The Nifty opened with an upward gap and buying momentum for the most part of the session led it to close near the day's high on June 10.

The daily price action has formed a bullish candle that remained restricted within the previous session's high-low range indicating the absence of strength on either side.

On the daily chart, the Nifty continues to form a series of higher tops and higher bottom formations, indicating sustained strength.

The Sensex closed 359 points, or 0.69 percent, higher at 52,300.47 while the Nifty settled with a gain of 102 points, or 0.65 percent, at 15,737.75. Nifty Bank logged a gain of 331 points, or 0.95 percent, to close at 35,131.20.

"The next higher levels to be watched are around 15,750. Any sustainable move above this level may cause momentum towards 15,800-15,850. On the downside, any violation of an intraday support zone of 15,700 may cause profit-booking towards 15,600-15,550. The daily strength indicator RSI has turned bearish from overbought zone indicating loss of strength," said Rajesh Palviya, VP - Technical and Derivative Research, Axis Securities.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 15,673.8, followed by 15,609.8. If the index moves up, the key resistance levels to watch out for are 15,776.5 and 15,815.2.

Nifty Bank

The important pivot level which will act as crucial support for Bank Nifty is placed at 34,855.2, followed by 34,579.2. On the upside, key resistance levels are placed at 35,286.41 and 35,441.61.

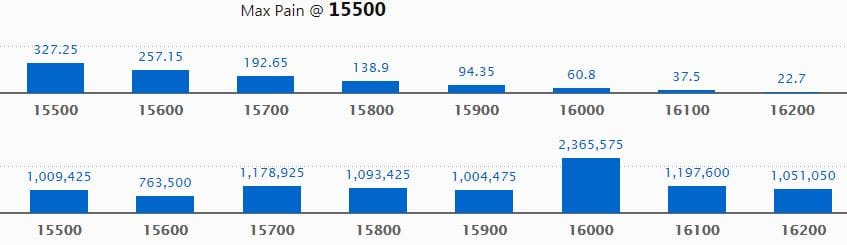

Call option data

Maximum Call open interest of 23.66 lakh contracts was seen at 16,000 strike, which will act as a crucial resistance level in the June series.

This is followed by 16,100 strike, which holds 11.98 lakh contracts, and 15,700 strike, which has accumulated 11.79 lakh contracts.

Call writing was seen at 16,100 strike, which added 17,175 contracts, followed by 15,400 strike which added 15,525 contracts.

Call unwinding was seen at 16,200 strike, which shed 2.3 lakh shares, followed by 15,800 strike, which shed 1.36 lakh contracts and 15,600 strike which shed 1.13 lakh contracts.

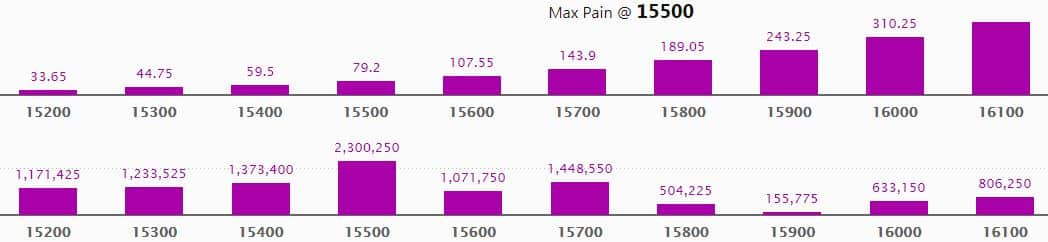

Put option data

Maximum Put open interest of 23 lakh contracts was seen at 15,500 strike, which will act as a crucial support level in the June series.

This is followed by 15,700 strike, which holds 14.5 lakh contracts, and 15,400 strike, which has accumulated 13.73 lakh contracts.

Put writing was seen at 15,700 strike, which added 3.44 lakh contracts, followed by 15,600 strike which added 1.73 lakh contracts, and 15,500 strike which added 1.63 lakh contracts.

Put unwinding was seen at 15,400 strike which shed 2.46 lakh contracts, followed by 15,300 strike, which shed 1.77 lakh contracts.

