The market lost more than a percent on April 22, snapping a two-day winning as global markets were in a bear trap after the US Federal Reserve chairman Jerome Powell hinted at a 50 bps rate hike in the May policy meeting.

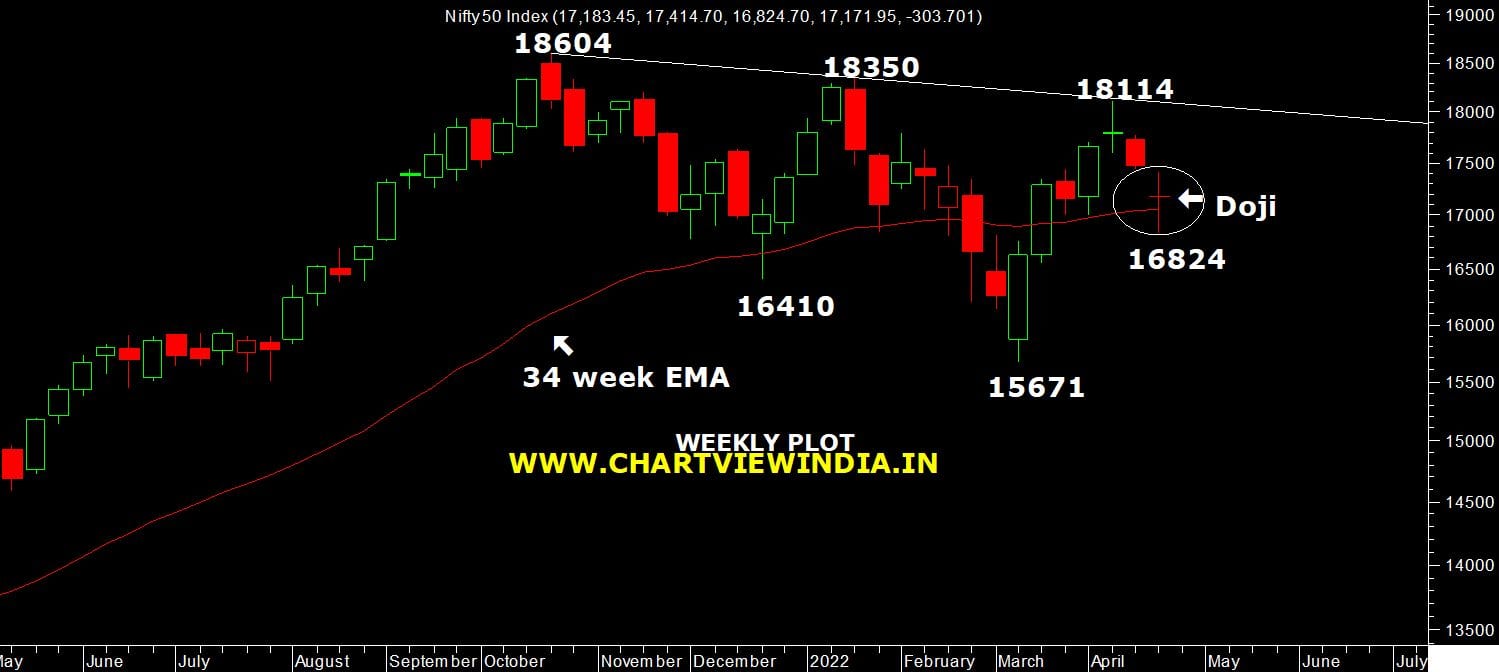

The Sensex dropped more than 700 points to 57,197, while the Nifty plunged 221 points to 17,172 to form a bearish candle on the daily charts, indicating a trend favouring bears. For the week, the Nifty saw long-legged Doji pattern on the weekly scale as the index lost nearly 2 percent.

“Albeit, the Nifty registered a bearish candle on the daily chart, it witnessed a long-legged Doji on weekly charts hinting at the indecisive nature of the bears at the lower levels," Mazhar Mohammad, Founder & Chief Market Strategist at Chartviewindia said.

He said a washout with a close below 17,200 would favour bears in the next trading session. Hence, it is critical the Nifty sustains above 17,149 and a failure to do so can initially extend the weakness towards 16,978, Mohammad said.

