December 12, 2022 / 16:18 IST

Ajit Mishra, VP - Technical Research, Religare Broking

Markets started the week on a volatile note and ended almost unchanged, in continuation to the prevailing corrective phase. After the gap-down start, the Nifty index oscillated sharply on both sides and finally settled at 18497.15 levels. Meanwhile, a mixed trend on the sectoral front kept the traders busy wherein buoyancy in the banking capped the downside. Besides, recovery in the broader indices further eased the pressure.

Markets are currently dancing to the global tunes and we expect the same trend to continue, in absence of any major domestic event. Traders should focus on sectors that are showing resilience viz. banking, FMCG and metal for the long trades while the IT and pharma may continue to trade subdued. At the same time, managing risk is also critical citing the upcoming event and data.

December 12, 2022 / 16:01 IST

Shrikant chouhan, Head of Equity Research (Retail), Kotak Securities

After retreating sharply in early trades, both benchmark indices recouped most of their losses but traded range-bound in a listlesss trading for almost entire trading session, as investors mostly stayed on the sidelines ahead of the inflation data and the US Fed meeting later this week.

More clarity will emerge post the US Fed meeting, which would determine the trend in the near term.

December 12, 2022 / 15:58 IST

Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas

The Nifty stepped into a short term consolidation phase in the last week. As a result, it opened gap down on December 12. On the downside, the bulls moved in to offer support as the index inched towards the short term support of 18300, which is 78.6% retracement of the recent up move.

On the other hand, recovery for the day was restricted near 18500. Overall structure shows that the Nifty can have a short term consolidation in the range of 18300-18650. The Bank Nifty, on the flip side, is maintaining its positive trajectory.

December 12, 2022 / 15:41 IST

Vinod Nair, Head of Research at Geojit Financial

A tepid start-off in the domestic market was flattened due to a recovery in banking, metals, and oil & gas, while continued selling in IT stocks weighed on the indices.

Key inflation numbers are expected to soften from the previous month, owing to a moderation in food prices. Extending the stock market route, the global markets remained fragile as rate decisions by major central banks took centre stage.

December 12, 2022 / 15:32 IST

Rupee Close:

Indian rupee closed 27 paise lower at 82.54 per dollar on Monday against Friday's close of 82.27.

December 12, 2022 / 15:30 IST

Market Close

: Indian benchmark indices ended marginally lower in the volatile session on December 12.

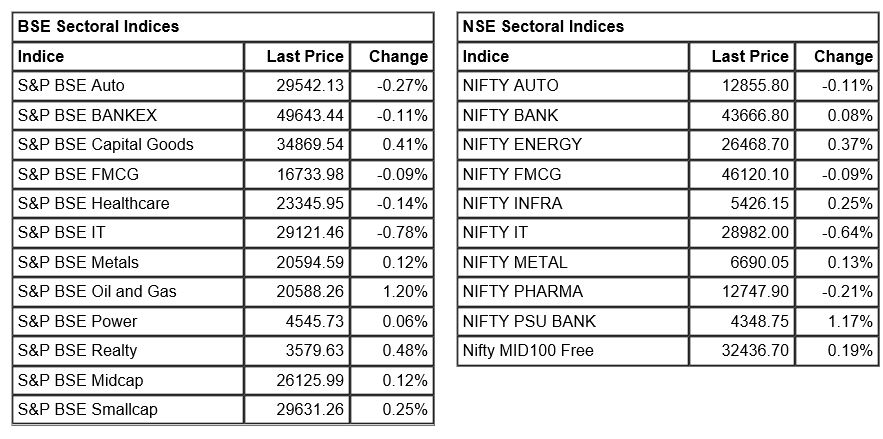

At Close, the Sensex was down 51.10 points or 0.08% at 62,130.57, and the Nifty was up 0.60 points at 18,497.20. About 1787 shares have advanced, 1688 shares declined, and 194 shares are unchanged.

Asian Paints, Infosys, Eicher Motors, Titan Company and Kotak Mahindra Bank were among the top Nifty losers, while gainers were BPCL, Divis Laboratories, Coal India, Apollo Hospitals and UPL.

Among sectors, Information Technology index down 0.5 percent, while PSU bank and oil & gas indices up 1 percent each.

BSE midcap and smallcap indices ended marginally higher.

December 12, 2022 / 15:23 IST

Morgan Stanley downgrade Aditya Birla Capital to equal-weight from overweight

-Downgrade to equal-weight from overweight, target at Rs 160 per share

-Taking a breather after strong recent run up

-Profitability across businesses has been improving & gaining investor recognition

-See scope for further medium-term re-rating

Aditya Birla Capital was quoting at Rs 157, up Rs 1.15, or 0.74 percent on the BSE.

December 12, 2022 / 15:18 IST

Dalmia Cement (Bharat) Limited (DCBL), wholly owned subsidiary of Dalmia Bharat Limited has today entered into a binding Framework Agreement for the acquisition of the Cement, Clinker and Power Plants from Jaiprakash Associates Limited and its associate having total cement capacity of 9.4 MnT (along with Clinker capacity of 6.7MnT and Thermal Power plants of 280MW). The said plants are situated at Madhya Pradesh, Uttar Pradesh, and Chhattisgarh.