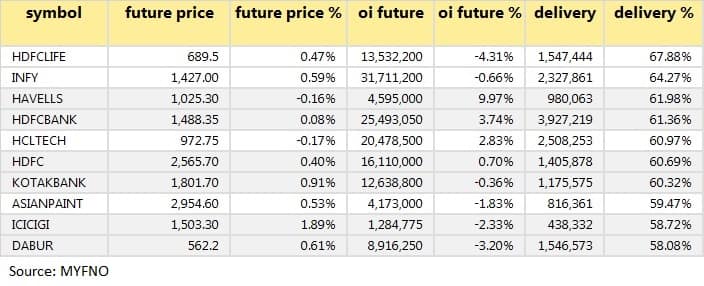

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

70 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

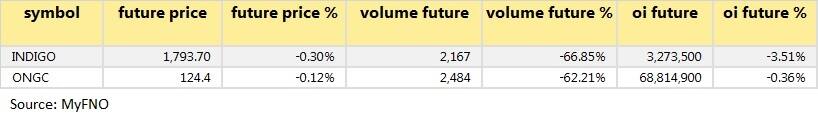

Two stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding.

23 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

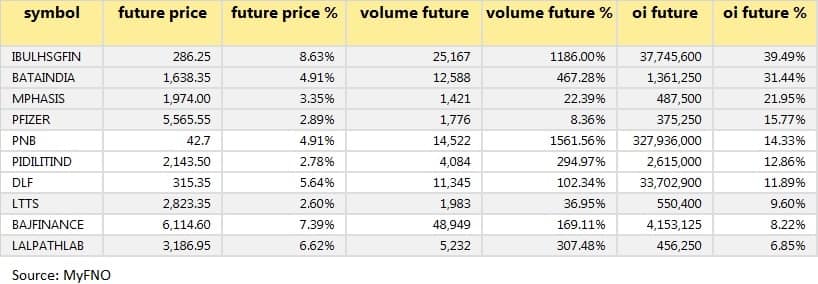

64 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

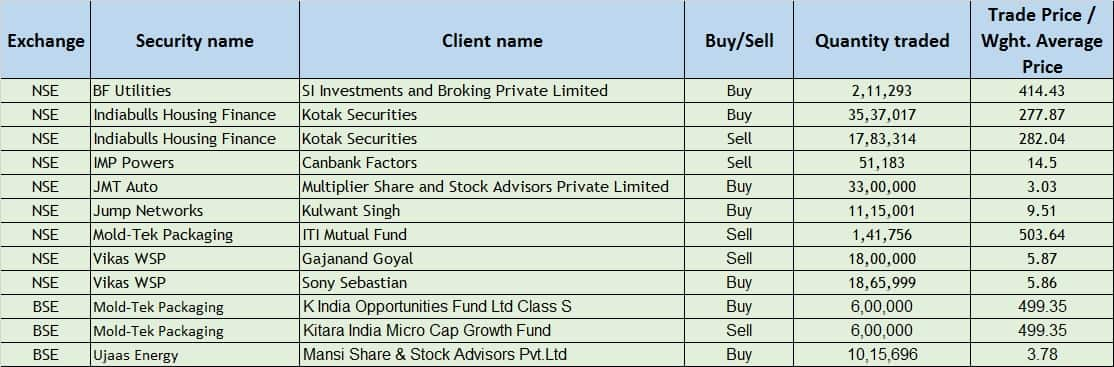

Bulk deals

(For more bulk deals, click here)

Results on June 11

BEML, BHEL, CG Power, Cochin Shipyard, DLF, Edelweiss Financial Services, Goa Carbon and Sun TV are among the companies that will announce their March quarter results on June 11.

Stocks in news

Oil India: The company board meeting scheduled on June 21 to consider and approve the audited financial results for the quarter and year ended March 31, 2021, and to recommend the final dividend for the FY2020-21, if any.

YES Bank: The company board considered and approved seeking shareholders’ approval for borrowing/raising funds in Indian/foreign currency up to an amount of Rs 10,000 crore by issue of debt securities including but not limited to non-convertible debentures, bonds, Medium Term Note (MTN).

GOCL Corporation:The company along with IDL Explosives bagged orders worth an aggregate amount of Rs 286.63 crore to supply Raydets, Electronic and other Detonators and Cartridge Explosives over a period of two years.

Mayur Uniquoters:The company will give a final dividend of Rs 2 per equity share.

NHPC:The company will raise debt up to Rs 4,300 crore through issuance of corporate bonds and /or raising of term loans/ECB.

Tera Software:The company posted Q4FY21 profit at Rs 0.99 crore against Rs 2 crore in Q4FY20.

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 1,329.7 crore, while domestic institutional investors (DIIs) net sold shares worth Rs 575.19 crore in the Indian equity market on June 10, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Five stocks - BHEL, Canara Bank, Indiabulls Housing Finance, National Aluminium and Sun TV Network - are under the F&O ban for June 11. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!