March 20, 2023 / 16:17 IST

Ajit Mishra, VP - Technical Research, Religare Broking

Markets started the week on a volatile note and lost over half a percent, in continuation to the prevailing trend. After the initial downtick, the Nifty index traded under pressure and slipped below Friday’s low; however, rebound in the select heavyweights trimmed the losses in the latter half. Eventually, it settled at the 16,988.40 level; down by 0.65%. Most of the sectoral indices traded in line with the benchmark wherein metal, realty and IT were among the top losers. Meanwhile, the broader indices underperformed and shed nearly a percent each.

Mixed global cues are keeping the participants on the edge and it might continue in near future, in absence of any major domestic event. Amid all, we are expecting some respite in the Nifty index however the view would negate if it fails to hold 16,800 levels. Meanwhile, the focus should be more on risk management.

March 20, 2023 / 16:14 IST

Kunal Shah, Senior Technical & Derivatives Analyst at LKP Securities

The Bank Nifty bulls managed to hold the support of 39,000 and formed a hammer pattern on the daily chart. The index remains in buy mode as long as it holds the support of 39,000 on a closing basis. The immediate upside hurdle is visible at the 39,700 - 39,800 zone and a break above this will lead to further short covering on the upside.

March 20, 2023 / 16:12 IST

Jatin Gedia, Technical Research Analyst, Sharekhan by BNP Paribas:

The Nifty witnessed a volatile day of trade today. It opened on a weak note and drifted lower during the first half of the trading session. As the day progressed it witnessed buying interest emerge from the lower end of the downward sloping channel support zone 16,800–16,850 and witnessed a sharp recovery. It closed on a negative note though well off the intraday lows indicating buying interest at lower levels.

On the hourly charts, we can observe that the momentum indicator has triggered a positive crossover which is a buy signal. Thus, we expect the Nifty to continue with the positive momentum which has started during the second half of today’s trading session for the next trading session as well.

On the upside, the immediate hurdle stands at the 17,145–17,200 zone where the previous swing high is placed. The immediate support stands at the lower end of the downward sloping channel 16,800–16,850.

March 20, 2023 / 16:09 IST

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities:

Pessimist mood prevailing across the global markets triggered a major sell-off in the domestic market, as investors are battling a slew of negative news from turmoil in large global banks to macro-economic concerns and falling commodity prices. Traders are also cutting down their equity bets ahead of the US Federal Reserve meeting on interest rate this week, as any aggressive hike in interest rates could spell more trouble for equity markets worldwide.

March 20, 2023 / 16:05 IST

Deepak Jasani, Head of Retail Research, HDFC Securities

Nifty snapped a two day rise on March 20 and closed in the negative, though after witnessing a sharp rebound from the afternoon lows. At close, Nifty was down 0.65% or 111.7 points at 16988.4. Volumes on the NSE fell compared to the recent average. Broad market indices fell more than the Nifty reflecting higher panic among non-institutional players. Advance decline ratio fell to 0.39:1.

Asian markets fell on Monday and European markets were trying to recover after a negative open as steps taken by central banks to boost liquidity and a deal to rescue Credit Suisse failed to quell investor worries of severe turbulence in the banking sector. Investors worry banks are cracking under the strain of unexpectedly fast, large rate hikes over the past year to cool economic activity and inflation and the banking turmoil may cause a recession if it sets off a credit crunch.

Nifty has formed a bullish hammer on daily charts after forming two dojis, hinting at possibility of an upward reversal. 17,146-16,939 band needs to be broken on either side for accelerated move in that direction.

March 20, 2023 / 16:03 IST

Rupak De, Senior Technical Analyst at LKP Securities

Nifty formed a hammer-like pattern on the daily chart, suggesting a reversal in the prevailing trend. On the daily chart, it fell below 16950 only to close a bit higher. The momentum indicator remained in a bearish crossover with a reading below 40.

On the hourly chart, the index has moved higher following a consolidation. The RSI on the smaller timeframe has entered a bullish crossover. On the higher end, the index may move up towards 17,250. On the lower end, closing basis support remains intact at 16,950.

March 20, 2023 / 15:59 IST

Vinod Nair, Head of Research at Geojit Financial Services

The fear of contagion of the financial crisis has kept investors away from the equity markets as the global market faces numerous hurdles. Despite Swiss regulators' intervention to protect the global financial system, investor sentiment remained shaky. The market is now awaiting the outcome of the Fed meeting to see how they will respond to the ongoing crisis, particularly in terms of rate hikes. Investors expect the central bank to raise interest rates by 0–25 basis points.

