Taking Stock: RBI booster shot helps Nifty close above 9,250; Sensex rallies 1,000 pts

The Nifty Bank rose more than 1,200 points or 6.6 percent led by gains in Axis Bank, ICICI Bank, IDFC First Bank, Bandhan Bank and Federal Bank.... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 85,138.27 | 0.00 | +0.00% |

| Nifty 50 | 26,032.20 | 0.00 | +0.00% |

| Nifty Bank | 59,273.80 | 0.00 | +0.00% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Asian Paints | 2,954.40 | 86.80 | +3.03% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| Interglobe Avi | 5,697.50 | -96.50 | -1.67% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Pharma | 22905.00 | 17.20 | +0.08% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Bank | 59273.80 | -407.50 | -0.68% |

We have continued to remain a Contrarian bull which has worked very well. We have been guiding for 9,300-9,500 zone which has been achieved. As the index approaches towards 9,500 one should be on a cautious side as the entire rally can fade out near the mentioned levels. We had been contrarian bull and as we approach towards 9,500 we advise caution.

Markets were buoyant following RBI measures to boost liquidity and reclassify NPA norms for commercial banks. The positive global markets also added to the buoyancy. Rate sensitive stocks managed to outperform. Focus will continue to be on how far these measures will help in containing the economic fallout of the virus and also on the earnings guidance of companies.

The Economic distress because of the pandemic is beyond doubt. And it is commendable that RBI is addressing the issue head-on and continually telling that they will keep looking at the data and take action proactively to reduce the stress in the Economy as the situation develops in the next few months.

It was heartening to see that RBI is taking a lot of concrete actions to ensure that the liquidity in the banking system is utilized for the purpose of lending to the corporate sector. RBI has also been addressing the concerns of the NBFC sector. The allocation of Rs 50,000 crore dedicated towards TLTRO of NBFC’s should also boost investor sentiments. This amount has to invested in Bonds, CP, NCD of NBFCs, with about 50% earmarked for the small and mid-sized NBFCs. This should ease the liquidity requirement of the smaller NBFC houses. Given the state of affairs of the economy they were the once having funding issues and the current corpus should make liquidity easily available for them.

The Liquidity boosting measures announced by the RBI on the back of positive global cues boosted the markets today despite profit booking seen in afternoon trade. Financials led the charge today and several heavy weights joined the party as the day progressed in anticipation of a Stimulus Package.

: Benchmark indices ended higher for the second consecutive day after RBI announced some key measures to inject the much needed liquidity in the system.

At close, the Sensex was up 986.11 points or 3.22% at 31588.72, while Nifty rose 273.95 points or 3.05% at 9266.75. About 1685 shares have advanced, 696 shares declined, and 177 shares are unchanged.

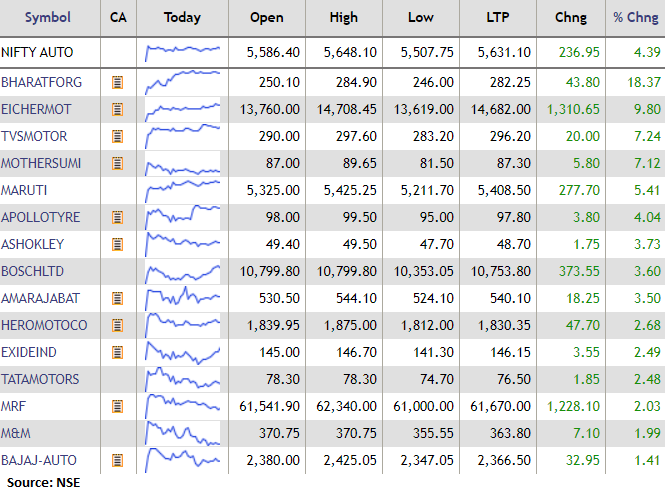

Axis Bank, Eicher Motors, ICICI Bank, Maruti Suzuki and IndusInd Bank were among major gainers on the Nifty, while losers were Nestle, HUL, Bharti Infratel, Sun Pharma and Tech Mahindra.

Among sectors, except pharma and FMCG other indices ended in the green. BSE Midcap and Smallcap indices rose 2 percent each.

The RBI announced a host of additional fiscal and regulatory measures to help the financial system and facilitate liquidity as well as credit flows. We feel recalibration of NPA norms, liquidity measures for NBFCs and special refinancing facility to institutions like NABARD, SIDBI and NHB would play a crucial role in handling the credit flow issues to agri., rural, small industries, HFCs and MFIs. Besides, further reduction in the reverse repo and cut in liquidity coverage ratio(LCR) will incentivise banks to lend more.

We believe these measures are positive for financial institutions and also for the borrowers amid this COVID 19 crisis as it not only addresses liquidity needs but also ensures their financial stability.

For the current week, the BSE-30 Index is seen closing in the positive zone on the back of positive global cues and announcement of stimulus package by the RBI. Reports from the US that a drug from Gilead is showing great results in treating covid-19 cases also led to positive sentiments.

In India, expectations of fresh set of fiscal stimulus package, which would be bigger than the earlier one, also lifted sentiments.

: As per the directives received from the regulatory authorities, the company resumed its operations at manufacturing facility located at Sachin Special Economic Zone (SEZ).

RBI continues to be very proactive to ensure financial stability on the system. The continued measures to boost system liquidity and help manage system stress are positive. Some of the liquidity and asset classification measures should help the large housing finance companies, as they have large diversified books. However, the systemic challenges continue to be quite significant as there is both demand and supply destruction in the economy which have significant balance sheet impact on the BFSI firms. So, with time, more reforms, guidelines and measures can be expected from RBI as the extent of systemic challenges become more visible.