It was another weak session for the market as benchmark indices corrected seven-tenth of a percent on January 21, as selling was seen across sectors barring FMCG, while the volatility increased significantly by more than 6 percent to nearly 19 levels.

The BSE Sensex declined 427.44 points to 59,037, while the Nifty50 dropped 140 points to 17,617 and formed Doji kind of pattern on the daily charts as the closing was near its opening levels. During the week, the index fell 3.5 percent and formed large bearish candle on the weekly scale.

"A small body candle was formed on the daily chart with upper and lower shadow. Technically, this formation indicate a formation of Doji or high wave type candle pattern (not a classical one). This pattern indicate a heightened volatility in the market at the lows," says Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

Normally, "such Doji pattern formations after a reasonable upmove or down move are considered as an impending signal for trend reversal. Having declined sharply in the last few sessions, one may expect chances of upside bounce in the short term," he says.

He feels the short term trend of Nifty continues to be weak with high volatility. "Placement of support around 17,600-17,500 levels and a formation of Doji at the swing lows on Friday pointing towards a possibility of an upside bounce from here or slightly lows. The confirmation of bottom reversal is likely to indicate a quantum of upside bounce from here. Immediate hurdle is placed at 17,800 levels," says Nagaraj Shetti.

The broader markets corrected more than frontline indices. The Nifty Midcap 100 index and Smallcap 100 index declined 2.4 percent and 2.3 percent, respectively.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,499.47, followed by 17,381.73. If the index moves up, the key resistance levels to watch out for are 17,721.27 and 17,825.33.

The Nifty Bank slippped 276.50 points to 37,574.30 on January 21. The important pivot level, which will act as crucial support for the index, is placed at 37,285.34, followed by 36,996.37. On the upside, key resistance levels are placed at 37,802.14 and 38,029.97 levels.

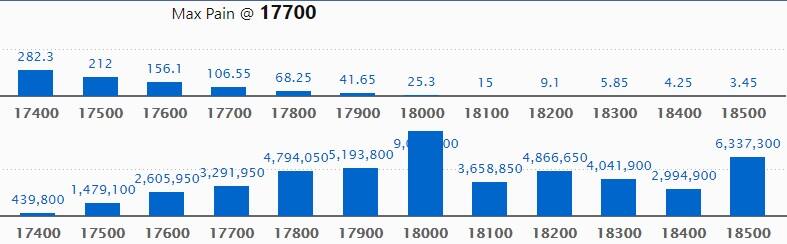

Maximum Call open interest of 90.69 lakh contracts was seen at 18000 strike, which will act as a crucial resistance level in the January series.

This is followed by 18500 strike, which holds 63.37 lakh contracts, and 17900 strike, which has accumulated 51.93 lakh contracts.

Call writing was seen at 17600 strike, which added 21.03 lakh contracts, followed by 17700 strike which added 20.64 lakh contracts, and 17800 strike which added 18.69 lakh contracts.

Call unwinding was seen at 17200 strike, which shed 19,500 contracts, followed by 17100 strike which shed 8,850 contracts and 16900 strike which shed 5,850 contracts.

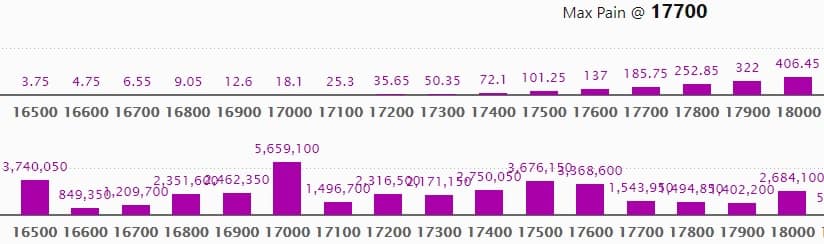

Maximum Put open interest of 56.59 lakh contracts was seen at 17000 strike, which will act as a crucial support level in the January series.

This is followed by 16500 strike, which holds 37.4 lakh contracts, and 17500 strike, which has accumulated 36.76 lakh contracts.

Put writing was seen at 17000 strike, which added 16.54 lakh contracts, followed by 17600 strike, which added 13.61 lakh contracts, and 17400 strike which added 11.37 lakh contracts.

Put unwinding was seen at 18000 strike, which shed 15.6 lakh contracts, followed by 17800 strike which shed 10.25 lakh contracts, and 17900 strike which shed 5.16 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the 7 stocks in which a long build-up was seen.

