The market erased all gains in the last hour of trade and finally settled with half a percent loss on April 20 as traders remained cautious about growth amid consistent increase in COVID-19 infections.

The BSE Sensex was down 243.62 points to close at 47,705.80, while the Nifty50 fell 63.10 points to 14,296.40 and formed bearish candle which resembles Bearish Belt Hold kind of pattern on the daily charts.

"Since the past six consecutive sessions, Nifty continues to trade extremely volatile within 14,650-14,200 levels indicating lack of strength on either side. The index continues to trend lower forming a lower Top and lower Bottom formation indicating short term downtrend," Rajesh Palviya, Head - Technical and Derivative Research at Axis Securities told Moneycontrol.

"The next higher levels to be watched are around 14,400 levels. Any sustainable move above 14,400 may cause pullback towards 14,500-14,650 levels. This pullback should be used as an exit opportunity for short term traders," he said.

On the downside, any violation of an intraday support zone of 14,200 levels may signal weakness towards 14,000 levels," he added.

The broader markets outpaced benchmark indices as the Nifty Midcap 100 index gained 0.3 percent and Smallcap 100 index rose 1 percent.

The market was shut on April 21 for Ram Navami.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 14,160.13, followed by 14,023.87. If the index moves up, the key resistance levels to watch out for are 14,479.83 and 14,663.27.

Nifty Bank

The Nifty Bank index was down 95.70 points at 31,112.70 on April 20. The important pivot level, which will act as crucial support for the index, is placed at 30,758.57, followed by 30,404.43. On the upside, key resistance levels are placed at 31,599.27 and 32,085.83 levels.

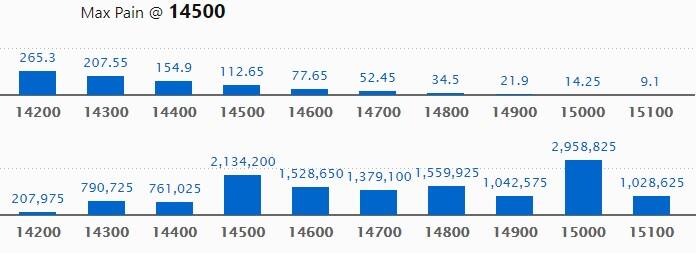

Call option data

Maximum Call open interest of 29.58 lakh contracts was seen at 15,000 strike, which will act as a crucial resistance level in the April series.

This is followed by 14,500 strike, which holds 21.34 lakh contracts, and 14,800 strike, which has accumulated 15.59 lakh contracts.

Call writing was seen at 14,500 strike, which added 4.81 lakh contracts, followed by 14,600 strike which added 2.98 lakh contracts and 15,100 strike which added 2.96 lakh contracts.

Call unwinding was seen at 14,100 strike, which shed 14,625 contracts, followed by 14,200 strike which shed 14,550 contracts and 13,500 strike which shed 9,600 contracts.

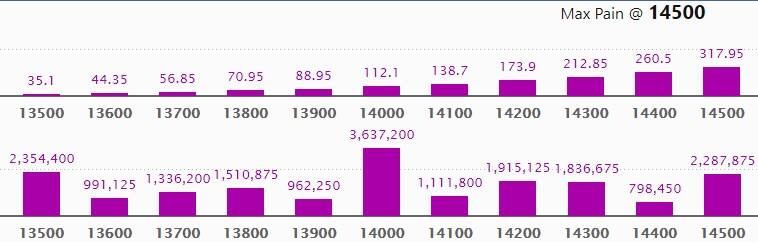

Put option data

Maximum Put open interest of 36.37 lakh contracts was seen at 14,000 strike, which will act as a crucial support level in the April series.

This is followed by 13,500 strike, which holds 23.54 lakh contracts, and 14,500 strike, which has accumulated 22.87 lakh contracts.

Put writing was seen at 13,500 strike, which added 2.14 lakh contracts, followed by 14,100 strike which added 1.52 lakh contracts and 14,300 strike which added 1.32 lakh contracts.

Put unwinding was seen at 14,500 strike, which shed 1.96 lakh contracts, followed by 14,700 strike which shed 37,500 contracts and 14,600 strike which shed 22,350 contracts.

