Bears dominated Dalal Street for the third consecutive session with the benchmark indices falling around 1.5 percent on March 4, following continuous acceleration in Ukraine-Russia war and rising oil prices. Selling was seen across sectors, barring IT, with Bank, Auto, Financial Services, FMCG and Metal being prominent losers.

The BSE Sensex plunged 769 points to 54,334, while the Nifty50 declined 253 points to 16,245 and formed Spinning Top kind of pattern indicating indecisiveness among bulls and bears. During the week, the index fell 2.5 percent and formed bearish candle on the weekly scale.

"The Nifty50 registered a Spinning Top kind of formation with a large trading range of 336 points hinting at a volatile session. At today's low of 16,133 levels, the Nifty seems to have hit the critical support, on medium-term charts, which is present at around 16,130 levels," says Mazhar Mohammad, Founder and Chief Market Strategist at Chartviewindia.

In case, he says, the Nifty slips below 16,130, then the next best support is placed at 15,850. Therefore, from current levels, a pullback rally cannot be ruled out from the zone of 16,100 – 15,800 levels, Mohammad said.

He feels that in the very short term, market tends to move in line with the global uncertainties but "further fall can be an opportunity for long-term investors whereas short-term traders will be better off by limiting themselves to the fence", he advised.

The broader markets also ended in the negative territory and the loss was higher than benchmarks. The Nifty Midcap 100 index was down 2 percent while the Smallcap 100 index fell 1.8 percent.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 16,101, followed by 15,956. If the index moves up, the key resistance levels to watch out for are 16,423 and 16,601.

Banking stocks were under pressure on March 4, dragging the Nifty Bank down by 536.50 points or 1.5 percent at 34,408. The important pivot level, which will act as crucial support for the index, is placed at 33,969, followed by 33,529. On the upside, key resistance levels are placed at 34,972 and 35,537 levels.

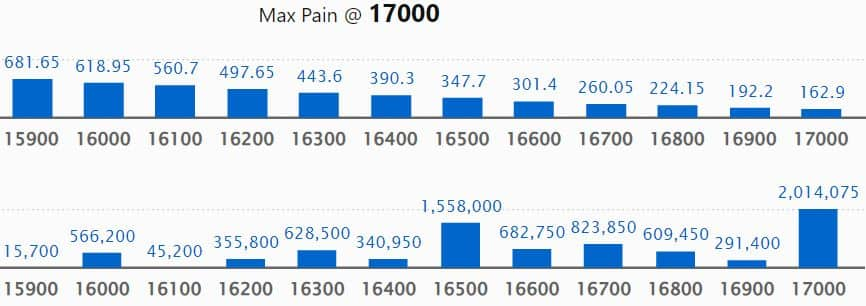

Maximum Call open interest of 20.14 lakh contracts was seen at 17,000 strike, which will act as a crucial resistance level in the March series.

This is followed by 17,500 strike, which holds 18.36 lakh contracts, and 16,500 strike, which has accumulated 15.58 lakh contracts.

Call writing was seen at 16,300 strike, which added 5.34 lakh contracts, followed by 16,200 strike which added 2.91 lakh contracts, and 17,200 strike which added 2.32 lakh contracts.

Call unwinding was seen at 16,800 strike, which shed 2 lakh contracts, followed by 17,500 strike which shed 1.8 lakh contracts, and 16,600 strike which shed 1.28 lakh contracts.

Maximum Put open interest of 42.96 lakh contracts was seen at 16,500 strike, which will act as a crucial support level in the March series.

This is followed by 16,000 strike, which holds 42.52 lakh contracts, and 15,500 strike, which has accumulated 34.71 lakh contracts.

Put writing was seen at 16,200 strike, which added 2.1 lakh contracts, followed by 15,300 strike, which added 1.71 lakh contracts, and 16,300 strike which added 1.54 lakh contracts.

Put unwinding was seen at 16500 strike, which shed 4.81 lakh contracts, followed by 16,600 strike which shed 3.74 lakh contracts, and 16,000 strike which shed 1.87 lakh contracts.

