Taking Stock | Market begins 2023 on a strong note; Sensex gains 327 points, Nifty nears 18,200

Broader indices performed inline with benchmarks with the BSE midcap and smallcap indices rising 0.5 percent each.... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 85,106.81 | -31.46 | -0.04% |

| Nifty 50 | 25,986.00 | -46.20 | -0.18% |

| Nifty Bank | 59,348.25 | 74.45 | +0.13% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Wipro | 254.69 | 4.52 | +1.81% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| Max Healthcare | 1,086.00 | -31.50 | -2.82% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty IT | 37825.30 | 284.00 | +0.76% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty PSU Bank | 8253.20 | -261.70 | -3.07% |

Nifty gained on the first day of the year after a flat opening. At close, Nifty was up 0.51% or 92.2 points at 18197.5. Volumes on the NSE continued to be on the lower side as some participants are still on holiday. Metals stocks rose as a foreign brokerage turned bullish on metal stocks due to easing of Covid curbs in China. Smallcap index outperformed the Nifty even as the advance decline ratio rose to 2.1:1.

Global equities were largely up on the first day of trading in 2023 amid thin volumes as traders assessed cheaper valuations following last year’s slump.

US stock markets will be closed Monday in observance of the New Year's Day holiday. Nifty has attempted to recover well from the fall seen till Dec 23. It could now face resistance in the 18265-18346 band while 18080 could offer support in the near term.

Markets started the calendar year with decent gains amid mixed signals. The beginning was upbeat as Nifty gradually marched towards 18,200 levels after the flat start. It oscillated in a range thereafter and finally settled around the upper band of the same to close at 18,197.45 levels. Meanwhile, continued buoyancy in the metal and select PSU banks combined with an uptick in realty and NBFC counters kept the participants busy.

We expect the prevailing consolidation to continue in the index citing mixed global cues and lack of any major trigger however the tone is likely to remain positive until the Nifty breaks 18000 levels. Participants should maintain their focus on identifying stocks from across sectors, barring pharma. At the same time, one shouldn’t get carried away with the recovery in the broader indices and stick with the fundamentally sound counters.

Investors welcomed the new year on a high note with data showing strengthening domestic business conditions. India’s manufacturing PMI rose to 57.8 in December from 55.7 in the previous month, with new orders rising at the fastest pace since February 2021.

Metal stocks led the surge following reports of China raising export duties to support their domestic demand, which is positive for India.

We expect 2023 to be a year to buy equities in anticipation that a large part of the global recession has already been factored in the market.

The Nifty has been witnessing short term consolidation for the last few sessions. On the higher side, a rising trendline & the key daily moving averages are acting as resistances whereas the 20-week moving average & the 50% retracement of the Sept – Dec 2022 rally are providing support on the downside.

The overall structure shows that the index can continue with the short term consolidation in the range of 17,800-18,400. Within this range, the Nifty is attempting a move towards 18,400. The level of 18,000 is acting as an intermediate support.

Markets gained confidence in the afternoon trades after European indices advanced sharply in their early trades. Local traders lapped up metals, realty and banking shares, which had faced relentless selling in the last week's sell-off.

However, markets may face strong bouts of volatility as investors brace for earnings season and the upcoming Union Budget.

Technically, the Nifty is consolidating between 18,050 and 18,250 levels. For the bulls 18,250 would be the fresh breakout level to watch out for, and above the same it could move up to 18,350-18,400.

On the flip side, below 18,100, there is a strong possibility of a quick intraday correction. Below the same, the index could slip till 18,050-18,000.

Indian rupee closed flat at 82.74 per dollar against previous close of 82.73.

Benchmark indices ended higher on January 2, the first trading session of 2023, with Nifty around 18,200.

At Close, the Sensex was up 327.05 points or 0.54% at 61,167.79, and the Nifty was up 92.20 points or 0.51% at 18,197.50. About 2254 shares have advanced, 1245 shares declined, and 177 shares are unchanged.

Tata Steel, Hindalco Industries, ONGC, Tata Motors and ICICI Bank were among the biggest Nifty gainers. However, losers included Titan Company, Asian Paints, Divis Labs, Bajaj Auto and Hero MotoCorp.

