November 21, 2022 / 15:42 IST

Rupak De, Senior Technical Analyst at LKP Securities:

Nifty started lower following a weak global cue and remained sideways during the day. On the lower end, it slipped towards the previous swing high (18100).

The trend looks a bit weak with a rounding top formation on the daily timeframe. The bearish crossover in RSI with a negative divergence suggests weak momentum.

Going forward, 18,100 may provide immediate support below which the index may drift down towards 17,750. On the higher end, resistance is visible at 18,200/18,450.

November 21, 2022 / 15:34 IST

Rupee Close:

Indian rupee closed 16 paise lower at 81.84 per dollar against previous close of 81.68.

November 21, 2022 / 15:33 IST

Market Close

: Benchmark indices ended on negative note for the third straight session on November 21 with Nifty below 18,200.

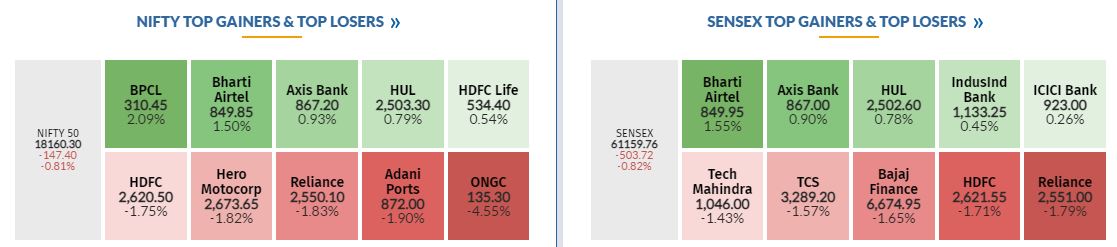

At Close, the Sensex was down 518.64 points or 0.84% at 61,144.84, and the Nifty was down 147.70 points or 0.81% at 18,160. About 1462 shares have advanced, 2014 shares declined, and 170 shares are unchanged.

ONGC, Adani Ports, Reliance Industries, Hindalco Industries and HDFC were among the top Nifty losers, while gainers were BPCL, Bharti Airtel, Axis Bank, HUL and IndusInd Bank.

PSU Bank index up 1.4 percent, while oil & gas, metal, information technology, power and realty indices down 0.5-1 percent.

The BSE midcap and the smallcap indices ended on flat note.

November 21, 2022 / 15:23 IST

Motilal Oswal maintains 'Buy' on Cyient, target Rs 910

-Maintain 'Buy' rating, Target Price of Rs 910

-Continue to see a strong rebound in ER&D spending, led by increased outsourcing and larger deal sizes

Management plans to leverage these spends, led by a refreshed GTM strategy and increased focus on large deal wins should bode well for its growth performance

The growth momentum in verticals such as Communications, Utilities, Medical Devices, Automotive, and Mining is likely to continue for the next two-to-three years

November 21, 2022 / 15:20 IST

Jefferies maintains Buy rating on Hindustan Unilever, target at Rs 3,000

-Buy call, target at Rs 3,000 per share

-Company guiding for impressive double-digit earnings growth over next decade

-Building blocks encompass ahead of industry growth in core business

November 21, 2022 / 15:15 IST

Citi keeps 'Hold' rating on Tata Steel, 'Underperform' rating on JSW Steel

-Hold call on Tata Steel, target at Rs 95 per share

-Underperform rating on JSW Steel, target at Rs 385 per share

-Decision to scrap steel export tariff should help drive a recovery

-Removal of export duty won’t provide much support to domestic prices in near term

November 21, 2022 / 15:10 IST

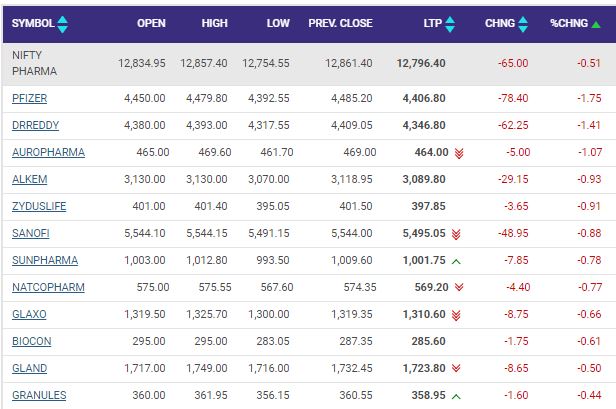

Nifty pharma index shed 0.5 percent dragged by the Pfizer, Dr Reddy's Laboratories, Aurobindo Pharma

November 21, 2022 / 15:05 IST

JPMorgan keeps 'Overweight' rating on Hindustan Unilever, target at Rs 2,800

-Overweight call, target at Rs 2,800 per share

-Cautious optimism on NT demand & margin outlook

-Innovation intensity has stepped up materially

Hindustan Unilever was quoting at Rs 2,502.15, up Rs 18.90, or 0.76 percent.

November 21, 2022 / 15:01 IST

Market at 3 PM

The Sensex was down 514.30 points or 0.83% at 61149.18, and the Nifty was down 153.70 points or 0.84% at 18154. About 1323 shares have advanced, 1999 shares declined, and 146 shares are unchanged.

November 21, 2022 / 14:54 IST

Indian Overseas Bank appoints Sanjay Vinayak Mudaliyar as Executive Director

Indian Overseas Bank has appointed Sanjay Vinayak Mudaliyar, Chief General Manager, Bank of Baroda, as Executive Director in lndian Overseas Bank for a period of three years with effect from the date pf assumption of office on or after 01.01.2023.

November 21, 2022 / 14:49 IST

Motilal Oswal reiterates 'Neutral' rating on Escorts Kubota

-Reiterate neutral rating with a Target Price of Rs 1,875

-Believe uncertainty in the tractor cycle would continue

-Faster recovery in other businesses and a ramp-up in its partnership with Kubota would dilute the impact of a weaker Tractor cycle on Escorts

-While the tractor cycle seems to be uncertain, the valuations are already reflecting volume recovery as well as the benefit of Kubota partnership.

Escorts Kubota touched a 52-week high of Rs 2,198 and quoting at Rs 2,193.10, up Rs 161.40, or 7.94 percent on the BSE.

November 21, 2022 / 14:43 IST

Steel prices may not decline as expected if duties were in place: Nomura

-Estimate marginal benefit to steel spreads resulting in 5 percent upside risk to FY24 EPS for JSW Steel

-Export duty removal reduces risk of inventory build-up as production rises

-Steel prices may not decline as expected if duties were in place

November 21, 2022 / 14:40 IST

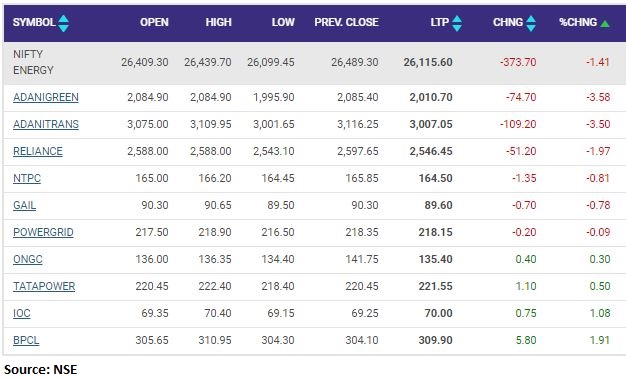

Nifty Energy index declined 1 percent dragged by the Adani Green, Adani Transmission, Reliance Industries