March 20, 2023 / 15:33 IST

Rupee Close:

Indian rupee ended marginally lower at 82.63 per dollar against previous close of 82.55.

March 20, 2023 / 15:32 IST

Ravindra Rao, CMT, EPAT VP-Head Commodity Research, Kotak Securities

After rising more than 5% in the previous week, gold prices are up 1.5% on Monday, amid broad risk off sentiments as UBS- CS deal failed to calm investor nerves. US bonds reversed early losses and yields on 2 year treasury notes fell more than 15 bps, to below 3.7%, the lowest since September 2022, signaling caution.

During the weekend, Swiss authorities brokered a takeover of Credit Suisse Group AG by rival UBS Group AG, while the Federal Reserve and five other central banks announced coordinated action to boost liquidity in US dollar swap arrangements.

WSJ during the weekend reported that in a new study, economists said they found 186 banks that may be prone to similar risks as of SVB. This raises concerns of a financial contagion and a hard landing in the US, improving the appeal for the yellow metal for its safe haven status.

This happens at a time when US Core CPI is at 5.5%, keeping the US Fed in a tough spot. Extreme risk off sentiments and caution prevails in markets and gold is a major beneficiary of this crisis.

March 20, 2023 / 15:30 IST

Market Close

: Benchmark indices snapped two days of winning streak and ended lower on March 20 with Nifty around 17,000.

At close, the Sensex was down 360.95 points or 0.62% at 57,628.95, and the Nifty was down 111.60 points or 0.65% at 16,988.40. About 1138 shares advanced, 2393 shares declined, and 125 shares unchanged.

Bajaj Finserv, Adani Enterprises, Bajaj Finance, Hindalco Industries and Wipro were among the top losers on the Nifty, while gainers were HUL, BPCL, ITC, Grasim Industries and Nestle India.

Barring FMCG, all other sectoral indices ended in the red with realty, capital goods, IT, metal and PSU Bank down 1-2 percent.

The BSE midcap and smallcap indices shed 1 percent each.

March 20, 2023 / 15:25 IST

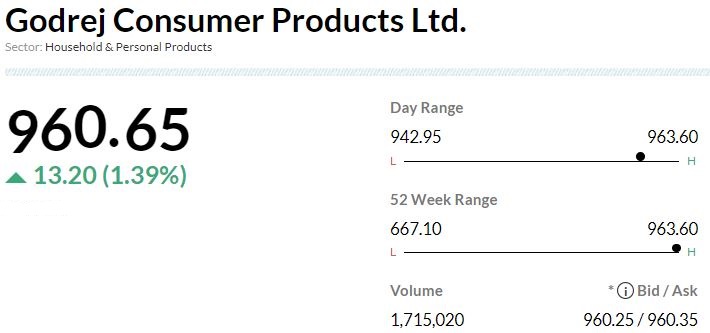

Goldman Sachs View On Godrej Consumer products

-Buy call, target at Rs 1,100 per share

-Turnaround likely to gather momentum as reset phase is behind

-Taken multiple tough decisions over past 12 months for improving long-term growth

-Most of these initiatives caused near-term pain to FY23 earnings

March 20, 2023 / 15:23 IST

Praveen Singh – AVP, Fundamental currencies and Commodities analyst at Sharekhan by BNP Paribas

Despite UBS agreeing to buy the beleaguered Credit Suisse, and the US Federal Reserve opening Dollar swap lines with other major central banks, banking concerns continue to linger, thus gold has clawed back its overnight losses to trade in a positive territory at USD 1992.

Gold is benefitting on the US yields plunging lower. Notion of a possibility of a rate hike pause at upcoming March 21-22 FOMC meeting maybe at play here. Even talks of a rate cut in coming months are doing rounds.

Gold is expected to be extremely volatile on recalibration of interest rate path and banking headlines.

Traders may buy gold around USD 1975 with a stoploss below USD 1950 for a possible target of USD 2025.

March 20, 2023 / 15:18 IST

Morgan Stanley View On PB Fintech

-Overweight call, target at Rs 705 per share

-Superior quality of business originated relative to agency channel is a key differentiator

-Increasing strength of franchise should help keep market spend growth much lower

-Reiterated profit guidance of Rs 1,000 crore for FY27 & adjusted EBITDA break-even in Q4

PB Fintech was quoting at Rs 581.00, down Rs 9.40, or 1.59 percent.