The recent run-up in the prices of several basic chemicals in China has sparked hopes of a rebound in demand, but analysts warn to not read too much into the surge as this may be short-lived.

In fact, sluggish demand and a decline in prices of most chemicals in the past few quarters have been denting the financials and stock performances of specialty chemicals players.

Prices of 28 of the 32 chemicals tracked by ICIS, a data services provider, ran up in China in August, with the ICIS China Petrochemical Index up ~15 percent by month-end as against its June lows.

ICIS attributes this increase to seasonal and likely temporary factors, including several production turnarounds, a seasonal upswing in demand, ahead of China's ‘golden’ season in September-October, and restocking by customers off run-down inventory levels.

The Indian scenario

Commentaries by certain companies like Aarti Industries recently, hinting at a pickup in demand, sequentially, may have played a role in the recent run-up in stock prices.

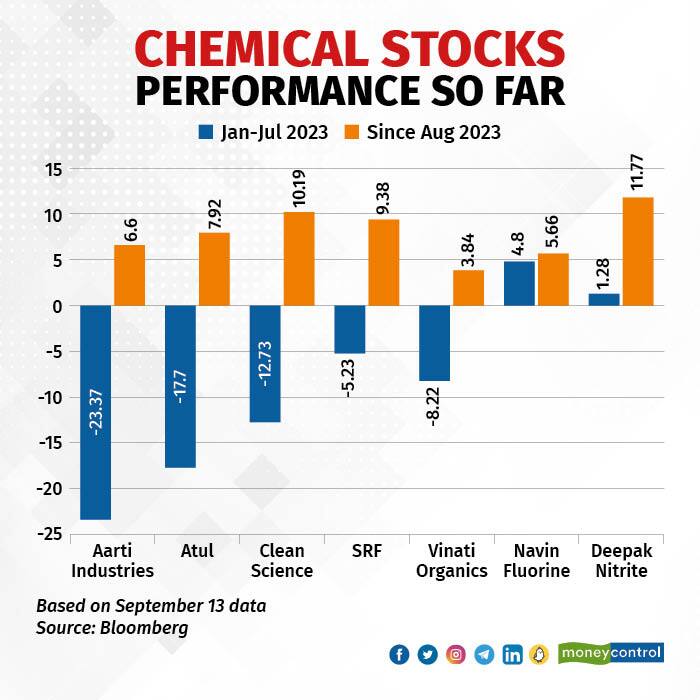

Tracking the recent rise in the prices of most chemicals, stocks of specialty chemicals players SRF, Vinati Organics, Aarti Industries, Navin Fluorine, Deepak Nitrite, Clean Science and Atul Ltd have bounced back 4-12 percent since the start of August.

This marks a stark contrast to the 5-23 percent drop recorded in the prices of most specialty chemicals players in the January-July period, barring just two.

What brokerages say

Brokerage firm Kotak Institutional Equities (KIE) warned that the rise in most chemical stock prices, which the markets are interpreting as an indication of recovering demand, may be overdone.

KIE also noted that any recovery will also be coming off a very depressed base and most earnings estimates already factor in a bounceback in demand from the second half of the current fiscal, aligned with the guidance rolled out by most chemicals players.

Also Read | 'Cautious' on chemical sector, Kotak Institutional Equities’ analysts downgrade two stocks

However, the major concern, as pointed out by analysts at KIE, is that the spike in prices has stretched valuations even more for most stocks within the sector.

Anand Rathi Share and Stock Brokers shares a similar view.

"Despite a weak Q1, soft Q2 guidance and tough market environment, there has not been much of a correction in the valuation of chemicals companies, considering the promising long-term outlook," the firm said, while stating that it remains cautious on the medium-term growth of the industry.

Also, the lack of clarity on whether China's stimulus, aimed at reviving the construction sector, will actually be able to trigger a change remains an overhang for KIE, which needs time to pan out.

Meanwhile, domestic players are also undergoing a rapid capacity expansion even in the face of weakening demand as they look towards the long-term opportunities coming their way due to the growing China+1 sentiment.

Analysts at Anand Rathi also highlighted that despite the tough business environment, domestically and globally, Indian chemicals companies are not deferring capex plans as they expect the demand slowdown to be transitory and would return, once high channel stocks are consumed.

However, in the near term, capacity expansion will have a negative bearing on the financials of domestic chemical players as the seasonal spike in demand fades away, post October. Likewise, Anand Rathi also noted that there are some chemical companies which expect the current volatile environment to hurt their near-term performance.

Additionally, extensive competition from the oversupply by Chinese players in the chemicals market, after the lifting of the zero-COVID restrictions earlier this year, is also expected to keep financial gains under pressure for domestic counterparts, analysts believe.

Also Read | Mapping Midcap Rush: These stocks saw returns outstrip earnings growth by the widest margin

In conclusion, even though long-term growth expectations remain resilient, the near-term headwinds suggest that specialty chemicals stocks may be too pricey to hop into at the current juncture.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!