The market remained in bear trap for sixth consecutive session on January 29 as traders maintained cautious stance ahead of Union Budget on Monday, the big event of the year.

The BSE Sensex plunged 588.59 points or 1.26 percent to 46,285.77, while the Nifty50 fell 182.90 points or 1.32 percent to 13,634.60 and formed bearish candle on the daily charts. The index lost over 5 percent for the week and formed bearish candle on the weekly scale.

Budget 2021: Follow our LIVE blog for the latest updates

"A long negative candle was formed on the weekly chart, which was formed after a gap of 4 months. This candle has breached the immediate weekly support of 10-week EMA at 13,720 levels. This moving average was offering support for the Nifty in past. Hence, this market action could be a confirmation of top reversal pattern as per larger timeframe chart," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

"The short-term trend of Nifty continues to be weak. The negation of upside bounce attempt and the downside break of weekly support could signal more declines ahead for the Nifty. The key economic event of Union Budget could play vital role to show the direction for the market," he said.

"Any rise from here could encounter resistance around 13,750-13,800 levels. The near term downside targets to be watched for Nifty around 13,050 (20-week EMA) for the next few weeks, he added.

The Nifty Midcap 100 index was down 0.4 percent and Smallcap 100 index fell 0.63 percent, outperforming the Nifty50 on Friday as well as in the week gone by. Indices corrected 3.5 percent and 2.3 percent for the week respectively.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 13,498.67, followed by 13,362.73. If the index moves up, the key resistance levels to watch out for are 13,868.67 and 14,102.73.

Nifty Bank

The Nifty Bank gained 207.20 points to end at 30,565.50 on January 29 and lost 2 percent for the week. The important pivot level, which will act as crucial support for the index, is placed at 30,176.1, followed by 29,786.7. On the upside, key resistance levels are placed at 31,033.4 and 31,501.3.

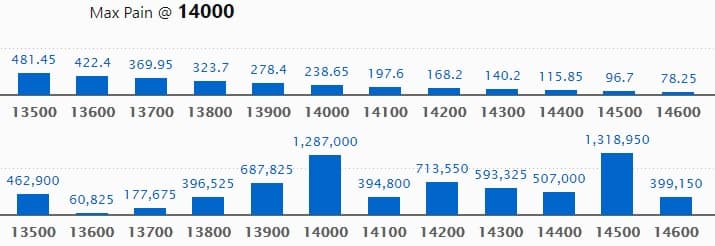

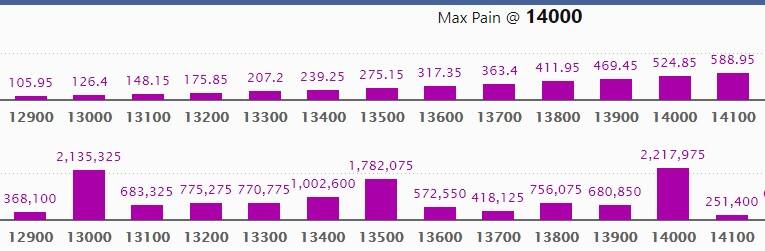

Call option data

Maximum Call open interest of 13.18 lakh contracts was seen at 14,500 strike, which will act as a crucial resistance level in the February series.

This is followed by 14,000 strike, which holds 12.87 lakh contracts, and 14,200 strike, which has accumulated 7.13 lakh contracts.

Call writing was seen at 14,200 strike, which added 2.78 lakh contracts, followed by 14,000 strike which added 2.65 lakh contracts and 14,100 strike which added 1.42 lakh contracts.

There was hardly any Call unwinding seen on January 29.

Put option data

Maximum Put open interest of 22.17 lakh contracts was seen at 14,000 strike, which will act as crucial level in the February series.

This is followed by 13,000 strike, which holds 21.35 lakh contracts, and 13,500 strike, which has accumulated 17.82 lakh contracts.

Put writing was seen at 13,100 strike, which added 2.47 lakh contracts, followed by 13,300 strike, which added 1.86 lakh contracts and 13,000 strike which added 1.85 lakh contracts.

Put unwinding was seen at 13,700 strike, which shed 1.57 lakh contracts, followed by 14,200 strike, which shed 58,950 contracts and 14,500 strike which shed 39,225 contracts.

