The market ended higher after trading volatile for the second consecutive day on November 7 on the hopes of a US-China trade deal.

Buying was seen in the metal, real estate, IT, FMCG and pharma stocks, while there was some selling seen in the auto and PSU banks.

At close, the Sensex was up 183.96 points at 40,653.74, while Nifty was up 46 points at 12,012.

The market breadth was positive with about 1,322 shares advancing against 1,182 declining and 179 shares staying unchanged.

"Index trading above crucial resistance of previous high standing around 12,103 will accelerate up move taking it higher towards the next levels of 12200; however a close below 5 DMA placed around 11950 levels will give an early indication of a trend reversal," said Shabbir Kayyumi, Head of Technical Research, Narnolia Financial Advisors

We have collated 15 data points to help you spot profitable trades:

Key support and resistance level for Nifty

According to the pivot charts, the key support level for the Nifty is placed at 11,965.4, followed by 11,918.8. If the index starts moving up, key resistance levels to watch out for are 12,040 and 12,068.

Nifty Bank

Nifty Bank added 38.15 points at 30,647.75 on November 7. The important pivot level, which will act as crucial support for the index, is placed at 30,456.76, followed by 30,280.33. On the upside, key resistance levels are placed at 30,815.46 and 30,997.73.

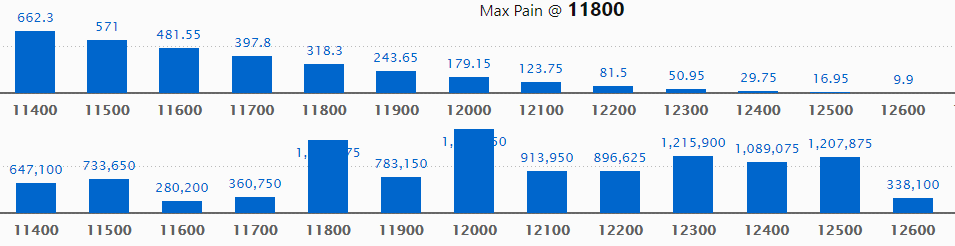

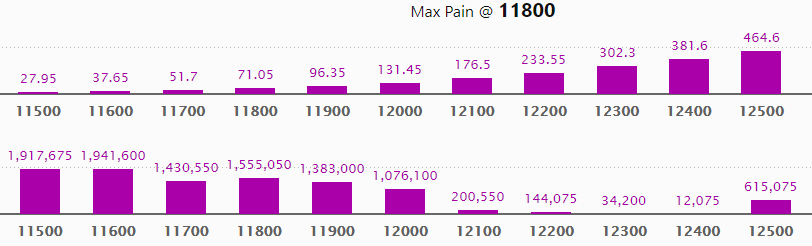

Call options data

Maximum call open interest (OI) of 17.93 lakh contracts was seen at 12,000 strike price. It will act as a crucial resistance level in the November series.

This is followed by 11,800 strike price, which holds 15.57 lakh contracts in open interest; and 12,300, which has accumulated 12.15 lakh contracts in open interest.

Call writing was seen at the 12,300 strike price, which added 1.43 lakh contracts, followed by 12,400 strike that added 1.26 contracts.

No major Call unwinding was seen.

Put options data

Maximum put open interest (OI) of 19.41 lakh contracts was seen at 11,600 strike price, which will act as crucial support in November series.

This is followed by 11,500 strike price, which holds 19.17 lakh contracts in OI; and 11,800 strike price, which has accumulated 15.55 lakh contracts in OI.

Put writing was seen at the 11,900 strike price, which added 2.54 lakh contracts, followed by 11,500 strike that added 1.83 lakh contracts and 11,700 strike that added 1.58 lakh contracts.

No major Put unwinding was seen.

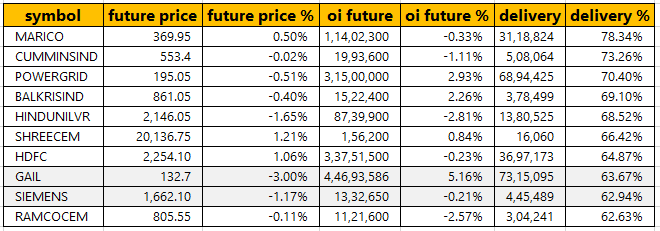

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

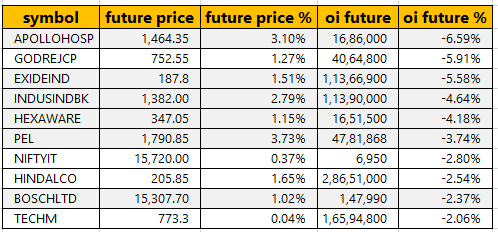

49 stocks saw long buildup

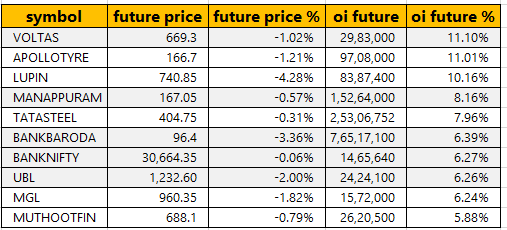

39 stocks witnessed short-covering

As per available data, 39 stocks witnessed short-covering. A decrease in open interest, along with an increase in price, mostly indicates a short covering. Based on the lowest open interest (OI) future percentage point, here are the top 10 stocks in which short-covering was seen.

