Taking Stock: Indices Erase Early Gains, End Flat Amid Volatility; Realty Stocks Outperform

BSE midcap and smallcap indices ended in the green.... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 85,138.27 | 0.00 | +0.00% |

| Nifty 50 | 26,032.20 | 0.00 | +0.00% |

| Nifty Bank | 59,273.80 | 0.00 | +0.00% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| No Biggest Gainer details available. | |||

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| Interglobe Avi | 5,697.50 | -96.50 | -1.67% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Pharma | 22905.00 | 17.20 | +0.08% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Bank | 59273.80 | -407.50 | -0.68% |

The choppy trend continued in the market and there is no respite for bulls, after showing upside bounce from the lower support (15635) in previous session. As long as the support holds, the odds of market bounce back remain alive for the next 1-2 sessions. A decisive move below the support is likely to extend weakness to 15500 levels. On the upside bounce, the area of 15800 could be a crucial resistance to be watched.

Markets traded in a range and ended unchanged, extending the prevailing consolidation phase. Initially, the benchmark opened on firm tracking positive global cues however profit taking at the latter half trimmed all the gains. On the sectoral front, a mixed trend was witnessed. The broader indices continued their outperformance wherein both midcap and small cap ended higher by 0.4% and 0.7% respectively.

Markets will react to the macroeconomic data viz. IIP and CPI inflation in early trade on Tuesday i.e. July 13. The tussle over the next directional move in the index is still on and upcoming earnings announcement may result in the probable breakout. Meanwhile, we suggest continuing with a selective trading approach while keeping a check on leveraged positions.

Rupee traded weak around 74.55 on back of dollar index strength, with overall resistance placed at 74.30-74.45 zones. Crude prices traded soft which helped the rupee not fall greatly beyond 74.60. Going ahead rupee can be seen between 74.45-74.80 range on the back of dollar strength.

Domestic indices started with mild gains hovering around the flat line, however, it trimmed early gains tracking cues from its European peers ahead of the release of key inflation data later today. Shares of small finance banks were in focus today as the RBI allowed the reverse merger with their respective promoter entities. The realty stocks rallied as hopes of demand revival boosted the sector’s outlook.

Markets were volatile and profit booking was expected given the outperformance of the Midcap & Smallcap Indices. As a matter of fact, we have not witnessed such an outperformance for almost 7 years. Today’s trade saw hectic activity and sustained interest in cement & textiles with the latter exhibiting good momentum across market capitalization.

The market witnessed a volatile movement and failed to breach the resistance level of Nifty 50 Index level of 15800. Market suggests it is prudent to wait for a decisive breakout above 15800 and technical factors to improve before going long in the market. 15620-15650 will be an important support zone. The traders are advised to refrain from building a new buying position until market see further improvement and breakout above 15800.

The index is struggling! It is unable to sustain at higher levels and hence makes a U-turn at any given instance. We are still stuck in a range which is between 15400 and 15900. Unless either level is not taken out, we will not see a meaningful move.

Indian rupee erased intraday gains but ended marginally higher at 74.57 per dollar, amid volatile trade selling seen in the domestic equity market.It opened 15 paise higher at 74.48 per dollar against Friday's close of 74.63 and traded in the range of 74.40-74.59.

: Benchmark indices ended flat on July 12 amid volatility.

At close, the Sensex was down 13.50 points or 0.03% at 52372.69, and the Nifty was up 2.80 points or 0.02% at 15692.60. About 1889 shares have advanced, 1163 shares declined, and 149 shares are unchanged.

UltraTech Cement, Grasim Industries, Shree Cements, JSW Steel and SBI Life Insurance were the top gainers on the Nifty. However, top losers were Adani Ports, Bharti Airtel, BPCL, Tata Steel and Infosys.

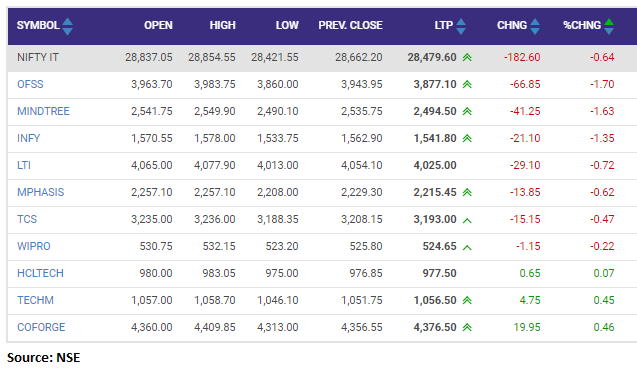

On the sectoral front, realty index added 3.5 percent, while selling was seen in the IT, metal, oil & gas and power indices. BSE midcap and smallcap indices ended in the green.

NMDC fixed iron ore price w .e. f. 10-07-2021. The Lump Ore (65.5%, 6-40mm) at Rs 7,450 per ton and Fines (64%, - 1Omm) at Rs 6,360 per ton.

NMDC was quoting at Rs 165.90, down Rs 1.60, or 0.96 percent on the BSE.

Kitex Garments has locked at 20 percent upper circuit for the second day in row after company has entered Telangana with an initial investment of Rs 1,000 crore.

It has touched a 52-week high of Rs 168.65.There were pending buy orders of 81,844 shares, with no sellers available.

The company has entered Telangana with an initial investment of Rs 1,000 crore, state Industries and Commerce Minister KT Rama Rao announced on July 9.