Bears took control of the D-Street on February 26, the first day of March series, pushing benchmark indices down 3.8 percent. Rising US bond yields amid expectations of inflation weighed on the D-Street.

The BSE Sensex plunged 1,939.32 points or 3.80 percent to 49,099.99, while the Nifty50 fell 568.20 points or 3.76 percent to 14,529.20, forming a Long Black Day kind on the daily charts. This was the sixth biggest single-day fall for the benchmark in the last 20 years.

"A long bear candle formed on Friday that moved the index below the immediate support of 14,635 levels. Hence, the intraday high of Thursday of 15,176 could be considered as a new lower top formation. This is for the first time that Nifty has formed a lower top in the last few months, which is a negative indication," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

"One may expect further slide towards the next crucial supports of around 14,350-14,300 levels in the coming few sessions, before showing any possibility of a bounce back. Upside rise from here could find stiff resistance at 14,640," he said.

The broader markets also corrected but outperformed frontline indices. The Nifty Midcap 100 index was down 1.6 percent and Smallcap 100 index declined 1.21 percent as two shares declined for every share rising on the NSE.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 14,358.17, followed by 14,187.13. If the index moves up, the key resistance levels to watch out for are 14,809.87 and 15,090.53.

Nifty Bank

The Nifty Bank index cracked 1,745.40 points, or 4.78 percent, to close at 34,803.60 on February 26. The important pivot level, which will act as crucial support for the index, is placed at 34,340.56, followed by 33,877.53. On the upside, key resistance levels are placed at 35,584.76 and 36,365.93 levels.

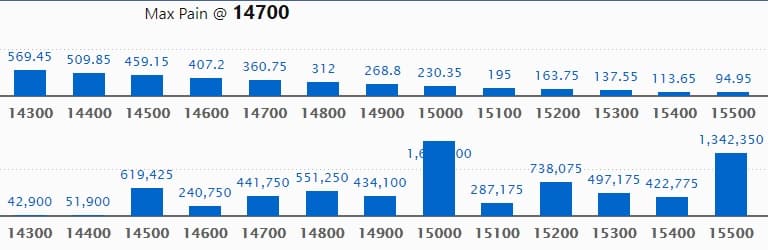

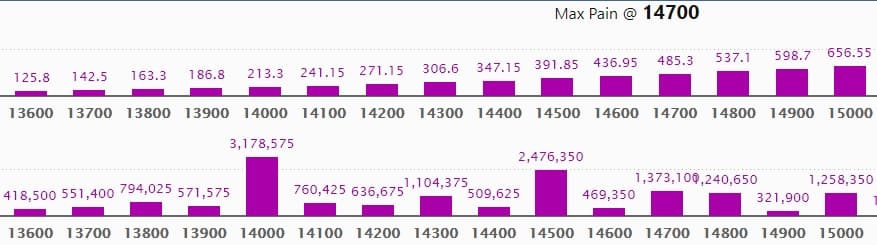

Call option data

Maximum Call open interest of 16.02 lakh contracts was seen at 15,000 strike, which will act as a crucial resistance level in the March series.

This is followed by 15,500 strike, which holds 13.42 lakh contracts, and 15,200 strike, which has accumulated 7.38 lakh contracts.

Call writing was seen at 15,000 strike, which added 5.4 lakh contracts, followed by 15,500 strike which added 3.77 lakh contracts and 15,200 strike which added 3.42 lakh contracts.

Call unwinding was seen at 14,000 strike, which shed 21,675 contracts, followed by 13,900 strike which shed 75 contracts.

Put option data

Maximum Put open interest of 31.78 lakh contracts was seen at 14,000 strike, which will act as a crucial support level in the March series.

This is followed by 14,500 strike, which holds 24.76 lakh contracts, and 14,700 strike, which has accumulated 13.73 lakh contracts.

Put writing was seen at 14,500 strike, which added 3.24 lakh contracts, followed by 14,100 strike, which added 1.94 lakh contracts and 13,700 strike which added 1.70 lakh contracts.

Put unwinding was seen at 15,100 strike, which shed 59,400 contracts, followed by 15,000 strike which shed 31,050 contracts.

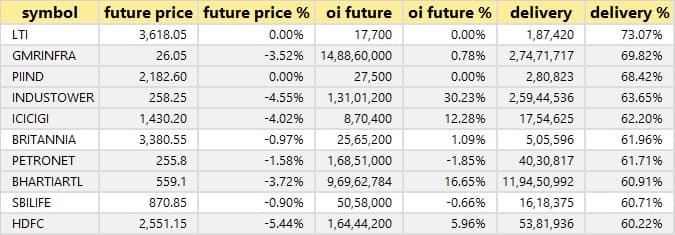

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

4 stocks saw long build-up

Based on the open interest future percentage, here are the 4 stocks in which a long build-up was seen.

