The downtrend continued for the fourth consecutive day, though it was yet another volatile and rangebound session for the market on June 15. Traders cautiously await the outcome of the Federal Reserve's policy meeting due tonight.

Technology, FMCG, power stocks and index heavyweight Reliance Industries pulled the market down, whereas the buying was seen in Bajaj Finance twins, auto, select banking and financial services, and metal stocks.

The BSE Sensex fell 152 points to 52,541, while the Nifty50 declined 40 points to 15,692 and formed a small-bodied bearish candle which resembles the Inside Bar kind of pattern formation on the daily charts.

"On the daily charts, the index made an Inside Day candle pattern, indicating silence before the big event. Since March 2022, the Nifty has been respecting 15,650 levels and this time also it is sustaining above that level since past three days, which shows the 15,650 levels would act as an immediate important support on the downside," Vidnyan Sawant, AVP - Technical Research at GEPL Capital said.

The upside resistance is placed at 15,886 (current week high) followed by the 16,000 mark (key resistance), he added.

According to the market expert, if the index breaches 15,650 levels then it will move down until the 15,450 mark in the coming days.

The volatility remained above 20 levels, indicating a favourable trend for bears. India VIX, which measures the expected volatility in the market, rose by 1.18 percent to 22.15 levels.

The broader markets managed to outshine frontliners as the Nifty Midcap 100 index gained 0.35 percent and Smallcap 100 index rose 0.6 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 15,653, followed by 15,613. If the index moves up, the key resistance levels to watch out for are 15,758 and 15,823.

Nifty Bank remained volatile and closed 28 points higher at 33,339 on Wednesday. The important pivot level, which will act as crucial support for the index, is placed at 33,208, followed by 33,076. On the upside, key resistance levels are placed at 33,513 and 33,686 levels.

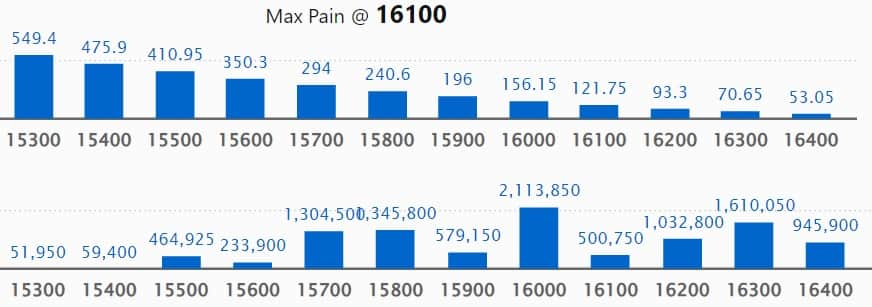

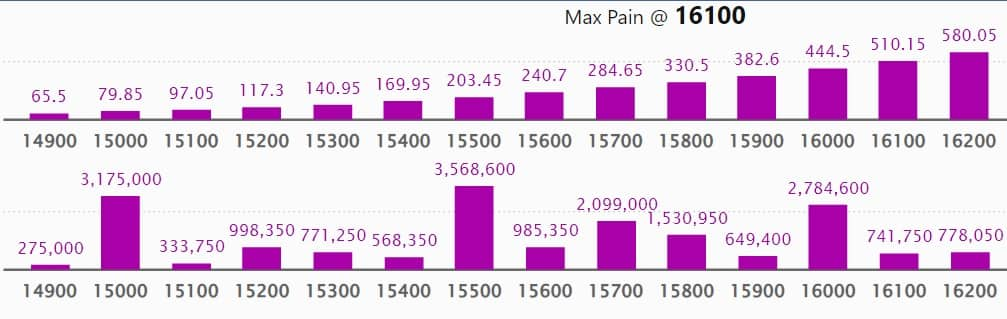

Maximum Call open interest of 25.91 lakh contracts was seen at 17,000 strike, which will act as a crucial resistance level in the June series.

This is followed by 16,500 strike, which holds 22.55 lakh contracts, and 16,000 strike, which has also accumulated 21.13 lakh contracts.

Call writing was seen at 15,700 strike, which added 6.41 lakh contracts, followed by 15,800 strike which added 2.45 lakh contracts and 16,300 strike which added 1.69 lakh contracts.

Call unwinding was seen at 16,800 strike, which shed 41,200 contracts, followed by 16,900 strike which shed 39,250 contracts and 17,200 strike which shed 37,550 contracts.

Maximum Put open interest of 35.68 lakh contracts was seen at 15,500 strike, which will act as a crucial support level in the June series.

This is followed by 15,000 strike, which holds 31.75 lakh contracts, and 16,000 strike, which has accumulated 27.84 lakh contracts.

