The market clocked more than 1 percent gains on February 9, thereby extending the rally into the second consecutive session, ahead of interest rate decision by RBI's Monetary Policy Committee.

All the sectors, barring PSU Banks, participated in the run, while the broader markets, too, joined the rally with the Nifty Midcap 100 and Smallcap 100 indices rising 1.14 percent and 0.41 percent, respectively.

The BSE Sensex climbed 657.39 points or 1.14 percent to 58,465.97, while the Nifty50 jumped 197 points or 1.14 percent to 17,463.80 and formed a bullish candle on the daily charts.

"On the indicator front, the RSI (relative strength index) plotted on the daily time frame can be seen moving higher after forming a bullish hinge near the 40-mark, indicating increasing bullish momentum in the prices," says Malay Thakkar, Technical Research Associate at GEPL Capital.

In the coming sessions, the multiple touch point level of the 17,300-17,260 will act as a support zone, Thakkar says, adding on the upside the market might move higher towards the 20-day SMA (17,640). "If the prices manage to sustain above this level, we might see the index move higher and test the 17,800-18,000 mark."

He further says the prices action and the technical indicators plotted on the daily time frame all point towards the possibility of the index forming an immediate bottom near the 17,000-mark.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,376.13, followed by 17,288.47. If the index moves up, the key resistance levels to watch out for are 17,514.33 and 17,564.87.

The Nifty Bank rose 581.85 points or 1.53 percent to 38,610.30, outperforming frontline indices on February 9. The important pivot level, which will act as crucial support for the index, is placed at 38,318.77, followed by 38,027.33. On the upside, key resistance levels are placed at 38,774.87 and 38,939.54 levels.

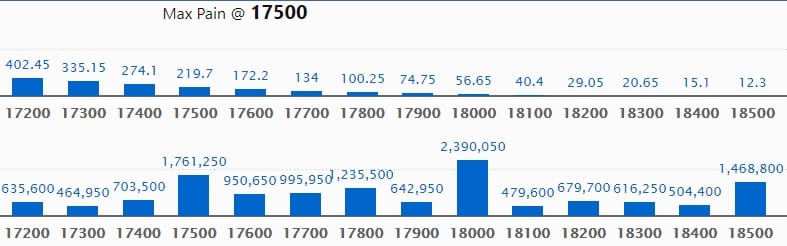

Maximum Call open interest of 23.90 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the February series.

This is followed by 17,500 strike, which holds 17.61 lakh contracts, and 18,500 strike, which has accumulated 14.68 lakh contracts.

Call writing was seen at 17,800 strike, which added 2.41 lakh contracts, followed by 18,400 strike which added 59,850 contracts, and 18,200 strike which added 41,050 contracts.

Call unwinding was seen at 17,300 strike, which shed 2.45 lakh contracts, followed by 18,000 strike which shed 1.91 lakh contracts and 17,200 strike which shed 1.72 lakh contracts.

Maximum Put open interest of 33.80 lakh contracts was seen at 16,500 strike, which will act as a crucial support level in the February series.

This is followed by 17,000 strike, which holds 30.65 lakh contracts, and 17,500 strike, which has accumulated 16.40 lakh contracts.

Put writing was seen at 17,400 strike, which added 1.98 lakh contracts, followed by 17,000 strike, which added 1.56 lakh contracts, and 17,100 strike which added 86,800 contracts.

Put unwinding was seen at 16,500 strike, which shed 2.81 lakh contracts, followed by 18,000 strike which shed 2.4 lakh contracts, and 16,900 strike which shed 2.07 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

101 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

Advani Hotels & Resorts: Delta Corp sold 2,83,024 equity shares in the company at Rs 90.39 per share on the NSE, the bulk deal data showed.

Vadilal Industries: Cliantha Trust sold 46,961 equity shares in the company at Rs 963.19 per share on the NSE, the bulk deal data showed.

India Infrastructure Trust: IIFL Wealth Prime offloaded 36 lakh units in the company at Rs 98.5 per unit, and Rapid Holdings 2 Pte Limited sold 50 lakh units at Rs 98 per unit on the BSE, the bulk deal data showed.

