The selling pressure continued in equity markets for yet another session as bears remained in control over Dalal Street on April 7. Weak Asian cues and caution ahead of the RBI's monetary policy weighed on the sentiment.

The BSE Sensex plunged 575 points to 59,035, extending the downtrend for a third consecutive session, while the Nifty50 fell 168 points to 17,639 and formed a bearish candle on the daily charts.

"A reasonable negative candle was formed on the daily chart with minor upper shadow. Technically, this pattern indicates a continuation of weakness in the market," says Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

He further said, "The positive sequence of higher tops and bottoms is into play. After the formation of a new higher top at 18,114 on April 4, the market is showing weakness from the highs towards the formation of a new higher bottom. But, there is no confirmation of any higher bottom reversal as of now."

He feels the short term trend of the Nifty continues to be negative. "Presently, the daily 10-day EMA (exponential moving average) is offering support at 17,600 levels and the crucial support is placed around 17,450-17,500 levels as per the concept of change in polarity."

Friday's outcome of the RBI's mid-quarter policy meet is expected to show fresh direction for the market, according to him.

The broader markets were under pressure with the Nifty Midcap and Smallcap indices falling one percent and a third of a percent respectively.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 17,580, followed by 17,520. If the index moves up, the key resistance levels to watch out for are 17,743 and 17,847.

The Bank Nifty also corrected for the third day in a row, declining 75.5 points to 37,557 on April 7. The important pivot level, which will act as crucial support for the index, is placed at 37,277, followed by 36,998. On the upside, key resistance levels are placed at 37,907 and 38,256 levels.

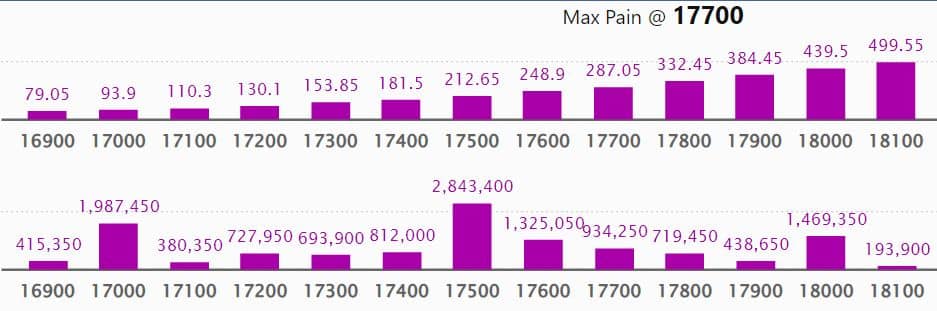

Maximum Call open interest of 22.87 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the April series.

This is followed by 19,000 strike, which holds 20.53 lakh contracts, and 18,500 strike, which has accumulated 15.47 lakh contracts.

Call writing was seen at 17,800 strike, which added 3.97 lakh contracts, followed by 17,700 strike which added 3.29 lakh contracts, and 18,000 strike which added 87,550 contracts.

Call unwinding was seen at 17,900 strike, which shed 1.14 lakh contracts, followed by 17,500 strike which shed 1.13 lakh contracts and 18,400 strike which shed 42,550 contracts.

Maximum Put open interest of 28.43 lakh contracts was seen at 17,500 strike, which will act as a crucial support level in the April series.

This is followed by 17,000 strike, which holds 19.87 lakh contracts, and 16,500 strike, which has accumulated 19.36 lakh contracts.

Put writing was seen at 17,700 strike, which added 3.77 lakh contracts, followed by 16,500 strike, which added 1.83 lakh contracts and 16,700 strike which added 1.69 lakh contracts.

Put unwinding was seen at 17,900 strike, which shed 2.42 lakh contracts, followed by 18,000 strike which shed 1.31 lakh contracts, and 17,500 strike which shed 47,300 contracts.