Put writing was seen at 15,700 strike, which added 7.78 lakh contracts, followed by 15,500 strike, which added 3.47 lakh contracts and 15,600 strike which added 1.57 lakh contracts.

Put unwinding was seen at 16,000 strike, which shed 3.46 lakh contracts, followed by 16,200 strike which shed 31,600 contracts, and 14,700 strike which shed 27,600 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Crompton Greaves Consumer Electricals, Ambuja Cements, Gujarat State Petronet, SBI Life Insurance Company, and Muthoot Finance, among others.

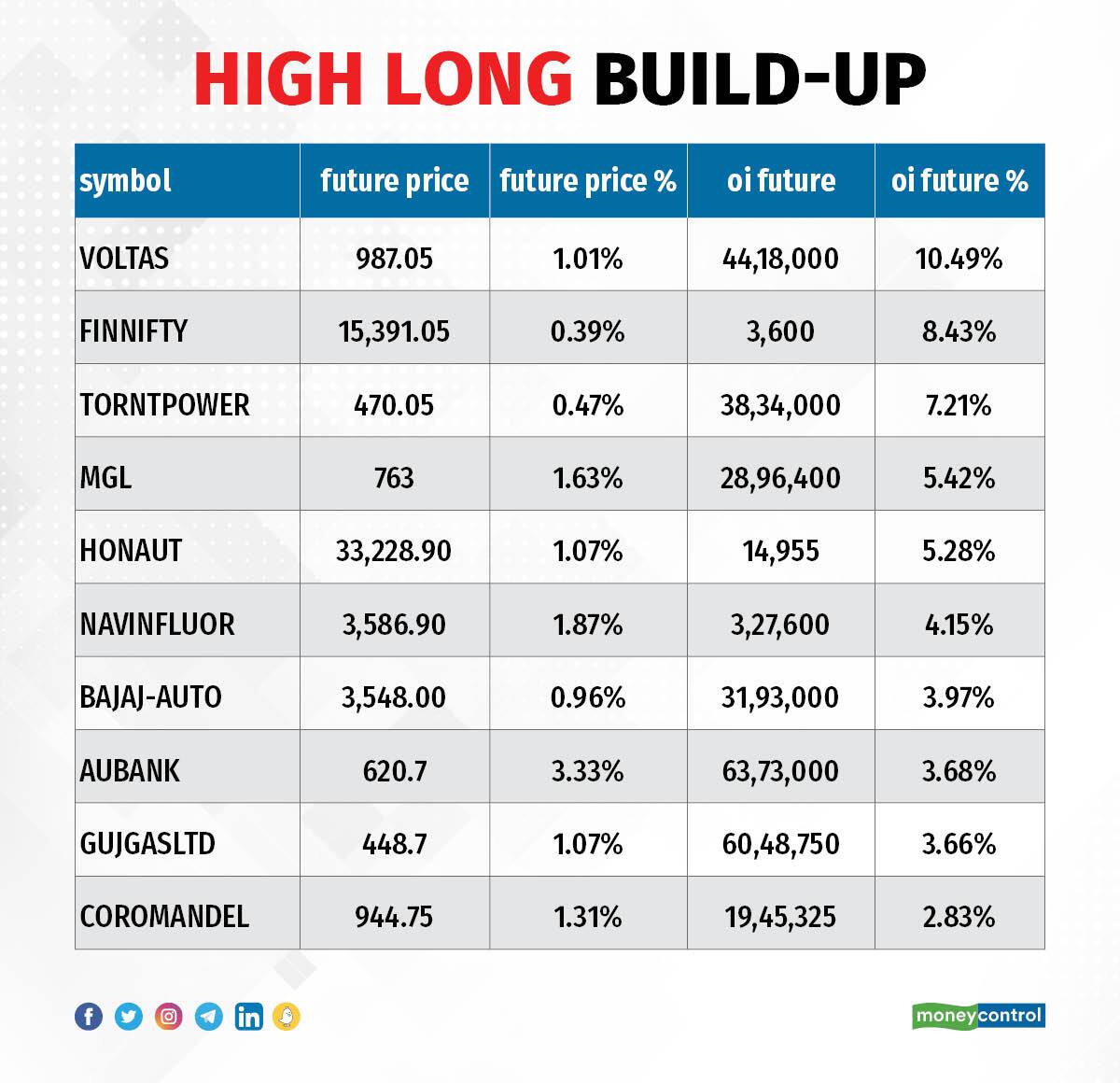

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including Voltas, Nifty Financial, Torrent Power, Mahanagar Gas, and Honeywell Automation, in which a long build-up was seen.

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Federal Bank, Canara Bank, Dalmia Bharat, Eicher Motors, and Bharat Electronics, in which long unwinding was seen.