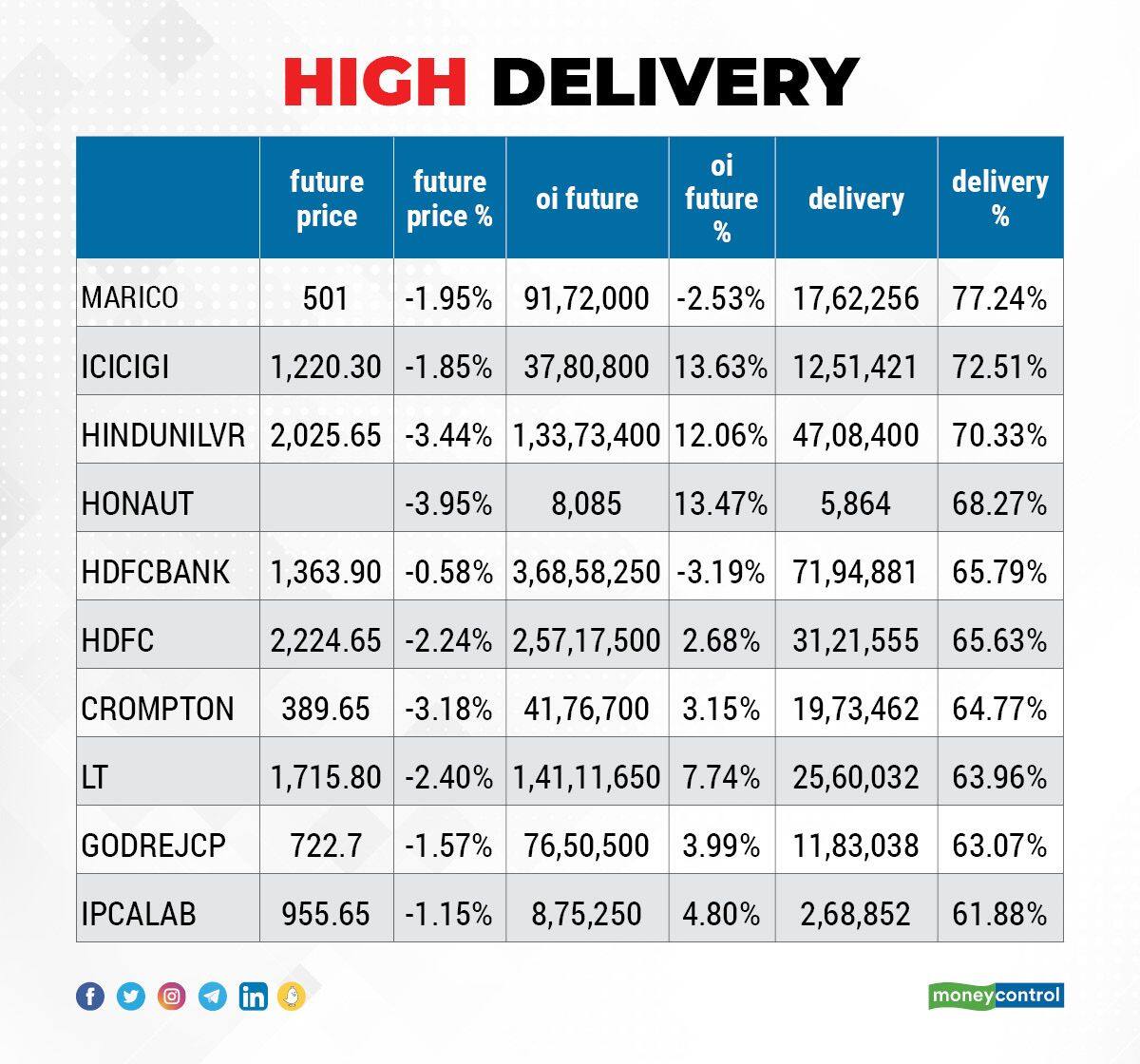

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Marico, ICICI Lombard General Insurance Company, Hindustan Unilever, Honeywell Automation, and HDFC Bank among others on Friday.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen including Ramco Cements, GNFC, GSPL, Intellect Design Arena, and Britannia.

