LiveNow

Closing Bell: Sensex, Nifty hit fresh record highs; FMCG gains, IT major drag

Benchmark indices ended in the green in the volatile session on December 19 with Nifty at 21,450. At close, the Sensex was up 122.10 points or 0.17 percent at 71,437.19, and the Nifty was up 34.40 points or 0.16 percent at 21,453.10.

We wrap up today's edition of the Moneycontrol live market blog, and will be back tomorrow morning with all the latest updates and alerts. Please visit https://www.moneycontrol.com/markets/global-indices/ for all the global market action.

Mandar Bhojane, Research Analyst at Choice Broking:

On December 19, the Indian benchmark indices concluded with marginal gains in a highly volatile session, closing positively by 34.45 points. The Nifty achieved a new all-time high at the 21,505 level. A Hammer candlestick pattern has formed on the daily chart, suggesting potential bullish momentum. If the Nifty surpasses the 21,500 level, there is positional potential for an upward movement to 21,650 and 21,750 in the coming days.

The Nifty is expected to consolidate within a range of 21,230 to 21,500. On the downside, crucial support is positioned at 21,300–20,200, while resistance is situated at 21,500–21,700. Overall, the trend is positive, and the current dip should be considered a buying opportunity.

Bank Nifty is also consolidating within the range of 47,600 to 48,200. On the downside, 47,500 is the crucial support, and as long as it holds, Bank Nifty is anticipated to resume its upward movement towards 48,200. The overall trend is positive, and declines towards 47,700–47,600 should be perceived as buying opportunities.

Ajit Mishra, SVP - Technical Research, Religare Broking

Markets remained range bound and settled marginally higher amid mixed signals. After the flat start, the Nifty index drifted lower in the first hour despite the favorable global cues, however buying in select heavyweights trimmed all the losses as the day progressed. Among the key sectors, energy and FMCG were among the top performers while IT and metal settled lower. The broader indices too witnessed a muted session and ended flat to marginally in the red.

We are seeing buying interest on every dip in the index and that reaffirms our bullish view. The defensive viz. FMCG and pharma are doing well on the expected lines however participation of rate sensitives would be essential to trigger the next leg of up move. Meanwhile, it is critical to identify the pattern of rotational buying across sectors and place the trading positions accordingly.

Vinod Nair, Head of Research at Geojit Financial Services:

The broader market sustained its optimism, but the incremental rally is contracting. Investors are cautious ahead of the Eurozone inflation data announcement, which is forecast to drop marginally. The dovish stance by BOJ maintained the market sentiments. Amid this, the price of oil stabilized as the US government announced plans to protect the shipping route through the Red Sea. After the recent rally of growth stocks, investors are exhibiting interest in consumption stocks as a bargain strategy.

Aditya Gaggar Director of Progressive Shares

Extreme volatility was seen on both sides whereas in the opening trade, a strong recovery was witnessed under the leadership of heavyweight Reliance. In the mid-session, PSU Banks and Pharma counters joined the party and pushed the Index further higher to register a fresh high of 21,505.05; however, towards the end of the day, the Index pared off some of its gains to settle at 21,453.10 with gains of 34.45 points.

On the sectoral front, Energy was up by 1.58% and ended the session as a top performer followed by FMCG (+1.41%) while IT and Auto sectors witnessed a profit booking pressure. Underperformance was observed by the Broader markets as Mid and Smallcaps corrected by 0.38% & 0.12% respectively.

Nifty50 has made a Long Legged DOJI candlestick pattern which indicates indecisiveness between the bulls and bears. A range of consolidation will remain the same i.e. 21,330-21,500.

Rupee Close:

Indian rupee ended 12 paise lower at 83.18 per dollar versus previous close of 83.06.

Market Close: Benchmark indices ended in the green in the volatile session on December 19 with Nifty at 21,450.

At close, the Sensex was up 122.10 points or 0.17 percent at 71,437.19, and the Nifty was up 34.40 points or 0.16 percent at 21,453.10. About 1833 shares advanced, 1797 shares declined, and 132 shares unchanged.