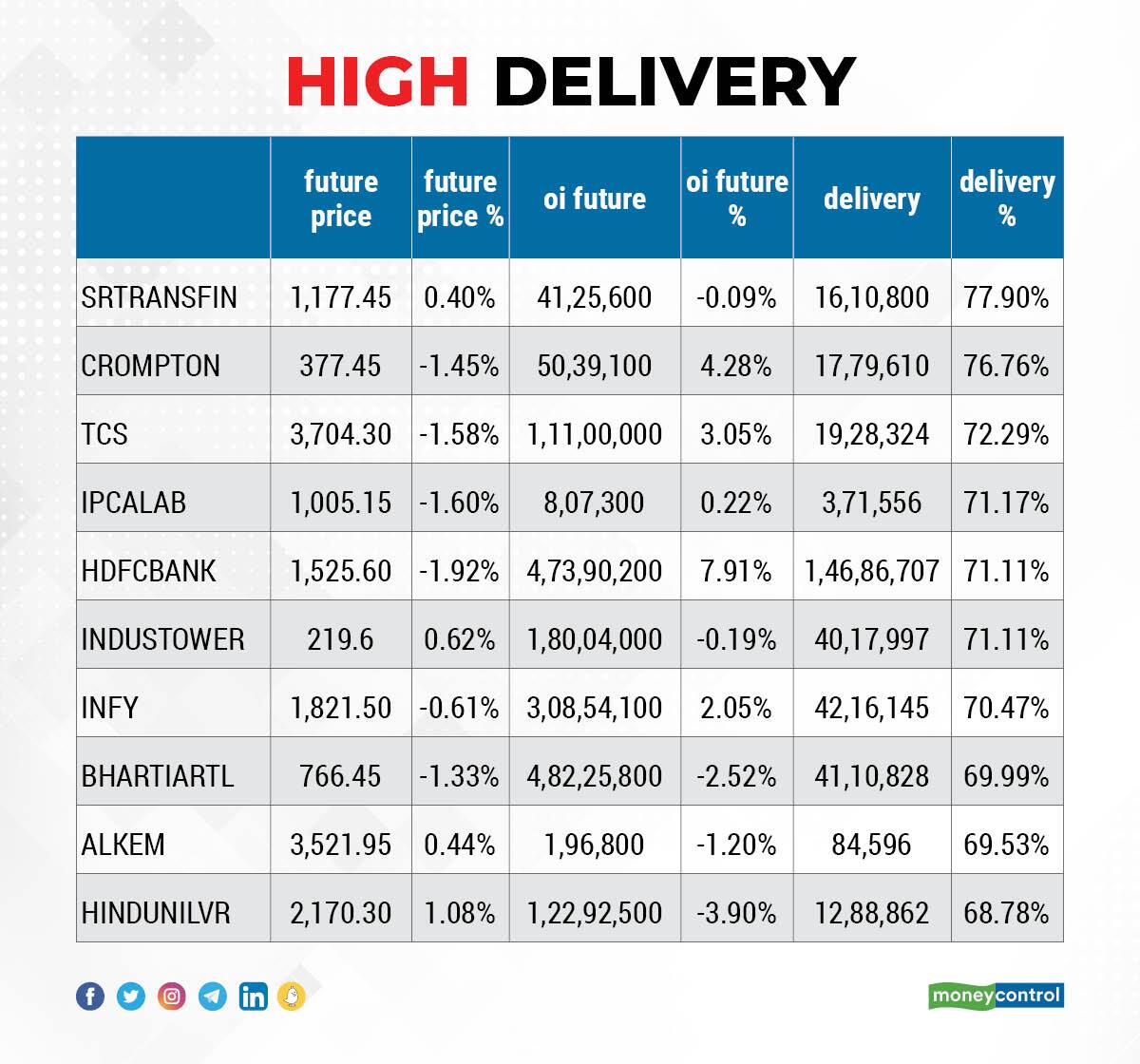

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Shriram Transport Finance, Crompton Greaves Consumer Electricals, TCS, Ipca Laboratories, and HDFC Bank, among others.

