Taking Stock | Market extends gains; Nifty above 18,100, Sensex rises 390 points

On the BSE, metal index gained 2.4 percent, capital goods index added 1.4 percent, while bank and pharma indices added 0.5 percent each.... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 85,106.81 | -31.46 | -0.04% |

| Nifty 50 | 25,986.00 | -46.20 | -0.18% |

| Nifty Bank | 59,348.25 | 74.45 | +0.13% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Wipro | 254.69 | 4.52 | +1.81% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| Max Healthcare | 1,086.00 | -31.50 | -2.82% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty IT | 37825.30 | 284.00 | +0.76% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty PSU Bank | 8253.20 | -261.70 | -3.07% |

After the adverse performance during the last one and a half months, Indian market has been advancing in the last 2-3 trading days.

The trend is supported by the marginal improvement in FIIs inflows and upside in domestic investments. The domestic investors are adopting buy on dip strategy.

Nifty rose for the second consecutive session on Jan 18 driven by positive Asian cues and dovish signals from Bank of Japan this morning.

At close, Nifty was up 0.62% or 112.1 points at 18165.4.

Metal stocks continued to rise post China reopening. Broad market indices rose less than the Nifty even as the advance decline ratio was up at 1.2:1.

Nifty has managed to build on the gains of the previous day. Now it could face resistance from 18265 while 18049-18072 band could provide support.

The benchmark indices continued positive momentum for the second day in a row, the Nifty ended 112 points higher while the Sensex was up by 390 points.

Among sectors, Metal index bounced back sharply, rallied over 1.75 percent whereas despite strong momentum profit booking continued in PSU Bank index.

Technically, the market continued positive momentum and after a long time the index succeeded to close above the 20-day SMA (Simple Moving Average) which is broadly positive. However, 18250/61300 could act as a profit booking zone for the trend following traders.

We are of the view that, as long as the index is trading above 18050/60700 or 20-day SMA, the texture of the chart suggests positive sentiment is likely to continue in the near future. Above 18050/60700, the index could move up to 18250/61300 and further upside may also continue which could lift the market till 18300/61500 or 50-day SMA. On the flip side, below 18050/60700 uptrends would be vulnerable.

The Indian equity markets have witnessed a splendid day of trade amid the follow-up buying in the benchmark index. The across-board buying participation provided the much needed impetus to levitate the market sentiments. Amidst the action-packed day, Nifty surged consecutively for the second time in the week and concluded the session a tad above 18,150, procuring 0.62 percent.

On the technical aspect, the index has soared over all the major exponential moving averages on the daily chart, construing a positive development. However, the current placement at the sloping trendline could be seen as the last hurdle to overcome, and any breakout above 18,200 could trigger a fresh round of longs in the system.

As far as levels are concerned, 18,050-18,100 is likely to cushion any fall in the index, followed by the sacrosanct support of the 18,000 mark. On the flip side, an authoritative move beyond 18,200-18,250 is needed to affirm the bullish trend, and then we may expect 18,400-18,500 in a comparable period.

There have been contributions across the board, wherein the significant benefactors that boosted the bullish sentiments were from the Metal space. Looking at the recent developments, the undertone is likely to remain bullish, wherein any dip could be seen as a buying opportunity.

Meanwhile, we advocate to keep identifying apt themes and potential movers within the same that are likely to provide better trading opportunities and stay abreast with global developments.

Dharni Capital Services is coming up with its IPO for 53,70,000 shares to raise Rs 1074 lakhs on BSE SME platform.

The face value per equity share is Re 1 and the issue price per share will be Rs 20, including a share premium of RS 19 per equity share.

The lot size is of 6,000 equity shares. Out of the 53,70,000 shares being offered, 25,50,000 shares are reserved for the Non-Retail Investor, 25,50,000 shares are reserved for the retail investors and 2,70,000 shares have been reserved under the market maker quota.

The issue opens on the January 18, 2023 and will close on the January 20, 2023. It will subsequently be listed on the BSE SME platform.

Indian rupee closed 52 paise higher at 81.24 per dollar against previous close of 81.76.

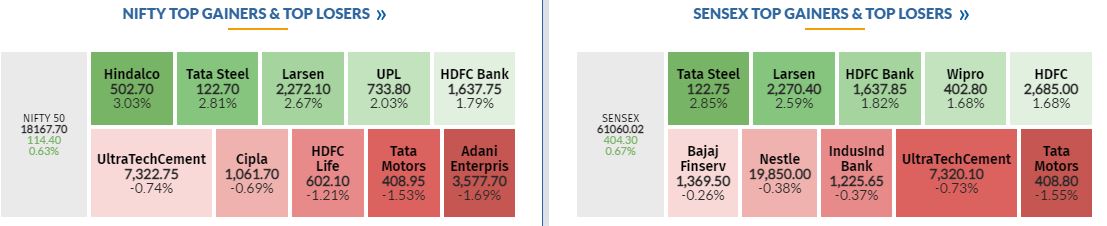

Hindalco Industries, Tata Steel, Larsen and Toubro, UPL and HDFC were among the top gainers on the Nifty, while losers included Tata Motors, HDFC Life, UltraTech Cement, Adani Enterprises and BPCL.

On the sectoral front, metal index added 2 percent and capital goods index rose 1 percent, while bank and pharma indices added 0.5 percent each.