Biggest gainers on the Nifty were Coal India, Nestle India, Tata Consumer Products, NTPC and Cipla, while losers included SBI Life Insurance, Hero MotoCorp, Adani Ports, Wipro and Adani Enterprises.

Mixed trend was seen on the sectoral front, with metal, pharma, oil & gas, power and FMCG rose 0.3-1 percent, while auto, capital goods, realty, Information Technology down 0.3-0.8 percent.

Among broader indices the smallcap index hit fresh record high of 42,544.95, before closing with marginal gains, while BSE Midcap index lost 0.3 percent.

Sensex Today | Muthoot Microfin IPO subscribed 2.12 times, retail portion bought 3.37 times on Day 2

The Muthoot Microfin IPO has been subscribed 2.12 times so far on December 19, with bids coming in for 5.15 crore shares against the issue size of 2.43 crore shares.

Retail investors bought 3.37 times the allotted quota of shares. The portion set aside for non-institutional investors was subscribed 1.91 times, and the employees' portion was booked 2.57 times, while the qualified institutional buyers bid for 6 percent shares of the reserved portion.

Stock Market LIVE Updates | CLSA On Devyani International:

-Outperform call, target Rs 211 per share

-Will pay Rs 341.4 crore for a 50% stake Restaurant Development Co

-Temasek holdings will take a 48% stake & a local Thai partner will take the rest

-Total purchase of Rs 1,066 crore includes local bank debt of Rs 385 crore

-Purchase is valued at a TTM EV/sales of 0.83x

Sensex Today | Oil steadies as investors weigh up impact of Red Sea attacks

Oil steadied on Tuesday as investors considered the potential impact on oil supply from attacks by Yemen's Iran-aligned Houthi militants against ships in the Red Sea, which have disrupted maritime trade and forced companies to reroute vessels.

Crude prices had climbed nearly 2% on Monday on fears over the disruptions to trade via the Suez Canal, the shortest shipping route between Europe and Asia, which accounts for about 15% of global shipping traffic.

Brent crude fell 12 cents to $77.83 a barrel. U.S. West Texas Intermediate crude for January, which expires on Tuesday, was down 62 cents at $71.85 while the more active February contract lost only 3 cents.

Stock Market LIVE Updates | Jefferies View On ITC

-Buy call, target Rs 530 per share

-BAT has been facing headwinds due to volume decline

-Company has been facing headwinds due to high level of debt

-High level of debt compressed valuation to 6x P/E, lowest among tobacco majors

-Interestingly, strong momentum at company has allowed it to pip BAT's market cap recently

-Recent communication shows BAT appears to be comfortable trimming C.4 ppt stake in company to 25%

-Also sees hotels as non-core signalling a potential stake sale once ITC Hotels is listed

Sensex Today | Anuj Choudhary Research Analyst, Sharekhan by BNP Paribas:

Indian Rupee depreciated on Tuesday on positive tone in the US Dollar and Dollar demand by OMCs and importers. However, positive tone in domestic markets and decline in crude oil prices cushioned the downside. US Dollar gained as Fed officials downplayed imminent rate cut expectations.

We expect Rupee to trade with a slight negative bias on positive tone in US Dollar and demand for Dollar by importers. RBI may also buy Dollars to shore up its reserves. However, positive domestic markets and FII inflows may support Rupee at lower levels.

Bank of Japan kept its monetary policy unchanged, which supported US Dollar. Traders may remain cautious ahead Housing starts and Building permits data from US. USDINR spot price is expected to trade in a range of Rs 82.90 to Rs 83.60.

