The market corrected for the sixth consecutive session on September 24 with the Nifty falling well below the psychological 11,000 mark amid uncertainty over economic recovery and rising COVID-19 infections.

The BSE Sensex plunged 1,114.82 points or 2.96 percent to close at 36,553.60, while the Nifty50 closed the expiry day for September derivative contracts at 10,805.50, down 326.40 points or 2.93 percent and formed a big bearish candle on the daily charts.

"A long bear candle was formed on Thursday, which indicates that bears are in the driver's seat and dragging the market sharply lower. This is a negative indication and signals probable completion of an intermediate uptrend of the last 4-5 months and the downside momentum is picking up," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

"The sharp downward corrective action is unfolding in the market from the important swing highs (11,794) and the retracement theory shows almost reaching of 23.6 percent retracement at 10,800 (taken from the low of 7,511 and the high of 11,794) and the next important lower retracement area is at 38.2 percent, which is around 10,175 levels. Nifty testing this area can't be ruled out in the near term," he said.

All sectoral indices closed in the red with Bank, Auto, IT, Metal and Pharma falling in the range of 3-4 percent, while the Nifty Midcap and Smallcap indices declined over 2.5 percent each.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty is placed at 10,725.37, followed by 10,645.23. If the index moves up, the key resistance levels to watch out for are 10,950.47 and 11,095.43.

Nifty Bank

The Bank Nifty fell 721.70 points or 3.41 percent to end at 20,456.80, underperforming Nifty50 on September 24 and formed a bearish candle on the daily charts. The important pivot level, which will act as crucial support for the index, is placed at 20,255.94, followed by 20,055.07. On the upside, key resistance levels are placed at 20,806.63 and 21,156.47.

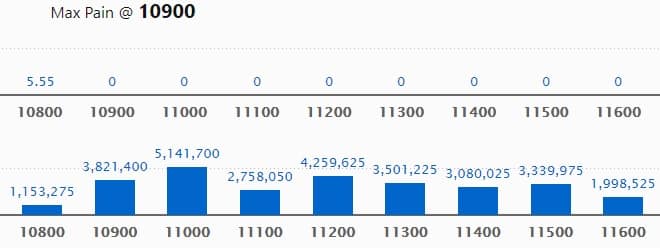

Call option data

Maximum Call open interest of 51.41 lakh contracts was seen at 11,000 strike, which will act as crucial resistance in the October series.

This is followed by 11,200 strike, which holds 42.59 lakh contracts, and 10,900 strike, which has accumulated 38.21 lakh contracts.

Call writing was seen at 11,000 strike, which added 43.41 lakh contracts, followed by 10,900 strike, which added 37.26 lakh contracts, and 10,800 strike, which added 10.89 lakh contracts.

Call unwinding was seen at 11,300 strike, which shed 10.41 lakh contracts, followed by 11,500 strike, which shed 9.69 lakh contracts and 11,600 strike which shed 9.33 lakh contracts.

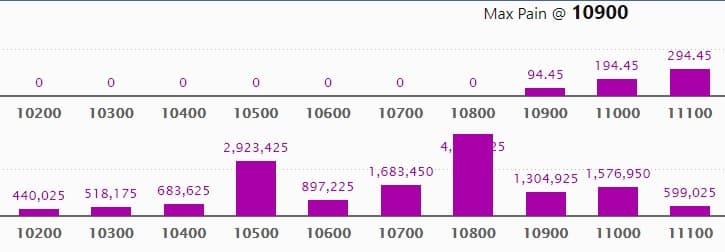

Put option data

Maximum Put open interest of 43.43 lakh contracts was seen at 10,800 strike, which will act as crucial support in the October series.

This is followed by 10,500 strike, which holds 29.23 lakh contracts, and 10,700 strike, which has accumulated 16.83 lakh contracts.

Put writing was seen at 10,800 strike, which added 22.97 lakh contracts, followed by 10,700 strike, which added 4.08 lakh contracts and 10,600 strike which added 1.3 lakh contracts.

Put unwinding was witnessed at 11,000 strike, which shed 29.18 lakh contracts, followed by 11,100 strike which shed 21.17 lakh contracts and 11,200 strike which shed 10.53 lakh contracts.

