September 06, 2021 / 16:29 IST

Ajit Mishra, VP - Research, Religare Broking:

Markets started the week on a positive note in continuation to the prevailing uptrend and ended marginally higher. The benchmark opened gap-up following supportive global cues however mixed trends across heavyweights capped the move. Healthy buying interest in IT pack and Reliance kept the tone positive however subdued performance of banking majors capped the upside as the day progressed. Finally, Nifty settled at 13,777.8; up by 0.3%. The broader markets outperformed the benchmark as Midcap and Smallcap ended higher by 0.4% and 1% respectively.

Markets are steadily inching higher, tracking favourable global markets and supportive domestic sentiment. We may see some consolidation ahead and it would be healthy however there’ll be no shortage of trading opportunities on the stock-specific front. Considering the recent momentum, it’s prudent to look for strong counters to accumulate on dips.

September 06, 2021 / 16:07 IST

Shrikant Chouhan, Executive Vice President, Equity Technical Research, Kotak Securities:

The market continued its positive momentum and mirrored the upmove in other global markets. The Nifty is still maintaining a higher bottom formation which is broadly positive. However, the markets being in an overbought situation could trigger a quick intraday correction if it trades below 17330 support level.

As long as the index is trading above 17330, the uptrend texture is likely to continue up to 17450-17500 levels. On the flip side, if Nifty trades below 17330, it could trigger an intraday correction up to 17250-17210 levels.

September 06, 2021 / 16:04 IST

Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas:

The Nifty had a gap up opening on September 06 however couldn’t build upon the early gains. In fact, the index traded in a narrow range throughout the day & consolidated its gains. The sideways action is allowing the overbought momentum indicator on the hourly chart to cool off.

On the downside, the junction of 20 hour moving average & lower end of a rising channel on the hourly chart, which is near 17300, is a crucial near term support. As long as the index trades above 17300, the short term trajectory is expected to remain positive & the index can head towards 17500 & 17630 in the short term.

September 06, 2021 / 15:50 IST

Rohit Singre, Senior Technical Analyst at LKP Securities:

Index opened a day with a good gap but showed a range-bound session and closed a day at 17,378 with gains of half a percent. Index again shifted its support to 17,300-17,200 zone and any dip around mentioned level will be fresh buying opportunity.

If it managed to hold above-said levels we may see the extension in the current up move towards 17,500 zone, where traders can lock their gains as 17,500 will act as strong hurdle and also if sustain above 17,500 zone, then fresh doors will open for 18k mark.

September 06, 2021 / 15:48 IST

Milind Muchhala, Executive Director, Julius Baer:

The Indian markets continue to clock new highs, aided by contributions from a few index heavy weights. However, the broader markets seem to be witnessing some signs of exhaustion, after the healthy rally seen in the past month where India was the best performing markets with gains of around 9%. In fact, a small correction would be welcome at this juncture and help the markets to become healthier, although the trigger for that currently seems elusive and it could just be a part of broader global correction.

The underlying sentiment, however, remains quite constructive, well supported by steadily improving economic data, positive earnings expectation and a healthy pick up in daily inoculations, and investors would be on the look-out for intermittent corrections to add positions.

The retail consumer demand will be closely monitored as we enter the festive season and as the restrictions continue to ease, albeit the concerns on the third wave of the pandemic. While the US job data over the past weekend disappointed, it could be supportive for equity markets as it might prompt US Fed to go slow in their tapering plans. We expect sector rotations to play out in the market, with some of the recently underperforming sectors such as financials, auto and healthcare to see better market interest.

September 06, 2021 / 15:45 IST

Narendra Solanki, Head- Equity Research (Fundamental), Anand Rathi Shares & Stock Brokers:

Indian markets started on a positive note following positive Asian markets cues as US Fed's tightening fears cool off following disappointing jobs data and Fed Chairman comments emphasizing the need for stronger jobs data before the central bank would start to unwind its massive bond-buying program.

During the afternoon session, markets continued to trade in positive zone as traders continue to get encouragement with regular foreign capital inflows on the back of strong global cues and domestic economic activity. Buying in realty and energy counters too helped markets to edge higher, though some selling was witnessed in oil & gas and power stocks.

Adding to the positive sentiments, a private report stated that Union government's net (post-refunds) direct tax collections rose 95% on-year to Rs 3.7 lakh crore till September of the current financial year, thanks to a low base, a pick-up in economic activities, higher corporate earnings and better compliance. The robust collections are despite a surge in refunds.

