January 19, 2022 / 16:31 IST

Ajit Mishra, VP - Research, Religare Broking:

Markets traded under pressure and lost nearly a percent, in continuation to the previous session’s fall. The benchmark opened flat amid weak global cues however bears regained control as the day progressed and pushed the index gradually lower.

Among the sectors, profit booking in IT, financials and FMCG sectors impacted sentiments. Consequently, the Nifty settled closer to 17,938; down by 0.96%. The broader markets showed some resilience and ended almost on a flat note.

Weak global cues like rising US bond yields and crude at record highs are taking a toll on markets across the globe including ours. Besides, there's nothing much to support from the domestic front as well. At the top of it, volatility, due to the earnings, is further adding to the participants’ worries. Amid all, we reiterate our positive view on markets and suggest utilising dips to add quality stocks. Nifty has next support at 17,800 and major around 17600 zone.

January 19, 2022 / 16:27 IST

Manish Hathiramani, proprietary index trader and technical analyst, Deen Dayal Investments

The market was unable to hold on to the 18000 level. It should now take support at the 17800-17850 zone. If the Nifty needs to turn, this is the juncture from where that is possible. If we break 17850, the index could slide further to 17650.

January 19, 2022 / 16:26 IST

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities:

Overseas factors continued to weigh on domestic stocks as weak global markets coupled with concerns that a rate hike by the US Fed could be on the cards sooner-than-expected triggered wide-spread selling for the second straight session.

The Nifty breaking the important level of 18000 and closing below the same will be largely negative for the market. The index is likely to consolidate within the range of 17820 to 18050.

For the bulls, 17960 would be the key level to watch for, and above the same the index could rally up to 18000-18050 levels. On the flip side, dismissal of 17900 would trigger one more leg of correction up to 17850-17820 levels.

January 19, 2022 / 16:18 IST

Mohit Nigam, Head - PMS, Hem Securities:

Benchmarks Indices started the session in red tracking weakness in global markets and ends their session via extended their losses with Nifty50 at 17,938 and Sensex at 60,099.

On the technical front, the key resistance level for Nifty50 is 18,300 and on the downside 17,700 can act as strong support. Key resistance and support levels for Bank Nifty are 38,500 and 37,500 respectively

January 19, 2022 / 16:14 IST

S Hariharan, Head- Sales Trading, Emkay Global Financial Services:

A rise in crude oil prices to 7-year highs and continuing high inflation prints globally have driven global bond yields to near pre-covid levels, while US FOMC participants have indicated in separate interviews their intent to act decisively to bring inflation under control. As a result, risk assets have been under pressure this week, reflected in net selling of $800 mn by FIIs in Indian markets the last 5 sessions.

While results from large caps declared so far have been strong and meeting or beating expectations, price moves in reaction to results have been very weak and point to excessive pre-positioning and a high bar to beat priced-in expectations. Market attention would turn towards Budget expectations for Infrastructure and Housing sectors in the coming weeks as a major focus area of fiscal spends in the coming year. Energy and Metals names are expected to trade stronger, while Consumer Staples & Autos can give up some recent gains as a result of weak results for Oct_Dec quarter.

January 19, 2022 / 16:11 IST

Emkay Global Financial Services:

SPOT USDINR pair continued with its recovery trade for the 4th consecutive session this week. The counter has managed to erase its recent losses from the lows of 73.76 levels seen during the last week. The U.S. Treasury yields hit fresh two-year highs which got investors worried about inflation and bracing for tighter U.S. monetary policy in the US Federal Reserve meet scheduled for the next week.

Also, crude oil prices hit their highest since 2014 amid an outage on a pipeline from Iraq to Turkey and global political tensions, stoking fears of inflation becoming more persistent and propping up the dollar, which hovered near one-week highs. We expect the current recovery in the pair to extend towards 74.95/75.20 levels during the coming weeks. Support on dips is seen around 74.40 on the spot.

January 19, 2022 / 16:09 IST

Rahul Sharma, Co-owner, Equity 99:

The correction in markets continues for 2nd day as markets correct 1% post US bond yield hitting 2 years high. We see weakness in market for coming 2 weeks.

Investors are advised to keep strict stop losses and adopt buy on dips strategy. We expect the volatility to continue till the budget session. It is advised to not to over trade in current scenario.

For Nifty 17880 will act as immediate support on breaking which 17765 levels is possible. On upper side 17980 will act as strong resistance. Once this level is breached we might see 18075 levels and even 18200.

