The market snapped two days of gains amid volatility and fell nearly half a percent on June 22. The weak global cues after the hawkish tone by the Federal Reserve and selling in most sectors dented sentiment.

The BSE Sensex dropped 284 points to 63,239, while the Nifty50 declined 86 points to 18,771 and formed a bearish candlestick pattern on the daily scale, but still defended support of 18,700.

Intraday, the BSE Sensex hit a fresh all-time high, while the Nifty50 went very close to its previous record high again but failed for the third time this week.

On the hourly chart, a distinct 'Double Top' pattern can be identified on the Nifty. This suggests that a breakout above 18,888 is necessary to sustain the upward trend, Rajesh Bhosale, Technical Analyst at Angel One said.

Conversely, he says, the low reached on Tuesday, around 18,650, coincides with the 20-day EMA (exponential moving average) and can be regarded as a significant support level. A breach below this level could trigger a breakdown of the Double Top pattern, potentially leading to further profit booking in the Nifty.

Nevertheless, "considering the recent sessions where profit booking occurred, it is our belief that such corrections, whether in terms of time or price, should be viewed as healthy for the overall primary uptrend," Bhosale said.

The Nifty Midcap 100 and Smallcap 100 indices also saw profit booking after an eight-day run, falling 1 percent and 0.8 percent respectively.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data and not just the current month.

Key support, resistance levels on Nifty

The pivot point calculator suggests that the Nifty may get support at 18,757, followed by 18,727 and 18,679, whereas in case of upside, 18,854 can be a key resistance area for the index, then 18,884 and 18,933.

The Bank Nifty consolidated for yet another session around the 20-day exponential moving average mark (43,826) and closed 134 points lower at 43,725, forming a bearish candlestick pattern on the daily scale.

"The resistance for the Bank Nifty is placed at 44,000 while the 43,500 zone is likely to act as a strong support as we head into the final expiry week of June series," Ashwin Ramani, Derivatives & Technical Analyst at SAMCO Securities said.

The pivot point calculator indicated that the Bank Nifty is likely to take support at 43,665, followed by 43,576 and 43,431, whereas 43,955 can be the initial resistance zone for the index, followed by 44,044 and 44,189.

The weekly options data showed that we have maximum Call open interest (OI) at 19,000 strike, with 1.08 crore contracts, which can act as a crucial resistance area for the Nifty50 in coming sessions.

This was followed by 1.04 crore contracts at 18,800 strike, while 18,900 strike has 84.3 lakh contracts.

We have meaningful Call writing at 18,800 strike, which added 31.66 lakh contracts, followed by 19,500 strike and 19,300 strike, which added 2.22 lakh contracts, and 1.36 lakh contracts, respectively.

Maximum Call unwinding was at 18,900 strike, which shed 34.34 lakh contracts, followed by 19,100 and 19,000 strikes, which shed 34.05 lakh and 23.69 lakh contracts, respectively.

On the Put side, the maximum open interest was at 18,700 strike, with 1.02 crore contracts, which can be a crucial support level for the Nifty50 in the coming sessions.

This was followed by the 18,600 strike, comprising 62.38 lakh contracts, and the 18,500 strike, which has 46.91 lakh contracts.

Put writing was seen at 17,900 strike, which added 18.13 lakh contracts, followed by 17,700 strike, which added 1.56 lakh contracts.

We have Put unwinding at 18,800 strike, which shed 1.12 crore contracts, followed by 18,500 strike and 18,700 strike, which shed 32.56 lakh contracts, and 31.41 lakh contracts, respectively.

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. We have seen the highest delivery in Bata India, Alkem Laboratories, Cipla, HDFC, and Container Corporation of India among others.

An increase in open interest (OI) and price indicates a build-up of long positions. Based on the OI percentage, we have seen a long build-up in 14 stocks including Coromandel International, Balrampur Chini Mills, Jubilant Foodworks, Bharat Electronics and Federal Bank.

A decline in OI and price generally indicates a long unwinding. Based on the OI percentage, 94 stocks including Oracle Financial, JK Cement, Rain Industries, Exide Industries and Punjab National Bank saw a long unwinding.

68 stocks see a short build-up

An increase in OI along with a price decrease indicates a build-up of short positions. Based on the OI percentage, we have seen a short build-up in 68 stocks including RBL Bank, Indiabulls Housing Finance, Petronet LNG, Vodafone Idea and Chambal Fertilizers.