On the sectoral front, metal index added nearly 3 percent and realty index rose 1 percent.

BSE midcap and smallcap indices rose 0.5 percent each.

The dollar edged up on Monday, pulling away from recent six-month lows against a basket of major currencies, for now.

It has weakened recently as markets bet a U.S. Federal Reserve tightening cycle may be nearing an end and sentiment remained fragile.

And the first trading day of the year was subdued, with many countries including big trading centres such as Britain and Japan closed for a holiday.

The dollar index, which measures the value of the greenback against a basket of other major currencies, was trading up around 0.16% at 103.65 - off roughly six-month lows hit last week at around 103.38.

The euro was down about a third of a percent at $1.0680, but not far off its highest levels since June.

Against the yen, the dollar was a touch softer at 130.94, having hit its lowest levels since August last month.

-Outperform rating, target at Rs 1,400 per share

-Falling credit costs could drive RoA to 1.8 percent

-Faster growth in MFI/CV books could offset higher funding costs

-See implied upside of 32 percent if fair value is based on FY25E BVPS

IndusInd Bank was quoting at Rs 1,226.15, up Rs 4.65, or 0.38 percent.

Supreme Petrochem has received consent to operate (CTO) from Maharashtra Pollution Control Board, for polystyrene (PS) and expandable polystyrene (EPS) capacity expansion projects at Amdoshi plant in Raigad, Maharashtra.

With this, company's effective manufacturing capacity of polystyrene increased from existing 2,20,000 MTA to 3,00,000 MTA and expandable polystyrene from existing 50,000 MTA to 85,000 MTA.

Supreme Petrochem was quoting at Rs 788.55, down Rs 2.05, or 0.26 percent on the BSE.

Texmo Pipes & Products has reappointed Rashmi Agrawal as Whole Time Director and Chairperson, Sanjay Kumar Agrawal as Managing Director, and Vijay Prasad Pappu as Whole Time Director cum Chief Financial Officer for five years with effect from September 1, 2023 till August 31, 2028.

Texmo Pipes and Products was quoting at Rs 59.05, up Rs 1.35, or 2.34 percent.

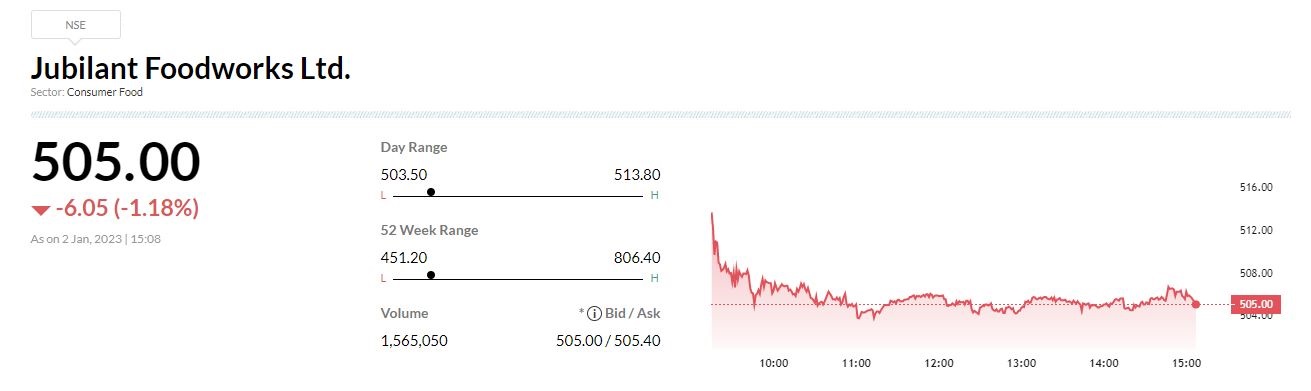

-Underperform rating, target at Rs 445 per share

-Sales per store likely to remain under pressure

-Peers city count makes company more reliant on smaller cities

-Input inflation-linked headwinds, elevated capex plans pose risk to near-term margin

-Competitive pressures pose risks to return ratios

-At 57x FY24e EPS, valuation remains elevated versus historical trading range

-Margin risks underappreciated