The market extended losses for second consecutive session with the Nifty50 falling below 15,700 mark on June 17, as the selling pressure was seen in Banking & financials, Auto, Metals and Pharma stocks. Weak global cues also dented sentiment.

The BSE Sensex was down 178.65 points to close at 52,323.33, while the Nifty50 fell 76.10 points to 15,691.40 and formed Inverted Hammer kind of pattern on the daily charts.

"A small positive candle was formed at the lows with long upper shadow. Technically, this signals a follow-through weakness with high volatility," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

"Nifty has broken the sequence of one day decline, as it witnessed back-to-back declines for two sessions on Thursday, after the span of 19 sessions. Hence, this action signal strength of profit booking which has emerged from the new highs. This is not a good sign for bulls to sustain the highs," he said.

He feels the short term trend of Nifty seems to have reversed down with the short term top reversal at 15,901 (June 15).

"The next downside levels to be watched around 15,550 in the next couple of sessions, before showing another round of minor upside bounce. Any upside rally towards 15,750-15,800 could be a sell on rise opportunity for the coming sessions," Shetti said.

The broader markets also witnessed correction with the Nifty Midcap 100 and Smallcap 100 indices falling 1.23 percent and 0.53 percent respectively.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 15,615.7, followed by 15,540. If the index moves up, the key resistance levels to watch out for are 15,768.2 and 15,845.

Nifty Bank

The Nifty Bank fell 398.10 points or 1.14 percent to 34,605.40 on June 17. The important pivot level, which will act as crucial support for the index, is placed at 34,414.87, followed by 34,224.34. On the upside, key resistance levels are placed at 34,839.16 and 35,072.93 levels.

Call option data

Maximum Call open interest of 36.44 lakh contracts was seen at 16,500 strike, which will act as a crucial resistance level in the June series.

This is followed by 15,800 strike, which holds 36.31 lakh contracts, and 16,000 strike, which has accumulated 35.66 lakh contracts.

Call writing was seen at 15,700 strike, which added 17.33 lakh contracts, followed by 16,500 strike which added 15.43 lakh contracts, and 15,800 strike which added 15.31 lakh contracts.

Call unwinding was seen at 15,400 strike, which shed 38,700 contracts, followed by 15,300 strike which shed 600 contracts.

Put option data

Maximum Put open interest of 37.39 lakh contracts was seen at 15000 strike, which will act as a crucial support level in the June series.

This is followed by 15,500 strike, which holds 30.86 lakh contracts, and 15,700 strike, which has accumulated 22.19 lakh contracts.

Put writing was seen at 15,000 strike, which added 8.8 lakh contracts, followed by 15,400 strike which added 5.06 lakh contracts, and 15,300 strike which added 4.55 lakh contracts.

Put unwinding was seen at 15,800 strike which shed 2.65 lakh contracts, followed by 15,500 strike which shed 1.1 lakh contracts and 16,100 strike which shed 76,125 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

22 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

55 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

63 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

17 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

Bulk deals

Advanced Enzyme Technologies: Plutus Wealth Management LLP acquired 11 lakh equity shares in Advanced Enzyme at Rs 400.06 per share on the NSE. Promoter Advanced Vital Enzymes was the seller in a deal, offloading 14 lakh equity shares at Rs 400.17 per share on the NSE and 17 lakh shares at Rs 400.43 per share on the BSE, the bulk deals data showed.

Globus Spirits: Templeton Strategic Emerging Markets Fund IV LDC remained seller from the month of May, selling 8,93,388 equity shares in liquor maker Globus Spirits at Rs 490.16 per share. Old Bridge Capital Management was the buyer in a deal, acquiring 7,25,701 equity shares in the company at Rs 495.02 per share, the NSE bulk deals data showed.

Max Financial Services: Promoter entity Max Ventures Investment Holdings sold 78,28,217 equity shares in Max Financial at Rs 1,000.08 per share. Government of Singapore bought 60,13,487 equity shares in Max Financial at Rs 1,000 per share, the NSE bulk deals data showed.

