The stock market extended selling for the second consecutive session on March 3 with the benchmark indices falling a little more than six-tenth of a percent as oil prices hit nearly 10-year high amid ongoing Ukraine-Russia war. Banking & financials, auto, and FMCG stocks dragged the market lower.

The BSE Sensex fell 366 points to 55,103, while the Nifty50 declined 108 points to 16,498 and formed a Bearish Engulfing or Inside Bar kind of pattern on the daily charts especially after Doji pattern formation in the previous session, indicating negative sentiment.

"A long bear candle was formed on the daily chart, which has engulfed the small range candle of previous session. Technically, this indicate a broader range movement in the market around 16,750-16,450 levels and the market is now placed at the lower end of the range. This is negative indication and a decisive move below 16,400 is likely to drag Nifty down to 16,000 levels," says Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

Shetti further says the short term movement in Nifty is choppy and the market is now placed to show further weakness for the short term. "There is a higher possibility of retest of recent swing lows of around 16,200 levels in the next few sessions."

The broader markets fared a bit better than benchmark indices. The Nifty Midcap 100 index slipped 0.4 percent, however, the Nifty Smallcap 100 index gained 0.35 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 16,371, followed by 16,244. If the index moves up, the key resistance levels to watch out for are 16,697 and 16,896.

Banking stocks remained drivers for the market towards downside on March 3 as the Nifty Bank corrected 428.50 points or 1.2 percent to 34,944. The important pivot level, which will act as crucial support for the index, is placed at 34,509, followed by 34,073. On the upside, key resistance levels are placed at 35,592 and 36,239 levels.

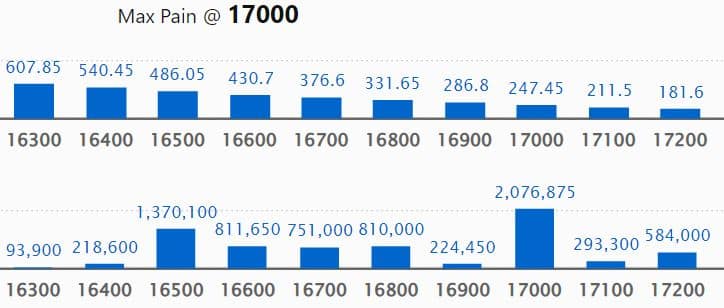

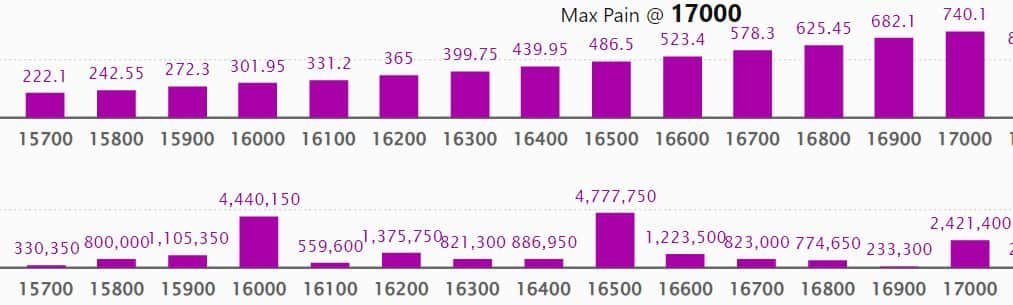

Maximum Call open interest of 24.27 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the March series.

This is followed by 17,000 strike, which holds 20.76 lakh contracts, and 17,500 strike, which has accumulated 20.17 lakh contracts.

Call writing was seen at 16,500 strike, which added 1.4 lakh contracts, followed by 18,000 strike which added 1.36 lakh contracts, and 16,600 strike which added 98,050 contracts.

Call unwinding was seen at 17,000 strike, which shed 42,550 contracts, followed by 16,000 strike which shed 38,950 contracts, and 17,900 strike which shed 31,850 contracts.

Maximum Put open interest of 47.77 lakh contracts was seen at 16,500 strike, which will act as a crucial support level in the March series.

This is followed by 16,000 strike, which holds 44.4 lakh contracts, and 15,500 strike, which has accumulated 33.56 lakh contracts.