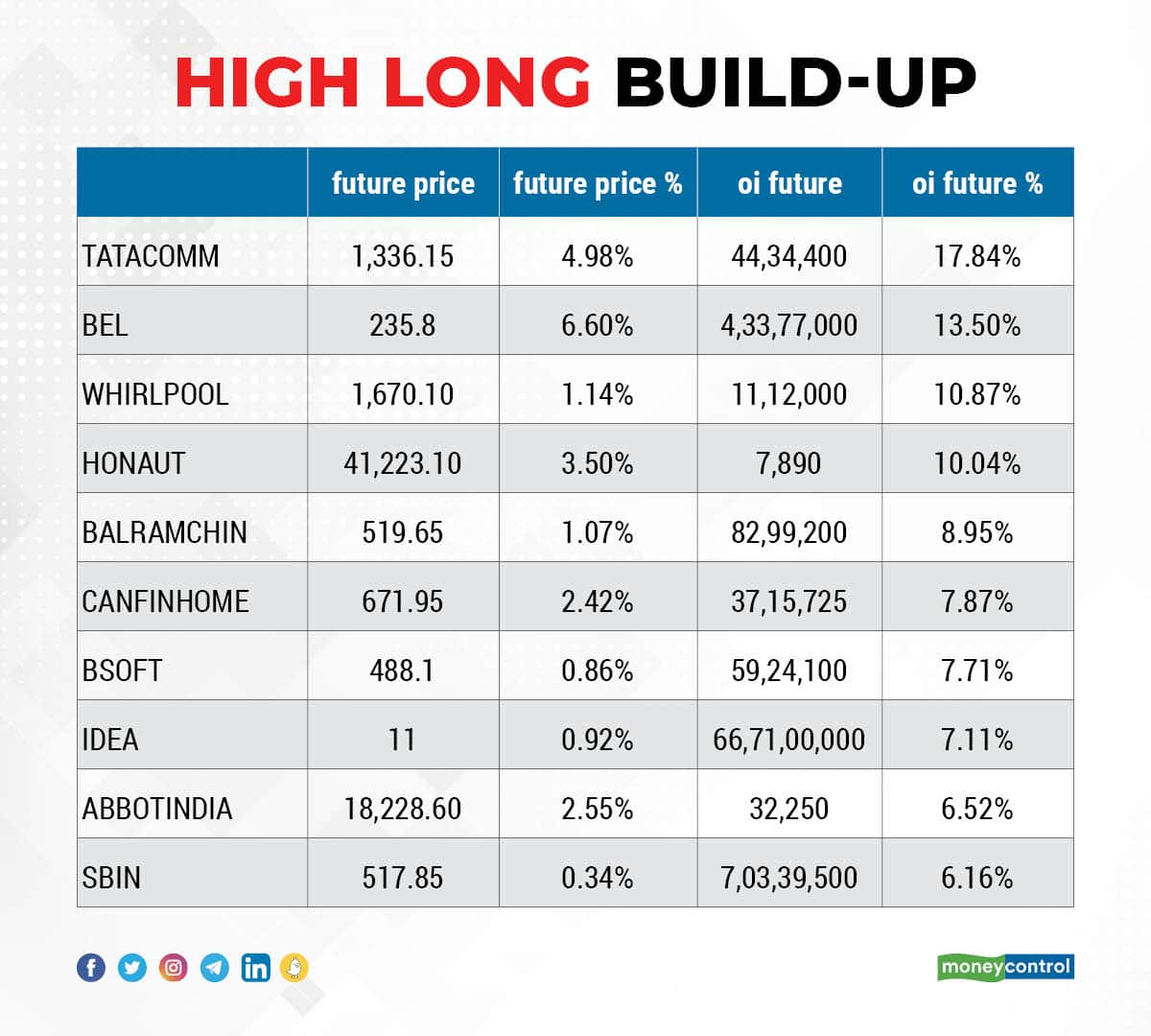

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including Tata Communications, Bharat Electronics, Whirlpool of India, Honeywell Automation, and Balrampur Chini Mills, in which a long build-up was seen.