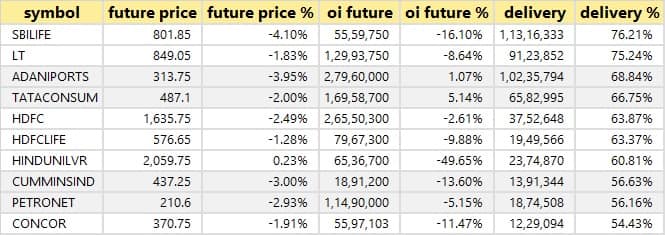

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

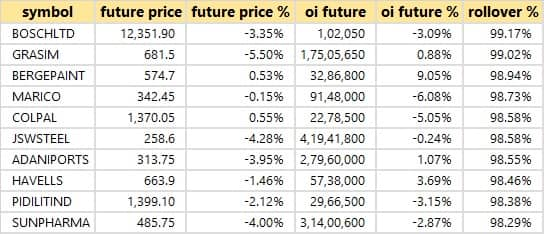

Rollovers

Here is the list top 10 stocks which witnessed higher rollovers.

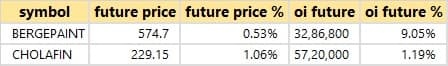

2 stocks saw long build-up

Based on the open interest future percentage, here are those 2 stocks in which long build-up was seen.

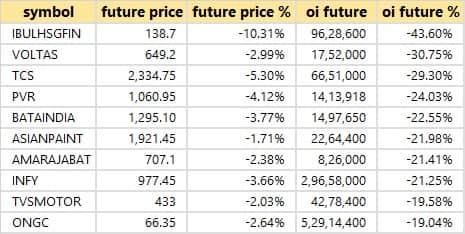

116 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

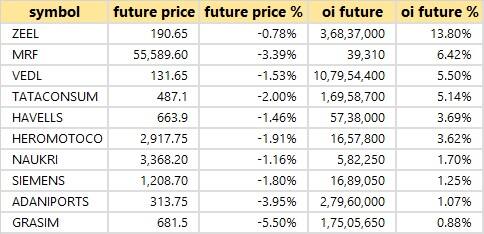

14 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which short build-up was seen.

6 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are those 6 stocks in which short-covering was seen.

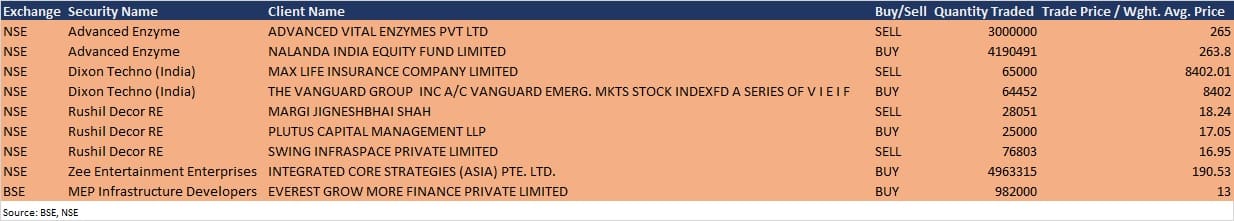

Bulk deals

(For more bulk deals, click here)

Analysts/Board Meetings

Eicher Motors: The company's officials will hold a conference call with Sundaram Mutual Fund on September 25.

Atul Auto: Neeraj J Chandra, Whole-time Director and J V Adhia, President - Finance of the company is going to meet analyst/s of Laburnum Capital on September 25 through video conference.

Nestle India: The company on October 23 will consider un-audited financial results for the third quarter ending September 2020.

Stocks in the news

TCS: The company bagged an order from fashion apparel retailer Maurices for digital services.

ONGC: The company to soon resume operations in Hazira plant after the fire.

RITES: The company received a turnkey contract for the construction of road over bridges for Rs 205.85 core.

Mahindra & Mahindra: The company raised stake in Sampo Rosenlew to 74.97 percent from 49.14 percent.

Nippon Life: The company received a joint mandate to manage Post Office Life Insurance Fund and Rural Post Office Life Insurance Fund for 3 years.

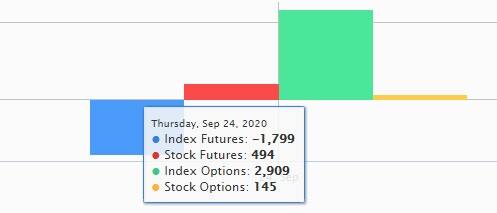

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 1,885.69 crore, whereas domestic institutional investors (DIIs) net bought shares worth Rs 188.64 crore in the Indian equity market on September 24, as per provisional data available on the NSE.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!