(For more bulk deals, click here)

Analysts/Investors Meeting; and Results on February 10

Results on February 10: Hero MotoCorp, Mahindra & Mahindra, Hindalco Industries, Zomato, ABB India, Aegis Logistics, Amara Raja Batteries, Alembic Pharmaceuticals, BEML, Bharat Forge, Computer Age Management Services, Cummins India, Gujarat Pipavav Port, Gujarat State Petronet, Hindustan Aeronautics, IRB Infrastructure Developers, Indian Railway Finance Corporation, Krishna Institute of Medical Sciences, Dr Lal PathLabs, Mindspace Business Parks REIT, MRF, MTAR Technologies, Novartis India, Page Industries, Quess Corp, Reliance Power, SJVN, Speciality Restaurants, Strides Pharma Science, Sundram Fasteners, Sunteck Realty, Sun TV Network, Tata Chemicals, Trent, Titagarh Wagons, Welspun Corp, Whirlpool of India, West Coast Paper Mills, and Zee Media Corporation will release their quarterly earnings on February 10.

M&M Financial Services: The company's officials will attend BofA Securities - Investor Conference on February 10.

UltraTech Cement: The company's officials will meet Aberdeen Asset Management on February 10, and Fiera Capital & Fidelity Investments on February 11.

Syngene International: The company's officials will meet Fred Alger on February 10.

Dixon Technologies: The company's officials will participate in Edelweiss Virtual Conference on February 10 & February 11.

GMR Infrastructure: The company's officials will meet investors and analysts on February 10 to discuss Q3FY22 results.

FDC: The company's officials will meet analysts and investors on February 11, to discuss financial results.

V-Mart Retail: The company's officials will meet analysts and investors on February 11 to discuss financial performance.

Texmaco Rail and Engineering: The company's officials will meet analysts and investors on February 11, to discuss financial results.

Allcargo Logistics: The company's officials will meet investors on February 14, to discuss financial performance.

RateGain Travel Technologies: The company's officials will meet investors and analysts on February 14, to discuss financial results.

Oil and Natural Gas Corporation: The company's officials will meet analysts and investors on February 14, to discuss financial performance.

Stocks in News

ACC reported lower profit at Rs 280.9 crore in Q4CY21 against Rs 472.4 crore in Q4CY20, revenue rose to Rs 4,225.8 crore from Rs 4,144.7 crore YoY.

Tata Power Company: The company reported sharply higher profit at Rs 551.8 crore in Q3FY22 against Rs 318 crore in Q3FY21, revenue jumped to Rs 10,913.4 crore from Rs 7,597.9 crore YoY.

Power Grid Corporation of India: The company reported lower profit at Rs 3,292.9 crore in Q3FY22 against Rs 3,367.7 crore in Q3FY21m, revenue rose to Rs 10,446.8 crore from Rs 10,142.4 crore YoY.

Nykaa: The company recorded steep decline in profit at Rs 27.9 crore in Q3FY22 against Rs 68.9 crore in Q3FY21, revenue climbed to Rs 1,098.3 crore from Rs 807.9 crore YoY.

Engineers India: The company reported lower profit at Rs 40.6 crore in Q3FY22 against Rs 88 crore in Q3FY21, revenue declined to Rs 692.1 crore from Rs 845.4 crore YoY.

Aurobindo Pharma: The company reported sharply lower profit at Rs 604.2 crore in Q3FY22 against Rs 2,947.9 crore in Q3FY21, revenue declined to Rs 6,002.2 crore from Rs 6,364.9 crore YoY.

Petronet LNG: The company clocked strong profit growth, rising to Rs 1,143.5 crore in Q3FY22 against Rs 823 crore in Q2FY22, revenue jumped to Rs 12,597.2 crore from Rs 10,813 crore QoQ.

Fund Flow

Foreign institutional investors (FIIs) net sold shares worth Rs 892.64 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 1,793.35 crore in the Indian equity market on February 9, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Two stocks - BHEL and Punjab National Bank - are under the F&O ban for February 10. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!