As markets seem to be in a volatile phase without a proper direction, it would be prudent to avoid index bets till some signs of stability are visible, he said.

The broader space also saw selling pressure but the fall was lower than benchmark indices. The Nifty midcap 100 fell 0.94 percent and the smallcap 100 index declined a third of a percent.

We have collated 14 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregate of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support for the Nifty is at 17,109 followed by 17,046. If the index moves up, the key resistance levels to watch out for are 17,275 and 17,378.

Banking stocks were the major reason for the selloff, with the Bank Nifty plunging 771 points, or 2.1 percent, to close at 36,045 on April 22. The important pivot level, which will act as crucial support, is placed at 35,831 followed by 35,618. On the upside, key resistance are at 36,419 and 36,792.

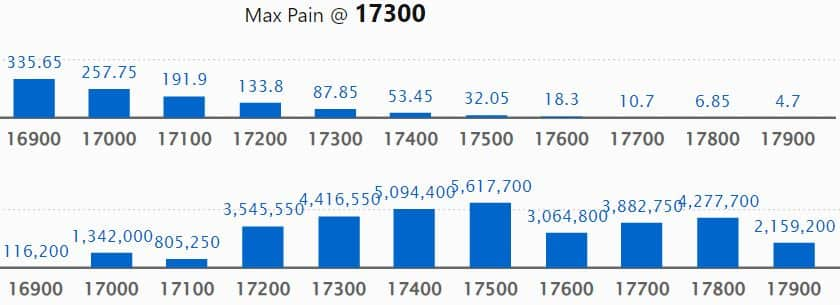

Maximum Call open interest of 1.08 crore contracts was seen at 18,000 strike, which will act as a crucial resistance level in the April series.

This is followed by 17,500 strike, which holds 56.17 lakh contracts, and 17,400 strike that has accumulated 50.94 lakh contracts.

Call writing was seen at 18,000 strike, which added 58.9 lakh contracts followed by 17,400 strike that accumulated 26.4 lakh contracts, and 17,800 strike, which added 21.65 lakh contracts.

Call unwinding was seen at 17,000 strike, which shed 67,250 contracts, followed by 16,900 strike, which dumped 33,050 contracts and 16,800 strike, which shed 19,350 contracts.

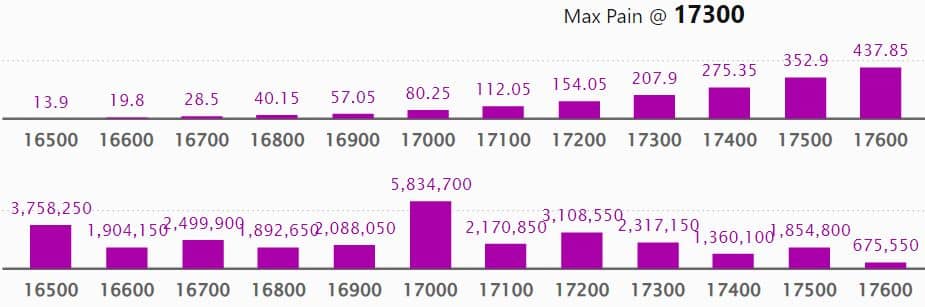

Maximum Put open interest of 58.34 lakh contracts was seen at 17,000 strike, which will act as a crucial support level in the April series.

This is followed by 16,000 strike, which holds 44.34 lakh contracts, and 16,500 strike, which has accumulated 37.58 lakh contracts.

Put writing was seen at 17,000 strike, which added 15.97 lakh contracts, followed by 16,000 strike, which added 14.58 lakh contracts, and 16,700 strike that added 9.53 lakh contracts.

