December 13, 2021 / 16:27 IST

Ajit Mishra, VP - Research, Religare Broking:

Markets started the week with a cut of over half a percent amid mixed cues. Initially, the benchmark opened higher, tracking firm global cues however profit taking at the higher levels trimmed all the gains and pushed the index further lower as the day progressed.

The Nifty index eventually ended at 17,368.25 levels; down by 0.7%. The sectoral indices traded mixed wherein oil & gas, telecom and realty ended with losses.

Markets are currently dealing with mixed cues. At one end, the encouraging updates on the new COVID variant have eased some pressure however caution ahead of the US Fed meet amid the inflation woes is keeping the participants on the edge. In the current scenario, it’s prudent to restrict leveraged positions and let the markets stabilise.

December 13, 2021 / 16:17 IST

Siddhartha Khemka, Head - Retail Research, Motilal Oswal Financial Services:

Equity Market opened on a strong note on the back of positive global cues. However selling emerged in the second half with Nifty falling 270 points to close near day's low at 17,368. Investors become cautious ahead of the various central bank meeting across the world including that of Bank of England, US Fed, ECB and Bank of Japan given the backdrop of inflation and Omicron virus.

Markets are consolidating on expected lines. Investors will keep an eye on various central bank meetings and take cues for fresh market direction. After the fall and recovery in the last two weeks, the market is unable to hold back at higher levels, indicating that index may remain sideways in a consolidative mode for some more time.

December 13, 2021 / 16:10 IST

Manish Hathiramani, proprietary index trader and technical analyst, Deen Dayal Investments

The markets failed to close above the 17500 level, we witnessed a sharp reversal and the Nifty dropped! The resistance of 17500 is crucial for the markets and we have to close above it in order to scale higher. On the flip side if 17300 breaks, we might see a deeper correction which could take the index lower to 17000.

December 13, 2021 / 15:52 IST

Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas

The Nifty, with a gap up opening, attempted to cross the hurdle of 17600 on the upside. However it couldn’t sustain in the higher territory. The hourly chart shows that the index faced resistance near upper end of a rising channel.

Also, in terms of the Fibonacci retracement, 61.8% retracement of the previous fall from 18210 to 16782 acted as a crucial barrier, which attracted fresh round of selling. Thus the index failed to cross the hurdle of 17600 on a closing basis.

On the daily chart, the index has formed a Popgun pattern, which makes today’s high of 17639 a key resistance. The overall structure shows that the short term consolidation is likely to continue further before the index prepares for a larger up move. On the downside, the Nifty is expected to fill up a recent gap area, which is near 17250-17300.

December 13, 2021 / 15:33 IST

Market Close

: Benchmark indices ended lower for the second consecutive day on December 13 amid selling seen in the realty, oil & gas and PSU banking names.

At close, the Sensex was down 503.25 points or 0.86% at 58,283.42, and the Nifty was down 143.00 points or 0.82% at 17,368.30. About 1840 shares have advanced, 1554 shares declined, and 158 shares are unchanged.

Bajaj Finance, Bajaj Finserv, Tata Consumer Products, Reliance Industries and M&M were among the top Nifty losers. Gainers included Tech Mahindra, Axis Bank, Maruti Suzuki, Wipro and SBI Life Insurance.

Among sectors, except Nifty IT all other sectoral indices ended in the red. The BSE midcap index was down 0.5 percent, while smallcap index was up 0.20 percent.

December 13, 2021 / 15:27 IST

Nandan Terry files DRHP for IPO with SEBI

Ahmedabad based Chiripal Group’s Nandan Terry has filed draft red herring prospectus (DRHP) with market regulator Sebi to raise Rs 255 crore initial public offering.

Nandan Terry may consider raise Rs 40 crore through a pre IPO placement which would be in consultation with the appointed lead managers to the issue. If Pre-IPO round is done, it will reduce the amount from the IPO issue size.

December 13, 2021 / 15:25 IST

Digital payments are witnessing strong growth: Motilal Oswal Financial Services

According to the SBI Cards and Payment Services report of Motilal Oswal Financial Services Limited (MOFSL), digital payments have grown at 69% CAGR over the past three years, led by robust traction in UPI, while other payment instruments have reported strong growth.

The mix of digital payments in the overall retail payments has thus increased, with UPI constituting 80% of digital payments (barring NEFT, RTGS, and IMPS).

With an improvement in the economic environment and ongoing recovery after the COVID19 outbreak, Credit Card spends have shown a strong 65% YoY growth during FY22 YTD (crossed the milestone of INR1t during Oct’21).

December 13, 2021 / 15:21 IST

Nazara Technologies arm Nodwin Gaming acquires strategic 10% stake in Rusk Media

NODWIN Gaming, the material subsidiary of Nazara Technologies and South Asia’s leading esports company, has acquired a strategic 10% stake in the digital content IP media network Rusk Media, company said in its press release

Nazara Technologies was quoting at Rs 2,446.30, up Rs 116.45, or 5 percent on the BSE.

December 13, 2021 / 15:17 IST

BSE Oil & Gas index slipped 1 percent dragged by the HPCL, Reliance Industries, Gail India

December 13, 2021 / 15:11 IST

Shriram Group announces composite scheme of arrangement

Shriram Transport Finance Limited (STFC) and Shriram City Union Finance (SCUF) and their Promoter entity Shriram Capital Limited (SCL) announced that the boards of directors of STFC, SCUF & SCL, at their respective board meetings held approved the merger of SCL & SCUF with STFC.

Also approved amalgamation of Shrilekha Business Consultancy Private Limited with Shriram Capital and the demerger of Financial Services undertaking, Life Insurance Undertaking and General Insurance Undertaking of SCL and the amalgamation of SCL (with its remaining undertaking and investments) with Shriram Transport Finance.

Shriram Transport Finance Corporation was quoting at Rs 1,488.90, down Rs 13.80, or 0.92 percent.

December 13, 2021 / 15:01 IST

Market at 3 PM

Benchmark indices erased some of the intraday losses but still trading lower with Nifty below 17400.

The Sensex was down 456.42 points or 0.78% at 58330.25, and the Nifty was down 130.10 points or 0.74% at 17381.20. About 1821 shares have advanced, 1398 shares declined, and 137 shares are unchanged.

December 13, 2021 / 14:58 IST

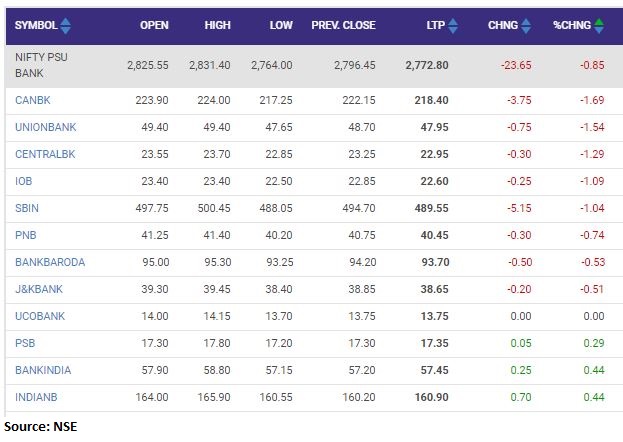

Nifty PSU Bank index shed nearly 1 percent dragged by Canara Bank, Union Bank of India, Central Bank of India