The recovery in late trade helped the market close the session on a flat note on December 2 despite positive news on the vaccine front, after a day of strong start to December. The UK approved to roll out Pfizer-BioNTech's COVID-19 vaccine next week.

The BSE Sensex fell 37.40 points to end at 44,618.04, while the Nifty50 gained 4.80 points at 13,113.80 and formed Doji kind of pattern on the daily charts.

"The negative pattern of Bearish Engulfing of daily timeframe chart (November 25) and Doji pattern of last week is still intact as long as the new high of 13,150 is protected. A decisive/sustainable move above 13,150 is expected to negate both the negative pattern and that could turn sentiment into further bullish," Nagaraj Shetti, Technical Research Analyst at HDFC Securities, told Moneycontrol.

"The display of instability around 13,150-13,200 levels could mean an emergence of selling pressure at the highs and one big drop in the index can't be ruled out from the new highs. One needs to be cautious at the highs," he said.

According to him, the market is expected to face stiff resistance around 13,150 or slight higher in the coming sessions. "A sustainable move above this area could open some more upside for the market. A lack of strength to sustain around 13,150 levels is expected to result in another one-day sharp drop in the index from the highs. Immediate support is now at 12,980," he said.

Banking & financials closed in the red, but auto, metals, select FMCG, IT, and pharma stocks supported the market.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty is placed at 13,022.03, followed by 12,930.27. If the index moves up, the key resistance levels to watch out for are 13,167.03 and 13,220.27.

Nifty Bank

The Bank Nifty declined 354.60 points or 1.19 percent to 29,463.20 on December 2. The important pivot level, which will act as crucial support for the index, is placed at 29,113.33, followed by 28,763.47. On the upside, key resistance levels are placed at 29,849.63 and 30,236.06.

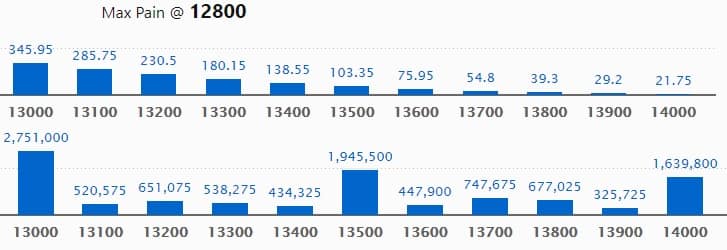

Call option data

Maximum Call open interest of 27.51 lakh contracts was seen at 13,000 strike, which will act as crucial resistance level in the December series.

This is followed by 13,500 strike, which holds 19.45 lakh contracts, and 14,000 strike, which has accumulated 16.39 lakh contracts.

Call writing was seen at 13,800 strike, which added 1.79 lakh contracts, followed by 13,700 strike which added 1.18 lakh contracts and 13,900 strike which added 1.14 lakh contracts.

Call unwinding was seen at 13,000 strike, which shed 57,975 contracts, followed by 13,300 strike which shed 48,375 contracts and 14,000 strike which shed 39,750 contracts.

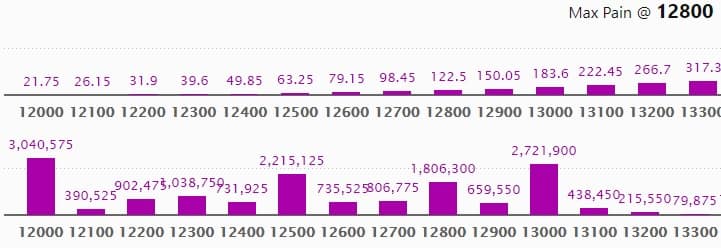

Put option data

Maximum Put open interest of 30.40 lakh contracts was seen at 12,000 strike, which will act as a crucial support in the December series.

This is followed by 13,000 strike, which holds 27.21 lakh contracts, and 12,500 strike, which has accumulated 22.15 lakh contracts.

Put writing was seen at 12,800 strike, which added 2.37 lakh contracts, followed by 12,300 strike, which added 2.07 lakh contracts and 12,000 strike which added 1.4 lakh contracts.