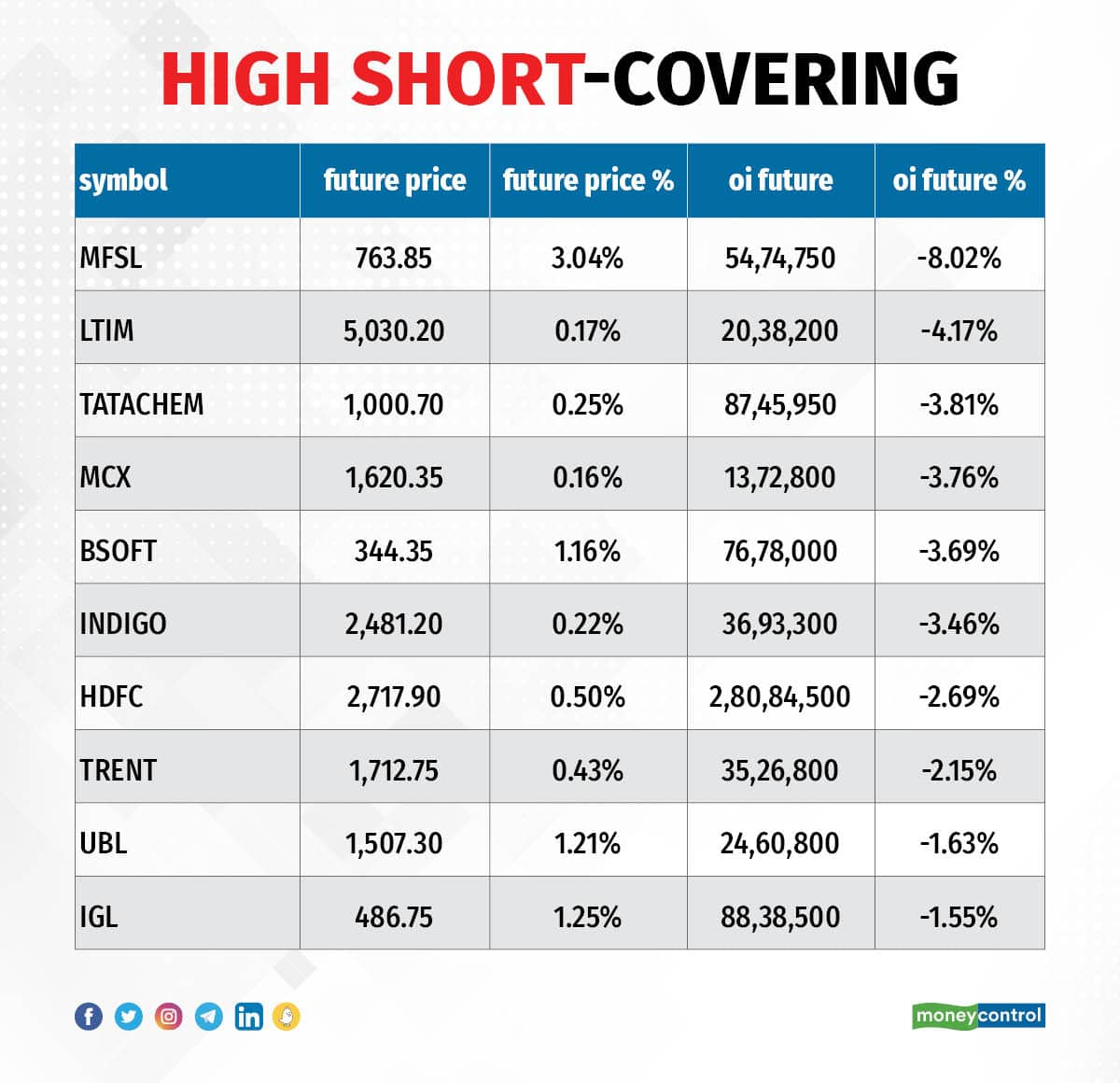

A decrease in OI along with a price increase is an indication of short-covering. Based on the OI percentage, 14 stocks were on the short-covering list. These included Max Financial Services, LTIMindtree, Tata Chemicals, MCX India and Birlasoft.