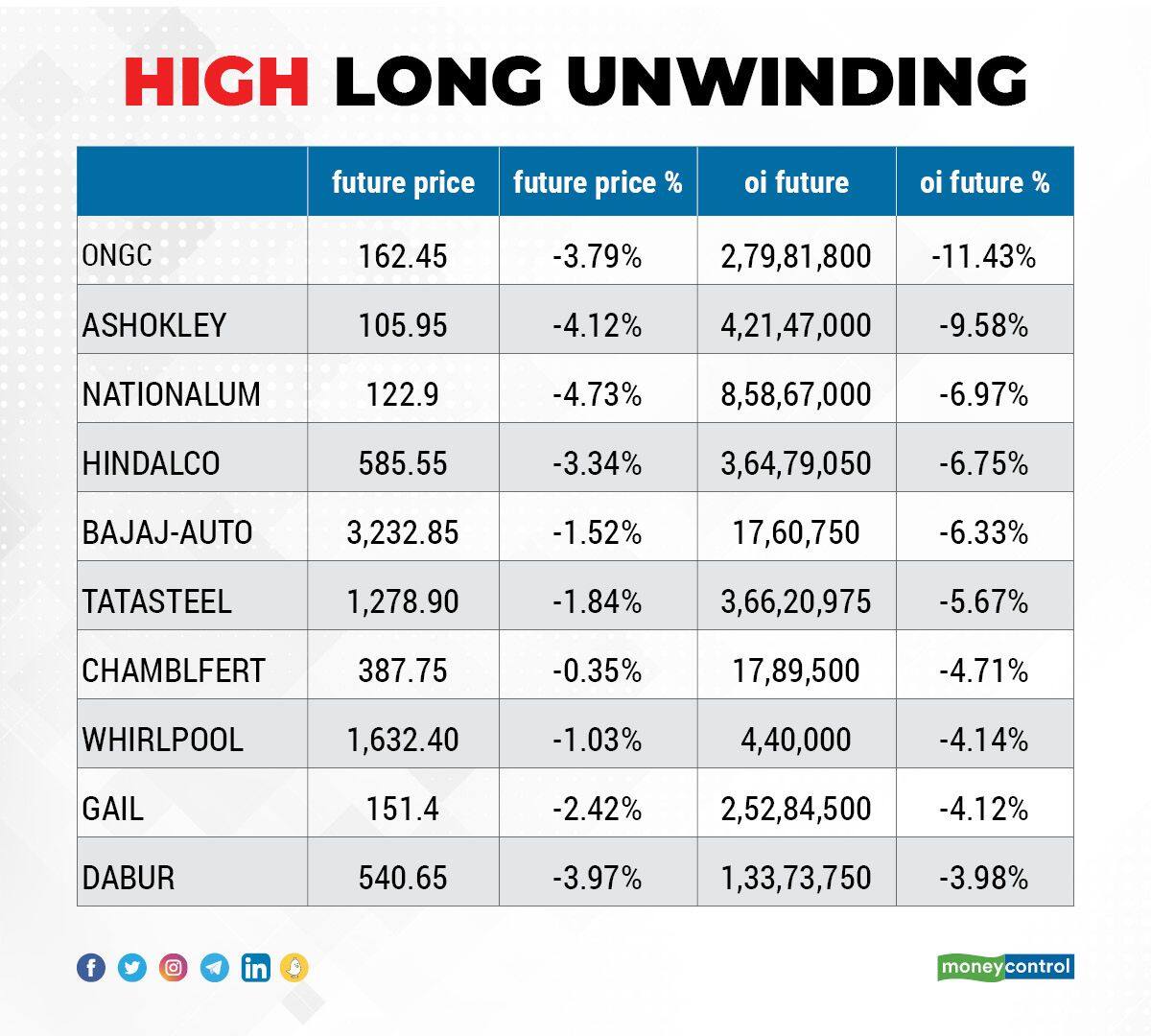

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen, including ONGC, Ashok Leyland, National Aluminium Company, Hindalco Industries, and Bajaj Auto.

