Extending their losing streak into the fifth consecutive session, the Indian equity benchmark S&P BSE Sensex fell more than 1,100 points while NSE's Nifty50 slipped below 14,650 in the intraday trade on February 22.

Rising COVID-19 cases and surging global bond yields spooked investors.

At close, Sensex was 1,145 points, or 2.25 percent, down at 49,744.32 while Nifty ended 306 points, or 2.04 percent lower at 14,675.70.

"The market may continue with profit-booking for some time till the concerns over rising bond yields and inflation recede. Even the spike in virus cases is worrying the market. Nifty valuations at about 21 times

FY22 EPS are not inexpensive anymore and demand consistent earnings delivery ahead," said Siddhartha Khemka, Head - Retail Research, Motilal Oswal Financial Services.

As per Shrikant Chouhan, Executive Vice President, Equity Technical Research at Kotak Securities, the next level to watch out for would be 14,500/49,340, which is the 50 percent retracement of the previous up-move started from the lowest levels of 13,600/46,160.

"As the market is approaching the monthly expiry of the current month, it could bounce back from 14,500/49,340 levels. On the higher side, 14,900/50,400 and 15,000/50,600 levels would be immediate hurdles. Our advice is to invest in strong companies between 14,650-14,550/49,400-49,500 levels with a medium-term view," said Chouhan.

We have collated 14 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 14,537.1, followed by 14,398.5. If the index moves up, the key resistance levels to watch out for are 14,912.2 and 15,148.7.

Nifty Bank

The Nifty Bank index fell 584 points, or 1.63 percent, to close at 35,257.20 on February 22. The important pivot level, which will act as crucial support for the index, is placed at 34,860.23, followed by 34,463.27. On the upside, key resistance levels are placed at 35,891.53 and 36,525.86 levels.

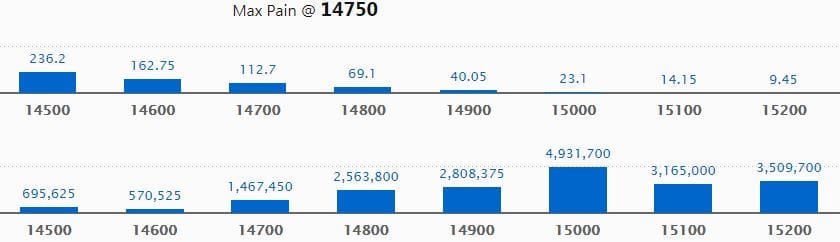

Call option data

Maximum Call open interest of 49.32 lakh contracts was seen at 15,000 strike, which will act as a crucial resistance level in the February series.

This is followed by 15,200 strike, which holds 35.1 lakh contracts, and 15,100 strike, which has accumulated 31.65 lakh contracts.

Call writing was seen at 15,000 strike, which added 26.9 lakh contracts, followed by 14,900 strike which added 21.5 lakh contracts and 14,800 strike which added 19 lakh contracts.

Call unwinding was seen at 14,400 strike, which shed 13,275 contracts, followed by 14,200 strike which shed 2,625 contracts.

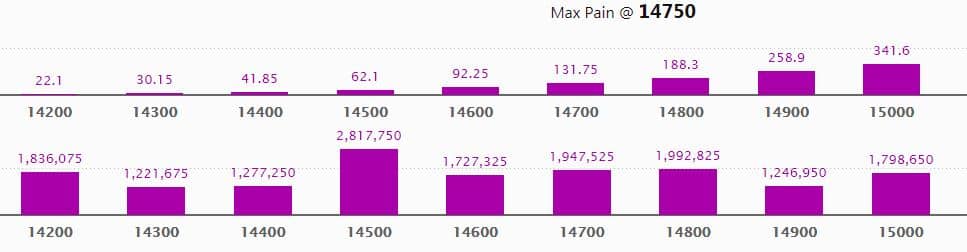

Put option data

Maximum Put open interest of 28.2 lakh contracts was seen at 14,500 strike, which will act as a crucial support level in the February series.