January 19, 2022 / 15:57 IST

Vinod Nair, Head of Research at Geojit Financial Services:

Globally, risk sentiments took a blow as rising inflation resulting in elevated bond yield along with the on-going geopolitical tensions and surge in oil prices weighed on investor confidence.

This along with consistent FII selling forced the domestic market to trade in favour of bears for the second consecutive day. The UK's inflation rate rose to 5.4% in December from 5.1% in November owing to rising demand, surging energy costs and supply constraints.

January 19, 2022 / 15:41 IST

Rupak De, Senior Technical Analyst at LKP Securities:

Weakness entered into the second day as Nifty slipped below the 18000 mark. Selling pressure during the day dragged the Nifty below 10 days exponential moving average for the first time since December last year.

Besides, two back to back significant red candles on the daily chart indicate weakness in the market which may extend over the near future. On the lower end support is visible at 17880, below which the index may dip towards 17750. Resistance is pegged at 18050/18200.

January 19, 2022 / 15:34 IST

Market Close

: Benchmark indices continued the selling on the second consecutive day on January 19 with Nifty below 18,000.

At close, the Sensex was down 656.04 points or 1.08% at 60,098.82, and the Nifty was down 174.60 points or 0.96% at 17,938.40. About 1432 shares have advanced, 1766 shares declined, and 72 shares are unchanged.

Asian Paints, Shree Cements, Infosys, Grasim Industries and HUL were the top Nifty losers, while gainers included ONGC, Tata Motors, SBI, Coal India and UPL.

Mixed trend saw on the sectoral front, with auto, metal, power and oil & gas indices ended in the green, while selling was seen in the bank, FMCG, IT, pharma and realty sectors. BSE midcap index fell 0.3 percent and smallcap index ended flat.

January 19, 2022 / 15:29 IST

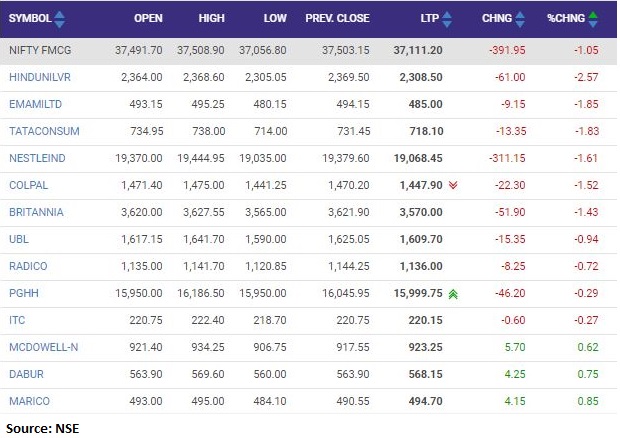

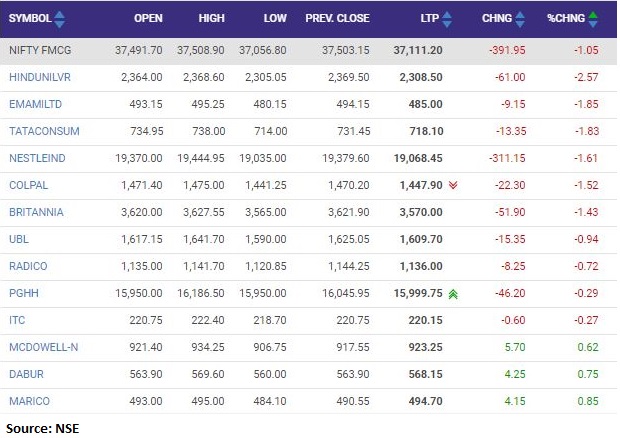

Nifty FMCG index fell 1 percent dragged by the HUL, Emami, Tata Consumer Products

January 19, 2022 / 15:28 IST

Nifty FMCG index fell 1 percent dragged by the HUL, Emami, Tata Consumer Products

January 19, 2022 / 15:25 IST

AnandRathi on Sonata Software

Sonata’s IT business is likely to clock a 17% (organic) CAGR over FY22-FY24 and may see segment margins of ~25.6% by FY24 (FY22e 26.4%) on global delivery build out and higher wage hikes.

On the domestic front, it is likely to record a 21% CAGR, taking the consolidated FY24e EPS to Rs 50. The stock trades at 17x FY24e EPS (5.3% FCF yield), which we find attractive. The risk is supply-side disruptions in the next few quarters. Rating Buy, target Rs 1050.