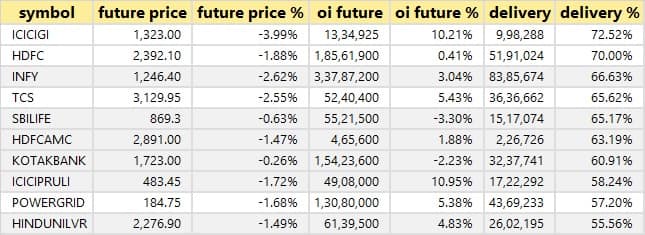

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

14 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

38 stocks saw long unwinding

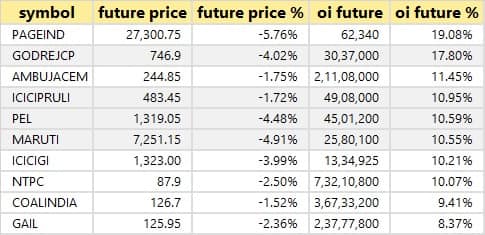

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

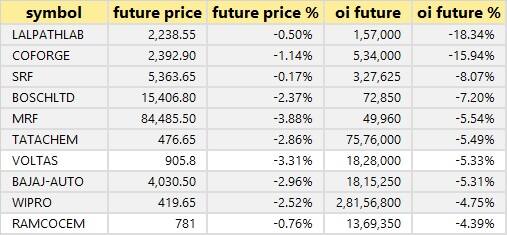

77 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

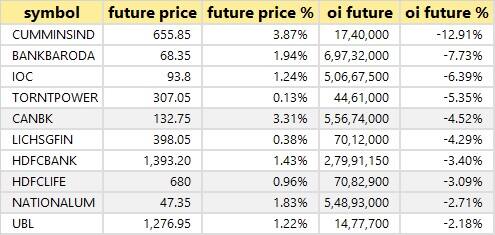

14 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

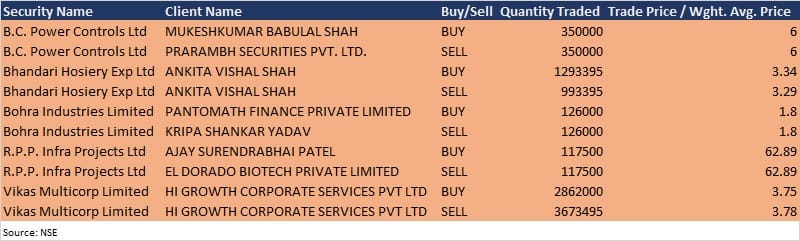

Bulk deals

(For more bulk deals, click here)

Results on February 1: Castrol India, Coromandel International, Finolex Industries, Fortis Malar Hospitals, Kansai Nerolac Paints, Mastek, OnMobile Global, Rane Brake Lining, Reliance Capital, Reliance Infrastructure, Subex, Talbros Engineering, Triveni Turbine and Zydus Wellness were among 37 companies to announce their quarterly earnings on February 1.

Stocks in the news

Tata Motors: The company reported sharply higher profit at Rs 2,906.5 crore in Q3FY21 against Rs 1,738.3 crore in Q3FY20, revenue rose to Rs 75,653.79 crore from Rs 71,676.07 crore YoY.

Tech Mahindra: The company reported higher consolidated profit at Rs 1,309.8 crore in Q3FY21 against Rs 1,064.6 crore in Q3FY20, revenue increased to Rs 9,647.1 crore from Rs 9,371.8 crore QoQ.

Cipla: The company reported sharply higher profit at Rs 748.2 crore in Q3FY21 against Rs 351 crore in Q3FY20, revenue jumped to Rs 5,168.7 crore from Rs 4,371 crore YoY.

IndusInd Bank: The company reported lower profit at Rs 852.8 crore in Q3FY21 against Rs 1,300.2 crore in Q3FY20, revenue increased to Rs 3,406.1 crore from Rs 3,074 crore YoY.

Vedanta: The company reported higher profit at Rs 4,224 crore in Q3FY21 against Rs 2,665 crore in Q3FY20, revenue increased to Rs 22,498 crore from Rs 21,126 crore YoY.

DLF: The company reported higher profit at Rs 451.2 crore in Q3FY21 against Rs 414 crore in Q3FY20, revenue rose to Rs 1,543 crore from Rs 1,342 crore YoY.

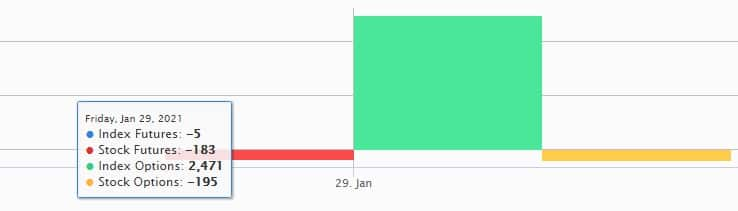

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 5,930.66 crore, whereas domestic institutional investors (DIIs) net bought shares worth Rs 2,443.2 crore in the Indian equity market on January 29, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Not a single stock is under the F&O ban for February 1 as we are in the initial days of February series. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!