There was hardly any Put unwinding seen on December 2.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

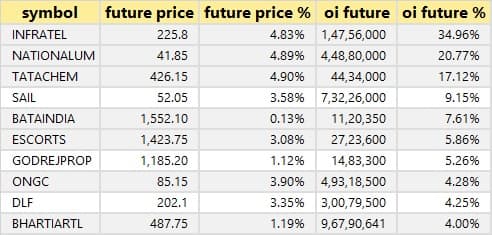

46 stocks saw long build-up

Based on the open interest future percentage, here are the 10 stocks in which long build-up was seen.

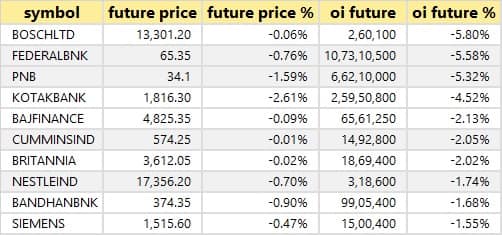

19 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

27 stocks saw short build-up

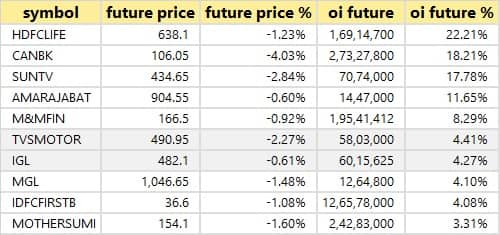

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which short build-up was seen.

47 stocks witnessed short-covering

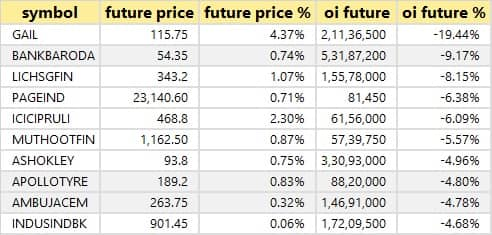

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are top 10 stocks in which short-covering was seen.

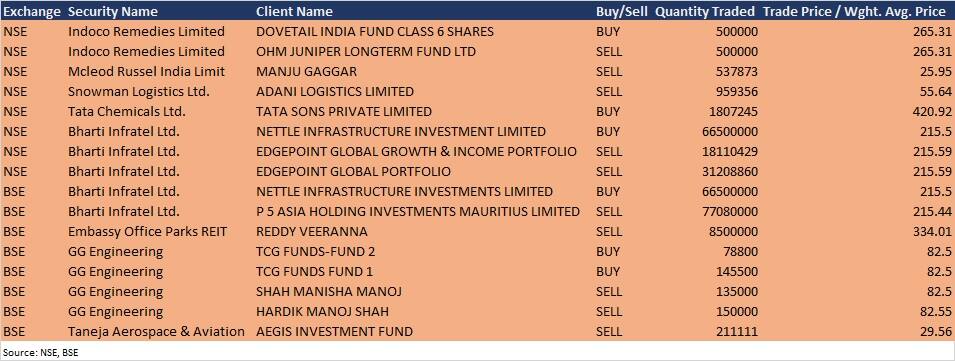

Bulk deals

(For more bulk deals, click here)

Analysts Meets/Board Meetings

Advanced Enzyme Technologies: Group concall will be held with Phillip Capital (India) on December 4.

Stocks in the news

Apollo Hospital Enterprises: Board approved raising of funds of Rs 1,500 crore in one or more tranches.

Wipro: Company received multi-year contract from Verifone for its cloud services.

Jindal Steel & Power: Promoter entity Opelina Sustainable Services Ltd released pledge on company's 15 lakh equity shares.

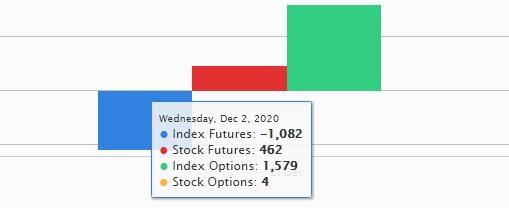

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 357.35 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 1,635.97 crore in the Indian equity market on December 2, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Not a single stock is under the F&O ban for December 3. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!