Stock Market LIVE Updates | Antique View On Sansera Engineering:

-Initiate buy, target Rs 1,150 per share

-Company is an integrated player engaged in manufacturing of various critical components

-Precision engine forged components for 4Ws, 2Ws, And CVs

-Company also manufactures components for the aerospace, defence, and EV industries

-Company has a strong orderbook of Rs 1,930 crore as of Q2FY24

-Orderbook includes 52% is from tech-agnostic, xEV & non-auto segments

-Tech-agnostic, xEV & non-auto segments believe should drive strong topline growth going ahead

-Build in revenue growth of 19% over FY23-26

-Assuming a margin of 17.7% for FY25/ 26, further driving PAT growth of 32% CAGR over FY23-26

-Also build in RoE/ RoCE of 19%/ 20.2% in FY26 against 13.3%/ 14.3% in FY23

Stock Market LIVE Updates | Sanghvi Movers bags work orders worth Rs 166 crore

Sanghvi Movers has received work order aggregating to Rs 166 crores from one of eminent Independent Power Producers (IPP) in the renewable energy sector, for providing Cranes, WTG Inter-carting, Installation & Precommissioning and making WTG Foundations with geotechnical analysis.

The total duration of this contract is 24 months starting from January - 2024 till January 2026.

Stock Market LIVE Updates | Jefferies View On Devyani International:

-Hold call, target Rs 190 per share

-In a surprising move, co has announced acquisition of Thailand-based Restaurant Dev

-‘Growth at reasonable price’ seems to be the rationale

-‘Growth at reasonable price' evident from 8x trailing EV/EBITDA

-‘Growth at reasonable price' evident from 13% store addition CAGR

-Forward growth multiple could be 5-6x EBITDA even if assume modest growth

-However, would have liked an India growth effort instead

-Hope this does not kick-start overseas M&As

Sensex Today | Market at 3 PM

The Sensex was up 62.86 points or 0.09 percent at 71,377.95, and the Nifty was up 12.30 points or 0.06 percent at 21,431.00. About 1626 shares advanced, 1609 shares declined, and 91 shares unchanged.

| Company | Price at 14:00 | Price at 14:53 | Chg(%) Hourly Vol |

|---|---|---|---|

| United Drilling | 245.00 | 290.50 | 45.50 661 |

| Pritish Nandy | 47.75 | 53.40 | 5.65 88 |

| Shivam Auto | 37.60 | 41.61 | 4.01 4.13k |

| Prima Ind | 20.16 | 22.28 | 2.12 60 |

| Kutch Minerals | 23.81 | 26.19 | 2.38 2.04k |

| Apoorva Leasing | 34.36 | 37.23 | 2.87 17 |

| Mac Charles | 466.00 | 504.00 | 38.00 205 |

| Securekloud Tec | 40.25 | 43.10 | 2.85 913 |

| Fortune Intl | 31.83 | 33.94 | 2.11 339 |

| PC Jeweller | 38.34 | 40.75 | 2.41 874.84k |

Stock Market LIVE Updates | Jindal Stainless board approves acquisition of 100% stake in Rabirun Vinimay:

The board of directors of Jindal Stainless at its meeting held on December 19, 2023, accorded its consent for acquisition of 100% stake in Rabirun Vinimay Private Limited, a company under liquidation, on a going concern basis, in terms of the applicable provisions of Insolvency and Bankruptcy Code, 2016.

Stock Market LIVE Updates | United Drilling Tools bags order worth Rs 96 crore from ONGC

United Drilling Tools has received order aggregating to Rs 958 million for supply of casing pipe with connector to Oil and Natural Gas Corporation (ONGC), which will be executed within the time frame of approximately 28 week & 42 weeks or gradual dispatch as per the requirement of client from its facilities in Utter Pradesh and Gujarat, India.

Stock Market LIVE Updates | Motilal Oswal View On PSU Banks

SBI – buy call, target raised to Rs 800 per share

PNB – neutral call, target Rs 90 per share

BoB – buy call, target raised to Rs 280 per share

Canara Bank – buy call, target raised to Rs 550 per share

Union Bank – buy call, target raised to Rs 150 per share

Indian Bank – buy call, target raised to Rs 525 per share

Well poised for re-rating 2.0

1% RoA – from aspirational to sustainable; valuations remain attractive

Liability franchise robust, LCR ratio at comfortable levels

Margin performance resilient, higher mix of MCLR to shield margins

Wage provisions to have limited impact (Barring SBI), opex to moderate

Asset quality ratios improving steadily, low SMA pool further augurs well

Stock Market LIVE Updates | Man Infraconstruction gets commencement certificate for its residential project in Mumbai

Man Infraconstruction Group Secures Commencement Certificate (CC) for its UberLuxurious Residential Project in Ghatkopar East, Mumbai introducing Innovative Community Living Concept, having carpet area of approx. 4 lakh sq. ft. for sale.