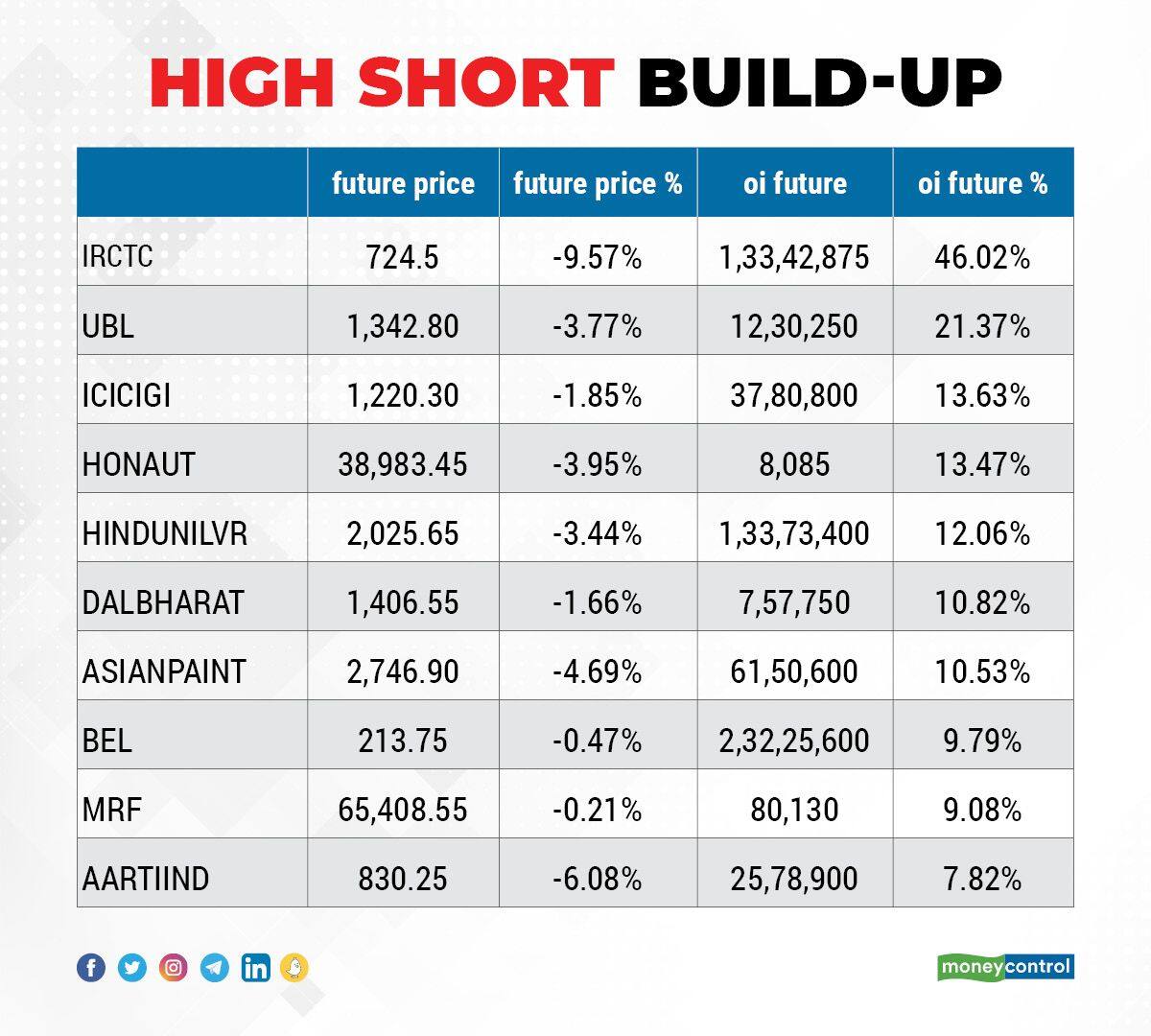

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the 10 stocks in which a short build-up was seen including IRCTC, United Breweries, ICICI Lombard General Insurance Company, Honeywell Automation, and Hindustan Unilever.