December 12, 2022 / 15:17 IST

Prabhudas Lilladher on OMCs:

Upgrading all three oil marketing companies (OMCs) to ‘BUY’ due to sharp correction in crude oil prices and turnaround in diesel marketing profitability

Crude oil prices have corrected to ~USD76/bbl, down ~40% from Jun-22 highs of USD125/bbl post Russia-Ukraine war

Increase our FY24/25E marketing margins on diesel & petrol to Rs3.5/4.0 (Rs2.0/3.5 earlier), reduce operating expense (due to likely lower LNG prices) and increase earnings by 50-130%

Among OMCs, HPCL is our preferred pick, as its marketing share is double of refining

December 12, 2022 / 15:12 IST

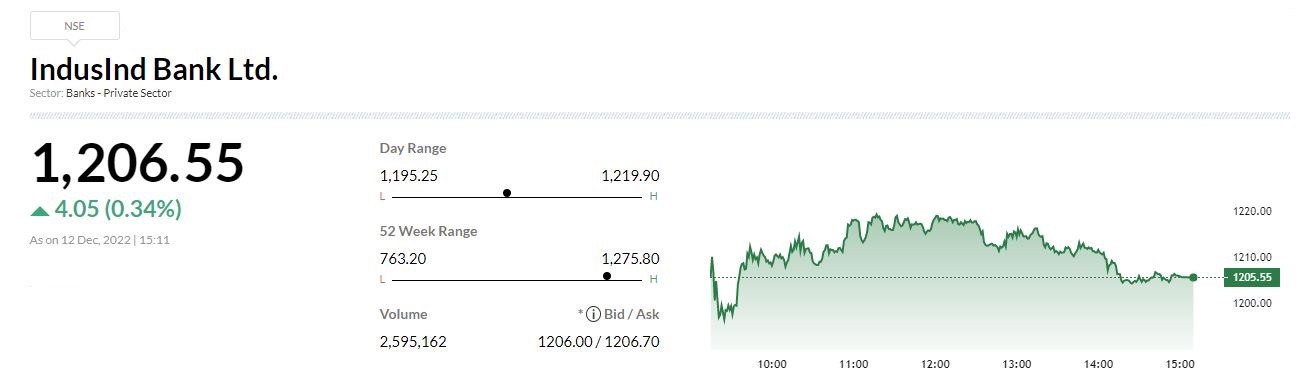

Jefferies maintains 'Buy' rating on IndusInd Bank; target raised to Rs 1,600

-Buy rating, target raised to Rs 1,600 per share

-Ready for next leg of re-rating

-Expect loan growth to improve to over 20% from FY24

-RoA should move towards 2%, raise earnings estimates by 3-5%

-Valuations attractive at current levels

-Approval for extension to CEO tenure will be a key catalyst

December 12, 2022 / 15:08 IST

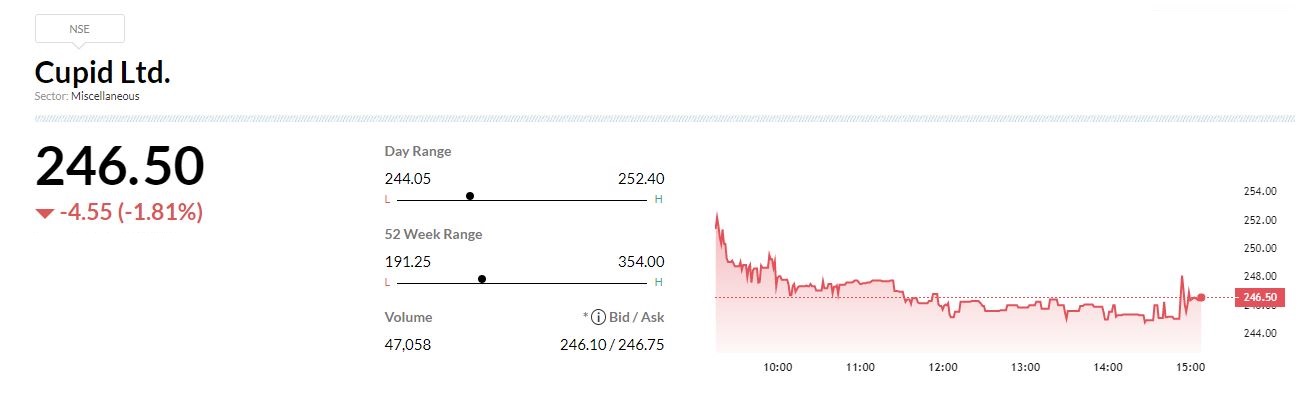

Cupid has received a purchase order from United Nations Population Fund (UNFPA) for supply of Water Based Lubricant worth Rs 5.75 crore.

December 12, 2022 / 15:05 IST

Sula Vineyards IPO subscribed 16% on day one as retail portion booked 30%

The initial public offering of Sula Vineyards, the leading wine producer in India, has garnered bids for 30.33 lakh equity shares against IPO size of 1.88 crore shares, getting subscribed 16 percent on December 12, the first day of bidding.

Retail investors and high networth individuals turned active on the first day itself, buying 30 and 6 percent of their quotas respectively.

But qualified institutional buyers are yet to put in their bids for the offer. They already have invested Rs 288.10 crore in the company via the anchor book.

December 12, 2022 / 15:01 IST

Market at 3 PM

Sensex was down 122.13 points or 0.20% at 62059.54, and the Nifty was down 24 points or 0.13% at 18472.60. About 1597 shares have advanced, 1736 shares declined, and 155 shares are unchanged.