Stock Market LIVE Updates | Transformers and Rectifiers bags orders worth Rs 237 crore

Transformers and Rectifiers India has been awarded orders of Transformers for total contract value of Rs 237 crores from Power Grid Corporation of India Limited.

Sensex Today | Geojit View on Happy Forgings IPO:

At the upper price band of Rs 850, Happy Forgings is available at a P/E of 33.6x (FY24 annualized), which seems in-line compared to its peers. Considering the company's well-established standing in the crankshaft manufacturing industry, notable customers, solid financials, varied product range, global reach with future strategic acquisitions and expansion plans, and new customer additions, Geojit recommend a ‘Subscribe’ rating for the issue on a short to medium-term basis.

Stock Market LIVE Updates: Nifty at record high, Sensex up 270 pts

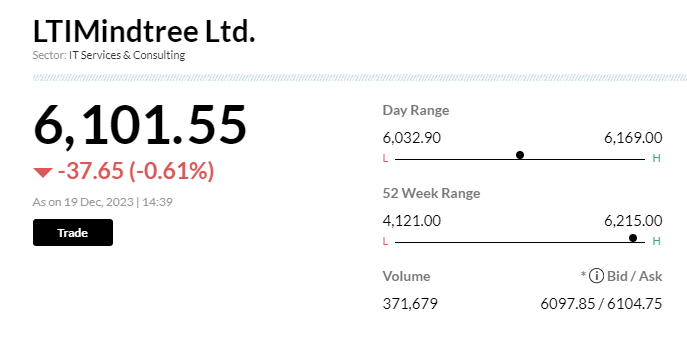

Stock Market LIVE Updates | LTIMindtree collaborates with Microsoft for AI applications

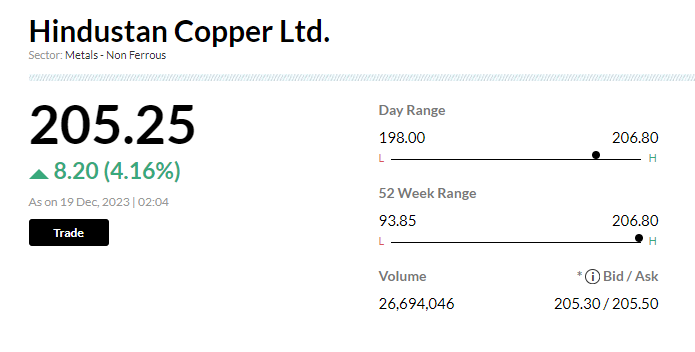

Stock Market LIVE Updates | Hindustan Copper surges 5%; hits 11 year high

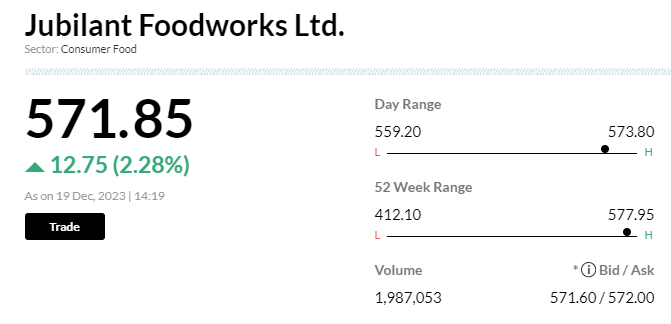

Stock Market LIVE Updates | Jubilant Food raises cash offer for DP Eurasia To 95 p/sh; new offer price values DP Eurasia At £139.3 m

