Taking Stock | Market sees worst fall in 2 months; Sensex plunges 872 pts, Nifty ends below 17,500

BSE midcap and smallcap indices shed over 1 percent each.... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 85,106.81 | -31.46 | -0.04% |

| Nifty 50 | 25,986.00 | -46.20 | -0.18% |

| Nifty Bank | 59,348.25 | 74.45 | +0.13% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Wipro | 254.69 | 4.52 | +1.81% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| Max Healthcare | 1,086.00 | -31.50 | -2.82% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty IT | 37825.30 | 284.00 | +0.76% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty PSU Bank | 8253.20 | -261.70 | -3.07% |

The Nifty had formed a Shooting Star candlestick pattern on the weekly chart for the last week. Also, on the daily chart the index had seen few bearish developments on August 19. Thus, follow through action was witnessed on the downside on August 22. In the week gone by, the index had crossed a falling trendline; however, it couldn’t sustain in the higher territory & has tumbled below the trendline today. This shows that the bears are having upper hand currently. The short-term momentum indicators are also in favor of the bears. Thus, the index is likely to witness further decline in the coming sessions. It can test 17300 & 17000 on the downside. On the other hand, 17700-17750 will act as a near term hurdle zone

Nifty slipped back below the falling trend line, indicating a failed breakout. On the lower end, the price has corrected towards the support zone of 17500-17400.

Over the near term, a fall below 17400 may trigger a further correction in the market. On the lower end, support is visible at 17200/17000. On the other hand, the Nifty may recover towards 17700 if it doesn't fall below 17400.

While correction was overdue for sometime after the recent upsurge, fresh concerns of a likely hawkish stance by the US Fed in its September meet and strengthening dollar index turned investors jittery and triggered a massive fall in banking, IT, metal & realty stocks.

Market sentiment could remain volatile in coming sessions as focus would shift back to global concerns of falling crude oil prices amid weakening demand, and US-China tussle over Taiwan.

Technically, a sharp intraday sell off and bearish candle on daily charts is indicating a continuation of weakness in the near future. However, a quick pullback rally is likely if the index trades above its key resistance level of 17575. Below the same, the correction wave will continue till 17400-17350.

Consolidation was triggered in the market in anticipation of tighter monetary policy by the FED and worries over a slowdown in global economic activity. The current risk reward is not favouring investors as the Nifty50 is now trading at a premium valuation of 21.5x P/E (1yr fwd basis), above the long-term average. Rising dollar index and higher US10 year bond yield act as the near-term headwinds for the market.

The Bank Nifty index witnessed continuous selling pressure throughout the day with lower high and lower low formation. The immediate upside resistance is placed at 38500 and a break above this will see a rally toward the 38,800-39,000 zone.

The downside support stands at 38,000 and if breached will see further selling pressure toward 37,700 levels.

Benchmark indices ended lower for the second consecutive session on August 22 amid selling across the sectors.

At Close, the Sensex was down 872.28 points or 1.46% at 58773.87, and the Nifty was down 267.80 points or 1.51% at 17490.70. About 1228 shares have advanced, 2214 shares declined, and 163 shares are unchanged.

Tata Steel, Asian Paints, Adani Ports, Tata Motors and JSW Steel were among the major Nifty lowers.

The gainers were ITC, Coal India, Tata Consumer Products, Nestle India and Britannia Industries.

All the sectoral indices ended in the red. BSE midcap and smallcap indices shed over 1 percent each.

Indian rupee ended 9 paise lower at 79.87 per dollar against Friday's close of 79.78.