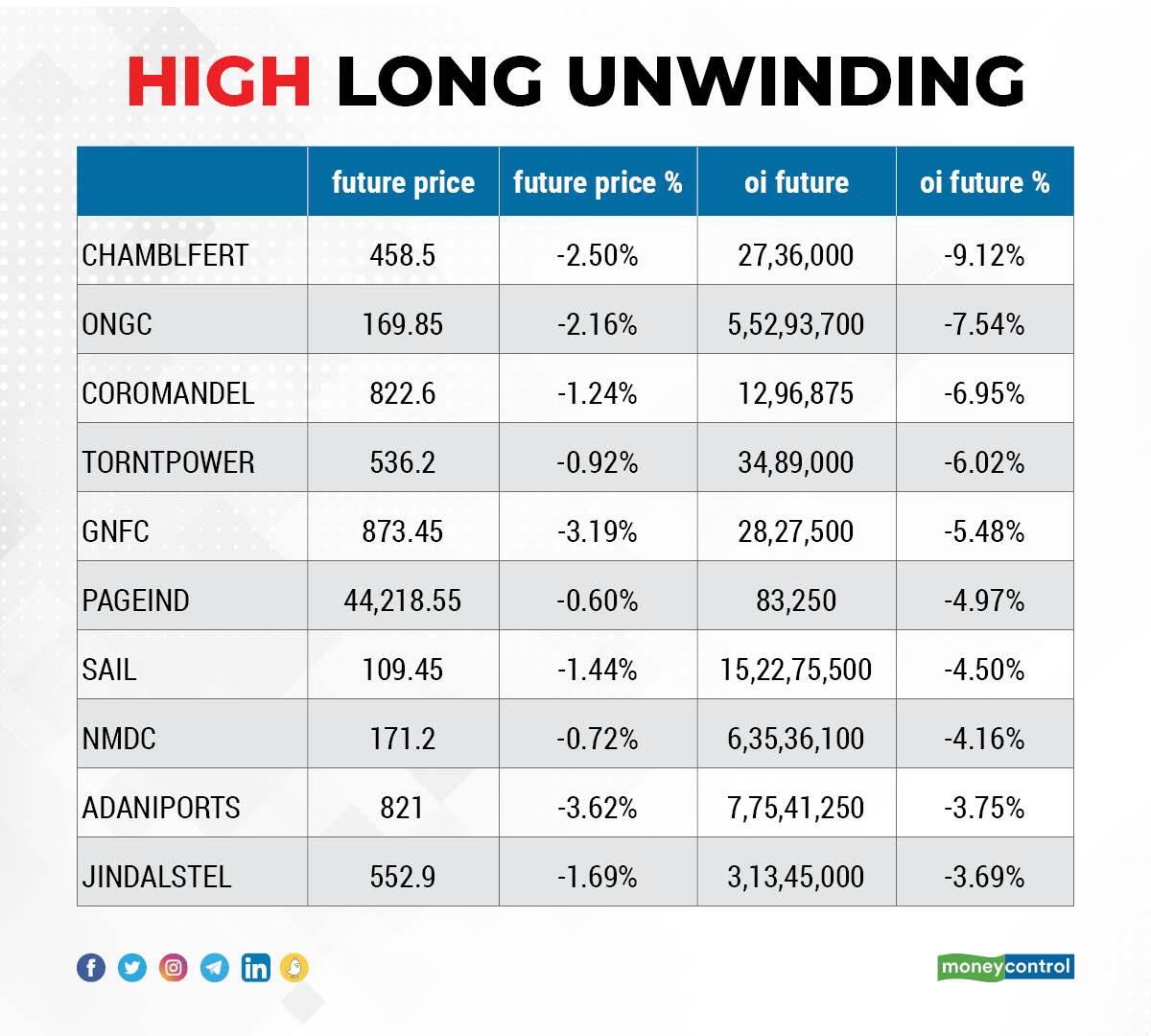

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Chambal Fertilizers, ONGC, Coromandel International, Torrent Power, and GNFC, in which long unwinding was seen.