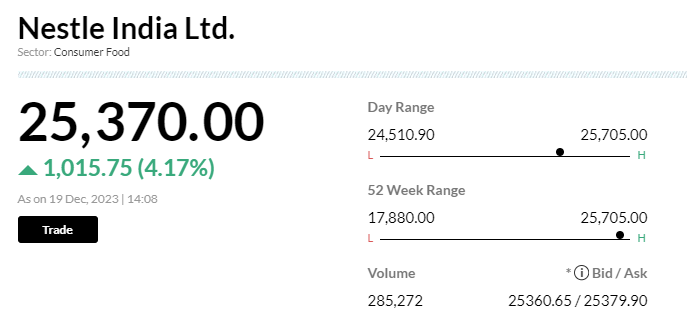

Stock Market LIVE Updates | Nestle India gains over 4% to fresh high; sets Jan 5 as record date for stock split

Shares of Nestle India gained over 4 percent after it has fixed January 5, 2024 as the record date for determining entitlement of equity shareholders for sub-division of existing equity shares of the company. One equity share having face value of Rs 10 each, will be sub-divided into 10 equity shares having face value of Re 1 each.

Sensex Today | Market at 2 PM

The Sensex was up 211.51 points or 0.30 percent at 71,526.60, and the Nifty was up 54.10 points or 0.25 percent at 21,472.80. About 1727 shares advanced, 1487 shares declined, and 89 shares unchanged.

| Company | Price at 13:00 | Price at 13:53 | Chg(%) Hourly Vol |

|---|---|---|---|

| Poddar Housing | 126.40 | 120.05 | -6.35 45.24k |

| V2 Retail | 265.00 | 255.00 | -10.00 6.62k |

| Ameya Precision | 54.00 | 52.05 | -1.95 2.00k |

| GKW | 1,580.00 | 1,531.50 | -48.50 316 |

| India Tourism D | 480.15 | 465.95 | -14.20 208.14k |

| Guj Raffia Ind | 56.70 | 55.05 | -1.65 641 |

| Aatmaj Health | 41.90 | 40.75 | -1.15 0 |

| Tridhya Tech | 35.50 | 34.60 | -0.90 2.25k |

| Gillanders Arbu | 122.35 | 119.55 | -2.80 8.81k |

| 63 Moons Tech | 479.50 | 468.75 | -10.75 53.07k |

| Company | Price at 13:00 | Price at 13:53 | Chg(%) Hourly Vol |

|---|---|---|---|

| Biofil Chem | 53.65 | 59.20 | 5.55 2.88k |

| Fidel Softech | 105.10 | 112.00 | 6.90 0 |

| Hitech Corp | 262.95 | 279.25 | 16.30 3.27k |

| Shriram Propert | 121.00 | 127.30 | 6.30 184.14k |

| The Hi-Tech Gea | 464.00 | 487.65 | 23.65 263 |

| Hathway Cable | 21.80 | 22.90 | 1.10 2.85m |

| Maheshwari Logi | 82.80 | 86.95 | 4.15 1.77k |

| Greenply Ind | 224.40 | 235.15 | 10.75 94.07k |

| Consol Finvest | 317.40 | 332.00 | 14.60 6.87k |

| Emkay Global | 135.15 | 141.30 | 6.15 65.00k |

Stock Market LIVE Updates | IDFC First Bank shares surge 3% as RBI approves merger with IDFC, IDFC Financial Holding

Shares of IDFC First Bank surged 3 percent to day's high of Rs 92.33 per share on December 19 after the Reserve Bank of India (RBI) approved merger of IDFC and IDFC Financial Holding Company with itself.