Put writing was seen at 16,600 strike, which added 4.08 lakh contracts, followed by 15,000 strike, which added 2.15 lakh contracts, and 17,500 strike which added 1.97 lakh contracts.

Put unwinding was seen at 15,500 strike, which shed 1.89 lakh contracts, followed by 16,500 strike which shed 1.35 lakh contracts, and 16,700 strike which shed 61,150 contracts.

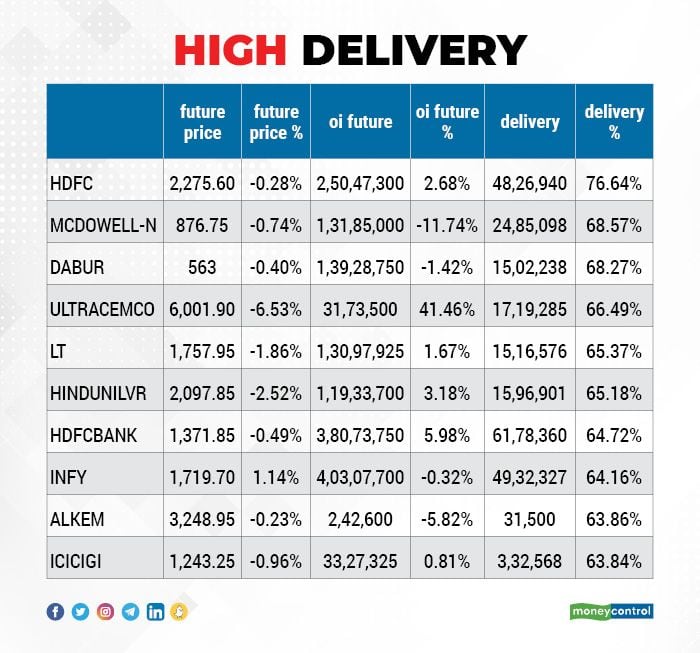

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. HDFC, United Spirits, Dabur India, UltraTech Cement, and L&T were the top five stocks which saw highest delivery on Thursday.

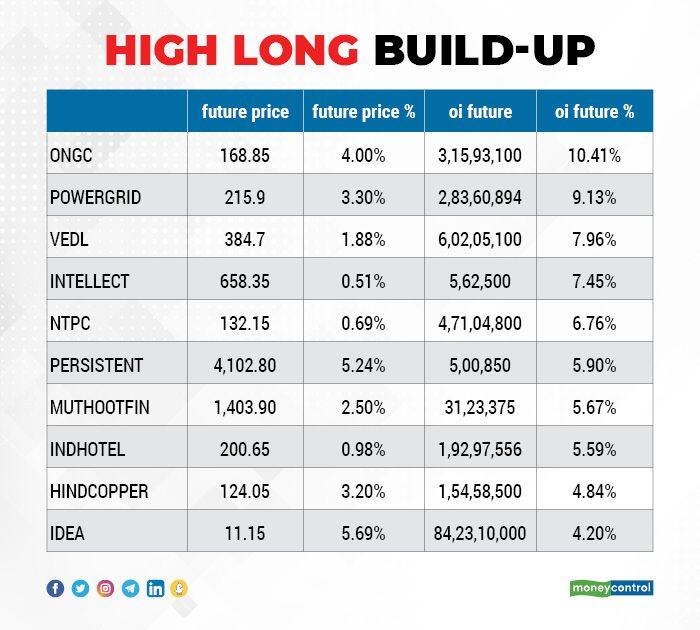

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen including ONGC, Power Grid Corporation of India, Vedanta, Intellect Design Arena, and NTPC.

