Taking Stock: Strong global cues help Sensex reclaims 35,000; IT, oil & gas shine

Top Nifty gainers included IOC, TCS, Infosys, and BPCL.... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 85,106.81 | -31.46 | -0.04% |

| Nifty 50 | 25,986.00 | -46.20 | -0.18% |

| Nifty Bank | 59,348.25 | 74.45 | +0.13% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Wipro | 254.69 | 4.52 | +1.81% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| Max Healthcare | 1,086.00 | -31.50 | -2.82% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty IT | 37825.30 | 284.00 | +0.76% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty PSU Bank | 8253.20 | -261.70 | -3.07% |

After trading range-bound between 10,250-10,350 in a dull session, Nifty closed at 10,383 gaining 94 points during the day. Technically, the Index has good support at 10165 level which is a 38.20% of Fibonacci Retracement level (FBL) of its recent up move which suggests a bounce back movement in the Index. FBL are horizontal lines that indicate where support and resistance are likely to occur. We see a good bounce back in few large cap stocks, which are trading at very good support level. Downside support for Nifty is seen at 10,200 points while upside resistance comes at 10400 level.

After an unbroken rise in the last two weeks, the markets turned a bit volatile this week. It remained so for the entire week's trading . This was mainly influenced by factors like the phenomenal rise in the corona virus cases in the US and India, the military stand-off between India and China at the border, and also with the ongoing spat between China and the US on many issues including trade and the source of the pandemic.

The modification of the US visa regulations, which may likely affect some of the tech companies adversely, and the not so encouraging weekly numbers from the US, also added to the uncertainties. It is felt that the very same factors continue to be relevant for the markets and would be of consequence to the markets as we move into the next week, and the month-end.

The FPI activity in the coming weeks is something that needs to be watched closely as there are already reports of likely rebalancing of portfolios and resultant trimming of positions. It is also significant that the domestic markets, for most part of the week reflected the broad trends in other global markets.

Global markets were in a consolidation mode after previous weeks of strong rally. Fresh spikes in Covid-19 cases and reports of further rift between the US and China on trade front, restricted further gains. The Sensex, however, continued to remain firm and gained 440 points for the week. Market mood remained buoyant on expectations of earlier-than-anticipated normalization of activities, as most states committed to remain open despite continuous increase in daily Covid cases.

Markets are seen entering a consolidation phase in the coming weeks with no major trigger. Geopolitical concerns and possibility of second wave of Covid-19 remain the near term risks which could impact investor sentiments. We advise investors to buy on declines from these levels.”

Index closed a week at 10383 with gains of 1.35 percent and formed doji candle pattern on weekly chart which hints uncertainty in the markets. For coming week strong hurdle is still at 10500-10600 zone once we managed to sustain above said levels then we may see smooth move towards 11k mark, support for Nifty is coming near 10300-10200 zone and overall base still at 10k mark, any dip near 10k mark will be again good buying opportunity.

Nifty Bank closed a week at 21592 with gains of 1 percent and formed a doji candle pattern on weekly chart, support for Nifty Bank is still at 21300-21000 zone and resistance is coming near 22000-22300 zone.

Bulls maintained their control today as IT heavyweights rose amidst positive commentary from leading companies. Oil Marketing Companies too witnessed buying interest as the market managed to close the day on the upside. Also with a 20% excess, rainfall Rural Themes attracted investor interest in the broader market.

Amidst stable global cues, Indian benchmark indices also ended with a positive bias. The FMCG index which was the top gainer yesterday, was the worst performer in today's trade. Nifty remains in a range and seems to be awaiting further cues for a breakout on either side. The close today means the uptrend remains, but upsides seem to be capped.

After two days of losses the market ended near day's high in the volatile trading on June 26 with Nifty started the July series on the positive note.

At close, the Sensex was up 329.17 points or 0.94% at 35171.27, and the Nifty was up 94.10 points or 0.91% at 10383. About 1629 shares have advanced, 1040 shares declined, and 141 shares are unchanged.

BPCL, Infosys, TCS, IOC and IndusInd Bank were among major gainers on the Nifty, while losers included Bharti Infratel, Bajaj Finance, ITC, Tata Motors and Kotak Mahindra Bank.

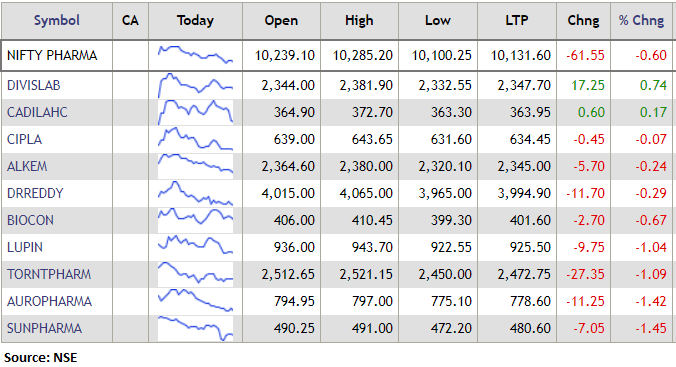

On the sectoral front, except FMCG and pharma other indices ended in the green. BSE Midcap and Smallcap indices ended marginally higher.

The company reported 59.4 percent YoY fall in its Q4 net profit at Rs 22.8 crore against Rs 56.1 crore and revenue was down 16.8% at Rs 532.7 crore versus Rs 640.4 crore, reported CNBC-TV18.

Nitco Tiles has posted net profit of Rs 0.9 crore in the quarter ended March 2020 against loss of Rs 11.9 crore, YoY. Revenue of the company was down 53.1% at Rs 79.4 crore versus Rs 169.4 crore. Its EBITDA loss was at Rs 15.4 crore against EBITDA of Rs 0.2 crore, YoY, reported CNBC-TV18.

Reserve Bank of India (RBI) board has deliberated on the current economic situation and evolving challenges posed by the Pandemic. The board has discussed RBI's activities during July 2019-June 2020 and also discussed budget for next AY (Accounting Year), other policy and operational matters. However, it haschanged its AY to April-March from July-June, reported CNBC-TV18.