The market continued uptrend for third consecutive session though there was some profit-booking in the last hour of trade on February 25, the expiry day for February futures & options (F&O) contracts. Positive global cues, and buying in metals, pharma, auto, select banking & financials and IT stocks pushed the market higher.

The S&P BSE Sensex climbed 257.62 points to 51,039.31, while the Nifty50 gained 115.40 points to 15,097.40 levels and formed a small bullish candle which resembles Shooting Star kind of pattern on the daily charts.

"Indices retreat from higher levels mainly due to hefty gains of 4 percent in the last two days. Technically, we feel that the market is opening the window of consolidation between the broader range of 15,350 and 14,850 levels," Shrikant Chouhan, Executive Vice President, Equity Technical Research at Kotak Securities told Moneycontrol.

"On Friday, the strategy should be to trade long if the Nifty drops to 14,950-14,900 levels with a stop loss at 14,800/50,200 levels. On the higher side, the level of 15,350 seems achievable but for that we need Nifty to remain above 15,200 levels," he said.

The broader markets also sustained rally with the Nifty Midcap 100 index rising 1.53 percent and Smallcap 100 index gaining 1.43 percent. The market breadth was also strong as about two shares gained for every share falling on the NSE.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 15,049.57, followed by 15,001.83. If the index moves up, the key resistance levels to watch out for are 15,160.77 and 15,224.23.

Nifty Bank

The Nifty Bank index gained 96.70 points to close at 36,549 on February 25. The important pivot level, which will act as crucial support for the index, is placed at 36,284.61, followed by 36,020.2. On the upside, key resistance levels are placed at 37,022.8 and 37,496.6 levels.

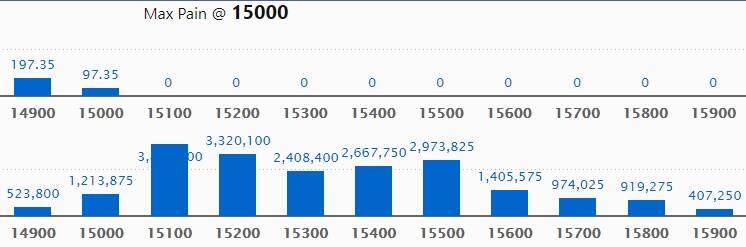

Call option data

Maximum Call open interest of 38.39 lakh contracts was seen at 15,100 strike, which will act as a crucial resistance level in the March series.

This is followed by 15,200 strike, which holds 33.20 lakh contracts, and 15,500 strike, which has accumulated 29.73 lakh contracts.

Call writing was seen at 15,100 strike, which added 14.82 lakh contracts, followed by 15,400 strike which added 8.59 lakh contracts and 15,500 strike which added 3.04 lakh contracts.

Call unwinding was seen at 15,000 strike, which shed 22.96 lakh contracts, followed by 14,900 strike which shed 9.69 lakh contracts and 14,800 strike which shed 8.61 lakh contracts.

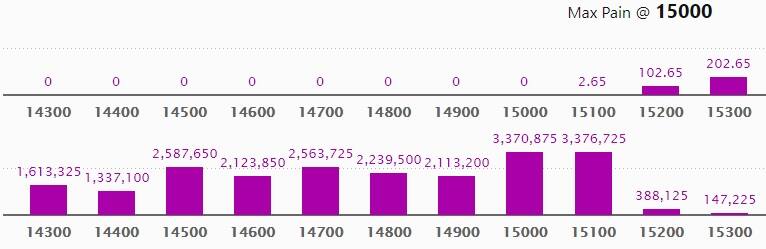

Put option data

Maximum Put open interest of 33.76 lakh contracts was seen at 15,100 strike, which will act as a crucial support level in the March series.

This is followed by 15,000 strike, which holds 33.70 lakh contracts, and 14,500 strike, which has accumulated 25.87 lakh contracts.

Put writing was seen at 15,100 strike, which added 30.37 lakh contracts, followed by 15,000 strike, which added 11.74 lakh contracts and 15,200 strike which added 1.6 lakh contracts.

Put unwinding was seen at 14,700 strike, which shed 8.09 lakh contracts, followed by 14,800 strike which shed 7.98 lakh contracts.