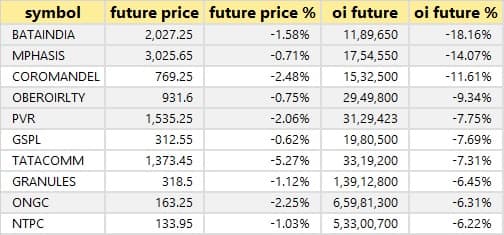

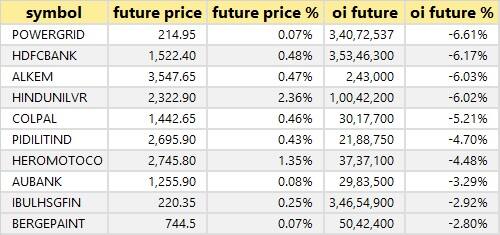

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

18 stocks witnessed short-covering

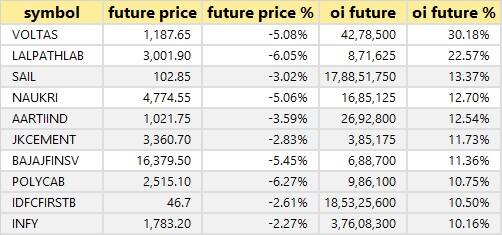

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

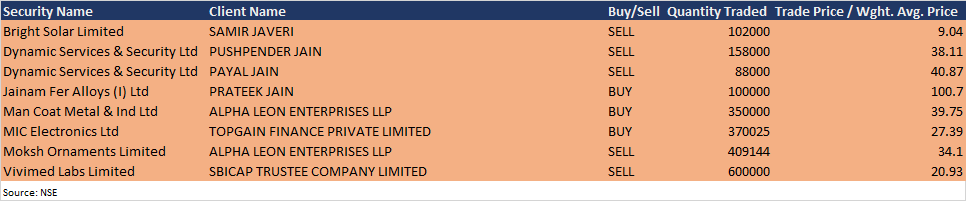

(For more bulk deals, click here)

Analysts/Investors Meeting; and Results on January 24

Results on January 24: Axis Bank, HDFC Asset Management Company, Apollo Pipes, Apollo Tricoat Tubes, Burger King India, Cera Sanitaryware, Chennai Petroleum Corporation, Craftsman Automation, Deepak Nitrite, Greenpanel Industries, GRM Overseas, Hindustan Fluorocarbons, Indian Energy Exchange, IIFL Securities, IndiaMART InterMESH, Kirloskar Ferrous Industries, Mahindra EPC Irrigation, Meghmani Finechem, Quick Heal Technologies, Music Broadcast, The Ramco Cements, Reliance Home Finance, SBI Cards and Payment Services, Shemaroo Entertainment, Shiva Cement, Shriram Transport Finance, Steel Strips Wheels, Sudarshan Chemical Industries, Supreme Industries, and Zensar Technologies will release quarterly earnings on January 24.

UltraTech Cement: The company's officials will meet Fidelity International, and Fullerton Fund Management on January 24.

IndiaMART InterMESH: The company's officials will meet investors and analysts on January 25, to discuss financial results.

Burger King India: The company's officials will meet investors and analysts on January 25, to discuss financial results.

Federal Bank: The company's officials will meet investors and analysts on January 25, to discuss financial results.

Arvind: The company's officials will meet analysts and investors on January 27, to discuss financial performance.

SRF: The company's officials will meet analysts and investors on January 27, to discuss financial performance.

CG Power and Industrial Solutions: The company's officials will meet analysts and investors on January 27, to discuss financial performance.

Embassy Office Parks REIT: The company's officials will meet investors and analysts on January 28, to discuss financial results.

UTI AMC: The company's officials will attend Spark Capital Investor Conference on February 9, and JM BFSI Financial Conference on February 14.

Stocks in News

Reliance Industries: The company reported sharply higher consolidated profit at Rs 20,539 crore in Q3FY22 against Rs 14,894 crore in Q3FY21, revenue rose to Rs 2,09,823 crore from Rs 1,37,829 crore YoY.

Vodafone Idea: The company posted loss of Rs 7,230.9 crore in Q3FY22 against loss of Rs 7,132.3 crore in Q2FY22, revenue rose to Rs 9,717.3 crore from Rs 9,406.4 crore QoQ.

Prince Pipes and Fittings: Mirae Asset Mutual Fund acquired 9.6 lakh equity shares in the company via open market transactions on January 13, increasing shareholding to 5.79% from 4.92% earlier.

CSB Bank: The bank reported higher profit at Rs 148.25 crore in Q3FY22 against Rs 53.05 crore in Q3FY21, net interest income increased to Rs 303.34 crore from Rs 251.18 crore YoY.

Tanla Platforms: The company reported higher profit at Rs 158 crore in Q3FY22 against Rs 93.52 crore in Q3FY21, revenue jumped to Rs 884.92 crore from Rs 654.11 crore YoY.

Titagarh Wagons: Titagarh Firema S.p.A., the subsidiary in Italy (TFA), has signed the framework agreement for design, manufacture, supply and ten years of maintenance of 38 trainsets of Metro for Lazio Regione, Italy. The total value of the framework agreement is 282 million euro (equivalent to Rs 2,380 crore).

Bandhan Bank: The bank reported higher profit at Rs 859 crore in Q3FY22 against Rs 632.6 crore in Q3FY21, net interest income rose to Rs 2,124.7 crore from Rs 2,071.7 crore YoY.

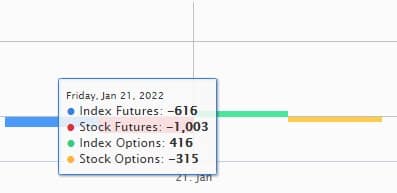

Fund Flow

Foreign institutional investors (FIIs) net sold shares worth Rs 3,148.58 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 269.36 crore in the Indian equity market on January 21, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Five stocks - BHEL, Escorts, Indiabulls Housing Finance, Vodafone Idea, and NALCO - are under the F&O ban for January 24. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!