A volatile week that started with domestic indices struggling to build any momentum after the sharp rally on May 20 ended with both the Nifty 50 and BSE Sensex rising more than one percent each.

The benchmark indices managed to rise for the second successive week aided by short covering rallies in banking and information technology stocks as the May derivative series expired on May 26.

However, the recovery in the benchmark indices after starting the week with three successive days of losses did not trickle down to the broader market as the Nifty Midcap 100 index ended the week over one percent lower.

On the sectoral front, banks were the dominant force as the Nifty Bank index rose over four percent in its best weekly performance for over two months. The banks were followed by automobile stocks as the Nifty Auto rose 3.3 percent during the week. Nifty Metal index was among the hardest hit as the index fell nine percent.

“The recent rebound in the US markets has eased some pressure but sustainability is critical for forming a base and attempting a reversal. And since we’re closely aligned at present, it could help the Nifty to surpass the hurdle at 16,400 and march towards the 16,700-16,800 zone,” said Ajit Mishra, vice president of research at Religare Broking.

Here are 10 factors that will keep traders busy next week:

1. Earnings

The March quarter earnings season enters its home stretch as more than 300 companies will report their results including some prominent ones like Sun Pharmaceutical Industries, Life Insurance Corporation of India, Jubilant Foods, Delhivery, and Dixon Technologies.

Other famous names that will be announcing their results include Dilip Buildcon, Dish TV, Dhani Services, Equitas Holdings, Nureca, Reliance Communications, TTK Prestige, and Vikas EcoTech.

2. Listing

Three companies will debut on Dalal Street next week – Aether, eMudhra, and Ethos.

Ethos:

Shares of Ethos will list on the bourses on May 30 after barely scraping through the public subscription process. The company’s issue was subscribed 1.04 times with a late push from institutional investors.

The grey market premium of the stock does not inspire much confidence as dealers expect it to most likely debut at a discount to the initial public offering (IPO) price.

e-Mudhra:

The company’s shares will list on June 1 after a successful IPO that got subscribed over 2.6 times.

However, the grey market premium of the stock looks muted ahead of its debut.

Aether:

The listing of the company’s shares will round off the week on Friday after its IPO barely scraped through getting subscribed a little over 100 percent with muted retail participation.

3. FII selling

Foreign institutional investors continued to remain net sellers of local stocks as their offloading streak entered the ninth month. So far in May, foreign investors have net sold domestic stocks worth Rs 44,346 crore taking the overall total in the past eight months to over Rs 2.5 lakh crore.

With global interest rates rising, concerns over domestic economic growth, and higher returns from global bonds, market participants do not expect the selling spree to ease anytime soon.

4. Domestic buying

Damage from foreign investors dumping stocks has been limited by domestic institutional investors who have net bought local stocks worth Rs 47,465 crore in May so far which is the highest since March 2020.

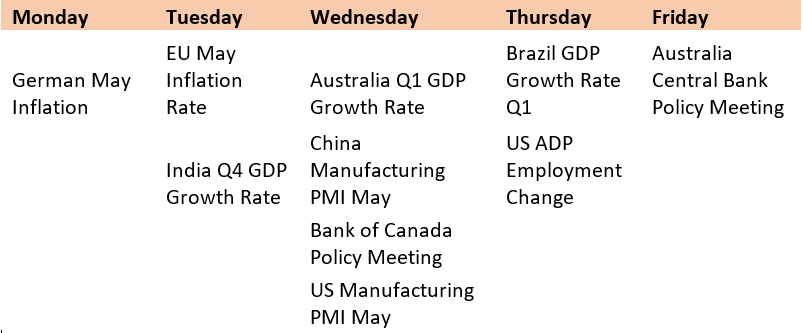

5. Global Data

Here are key global data points to watch out for next week:

6. Rupee

After seven consecutive weeks of weakness, the domestic currency finally strengthened against the US dollar aided by a general decline in the US dollar index against a basket of 10 major currencies.

The rupee ended the week at 77.59 to the US dollar after hitting a low of 77.78 during the period. Market participants expect the currency to remain rangebound as the Reserve Bank of India will likely continue to provide intermittent support.

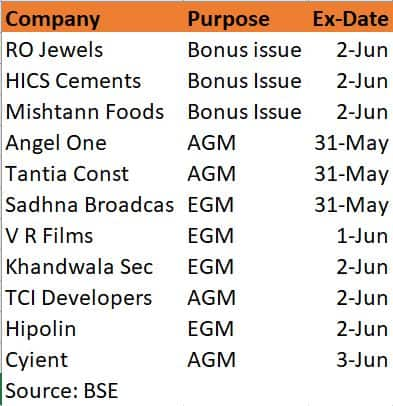

7. Corporate action

Here are key corporate actions taking place next week:

8. Technical View

On May 27, Nifty 50 index formed a bullish hammer candle on the daily scale with a long lower shadow, indicating buying on declines. It has to hold above 16,250 for an upmove towards 16,442 and 16,666 whereas supports are at 16,161 and 16,061, experts said.

"A key positive development on the technical charts is the fact that the Nifty closed above the 20 day simple moving average,” said Mazhar Mohammad, founder and chief market strategist at Chartviewindia.in.

9. F&O cues

The Nifty 50 options data for May 26 suggested a trading range between 16,000 and 16,700 points for the index.

Since it’s the beginning of the new series, the options data is scattered at various far strikes, analysts said. Maximum Call Open Interest (OI) is at 17,000 then 16,300 strike while maximum Put OI is at 16,000 then 16,300 strike.

Call writing is seen at 16,300 then 17,000 strike while Put writing is seen at 16,300 strike.

10. India GDP Data

India will report its gross domestic product (GDP) data for the March quarter on Tuesday. A Reuters poll showed that the country’s economic growth likely slowed for the third consecutive quarter as demand remains a concern amid rising fuel and food costs.

Economists polled by Reuters expect the March quarter GDP to grow at a paltry four percent from the year-ago quarter reflecting the impact of the third wave of the pandemic and Russia-Ukraine war.Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!