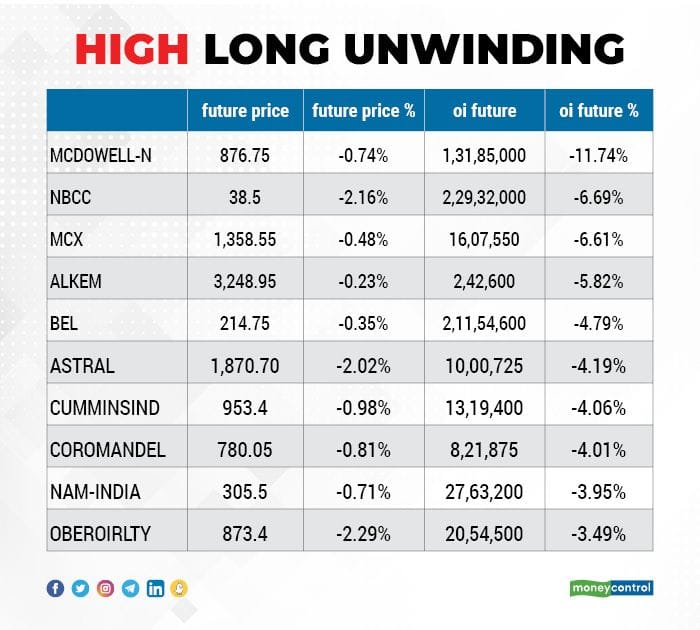

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen including United Spirits, NBCC, MCX India, Alkem Laboratories, and Bharat Electronics.

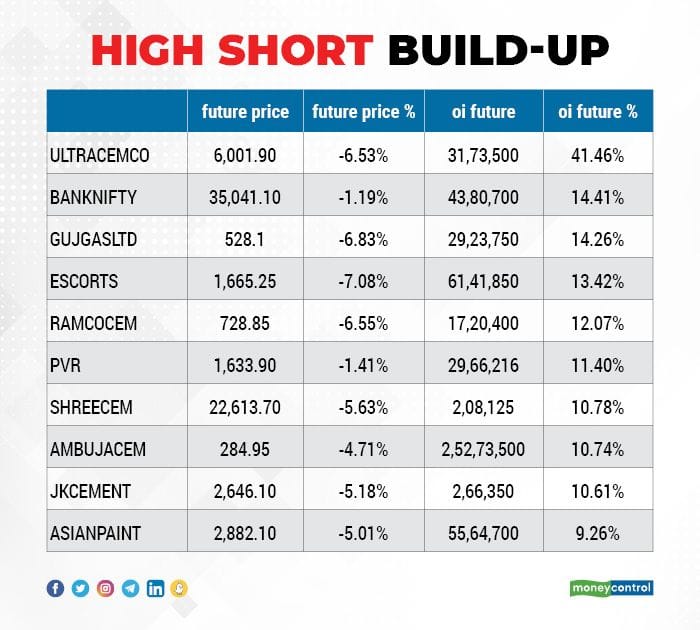

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the 10 stocks in which a short build-up was seen including UltraTech Cement, Bank Nifty, Gujarat Gas, Escorts, and Ramco Cements.

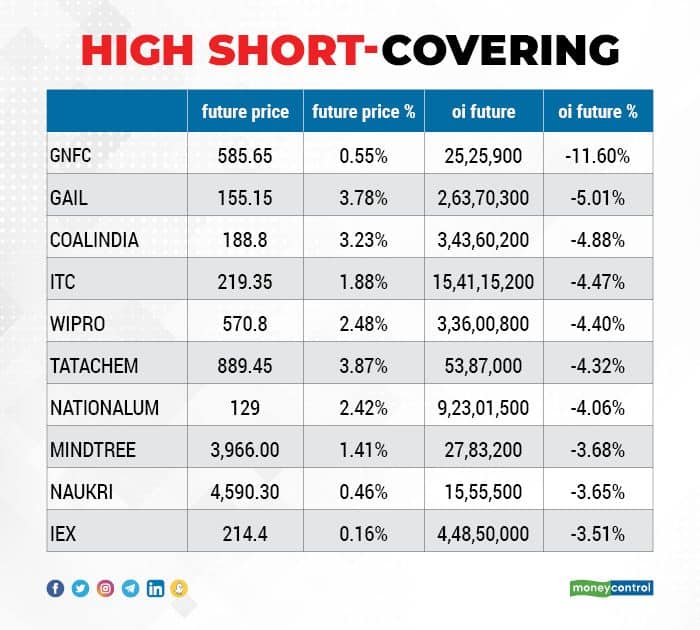

36 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen including GNFC, GAIL, Coal India, ITC, and Wipro.

Vedanta: France-based financial services company Societe Generale sold 2,24,50,200 equity shares in the billionaire Anil Agarwal-owned company via open market transactions. These shares were sold at an average price of Rs 391.74 per share.