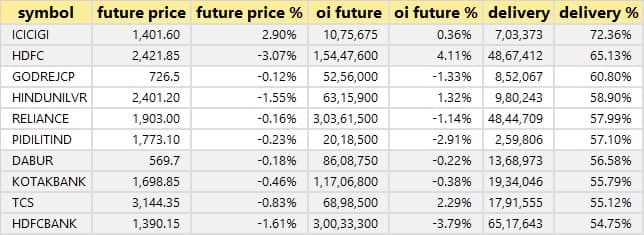

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

38 stocks saw long build-up

An increase in open interest, along with a increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

41 stocks saw long unwinding

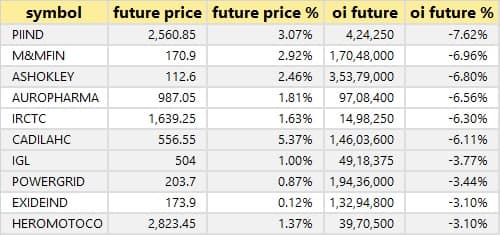

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

40 stocks saw short build-up

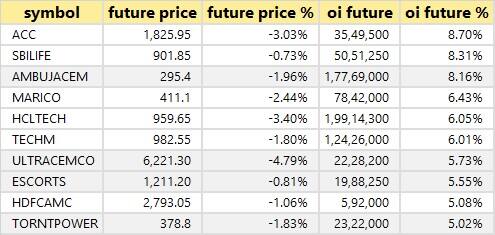

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

36 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

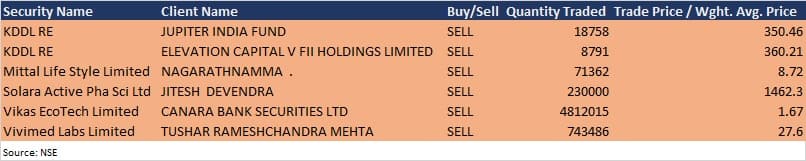

Bulk deals

(For more bulk deals, click here)

Results on April 22

Cyient, Indus Towers, Rallis India, Sasken Technologies, Tata Elxsi, Visaka Industries, Amal, Fineotex Chemical, Filatex India, Hindustan Bio Sciences, Indbank Merchant Banking Services, and Ind Bank Housing will release their quarterly earnings on April 22.

Stocks in News

Nestle India: The company has reported a 14.6% growth in Q1CY21 profit at Rs 602.2 crore against Rs 525.4 crore in the corresponding period, revenue rose to Rs 3,610.8 crore from Rs 3,325.8 crore YoY.

Swaraj Engines: The company reported sharply higher profit at Rs 32.6 crore in Q4FY21 against Rs 15.8 crore in Q4FY20, revenue jumped to Rs 304.9 crore from Rs 175.1 crore YoY.

Asahi Songwon Colors: The company said Utsav Pandwar has resigned as Chief Financial Officer and key managerial personnel of the company due to his personal reasons.

Voltas: Life Insurance Corporation of India acquired 46,000 equity shares (0.02% of paid up equity) in Voltas on April 19. LIC increased stake in the company to 5.01% from 4.99% earlier.

Orient Bell: Porinju Veliyath-owned Equity Intelligence India reduced 3.90% stake (or 5,59,512 equity shares) at the end of March 2021, from 4.25% stake (or 6,09,512 equity shares) as of December 2020.

Salasar Techno Engineering: The company has received new orders worth Rs 27.45 crore and Rs 20.25 crore from Rajasthan Rajya Vidyut Prasaran Nigam. The orders are for construction of 220KV and 132 KV transmission lines including supply of all equipments/materials, erection, testing and commissioning on supply & ETC basis.

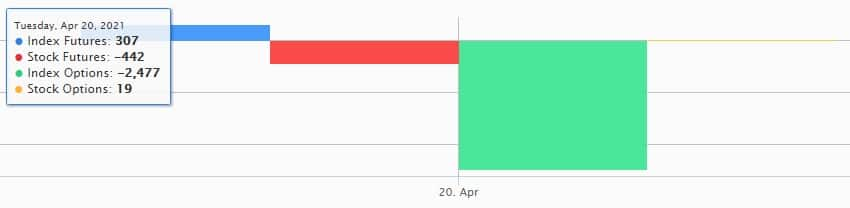

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 1,082.33 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 1,323.01 crore in the Indian equity market on April 20, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Two stocks - SAIL and Sun TV Network - are under the F&O ban for April 22. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: "Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd which publishes Moneycontrol."

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!