(For more bulk deals, click here)

Results on June 18 & 19, and Analysts/Investors Meeting

Results on June 18: Ashoka Buildcon, Archidply Industries, Balaji Telefilms, BC Power Controls, Gujarat Fluorochemicals, GMR Infrastructure, Hinduja Global Solutions, HT Media, Insecticides (India), Jubilant Industries, PSP Projects, SMS Lifesciences, Timken India, and Welspun Specialty Solutions will release quarterly earnings on June 18.

Results on June 19: NTPC, Amtek Auto, Arihant Superstructures, Galaxy Bearings, Kernex Microsystems, Muthoot Capital Services, Simplex Castings, and Vakrangee will release quarterly earnings on June 19.

CreditAccess Grameen: The company's officials will meet Ashmore Investments on June 18.

Syngene International: The company's officials will meet Alchemy Capital on June 18, Motilal Oswal on June 22, DSP Mutual Fund on June 24, UTI MF and Arohi Asset management on June 25, Skerryvore Asset Management on June 28.

Voltas: The company's officials will meet Capital Group on June 18.

Phillips Carbon Black: The company's officials will meet Equirus Securities on June 18.

Greaves Cotton: The company's officials will meet several analysts and investors from 16 firms including SBI General Insurance, Banyan Tree, Bellwether Capital, Mirae Asset, Invesco, Motilal Oswal, ITI MF, Birla Life Insurance on June 18.

Craftsman Automation: The company's officials will meet analysts and institutional investors in a JM Financial Virtual Meeting on June 18.

HEG: The company's officials will meet Matthews Asia on June 18.

Prince Pipes and Fittings: The company's officials will meet several analysts and institutional investors on June 18.

Stocks in News

Jammu & Kashmir Bank: The bank reported standalone profit at Rs 315.75 crore in Q4FY21 against loss of Rs 294.1 crore in Q4FY20, net interest income fell to Rs 917.42 crore from Rs 987.24 crore YoY.

Power Grid Corporation of India: The company reported higher consolidated profit at Rs 3,526.23 crore in Q4FY21 against Rs 3,313.47 crore in Q4FY20, revenue rose to Rs 10,510.23 crore from Rs 10,148.26 crore YoY. The company's board of directors recommended issue of bonus shares in the ratio of 3:1 (one new equity bonus share for every three existing equity share).

Tube Investments of India: The company reported higher consolidated profit at Rs 160.4 crore in Q4FY21 against Rs 59.76 crore in Q4FY20, revenue jumped to Rs 2,732.82 crore from Rs 1,031.01 crore YoY. The company approved fresh long-term borrowing of Rs 200 crore, to meet its requirement of funds during the financial year 2021-22, by way of issue of privately placed secured non-convertible debentures, in one or more tranches.

HealthCare Global Enterprises: The company reported higher consolidated profit at Rs 113.76 crore in Q4FY21 against Rs 50.44 crore in Q4FY20, revenue rose to Rs 297.04 crore from Rs 269.5 crore YoY.

Khadim India: The company reported consolidated profit at Rs 11.52 crore in Q4FY21 against loss of Rs 19.87 crore in Q4FY20, revenue rose to Rs 269.95 crore from Rs 158.2 crore YoY.

Mangalam Organics: CRISIL has reaffirmed long term rating for various credit facilities of the company at 'A-' and upgraded outlook to Positive from Stable.

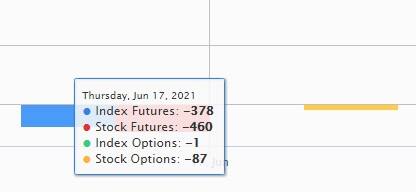

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 879.73 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 45.24 crore in the Indian equity market on June 17, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Five stocks - Adani Ports, BHEL, Canara Bank, Escorts, and Punjab National Bank - are under the F&O ban for June 18. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!