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks including Apollo Tyres, Sun TV Network, IndusInd Bank, Crompton Greaves Consumer Electricals, and Zee Entertainment Enterprises, in which a short build-up was seen.

78 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks including Deepak Nitrite, Syngene International, Polycab India, Ashok Leyland, and Shriram Transport Finance, in which short-covering was seen.

Rama Steel Tubes: Nomura Singapore bought one lakh equity shares in the company via open market transactions on June 15. These shares were acquired at an average price of Rs 371 per share.

KBC Global: Nomura Singapore has offloaded 1,96,20,000 equity shares (3.19 percent) in the company via open market transactions, at an average price of Rs 4.4 per share. It had held 4.01 percent (2.46 crore shares) in the company as of March 2022. In these bulk deals, E Waste Recycling acquired 1.3 crore shares, Wealth 4 U Hospitality Consultancy bought 1.32 crore shares, Arihant Share Consultancy purchased 50 lakh shares and Nakshatra Garments bought 50 lakh shares in the company at the same price.

(For more bulk deals, click here)

Investors Meetings on June 16

Vijaya Diagnostic Centre: Officials of the company will meet Marval Capital, and Dalton Investments.

Tube Investments of India: Officials of the company will meet WhiteOak Capital, and Spark Capital Advisors (India).

Tata Consumer Products: Officials of the company will meet Goldmans Sachs (India) Securities.

Rolex Rings: Officials of the company will meet Axis Mutual Fund.

Greaves Cotton: Officials of the company will meet HSBC Securities, and Tekene Capital.

Sapphire Foods India: Officials of the company will meet Mirae Asset Capital Markets, and Polunin Capital.

Voltas: Officials of the company will meet Systematix Shares and Stocks (India).

Century Enka: Officials of the company will meet Berggruen Holdings.

CSB Bank: Bank will be participating in the ‘Investec India Annual BFSI Conference’ to be held in Singapore.

KRBL: Officials of the company will meet M3 Investment, and O3 Capital.

Brigade Enterprises: Officials of the company will meet Dymon Asia, Eastspring Investments, Polunin Capital, and Nikko Asset Management.

The Phoenix Mills: Officials of the company will meet HSBC Securities.

BLS International Services: Officials of the company will meet Royce Investment Partners.

Sapphire Foods India: Officials of the company will meet Edelweiss Financial Services.

Welspun Corp, Aarti Industries, Shree Cement, Multi Commodity Exchange of India, The Great Eastern Shipping Company, Tata Chemicals: Officials of the companies will meet various investors at PhillipCapital Ground View Conference 2022.

UltraTech Cement: Officials of the company will meet Jupiter Asset Management, Soros Capital, and Theleme Partners.

Manappuram Finance: Officials of the company will meet Enam Asset Management, Invesco London, and Alpha Capital.

eMudhra: Officials of the company will meet Hornbill Orchid India Fund.

Trident: Officials of the company will meet JM Financial.

Ashiana Housing: Officials of the company will meet SBI Mutual Fund, and ICICI Prudential Mutual Fund.

Stocks in News

Usha Martin: Promoter entities Peterhouse Investments Ltd and PACs have sold 63,000 equity shares in the company via open market transactions on June 14 and June 16. With this, their shareholding in the company stands reduced to 1.91 percent, down from 1.94 percent earlier.

Jyothy Labs: Nalanda India Equity Fund bought 6.55 lakh equity shares in the company via open market transactions on June 14. With this, its shareholding in the company stands increased to 5.06 percent, up from 4.88 percent earlier.

Voltamp Transformers: HDFC Mutual Fund through its several funds acquired 50,000 equity shares in the company via open market transactions on June 14. With this, its shareholding in the company increased to 5.25 percent, up from 4.91 percent earlier.

UPL: UPL through its subsidiary USCL has acquired Kudos Chemie for Rs 40 crore, and is required to invest Rs 237 crore in Kudos over a period of 2 years as per the resolution plan approved by NCLT. Kudos manufactures speciality chemicals used as beverage and pharmaceutical ingredients and has a manufacturing facility near Chandigarh.

Indian Overseas Bank: The public sector lender said the board has approved the capital plan for FY23. The bank will raise up to Rs 1,000 crore by issuing equity shares and another Rs 1,000 crore by issuing bonds, in FY23.

NBCC (India): The company has secured total business of Rs 330.35 crore during May 2022.

Fund Flow

Foreign institutional investors (FIIs) have net sold Rs 3,531.15 crore worth of shares, whereas domestic institutional investors (DIIs) remained net buyers, to the tune of Rs 2,588 crore worth of shares on June 15, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Three stocks - Indiabulls Housing Finance, RBL Bank, and Delta Corp - remained under the NSE F&O ban for June 16 as well. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!