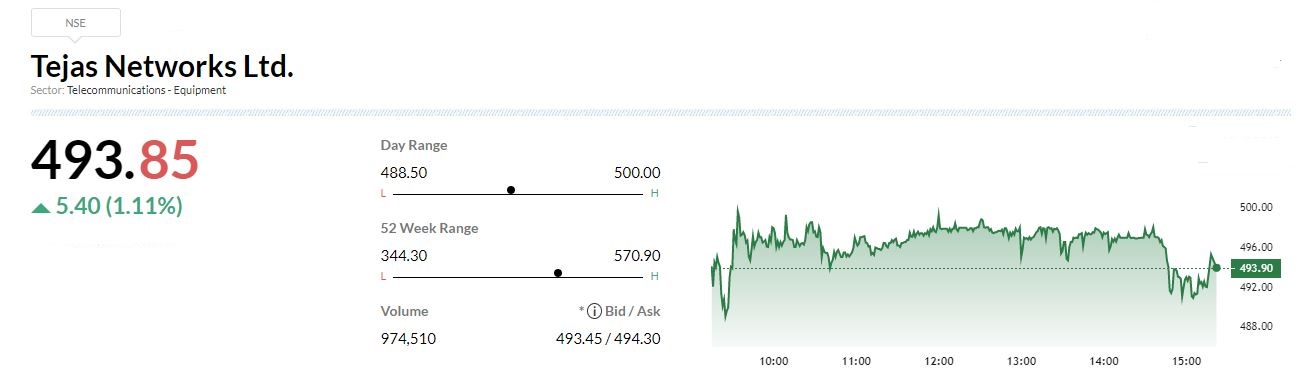

Tejas Networks has acquired the remaining 93,571 equity shares in Saankhya Labs at a price of Rs 454.19 per share by paying Rs 4.25 crore through secondary purchase.

With the said transaction, it has acquired entire 62,51,496 equity shares or 64.4% stake in Saankhya, for Rs 283.94 crore, on a fully diluted basis.

The food and hospitality division of Indrayani Biotech has bagged an order from Indian Institute of Technology, Roorkee.

The scope of work includes preparation and supply of food items to 5 of the 8 different Messes from August 20, 2022 to August 20, 2023. The contract is worth of Rs 12 crore per annum.

Indrayani Biotech was quoting at Rs 58, down Rs 2.30, or 3.81 percent on the BSE.

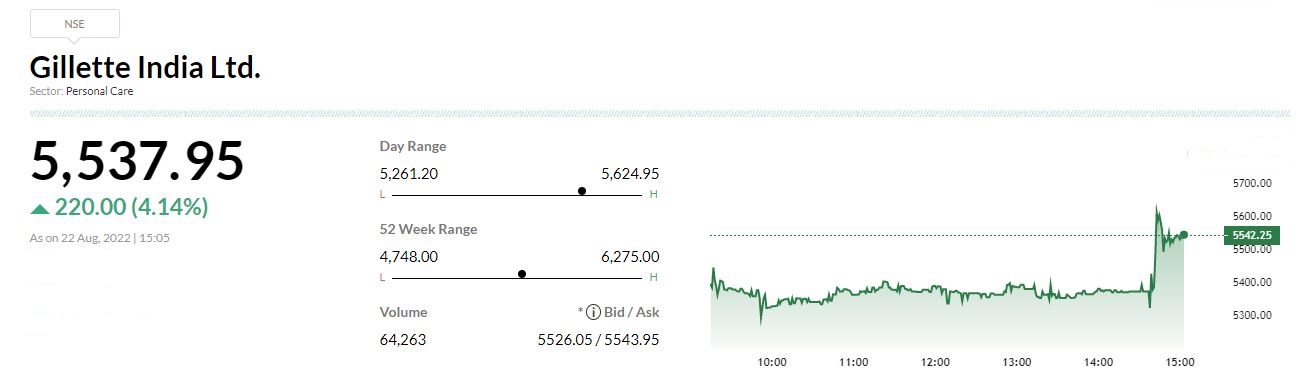

Gillette India has posted Q1FY23 net profit at Rs 67.6 crore against Rs 27.5 crore and revenue was up 26.8% at Rs 553 crore versus Rs 436 crore, YoY.

Earnings before interest, tax, depreciation and amortization (EBITDA) was at Rs 111.7 crore versus Rs 52.3 crore and margin at 20.2% versus 12%, YoY.