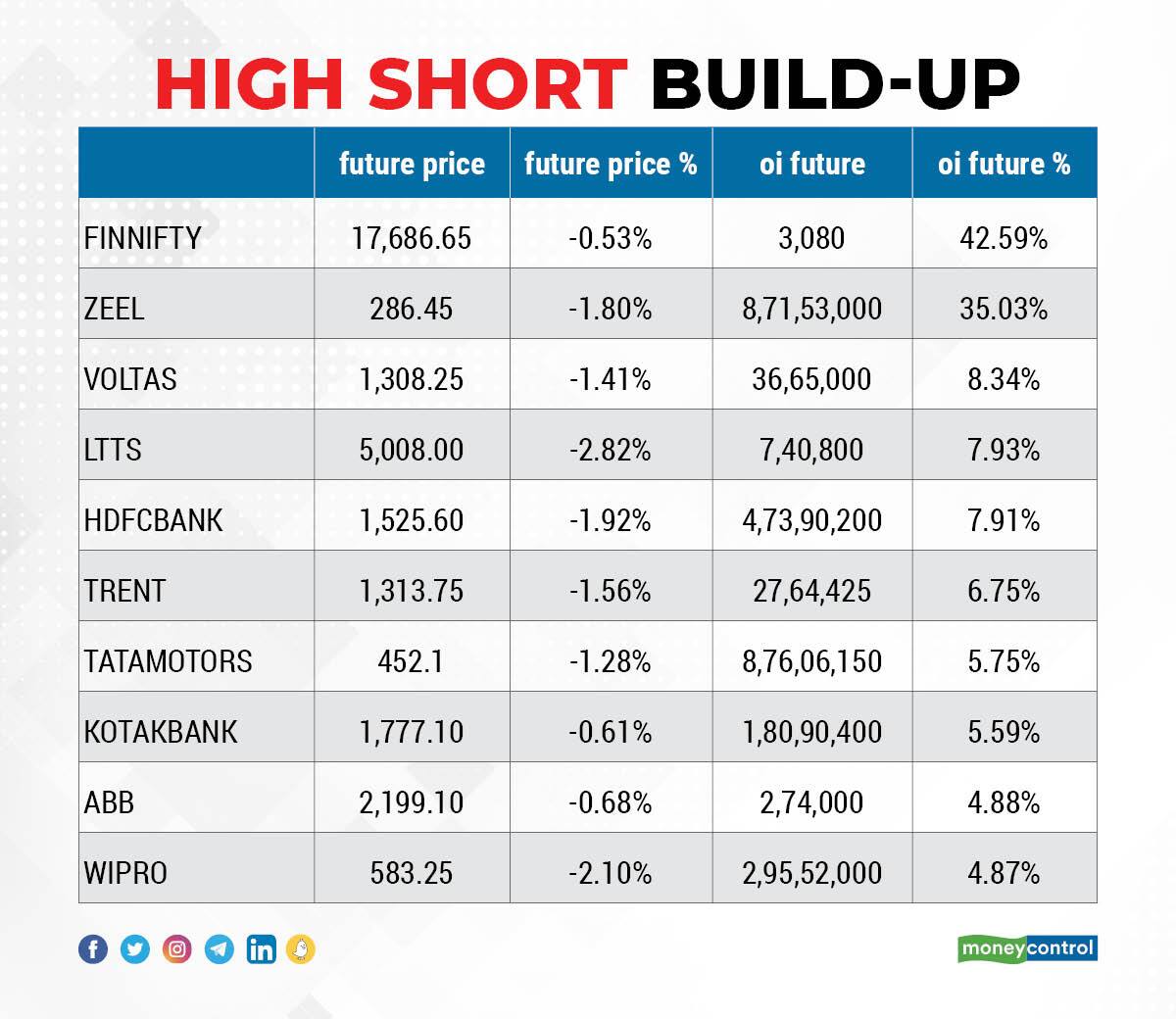

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks including Nifty Financial, Zee Entertainment Enterprises, Voltas, L&T Technology Services, and HDFC Bank, in which a short build-up was seen.

46 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks including United Breweries, Piramal Enterprises, JK Cement, Astral, and Ambuja Cements, in which short-covering was seen.

RBL Bank: Integrated Core Strategies Asia Pte Ltd offloaded 34,30,700 equity shares in the company via open market transactions. These shares were sold at an average price of Rs 139.07 per share.

Uma Exports: Tradedeal Financial Services has sold 2,84,121 equity shares in the company via open market transactions at an average price of Rs 79.8 per share. Asho Investment and Advisory offloaded 2,10,249 shares at an average price of Rs 83 per share, and Briya Enterprise sold 2,17,505 shares at an average price of Rs 84 per share.

Aster DM Healthcare: Indium IV (Mauritius) Holdings sold 33,79,797 equity shares in the company on the NSE at an average price of Rs 192.59 per share, and 32,86,751 shares on the BSE at an average price of Rs 192.35 per share.