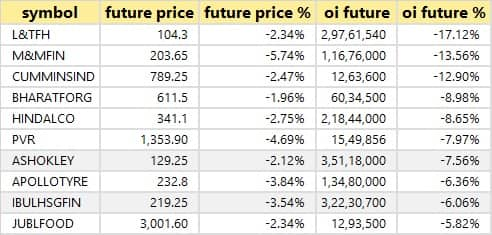

40 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

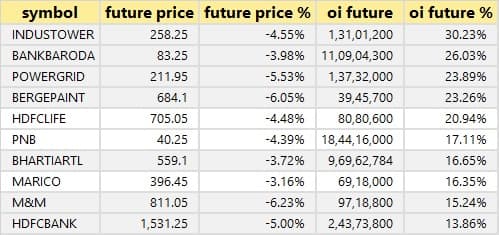

97 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

2 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the 2 stocks in which short-covering was seen.

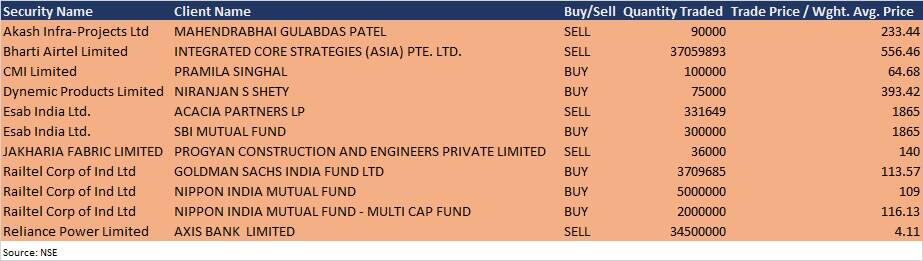

Bulk deals

(For more bulk deals, click here)

Analysts/Board Meetings

UltraTech Cement: Investor meeting to be held on March 1 which will be attended by the representatives of the company.

Finolex Industries: Analysts'/investors' call on March 1, 2021.

Marico: Analysts'/investors' meet - Virtual Roadshow - will be held from March 1 to March 3, 2021.

Torrent Power: The company's officials will meet ICICI Prudential Life on March 1.

UTI AMC: The company's officials will meet Motilal Oswal on March 1.

Chambal Fertilisers & Chemicals: The company's officials will meet FIL India Business and Research Services on March 1, and ICICI Prudential Mutual Fund on March 2.

Computer Age Management Services: The company has scheduled an Analysts' call on March 3 with Fidelity Management & Research (Japan).

Wipro: The company's officials will attend HDFC Securities Technology Investor Forum on March 1.

R Systems International: The investors'/ analysts' call of the company will be held on March 2 to discuss the financial results of the company for the quarter and year ended December 2020.

Welspun India: Board meeting is scheduled to be held on March 3 to consider the issuance of debenture, bonds or any other form of borrowing.

JB Chemicals: Investors and analysts' call with the management of the company is scheduled for March 2.

Stocks in the news

Indian Oil Corporation: The company will invest Rs 32,946 crore to expand Panipat refinery capacity to 25 million tonne per year from 15 million tonne per year earlier.

BL Kashyap and Sons: Acacia II Partners LP & Others reduced stake in the company to 2.47% from 4.91% earlier.

Affle (India): The company at its board meeting approved the fundraising of upto Rs 1,080 crore.

Equitas Holdings: Investor CDC Group PLC reduced stake in the company to 5.23% from 7.84% via open market sale.

Tata Chemicals: The company appointed Nandakumar S Tirumalai as the Chief Financial Officer after John Mulhall was elevated to Managing Director & CEO of subsidiary Tata Chemicals North America, Inc.

Acrysil: The company commence commercial production of additional 1 lakh units after completion of capacity expansion of Quartz kitchen sinks at Bhavnagar plant in Gujarat from 5 lakh units to 6 lakh units per annum.

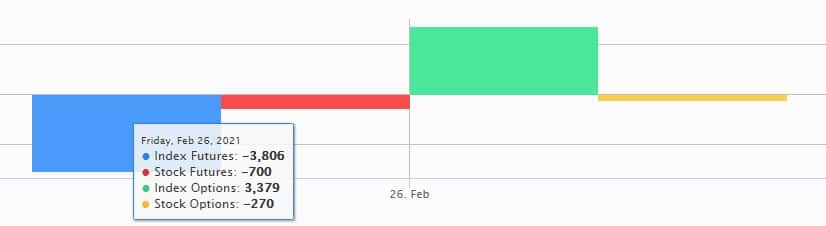

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 8,295.17 crore, whereas domestic institutional investors (DIIs) net bought shares worth Rs 1,499.7 crore in the Indian equity market on February 26, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

As we are at the beginning of the March series, not a single stock is under the F&O ban for March 1. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!