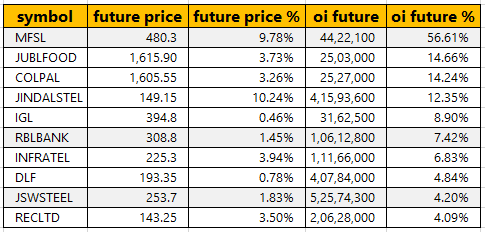

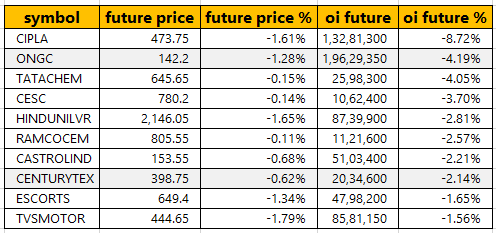

43 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on open interest (OI) future percentage, here are the top 10 stocks in which short build-up was seen.

63 stocks saw long unwinding

Based on the lowest open interest (OI) future percentage point, here are the top 10 stocks in which long unwinding was seen.

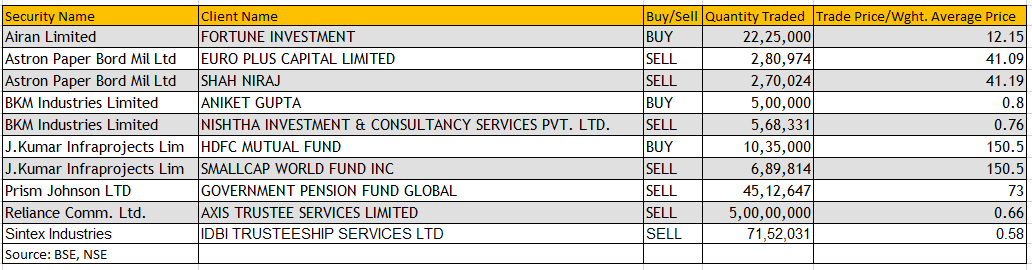

Bulk Deals

(For more bulk deals, click here)

Upcoming analyst or board meetings/briefings

Golden Tobacco - board meeting on November 14 to consider and approve the financial results for the period ended September 30, 2019

Info Edge - board meeting on November 12 to consider dividend

Reliance Infrastructure - board meeting on November 14 to consider and approve the unaudited financial results for the second quarter and half year ended September 30, 2019.

Nagarjuna Fertilisers - board meeting on November 12 to consider and approve the financial results for the quarter ended September 30, 2019

Omaxe - board meeting on November 13 to consider and approve the unaudited financial results for the period ended September 30, 2019

Sadbhav Engineering - board meeting on November 14 to consider and approve the financial results for the period ended September 30, 2019

Stocks in news

Results on November 8: M&M, Ashok Leyland, Bank Of Baroda, Eicher Motors, Allahabad Bank, Allcargo Logistics, Bharat Forge, Capacite Infraprojects, Century Plyboards, Chambal Fertilisers, CRISIL, Dredging Corporation, Equitas Holdings, Gail, Himatsingka Seide, IDFC, IDBI Bank, Inox Wind, KEC International, MRF, Religare Enterprises, Sical Logistics, Sobha, Subex, Tata Communications, Tata Power, Triveni Engineering

Results on November 9: Goldiam International, J.K.CEMENT, Jaiprakash Associates, Lakshmi Vilas Bank, Mangalam Cement, NTPC, Oil India, Tanla Solutions and Vimta Labs

Results on November 10: Shree Renuka Sugars, CG Power and MT Educare

Wockhardt Q2: Consolidated net loss at Rs 94.2 crore versus loss of Rs 31 crore, revenue down 28.7% at Rs 802.2 crore versus Rs 1,125.7 crore, YoY

Power Grid Q2: Net profit up 9.7% at Rs 2,527.1 crore versus Rs 2,304 crore, revenue up 4.8% at Rs 8,685 crore versus Rs 8,289 crore, YoY.

GSK Consumer Q2: Net profit up 25.3% at Rs 345.3 crore versus Rs 275.5 crore, revenue up 5.7% at Rs 1,345.1 crore versus Rs 1,272 crore, YoY

Andhra Sugars Q2: Consolidated net profit up 24.4% at Rs 52 crore versus Rs 42 crore, revenue up 14.5% at Rs 391.4 crore versus Rs 341.8 crore, YoY

Mindtree - Pradip Kumar Menon resigns as CFO of the company

Sudarshan Chemical Industries incorporates a wholly-owned subsidiary Sudarshan Japan K.K. in Japan

IGL Q2: Standalone net profit up 74.5% at Rs 381 crore versus Rs 218.4 crore, revenue up 7.4% at Rs 1,692.4 crore versus Rs 1,576.1 crore, QoQRaymond: Company demerged core lifestyle business to be listed as separate entity. Board approved issuing 33.4 lakh shares worth Rs 225 crore to the promoter via preferential allotment.

Amber Enterprises: Q2 consolidated net profit at Rs 11.7 crore versus loss of Rs 2.6 crore, revenue jumps 89 percent to Rs 623.2 crore versus Rs 329.8 crore YoY.

FII & DII data

Foreign institutional investors (FIIs) bought shares worth Rs 926.6 crore, while domestic institutional investors (DIIs) sold shares worth Rs 635.59 crore in the Indian equity market on November 7, as per provisional data available on the NSE.

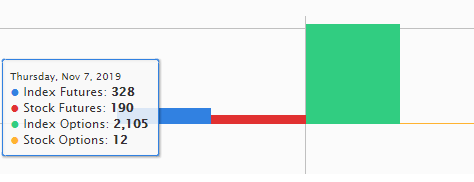

Fund Flow

No stock under ban period on NSE

For November 8, no stock is under F&O ban.

In the F&O segment, companies in which the security has crossed 95 percent of the market-wide position limit are put under a ban for a certain period.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!