Zee Entertainment Enterprises: Invesco Oppenheimer Developing Markets Fund has sold 7,43,18,476 equity shares in the company via open market transactions at an average price of Rs 281.46 per share. However, Segantii India Mauritius acquired 99 lakh shares and Morgan Stanley Asia Singapore Pte bought 1,01,95,126 shares at an average price of Rs 281.1 per share.

(For more bulk deals, click here)

Analysts/Investors Meetings on April 8

Krsnaa Diagnostics: The company's officials will meet Sunidhi Securities and Finance; and HDFC Life Insurance Company.

Ganesha Ecosphere: The company's officials will meet Abakkus Asset Manager.

Tata Motors: The company's officials will meet Canara Robeco Mutual Fund.

Data Patterns (India): The company's officials will meet Franklin Templeton Investments.

HSIL: The company's officials will meet HDFC Securities.

India Pesticides: The company's officials will meet Indgrowth, Amit Jasani Financial Services, and JMP Capital.

Welspun Corp: The company's officials will meet investors and analysts.

Nazara Technologies: The company's officials will meet Millennium Partners.

Ajmera Realty & Infra India: The company's officials will meet Ventura Securities.

Hindustan Foods: The company's officials will meet analysts and investors.

Stocks in News

Sterling and Wilson Renewable Energy: The company posted a loss of Rs 126.61 crore for the quarter ended March 2022, which narrowed from a loss of Rs 344.80 crore reported in the same period last year. However, revenue fell sharply to Rs 1,071 crore from Rs 1,364.5 crore during the same period. In the financial year FY22, the loss stood at Rs 916 crore, widened from Rs 290 crore in the previous year, while revenue rose moderately to Rs 5,199 crore from Rs 5,081 crore during the same period.

Sonata Software: The board has approved the appointment of Samir Dhir as CEO of the company with effect from April 8, 2022. Srikar Reddy is voluntarily stepping down as CEO and will be continuing as Managing Director of the company.

Cholamandalam Investment and Finance Company: The company in a BSE filing said disbursements for Q4FY22 stood approximately at Rs 12,718 crore, a growth of 58 percent compared to Rs 8,071 crore of disbursements in the corresponding period last fiscal. Collection efficiency on billing improved across all product segments and stood at 138 percent in Q4FY22 as against 120 percent in the year-ago period.

Infosys: The IT company and Rolls-Royce extended strategic collaboration with the launch of joint 'Aerospace Engineering and Digital Innovation Centre in Bengaluru. This centre will provide high-end research and development (R&D) services integrated with advanced digital capabilities to Rolls-Royce's engineering and group business services from India.

Hester Biosciences: The company in its BSE filing said the board has approved the execution of Grantin-Aid Letter Agreement for a grant of Rs 60 crore (in a phased manner) to the company by Biotechnology Industry Research Assistance Council (BIRAC), a Government of India Enterprise. This will support COVID vaccine manufacturing under Mission Covid Suraksha.

Sobha: The company achieved a total sales volume of 1.34 million square feet of super built-up area and the highest ever realisation of Rs 1,109.6 crore for the quarter ended March 2022, against 1.33 million square feet of super built-up area and realisation of Rs 1,072 crore in the year-ago period. The average realisation per square feet stood at Rs 8,265 crore in Q4FY22, against Rs 8,014 crore in Q4FY21.

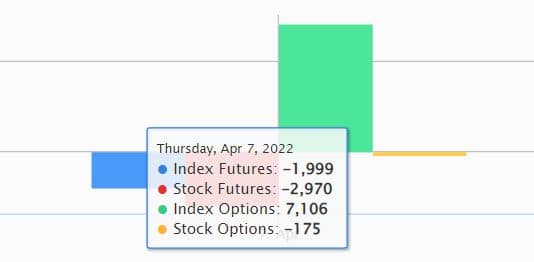

Fund Flow

Foreign institutional investors (FIIs) have increased selling pressure further, offloading shares worth Rs 5,009.62 crore, while domestic institutional investors (DIIs) have net bought shares worth Rs 1,774.70 crore on April 7, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Not a single stock is under the F&O ban for April 8. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!