This is followed by 14,800 strike, which holds 19.93 lakh contracts, and 14,700 strike, which has accumulated 19.48 lakh contracts.

Put writing was seen at 14,700 strike, which added 4.09 lakh contracts, followed by 14,600 strike, which added 2.05 lakh contracts and 14,200 strike which added 1.83 lakh contracts.

Put unwinding was seen at 15,000 strike, which shed 15 lakh contracts, followed by 15,100 strike which shed 6.41 lakh contracts.

14 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which long build-up was seen.

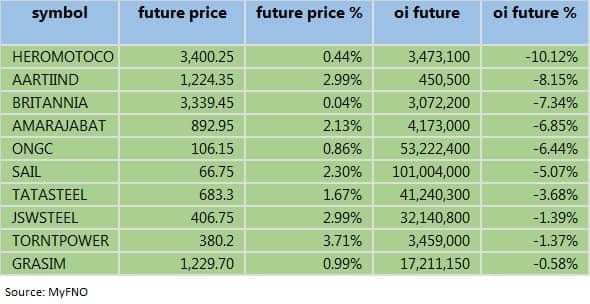

48 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

70 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

10 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

Bulk deals

Gammon Infrastructure Projects: LGOF Global Opportunities bought 2 crore shares of the company at an average price of Rs 0.75 in a bulk deal on BSE. On the other hand, ICICI Bank sold 1,90,10,226 shares of the company at the same average price.

Himadri Speciality Chemical: BC India Investments sold 50 lakh shares of the company at an average price of Rs 43.49 per share in a bulk deal on BSE.

Muthoot Capital Services:SAIF India VI FII Holdings bought 2 lakh shares of the company at an average price of Rs 397.50 per share in a bulk deal on BSE.

Majesco:India Acorn ICAV sold 3,14,000 shares of the company at an average price of Rs 87.30 in a bulk deal on NSE. On the other hand, V L S Finance bought 2 lakh shares of the company at an average price of Rs 87.30 on NSE.

Sanwaria Consumer:Shrinathji Dall Mills sold 56 lakh shares of the company at an average price of Rs 0.65 per share in a bulk deal on NSE.

(For more bulk deals, click here)

Board meetings

Venus Remedies: The board will meet on February 23 to consider and approve the issuance of warrants.

Safari Industries (India): The board will meet on February 23 for general purposes.

Uniply Industries: The board will meet on February 23 to consider and approve quarterly results.

Stocks in the news

Vedanta- GR Arun Kumar resigned as a whole-time director & chief financial officer of the company.

Bharti Airtel- The company will meet global fixed income investors on or after Feb 23, 2021, to take the decision on the issuance of foreign currency bonds/ notes.

APL Apollo - The company allotted commercial paper worth Rs 75 crore to ICICI Prudential Ultra Short Term Fund.

Urja Global - The company approved the allotment of 5 crore partly paid-up rights equity shares at a price of Rs 5 per rights equity share.

Bharat Forge - The company signed an agreement with Paramount Group for the production of protected vehicles in India.

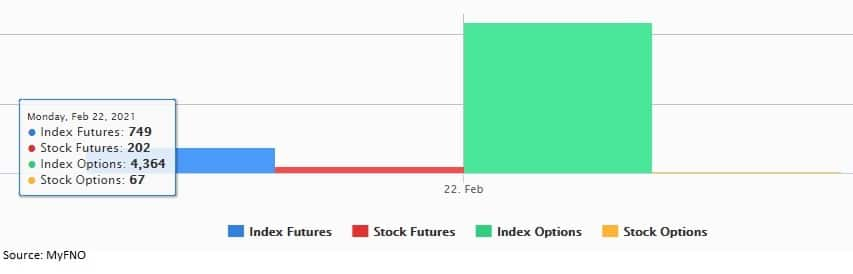

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 893.25 crore, whereas domestic institutional investors (DIIs) also sold shares worth Rs 919.88 crore in the Indian equity market on February 22, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Four stocks - BHEL, Canara Bank, Vodafone Idea and SAIL - are under the F&O ban for February 23. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!