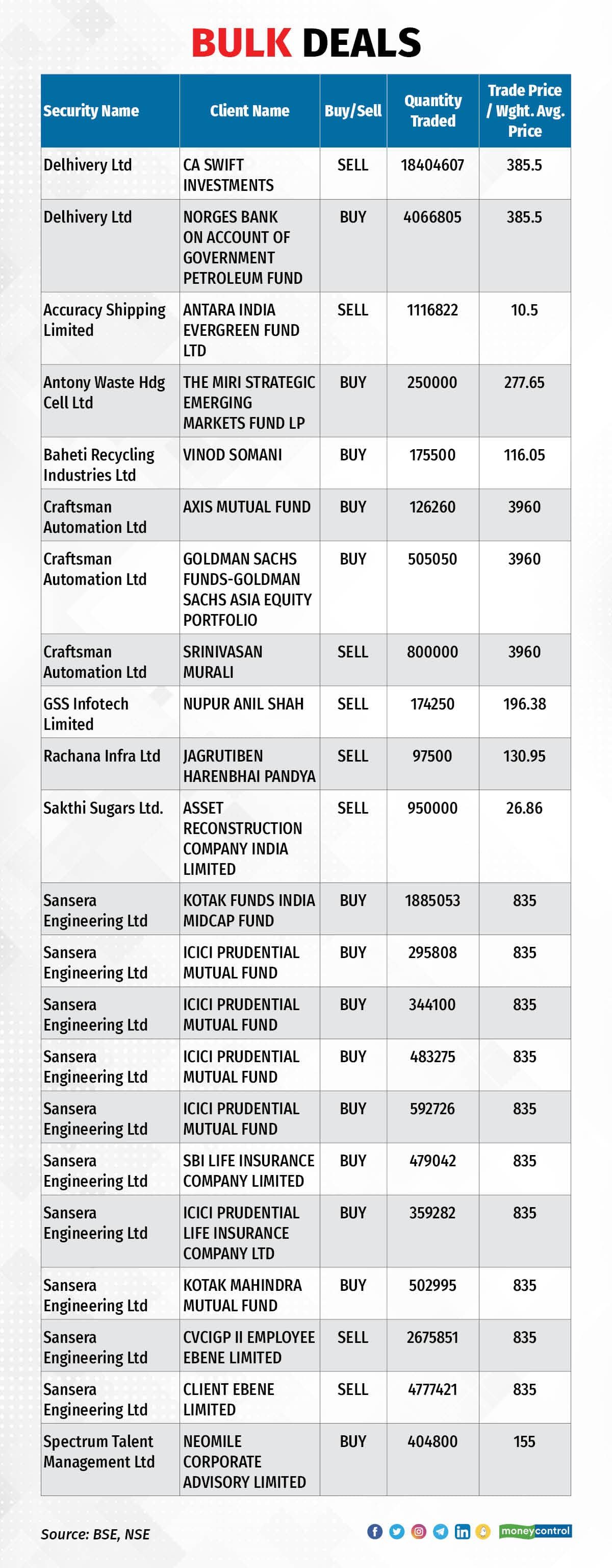

Bulk deals

(For more bulk deals, click here)

Investors Meetings on June 23

Stocks in the news

Landmark Cars: Private equity firm TPG Capital is likely to sell 44 lakh equity shares or an 11 percent stake in the automotive retailer via a block deal on June 23, reports CNBC-Awaaz quoting sources. The block deal is likely to take place at 0-5 percent discount to the current market price and the deal is launched by ICICI Securities. TPG Growth II SF Pte Ltd holds an 11.25 percent stake or 44.56 lakh shares in the company as of March 2023.

PNB Housing Finance: The housing finance company has received board approval for the issuance of non-convertible debentures worth up to Rs 5,000 crore in tranches on a private placement basis.

Bharat Petroleum Corporation: The oil marketing company said the meeting of the board of directors is scheduled for June 28 to consider various modalities for capital infusion including rights issue. The funds will help the company achieve energy transition, net zero and energy security objectives.

Coforge: The IT services firm has acquired the final tranche of shares of the balance 20 percent stake in Coforge Business Process Solutions for Rs 336.94 crore. In April 2021, it had acquired 60 percent of 80 percent stake in Coforge Business Process Solutions. Its total stake in Coforge Business Process Solutions stands at 80 percent now.

Eros International Media: Eros International Media’s Managing Director Sunil Arjan Lulla and CEO Pradeep Kumar Dwivedi have been restrained from holding any board positions or key managerial positions by the market regulator Sebi, through an interim ex-parte order. The two senior executives, the company, Eros Worldwide FZ and Eros Digital have been banned from accessing the securities markets until further orders too. Eros is in the process of seeking legal advice on the Sebi order.

Housing Development Finance Corporation: The Corporation has sold its entire 9.65 percent stake in Ruralshores Business Services. It also sold 10 lakh shares in HDFC Property Ventures, and 5 lakh shares in HDFC Venture Capital, which both are wholly owned subsidiaries, to Vividh Distributors, for Rs 1.20 crore and Rs 0.30 crore respectively. However, HDFC bought 3.86 percent shares in Bonito Designs for Rs 25 crore, while the corporation via HDFC Capital Advisors purchased 914 compulsorily convertible preference shares (CCPS) in Cognilements.

Fund Flow

Foreign institutional investors (FII) sold shares worth Rs 693.28 crore, while domestic institutional investors (DII) purchased shares worth Rs 219.42 crore on June 22, provisional data from the National Stock Exchange shows.

Stocks under F&O ban on NSE

The National Stock Exchange has added RBL Bank to its F&O ban list for June 23 and retained BHEL, Hindustan Copper, L&T Finance Holdings, and Punjab National Bank on the list. Securities thus banned under the F&O segment include companies where derivative contracts have crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!