buyback of shares.

Tata Motors: Jaguar Land Rover's retail sales fell 9 percent YoY to 1,28,469 units in the October-December period but up by 13.1 percent on a QoQ basis.

Force Motors: Board has approved raising up to Rs 500 crore via NCDs.

Emami: MFs reduced stake in the company to 20.41% in December quarter, from 22.14% in the September quarter, while FIIs increased shareholding to 9.62% from 8.95% in same periods.

Cummins India: MFs reduced stake in the company to 17.12% in December quarter, from 18.63% in September quarter. Aditya Birla Sun Life Trustee and L&T Mutual Fund Trustee names did not appear in December quarter's shareholding pattern. LIC lowered its stake in the company to 6.12% from 6.74% in same periods.

Dishman Carbogen Amcis: Promoter Adimans Technologies LLP will sell 3.87% stake in the company via offer for sale on January 12-13, with an option to additionally sell up to 2.05% shares.

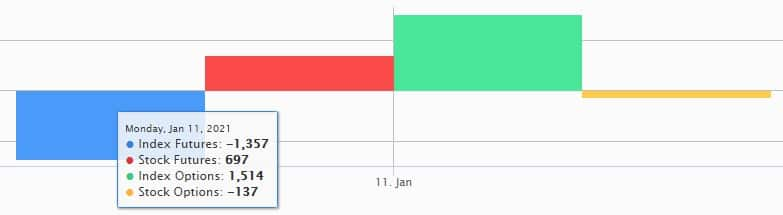

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 3,138.9 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 2,610.13 crore in the Indian equity market on January 11, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

One stock - SAIL - is under the F&O ban for January 12. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!