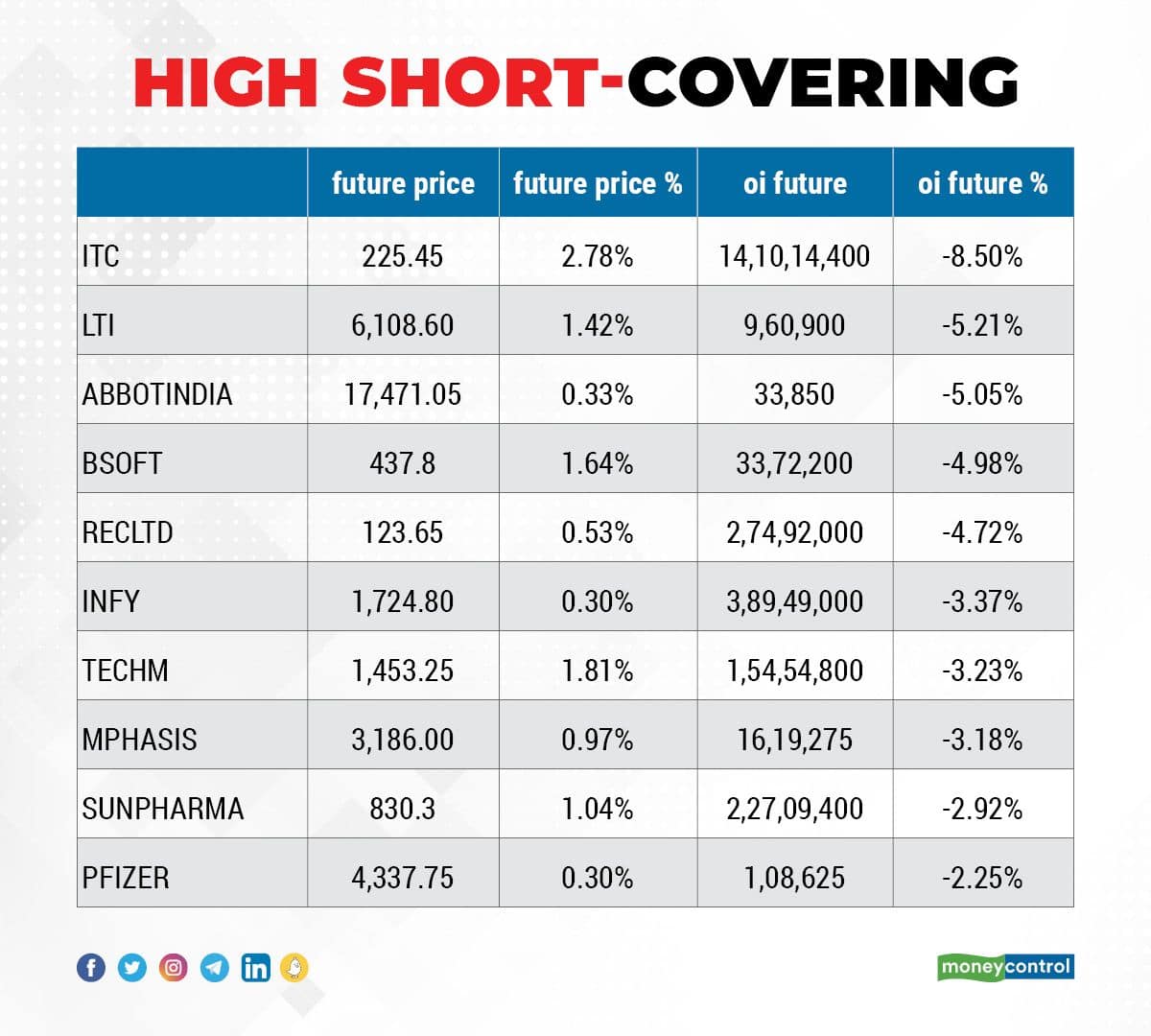

17 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen including ITC, L&T Infotech, Abbott India, Birlasoft, and REC.