In the past one month, the stock of this private sector lender has climbed over 6 percent as against 8 percent rise in the benchmark Sensex. Earlier, IDFC First Bank shares hit 52-week high of Rs 100.74 per share on September 5, 2023. Read More

| Company | CMP Chg(%) | Today Vol 5D Avg Vol | Vol Chg(%) |

|---|---|---|---|

| Apollo Tyres | 457.60 1.05% | 29.26m 119,862.00 | 24,307.00 |

| Mahindra Life | 536.85 0.55% | 709.90k 14,984.00 | 4,638.00 |

| Campus Active | 281.80 1.37% | 1.41m 41,036.00 | 3,335.00 |

| DCM Shriram | 1,095.50 9.57% | 80.40k 2,878.60 | 2,693.00 |

| Biofil Chem | 59.19 11.7% | 266.90k 13,446.20 | 1,885.00 |

| U. Y. Fincorp | 25.50 2.91% | 595.21k 58,349.80 | 920.00 |

| GTPL Hathway | 186.15 9.79% | 82.22k 8,089.60 | 916.00 |

| Bharat Immuno | 31.54 19.97% | 994.15k 104,956.20 | 847.00 |

| Ceejay Finance | 203.25 -0.68% | 146.47k 16,637.80 | 780.00 |

| Asian Hotel (E) | 151.40 5.07% | 10.21k 1,174.20 | 770.00 |

Sensex Today | Happy Forgings IPO issue subscribed 90%, retail portion booked 1.38 times on day 1

Happy Forgings IPO has been subscribed 90 percent so far on the first day of bidding, December 19, receiving bids for 75.6 lakh shares against an issue size of 83.65 lakh shares. Retail investors picked 1.38 times and high net-worth individuals bought 95 percent of the allotted quota.

Happy Forgings’ Rs 1,008.59 crore public offer, which will close on December 21, comprises a fresh issue of 47 lakh shares worth Rs 400 crore and an offer-for-sale of 71.59 lakh shares worth Rs 608.59 crore. The price band for the issue has been fixed at Rs 808-850 per share.

It is a good play for Tata Consumers to enter into organic products. Organic products will be towards the premium side of the portfolio, so company can earn on margins, say analysts on condition of anonymity.

Sensex Today | Muthoot Microfin IPO subscribed 1.72 times, retail portion bought 2.83 times on Day 2

The Muthoot Microfin IPO has been subscribed 1.72 times so far on December 19, with bids coming in for 4.19 crore shares against the issue size of 2.43 crore shares.

Retail investors bought 2.83 times the allotted quota of shares. The portion set aside for non-institutional investors was subscribed 1.4 times, and the employees' portion was booked 2.29 times.

The price band for the offer, which will close on December 20, has been fixed at Rs 277-291 per share. The company plans to raise Rs 960 crore from the IPO.

Sensex Today | Motisons Jewellers IPO issue booked 32.41 times, QIP portion at 15%

The Rs 151.09-crore public issue of Motisons Jewellers was subscribed 32.41 times on December 19, the second day of bidding. It received bids for 67.63 crore shares against an issue size of 2.08 crore shares.

Retail investors portion booked at 45.88 times, high net-worth individuals picked up 33.93 times, and qualified institutional buyers bought 15 percent of the allotted quota.

Sensex Today | Suraj Estate Developers IPO: Issue booked 1.50 times on Day 2

Suraj Estate Developers IPO was subscribed 1.50 times on December 19, the second day of bidding, with bids coming in for 1.23 crore shares against the issue size of 82.35 lakh.

The retail portion was booked 2.57 times and high net worth individuals (HNIs) bought 85 percent of their allotted quota of shares. Qualified institutional buyers had picked 12 percent of the portion set aside for them.

Sensex Today | Nifty Auto index shed 0.7 percent dragged by TVS Motor Company, Tube Investment, Hero MotoCorp:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| TVS Motor | 1,960.55 | -1.96 | 459.49k |

| Tube Investment | 3,601.05 | -1.72 | 155.31k |

| Hero Motocorp | 3,825.10 | -1.66 | 303.53k |

| Eicher Motors | 4,030.35 | -1.35 | 223.85k |

| MOTHERSON | 96.65 | -1.33 | 7.54m |

| Bajaj Auto | 6,409.70 | -0.87 | 235.32k |

| Maruti Suzuki | 10,244.45 | -0.73 | 382.63k |

| M&M | 1,699.15 | -0.68 | 1.12m |

| Balkrishna Ind | 2,512.85 | -0.48 | 85.63k |

| Tata Motors | 728.00 | -0.38 | 2.96m |

Stock Market LIVE Updates | DCW suspends operations at Tamil Nadu facility due to flooding

The company has suspended its operations at Sahupuram plant in Tamil Nadu due to flooding and water logging at the factory premises caused by heavy rains since December 17.