September 06, 2021 / 15:42 IST

Vinod Nair, Head of Research at Geojit Financial Services:

Positive global markets and strong support from IT and realty stocks, aided domestic markets to trade modestly higher. Hopes of continued economic support by the Fed Reserve due to weak US job data and talks of more stimulus in Japan and China boosted global markets. Economic normalisation attracted buyers in realty stocks, while safe haven IT stocks continued to lead the upbeat market.

September 06, 2021 / 15:34 IST

Market Close:

Benchmark indices ended on positive note led by the IT and Realty stocks.

The Sensex was up 166.96 points or 0.29% at 58,296.91, and the Nifty was up 54.20 points or 0.31% at 17,377.80. About 1657 shares have advanced, 1589 shares declined, and 165 shares are unchanged.

Wipro, HCL Technologies, Infosys, Reliance Industries and Hindalco Industries were the top Nifty gainers. IOC, IndusInd Bank, ONGC, Britannia Industries and Kotak Mahindra Bank were among the top losers.

Among sectors, IT and Realty indices rose 1-3 percent, while selling was seen in the bank, power and oil & gas stocks. BSE Midcap and Smallcap indices ended in the green.

September 06, 2021 / 15:30 IST

Fitch affirms Bharat Petroleum at 'BBB-'; outlook negative

Fitch Ratings has affirmed India-based Bharat Petroleum Corporation Limited's (BPCL) Long-Term Foreign-Currency Issuer Default Rating (IDR) at 'BBB-'. The outlook is negative.

The agency has also affirmed BPCL's senior unsecured rating and the ratings on its outstanding senior unsecured debt at 'BBB-'. Fitch has also affirmed the rating on subsidiary BPRL International Singapore Pte. Ltd.'s US dollar guaranteed notes at 'BBB-'.

Bharat Petroleum Corporation touched a 52-week high of Rs 496.80 and was quoting at Rs 490.20, down Rs 1.20, or 0.24 percent.

September 06, 2021 / 15:24 IST

Ashis Biswas, Head of Technical Research at CapitalVia Global Research:

The market witnessed some lackluster movement and an attempt to hold the level around the Nifty 50 Index level of 17400. The market shows that it is going to be crucial for the short-term scenario to sustain above the 17250 level. If the market is able to sustain the level of 17250, market to witness higher levels of 17450-17500. The momentum indicators like RSI, MACD indicating a positive outlook to continue.

September 06, 2021 / 15:22 IST

Fitch rates Power Finance Corporation's proposed EUR green bond BBB-:

Fitch Ratings has assigned India-based Power Finance Corporation Limited's (PFC, BBB-/Negative) proposed Regulation S senior unsecured euro green bond a rating of 'BBB-'.

The proposed bond will be issued from PFC's existing global medium-term note programme. The net proceeds of the bond will be lent to eligible green projects in accordance with the company's green bond framework.

September 06, 2021 / 15:17 IST

Welspun India becomes first Indian company to receive USFDA 510(k) for its 3 Ply Surgical Masks

Welspun India has now become the first Indian company to receive one of the stringent and most recognized quality approval i.e. US Food and Drug Administration (FDA) 510 (k) clearance for its 3 Ply Surgical Masks.

Welspun India was quoting at Rs 137.95, up Rs 11.65, or 9.22 percent on the BSE.

September 06, 2021 / 15:10 IST

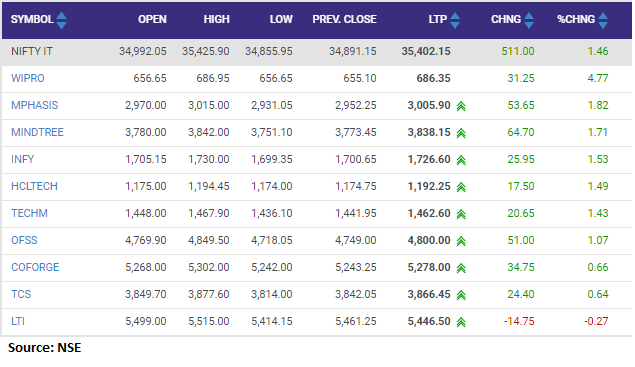

Nifty IT index rose 1 percent led by the Wipro, Mphasis, Mindtree