Stove Kraft: Sequoia Capital-owned SCI Growth Investments II sold 24,69,853 equity shares in Kitchen appliances manufacturer via open market transactions at an average price of Rs 645.35 per share. However, Bengal Finance and Investment acquired 9,30,232 equity shares, Nippon India Mutual Fund bought 3,10,078 equity shares and PGIM India Mutual Fund purchased 6,97,674 shares at an average price of Rs 645 per share.

(For more bulk deals, click here)

Analysts/Investors Meetings

MedPlus Health Services: The company's officials will meet ICICI Prudential Life Insurance, Goldman Sachs Asset Management, White Oak Capital Management, Axis Capital and Edelweiss Securities on March 4.

Vedant Fashions: The company's officials will meet analysts and investors on March 4.

Shemaroo Entertainment: The company's officials will attend Valorem Advisors investor conference on March 4.

Gujarat Mineral Development Corporation: The company's officials will meet ICICI Prudential AMC on March 4.

PI Industries: The company's officials will meet MFS Investment on March 4; and Spark Capital on March 9.

Renaissance Global: The company's officials will meet ICICI Securities on March 4.

Max Healthcare Institute: The company's officials will meet Flowering Tree Investment Management, and Elephant Asset Management on March 7.

Tatva Chintan Pharma Chem: The company's officials will meet SBI MF on March 7.

Cummins India: The company's officials will meet Axis Capital on March 7.

CRISIL: The company's officials will meet Mirae Asset Global Investments on March 10.

Havells India: The company's officials will attend 2nd Jefferies India Mid-Cap Summit on March 15.

Stocks in News

SJVN: The state-owned hydroelectric power generation company has achieved financial closure for its 210 MW Luhri-1 hydro-electric project in Himachal Pradesh and 75 MW Parasaran solar power project in Uttar Pradesh. State Bank of India will provide Rs 1,537 crore, and Punjab National Bank, Dubai will provide Rs 319.04 crore for Luhri HEP and Parasaran Projects respectively.

Gabriel India: HDFC Asset Management Company through its schemes acquired additional 2.13 percent stake via open market transactions on March 2. With this, its shareholding in the company stands at 9.17 percent now, against 7.04 percent earlier.

Vodafone Idea: The telecom operator said the board has approved fund raising of Rs 4,500 crore on a preferential basis, through its promoters. It has decided to issue more than 338.3 crore equity shares at an issue price of Rs 13.30 per share to Euro Pacific Securities, Prime Metals, and Oriana Investments Pte Ltd. The company has also received board approval for additional fund raising of Rs 10,000 crore via private placement or qualified institutions placement.

Themis Medicare: The company has received approval for its immunomodulatory antiviral drug Viralex from Drug Controller General of India. The drug will be used for treatment of COVID-19.

LT Foods: The consumer food company said its subsidiary LT Foods Americans Inc acquired 51 percent stake in Golden Star Trading Inc along with its brand Golden Star. It also has a call option to further buy remaining 49 percent stake at the end of three years.

Mahindra & Mahindra Financial Services: The firm has disbursed approximately Rs 2,733 crore of loans in February 2022, registering a 44 percent YoY growth. The year-to-date total disbursement was Rs 23,632 crore, a growth of 42 percent over same period last year. The collection efficiency remained stable at 98 percent for the month of February YoY. Asset quality has seen improvement due to positive trend in collections. The company is confident of meeting its commitment to bring the net Stage 3 below 4 percent by year-end.

Fund Flow

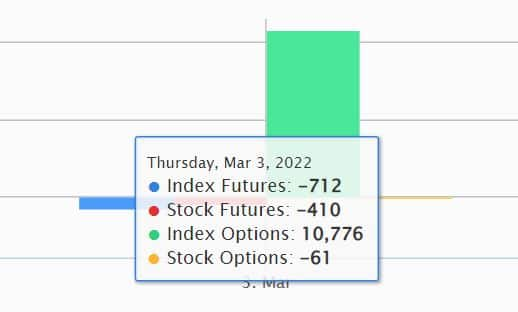

The relentless selling pressure by foreign institutional investors (FIIs) weighed on the market sentiment as they have net sold shares worth Rs 6,644.65 crore. However, domestic institutional investors (DIIs) have bought shares worth Rs 4,799.24 crore on March 3, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Not a single stock is under the F&O ban for March 4. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!