The company expects gradual scale up of operations after the water levels get back to normal and anticipates at least 7 days to get back its usual business operations.

| Company | 52-Week High | Day’s High | CMP |

|---|---|---|---|

| DCM Shriram | 1145.15 | 1145.15 | 1,114.90 |

| CenturyPlyboard | 849.35 | 849.35 | 816.95 |

| IRFC | 101.25 | 101.25 | 100.35 |

| BEML | 2751.00 | 2751.00 | 2,714.00 |

| GE Shipping | 974.50 | 974.50 | 970.05 |

| Hind Copper | 206.75 | 206.75 | 204.65 |

| Nestle | 25699.00 | 25699.00 | 25,389.85 |

| MRPL | 134.65 | 134.65 | 131.60 |

| HDFC AMC | 3124.00 | 3124.00 | 3,117.40 |

| Cochin Shipyard | 1337.00 | 1337.00 | 1,308.15 |

Stock Market LIVE Updates | Vijaya Diagnostic board approves acquisition of PH Diagnostic Centre for Rs 134.64 crore

The Board of Directors of Vijaya Diagnostic Centre at their meeting held on December 19, 2023 considered and approved the terms and conditions of the Share Purchase agreement between the Company, P H Diagnostic Centre Private Limited and its Promoters/Shareholders for the acquisition of 100% stake in “P H”.

Post completion of the aforesaid acquisition, “P H” will become wholly-owned subsidiary of the company.

| Company | Price at 12:00 | Price at 12:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| AKG Exim | 29.30 | 27.50 | -1.80 14.01k |

| Shri Rama Multi | 34.65 | 33.50 | -1.15 9.02k |

| Party | 121.00 | 117.00 | -4.00 0 |

| Jeena Sikho | 628.65 | 610.05 | -18.60 2.22k |

| Arihant Academy | 164.90 | 160.05 | -4.85 11.89k |

| Vardhman Poly | 60.00 | 58.55 | -1.45 6.33k |

| Cadsys India | 245.50 | 240.00 | -5.50 0 |

| On Door Concept | 199.55 | 195.10 | -4.45 - |

| Surani Steel Tu | 304.50 | 298.00 | -6.50 2.53k |

| Syrma SGS | 694.00 | 679.80 | -14.20 372.74k |

| Company | Price at 12:00 | Price at 12:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Coffee Day | 57.25 | 62.55 | 5.30 632.51k |

| Lorenzini Appar | 239.95 | 257.45 | 17.50 193 |

| Crop Life Sci. | 39.35 | 41.85 | 2.50 4.22k |

| Ishan Intl. | 75.00 | 79.50 | 4.50 5.71k |

| Indo Borax | 169.20 | 178.80 | 9.60 5.84k |

| Lambodhara Text | 162.90 | 171.90 | 9.00 1.49k |

| Poddar Housing | 120.00 | 126.40 | 6.40 5.05k |

| Edelweiss | 76.30 | 80.30 | 4.00 1.19m |

| Latteys Industr | 31.50 | 33.05 | 1.55 34.39k |

| BLAL | 189.70 | 197.25 | 7.55 121.55k |

Stock Market LIVE Updates | Tata Consumer leads race to buy controlling stake In Fabindia-backed Organic India

Tata Consumer Products has edged ahead of other suitors like ITC and is now the frontrunner in fray for a majority stake in Fabindia-backed organic herbal and Ayurvedic health products firm Organic India, multiple industry sources in the know told Moneycontrol.

"Tata Consumer wants to focus on the health and organic products segment and Organic India fits in with their investment thesis. The talks between both the parties are at an advanced stage," said one of the sources. Read More