Put unwinding was seen at 17,300 strike, which shed 8.96 lakh contracts, followed by 16,100 strike, which shed 5.75 lakh contracts, and 17,500 strike which shed 5.29 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Hindustan Unilever, Bata India, Ipca Laboratories, Power Grid Corporation of India and Infosys, among others. Here are the top 10 of these stocks:

An increase in open interest, along with an increase in price, typically indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen:

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen:

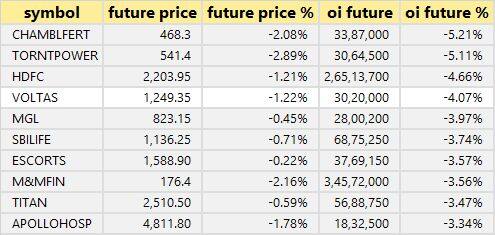

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

13 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

(For more bulk deals, click here)

Tatva Chintan Pharma Chem, Tata Investment Corporation, Century Textiles & Industries, Eveready Industries India, Gujarat Mineral Development Corporation, Mahindra CIE Automotive, Meghmani Finechem, Arihant Capital Markets, Artson Engineering, Automotive Stampings & Assemblies, Axita Cotton, Divyashakti, Maharashtra Scooters, Snowman Logistics, Steel Exchange India, Sylph Technologies, Triveni Enterprises and VTM will release quarterly earnings on April 25.

Stocks in news

ICICI Bank: The country's second-largest private sector lender reported a 59.4 percent year-on-year growth in standalone profit at Rs 7,019 crore in quarter ended March 2022 due to a sharp fall in provisions and jump in operating profit. Net interest income grew by 21 percent YoY to Rs 12,604.6 crore in Q4FY22, which also supported profitability. The bank declared a dividend of Rs 5 a share.

RailTel Corporation of India: The state-owned telecom infrastructure provider received a work order from the Odisha government's electronics & information technology department. The company will do provisioning of secondary bandwidth and replacement of equipment along with the implementation of SDWAN for OSWAN project for five years at a cost of Rs 122.08 crore.

Tata Metaliks: The company recorded a 30 percent year-on-year decline in Q4FY22 profit at Rs 52.5 crore due to higher input costs but was supported by income from the sale of land in Maharashtra. However, revenue increased 22 percent to Rs 808 crore from the year-ago quarter.

Tejas Networks: The telecom and networking products maker posted a loss of Rs 49.62 crore in the quarter ended March 2022 against a profit of Rs 33.55 crore in the year-ago period due to lower revenue growth. Revenue fell sharply by 37 percent to Rs 126.5 crore against Rs 201.5 crore during the period due to global chip supply shortages but sequentially increased 18 percent. The company continued to see a positive business momentum, with an order inflow of Rs 316 crore during the quarter, taking the total order book to an all-time high of Rs 1,175 crore.

Aditya Birla Money: Profit more than doubled to Rs 7.62 crore in the March quarter, up from Rs 3.68 crore in the same period of the previous year. Revenue increased 23.2 percent to Rs 60.4 crore year-on-year, driven by broking business that contributed 87 percent to the kitty.

Hindustan Zinc: The company clocked an 18 percent year-on-year growth in consolidated profit at Rs 2,928 crore in Q4FY22 driven by higher revenue and healthy operating income and margin. Revenue during the quarter grew by 26.6 percent YoY to Rs 8,797, largely led by the zinc business that increased 51 percent YoY.

Future Retail and Reliance Industries: The $3.4 billion deal to take over the retail assets of Future Retail (FRL) cannot be implemented as the company's secured creditors have "voted against the scheme", Reliance Industries told the stock exchanges.

Fund Flow

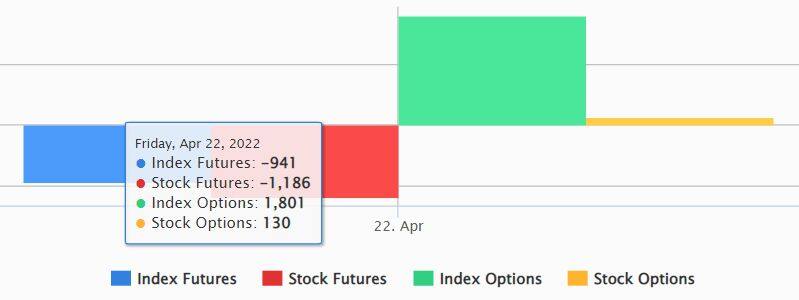

Foreign institutional investors (FIIs) have net sold shares worth Rs 2,461.72 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 1,602.35 crore on April 22, NSE provisional data shows.

Stocks under F&O ban on NSE

No stock is under the F&O ban for April 25. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!