The BSE midcap and smallcap indices ended with marginal gains.

The earnings season thus far has met or beat expectations – however, individual stocks reporting results have not reacted favourably to good results. This reflects a consensus state of positioning and points to a period of digesting gains at the headline index level.

The other notable feature of market action over the first half of Jan has been muted market volumes, despite elevated institutional activity – FIIs have been net sellers worth $2.5 bn in Jan so far, which has been set off by DII net buying. Retail segment is conspicuous by their absence in market action and is a slightly concerning factor for overall market conditions.

A reopening of Chinese economy is understandably attracting most institutional attention and as a result, expensive valuations in India have acted as a major factor in the propensity for FIIs to be net sellers – this is expected to continue in the near-term, and would be an overhang for Financials sector.

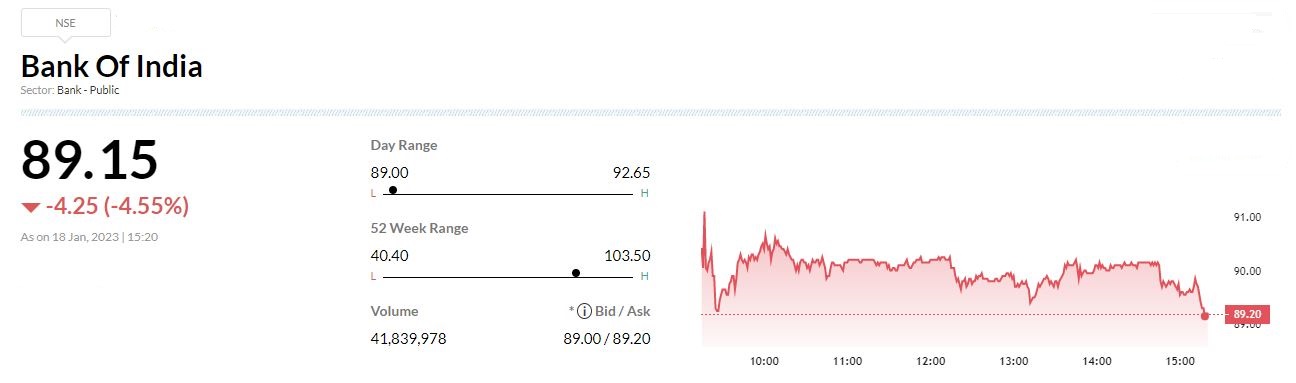

-Overweight rating, target at Rs 125 per share

-Q3 saw one-off interest income on IT refund

-One-off interest income was used to up-front provisions scheduled for Q4

-Expect sharp uptick in PAT run-rate starting next quarter

-Preferred pick in SoE banks

-Outperform rating, target at Rs 3,330 per share

-Strong ordering momentum

-Siemens, RVNL L-1 bidder for Gujarat metro orders

-Implies an order inflow worth Rs 688 cr with an execution timeline of 19 months

-Locomotive key driver for Siemens order inflow in near term

Siemens was quoting at Rs 3,049.40, up Rs 105.30, or 3.58 percent.

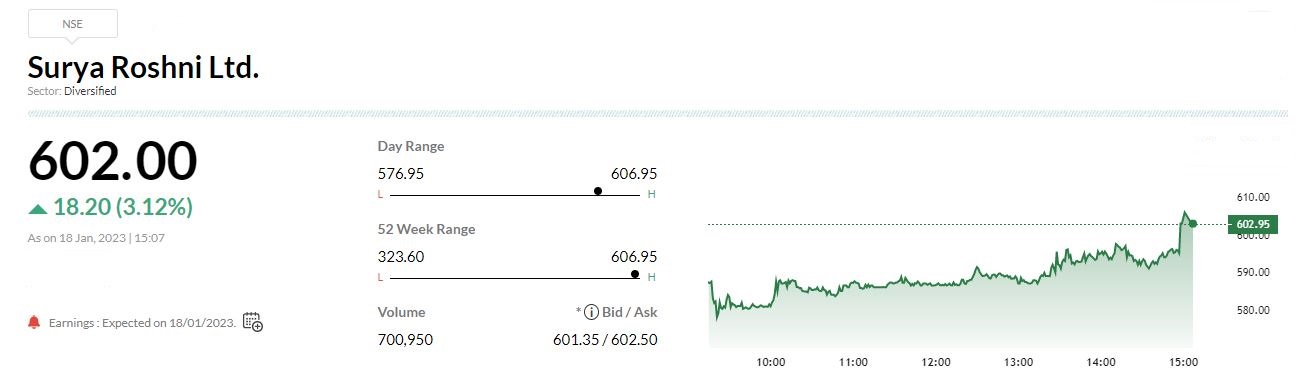

Surya Roshni has recorded net profit of Rs 89.7 crore in the quarter ended December 2022 against Rs 40.5 crore in the same quarter last year.

Revenue of the company was down at Rs 2,022 crore versus Rs 2,030 crore, YoY.

Benchmark indices were trading higher with Nifty above 18100.

The Sensex was up 437.31 points or 0.72% at 61093.03, and the Nifty was up 121.40 points or 0.67% at 18174.70. About 1739 shares have advanced, 1515 shares declined, and 127 shares are unchanged.