(For more bulk deals, click here)

Analysts/Investors Meetings

Piramal Enterprises: Officials of the company will attend Goldman Sachs India Pharma and Healthcare Tour 2022 on March 7.

Fermenta Biotech: Officials of the company will attend Valorem Advisors investor conference on March 7.

Sapphire Foods India: Officials of the company will meet Motilal Oswal Financial Services on March 7.

Max India: Officials of the company will meet Pratik Nawlakha-Individual Investor, Vikas Gupta-FM-Care Insurance, and Sameer Agarwal- Individual Investor on March 7.

Adani Transmission: Officials of the company will attend JPM EM Conference, Miami on March 7-8.

Sutlej Textiles & Industries: Officials of the company will meet JM Financial on March 7; and Phillip Capital on March 8.

Themis Medicare: Officials of the company will meet Faering Capital on March 7.

Globus Spirits: Officials of the company will meet Prabhudas Lilladher PMS on March 7.

MM Forgings: Officials of the company will meet Dolat Capital Market on March 8.

EPL: Officials of the company will meet group of institutional investors on March 8.

Tata Motors: Officials of the company will meet LIC & SBI MF on March 9; and Fidelity International on March 11.

Stocks in News

3i Infotech: The company has bagged a work order from Rajasthan State Pollution Control Board (RSPCB). The work includes design, development, implementation and maintenance of integrated e-Governance Solution 2.0 for Rajasthan State Pollution Control Board. The total contract value is Rs 12.85 crore.

Balkrishna Industries: The firm said it has successfully commenced commercial production of the brown field expansion and debottlenecking project at Bhuj plant ahead of schedule. This will result in increased production of tires up to 50,000 MTPA. The complete ramp-up in production is expected to be achieved in the next 6 months.

PNB Housing Finance: The company will held a board meeting on March 9 to consider fund raising.

Nazara Technologies: The mobile gaming company said its board has approved issuance of equity shares worth Rs 25 crore to existing shareholders of Datawrkz Business Solutions. These shares will be issued on a preferential basis, at a price of Rs 2,260 per share. Post completion of this acquisition, the company will hold 33% equity stake in Datawrkz Business Solutions Private Limited. Further, the company will be making an investment of upto Rs 30 crore in its subsidiary Next Wave by way of subscription to further equity shares.

V-Mart Retail: SBI Funds Management through various schemes acquired 4.5 percent stake in the retail company via open market transactions on March 3. With this, its shareholding in the company stands at 8.76 percent, against 4.2 percent earlier.

Tube Investments of India: Subsidiary TI Clean Mobility acquired 70 percent stake in Cellestial E-Mobility. The Murugappa Group company in January 2022 had entered into share subscription and purchase agreement with Cellestial E-Mobility, for the said transaction.

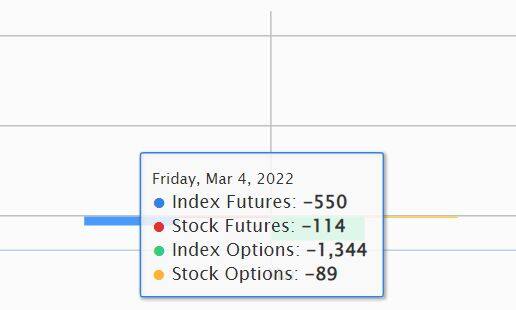

Fund Flow

The selling by foreign institutional investors (FIIs) seems unstoppable as they have net sold shares worth Rs 7,631.02 crore. However, domestic institutional investors (DIIs) have bought shares worth Rs 4,738.99 crore on March 4, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Not a single stock is under the F&O ban for March 7. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!