The market slipped one percent again, continuing the steep fall for the third consecutive session on January 20 as consistent FII selling, elevated oil prices, rising inflation concerns and caution ahead of Fed meet weighed on the sentiment.

The BSE Sensex closed below the 60,000 mark, falling 634.20 points to 59,464.62, while the Nifty50 plunged 181.40 points to 17,757 and formed a bearish candle on the daily charts again, indicating nervousness among traders.

"A long bear candle was formed on the daily chart with lower shadow. This is back-to-back three such negative candles in a row in the last three sessions. Technically, this pattern signals a sharp profit booking in the market from the highs of 18,350 levels, and the formation of lower shadow on Thursday could signal chances of buying emerging from the lower support of 17,650 levels," says Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

Shetty feels the short-term trend of Nifty continues to be down and there is no clear evidence of bottom formation at the lows. "A sustainable upmove in the subsequent session is likely to confirm higher bottom reversal in the market. The lower area of 17,650-17,600 levels is expected to be a strong support zone for the market ahead," says Shetti.

However, the broader markets continued to fare better than benchmarks as the Nifty Midcap 100 index declined 0.16 percent and Smallcap 100 index was down just 0.05 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,622.37, followed by 17,487.73. If the index moves up, the key resistance levels to watch out for are 17,917.67 and 18,078.33.

The Nifty Bank was down 190.50 points to close at 37,850.85 on January 20. The important pivot level, which will act as crucial support for the index, is placed at 37,572.56, followed by 37,294.23. On the upside, key resistance levels are placed at 38,148.56 and 38,446.23 levels.

Maximum Call open interest of 76.75 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the January series.

This is followed by 19,000 strike, which holds 70.05 lakh contracts, and 18,500 strike, which has accumulated 57.36 lakh contracts.

Call writing was seen at 19,000 strike, which added 53.73 lakh contracts, followed by 18,000 strike which added 45.33 lakh contracts, and 18,500 strike which added 33.56 lakh contracts.

Call unwinding was seen at 17,400 strike, which shed 26,450 contracts, followed by 17,300 strike which shed 16,950 contracts, and 17,100 strike which shed 6,250 contracts.

Maximum Put open interest of 42.44 lakh contracts was seen at 18,000 strike, followed by 17,000 strike, which holds 40.04 lakh contracts, and 17,500 strike, which has accumulated 31.84 lakh contracts.

Put writing was seen at 18,000 strike, which added 13.87 lakh contracts, followed by 17,800 strike, which added 7.59 lakh contracts, and 17,600 strike which added 6.96 lakh contracts.

Put unwinding was seen at 18,100 strike, which shed 2.42 lakh contracts, followed by 18,300 strike which shed 1.31 lakh contracts, and 18,200 strike which shed 39,750 contracts.

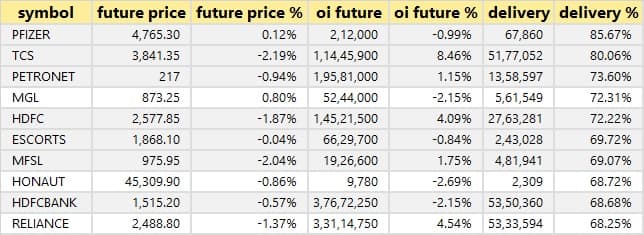

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

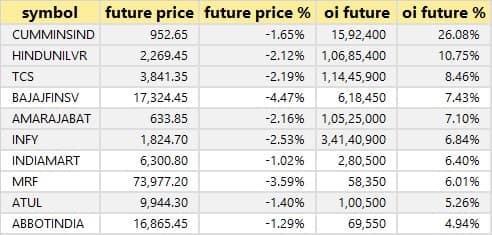

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

37 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

(For more bulk deals, click here)

Analysts/Investors Meeting; and Results on January 21 and January 22

Results on January 21: Reliance Industries, HDFC Life Insurance Company, SBI Life Insurance Company, JSW Steel, Bandhan Bank, CSB Bank, California Software, Elixir Capital, Gland Pharma, Gokaldas Exports, Heritage Foods, Hindustan Zinc, IDBI Bank, Vodafone Idea, Inox Leisure, Jyothy Labs, Kajaria Ceramics, L&T Finance Holdings, Max Ventures and Industries, Oriental Aromatics, Pioneer Distilleries, PNB Gilts, Polycab India, PVR, Ramco Industries, RattanIndia Power, Share India Securities, Supreme Petrochem, Supriya Lifescience, Tanla Platforms, Vinyl Chemicals, and Wendt (India) will announce their quarterly earnings on January 21.

Results on January 22: ICICI Bank, Yes Bank, Sangam (India), Seshasayee Paper & Boards, Sharda Cropchem, Sportking India, Vakrangee, Vardhman Textiles, and Welcure Drugs & Pharmaceuticals will release quarterly earnings on January 22.

Trident: The company's officials will meet GIC, Singapore, on January 21.

Banswara Syntex: The company's officials will interact with analysts and investors on January 21.

Aditya Birla Sun Life AMC: The company's officials will meet analysts and investors on January 25, to discuss financial results.

Sudarshan Chemical Industries: The company's officials will meet analysts and investors on January 25 to discuss financial results.

CE Info Systems: The company's officials will meet analysts and institutional investors on January 27.

Marico: The company's officials will meet investors and analysts on January 28 to discuss financial results.

Nava Bharat Ventures: The company's officials will meet investors and analysts on January 28 to discuss the operational and financial performance.

Escorts: The company's officials will meet investors & analysts on February 8, to discuss financial results.

Godrej Consumer Products: The company's officials will meet investors & analysts on February 8, to discuss financial results.

Stocks in News

Hindustan Unilever: The company reported higher profit at Rs 2,243 crore in Q3FY22 against Rs 1,921 crore in Q3FY21, revenue jumped to Rs 13,092 crore from Rs 11,862 crore YoY.

VST Industries: The company reported a higher profit at Rs 82.72 crore in Q3FY22 against Rs 73.71 crore in Q3FY21, revenue rose to Rs 431.48 crore from Rs 380.4 crore YoY.

Container Corporation of India: The company reported higher consolidated profit at Rs 283.39 crore in Q3FY22 against Rs 233.07 crore in Q3FY21, revenue jumped to Rs 1,938.03 crore from Rs 1,766.89 crore YoY.

Havells India: The company reported lower consolidated profit at Rs 305.82 crore in Q3FY22 against Rs 350.14 crore in Q3FY21, revenue jumped to Rs 3,664.21 crore from Rs 3,175.2 crore YoY.

Vimta Labs: The company reported higher consolidated profit at Rs 11.68 crore in Q3FY22 against Rs 8.07 crore in Q3FY21, revenue rose to Rs 67.34 crore from Rs 58.67 crore YoY.

Cyient: The company reported higher profit at Rs 131.8 crore in Q3FY22 against Rs 95.4 crore in Q3FY21, revenue rose to Rs 1,183.4 crore from Rs 1,044.3 crore YoY.

Surya Roshni: The company received orders of Rs 123.17 crore for ERW line pipe (API SL GRADE) and MS bare pipe 3LPE coated.

Fund Flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 4,679.84 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 769.26 crore in the Indian equity market on January 20, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Five stocks - BHEL, Escorts, Granules India, Indiabulls Housing Finance, and Vodafone Idea - are under the F&O ban for January 21. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!