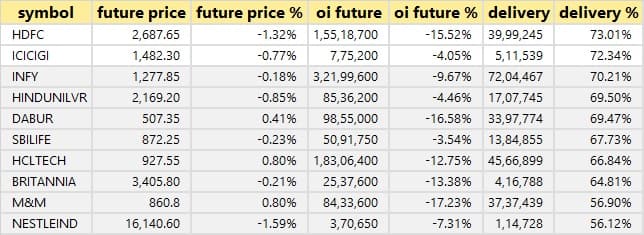

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

Rollovers

6 stocks saw long build-up

Based on the open interest future percentage, here are the 6 stocks in which a long build-up was seen.

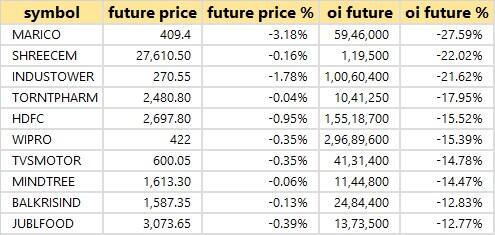

25 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

2 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the 2 stocks in which a short build-up was seen.

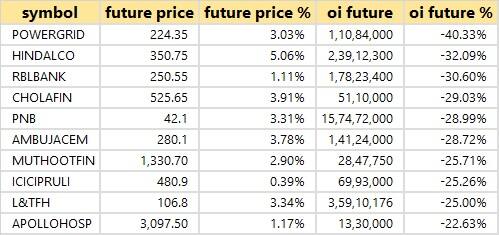

110 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

Bulk deals

Equitas Holdings: CDC Group PLC sold 89,30,410 equity shares in the company at Rs 88.2 per share on the BSE.

Himadri Speciality Chemical: BC India Investments sold 2,59,87,834 equity shares in the company at Rs 42.96 per share on the BSE. However, Plutus Wealth Management LLP acquired 97,81,191 equity shares at Rs 43.98 per share.

Vipul: Analysis Trade Consultancy LLP sold 8,98,987 equity shares in the company at Rs 26 per share on the BSE.

(For more bulk deals, click here)

Analysts/Board meetings

Indian Energy Exchange: The company's officials will meet Trident on February 26.

Cadila Healthcare: Managing Director of the company is going to participate in a panel discussion organised by Antique Broking on the theme 'Advantage India Pharma' on February 26.

Brigade Enterprises: The company's officials will meet Zeus Capital and Arth Capital on February 26.

Skipper: The investor/analyst conference will be held on February 26.

Inox Leisure: The company's officials will meet Sharekhan on February 26.

Zensar Technologies: The company's officials will participate in HDFC Securities Technology Investor Forum on March 1.

Gland Pharma: The company will be attending the Investor conference/event on March 2 and 3.

Symphony: The company's officials will meet Taiyo Pacific Partners on March 2.

Stocks in the news

RailTel Corporation of India: The company will list its equity shares on February 26. The issue price has been fixed at Rs 94 per share.

KSB: The company reported profit at Rs 32 crore in Q4CY20 against Rs 32.6 crore in Q4CY19, revenue rose to Rs 369.9 crore from Rs 337 crore YoY. The company recommended Rs 8.5 per share of Rs 10 each as dividend for the year ended December 2020.

Hatsun Agro Product: The company commenced commercial production at Solapur facility, Maharashtra.

Elecon Engineering: Promoter entity Prayas Engineering released pledge on 5.56% equity.

Vesuvius India: The company reported lower profit at Rs 16.24 crore in Q4CY20 against Rs 22.70 crore in Q4CY19. Revenue rose to Rs 234.46 crore from Rs 228.09 crore YoY.

Rain Industries: The company reported higher consolidated profit at Rs 321.98 crore in Q4CY20 against Rs 121.6 crore in Q4CY19, while revenue fell to Rs 2,640.2 crore from Rs 2,830.38 crore in the corresponding period of the previous fiscal.

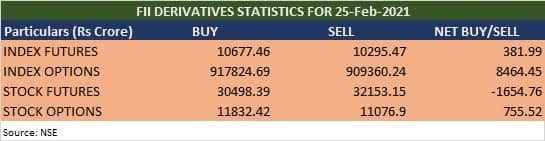

Fund Flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 188.08 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 746.57 crore in the Indian equity market on February 25, as per provisional data available on the NSE.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!